Some firms domiciled outside Europe are also unaware they may be impacted (or to the extent they are impacted) by SFTR. Still others are unaware that the April 2020 milestone only represents the first wave of SFTR compliance.

Broadridge Consulting Services has been engaged with firms helping them define their SFTR strategy and readiness. Leveraging our experience, this thought leadership piece outlines some of the key aspects of SFTR from a planning and operational impact standpoint. It aims to help firms better plan for reporting, based on what we are seeing evolve as common practices in the marketplace for SFTR compliance.

Background and Key Dates

The aftermath of the subprime crisis continues to see regulatory bodies globally assemble measures and provisions to curb shadow banking and monitor securities financing transactions (SFTs). One of the biggest challenges of the subprime crisis was determining how dire the situation was, where the risk was and how deep the challenges were.

The European Union (EU), through the European Securities Markets Authority (ESMA), is introducing SFTR to bring clarity and transparency to the securities financing markets through reporting by firms engaging in SFTs.

Initial reporting for SFTR is scheduled to commence April 11, 2020, for back-loading1 for banks and investment banks with reportable fields, many of them to be considered matching fields. At time of writing, there are seven additional phases to be monitored past April 2020. However, given the back-loading requirements of 180 days, all firms need to be mindful and have their data sets for back-loading as of April 2020. All firms therefore need to consider the following milestones for adequate planning on preparedness and adherence:

| Focus (published by the SFTR Task Force in April 2019) | Deadline |

|---|---|

| Back-loading1 /Reconciliation Phase 1: 43 data fields for repo for matching, 57 fields for all SFTs | April 11, 2020 |

| Go-live date for banks and investment banks (day after SFTR initial live date) | April 14, 2020 |

| CSDs and Central Counterparties (CCPs) | July 2020 |

| Insurance firms, UCITS, AIFMs and pension funds | October 2020 |

| Non-financial entities/counterparties and 5 more data fields for matching, back-loading for CSDs and CCPs | January 2021 |

| Back-loading for insurance firms, UCITs, AIFs, pension funds | April 2021 |

| Back-loading for non-financial entities/counterparties | July 2021 |

| Another 3 data fields for matching | April 2022 |

| Another 12 data fields for matching | January 2023 |

Back-load Complexity Warrants a Moment for Clarification

The back-loading requirements are evolving and complex. There is go-live, Reconciliation Phases 1 to 4 and Back-loading Phases 1 to 4 milestones and dates that should be examined. For clarity, the requirements at time of writing on back-loading for SFTR are as follows:

| DEADLINE | BACK-LOAD SCOPE |

|---|---|

| April 14, 2020 | Go-live banks and investment firms (fixed-term repos) – all fixed term repos that were live on April 11, 2020 (G) and were due to mature after October 8, 2020 (G+180) – these reports must be submitted BEFORE October 18, 2020 (G+190) |

| July 13, 2020 | Reconciliation Phase 1: 43 data fields for repo will have to match (57 fields for all SFTs) |

| October 12, 2020 | Go-live insurance firms, managers of UCITs and AIFs, pension funds (fixed-term repos) – all fixed-term repos that were live on October 11, 2020, and were due to mature after April 9, 2021 (G+180) – these reports must be submitted BEFORE April 19, 2021 (G+190) |

| October 17, 2020 | Go-live banks and investment firms (open repos) – all open repos that were live on April 11, 2020 (G) and were still live on October 8, 2020 (G+180) – backload between October 9, 2020, and October 17, 2020, inclusive, (G+181 and G+190) Back-loading Phase 1: deadline for banks and investment firms to backload (i) fixed-term SFTs that were live on G and had a maturity date later than October 8, 2020 (G+180 days) and (ii) open SFTs that were live on G and have still been live on October 8, 2020 (G+180 days) |

| DEADLINE | BACK-LOAD SCOPE |

|---|---|

| January 11, 2021 | Go-live non-financial entities (fixed-term repos) – all fixed-term repos that were live on January 11, 2021 (G) and were due to mature after July 10, 2021 (G+180) – these reports must be submitted before July 20, 2021 (G+190) |

| January 16, 2021 | Go-live CCPs and CSDs (open repos) – all open repos live on July 11, 2020 (G) and still live on January 7, 2021 (G+180) – backload between January 8, 2021, and January 16, 2021, inclusive (G+181 and G+189) Back-loading Phase 2: deadline for CSDs and CCPs to backload (i) fixed-term SFTs that were live on G and had a maturity date later than January 7, 2021 (G+180 days) and (ii) open SFTs that were live on G and are still live on January 7, 2021 (G+180 days) |

| April 18, 2021 | Go-live insurance firms, UCITSs, AIFs, pension funds (open repos) – all open repos live on October 11, 2020 and still live on April 9, 2021 (G+180) – backload between April 10, 2021, and April 18, 2021, inclusive (G+181 and G+ 190) Back-loading Phase 3: deadline for insurance firms, UCITs, AIFs, pension funds to backload (i) fixed-term SFTs that were live on G and had a maturity date later than April 9, 2021 (G+180 days) and (ii) open SFTs that were live on G and are still live on April 9, 2021 (G+180 days) |

| July 20, 2021 | Go-live non-financial counterparties (open repos) - all open repos live on January 11, 2021 (G) and still live on July 10, 2021 (G+180) – backload between July 1, 2021, and July 19, 2021, inclusive (G+181 and G+190) Back-loading Phase 4: deadline for non-financial counterparties to backload (i) fixed-term SFTs that were live on G and had a maturity date later than July 10, 2021 (G+180 days) and (ii) open SFTs that were live on G and are still live on July 11, 2021 (G+180 days) |

| April 11, 2022 | Reconciliation Phase 3: another 3 data fields for repo will have to match (4 in total) |

| January 11, 2023 | Reconciliation Phase 4: another 12 data fields for repo will have to match (30 in total) |

Scope and Organization of SFTR Reporting Readiness Planning

Firms must consider each legal entity in their organization impacted by SFTR. This view must be from the perspective of transactions acting as principals as well as transactions with third-parties and/or for clients. Firms must also consider the types of transactions in scope for SFTR. SFTs in scope can be allocated to four main buckets:

- A repurchase agreement transaction

- Securities/commodities lending and securities/commodities borrowing

- A margin lending transaction

- A buy-sell back or sell-buy back transaction

The organizational logistics of categorizing all impacted legal entities, transaction types and systems/data sources for many firms on an end-to-end basis can be daunting. Many firms assign a key SFTR program manager/steward. It is vital that SFTR program managers garner a clear view of SFTR requirements across all geographical, legal or departmental groups that could be impacted. This is a challenge Broadridge sees with many firms as they try to determine the full scope of SFTR reporting and/or the platforms and data available to comply.

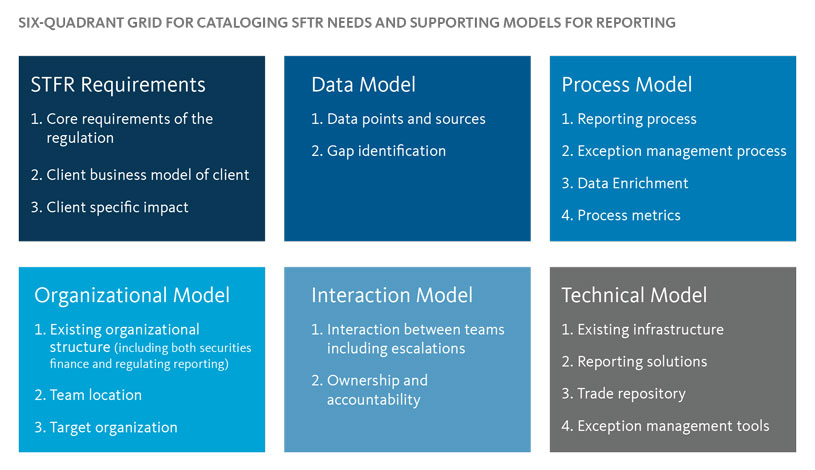

The six-quadrant grid below is a model and checklist that can be applied to each legal entity and SFT in-scope as a starting point for firms to catalogue and document the current state of raw materials available at the firm to adhere to SFTR needs.

Why is SFTR Scope Catching Firms Off Guard?

There are multiple reasons firms have been caught off guard for SFTR readiness. Some are not aware that some/all of their book of business must file under SFTR. Some firms who have been planning for SFTR reporting have simply focused on the European books of business and have been overly narrow in identifying the actual scope. One of the items SFTR is looking to measure is the flows of capital into/outside of the EU from a trading and legal domicile perspective.

Challenge 1: Interpretation of what is in scope is too narrow. Some North American-domiciled firms that are not anchored in the EU have discovered transactions they catalogued as out-of-scope since they originated outside the EU, are in fact in scope as a result of least one piece of the transaction. As a basic rule of thumb, Broadridge Consulting Services recommends examining all transactions that have even one leg of deals in their EU-domiciled legal entities or with any external entity domiciled within the jurisdiction of the regulation.

Challenge 2: Adherence is complex – workflow-driven reporting, rather than just gathering summary data is required. In recent years since the subprime crisis, global regulators have started to rethink their reporting needs. The global shift in regulatory reporting from snapshot in time reports to deeper dives into understanding workflow, legal/geographical domiciles for positions at end of day, and date/time stamps are challenging for firms to adhere to. This is especially the case when aiming to report on a cohesive basis across divisions, systems, data sets and internal processes and workflows. The 180-day back-loading requirement will be onerous and will highlight the scale of the challenges with the matching process as it comes into play when the other side of the transaction data is filed.

Challenge 3: Businesses don’t currently capture data for some fields required. This is a challenge for the granularity of data needed. Some firms are also not currently capturing or storing static data for their trades, such as Legal Entity Identifier (LEI) and Unique Trader Identifier (UTI) elements.

Challenge 4: Additional data matching fields required in later phases of SFTR rollout. In addition to the matching data fields required in April 2020, more matching fields are required over several phases of rollout currently scheduled for adoption. Planning for data needs beyond Phase 1 is critical to ensure solutions don’t become too tactical, fragmented and onerous to support for SFTR reporting once it is fully rolled out. Most firms and SFTR vendors are planning to populate all fields from day one, rather than taking a phased approach.

Challenge 5: Some in-house or vendor platforms for SFTR are not ready for adoption or are incomplete for needs. If the scope has not been completely identified by a firm, there is a strong chance that the solutions targeted for data and reporting for SFTR will not meet all needs. In addition, many vendors providing solutions are building out offerings. At the time of writing, however, few vendors have production-ready solutions for the collateral re-use elements under SFTR for FSB calculations – most are offering pass-throughs only. It is important for firms to perform detailed due diligence in selecting vendors that can offer a proven end-to-end solution for all phases and needs under SFTR reporting.

Data and Traceability: An Operational View of the Core Themes of SFTR

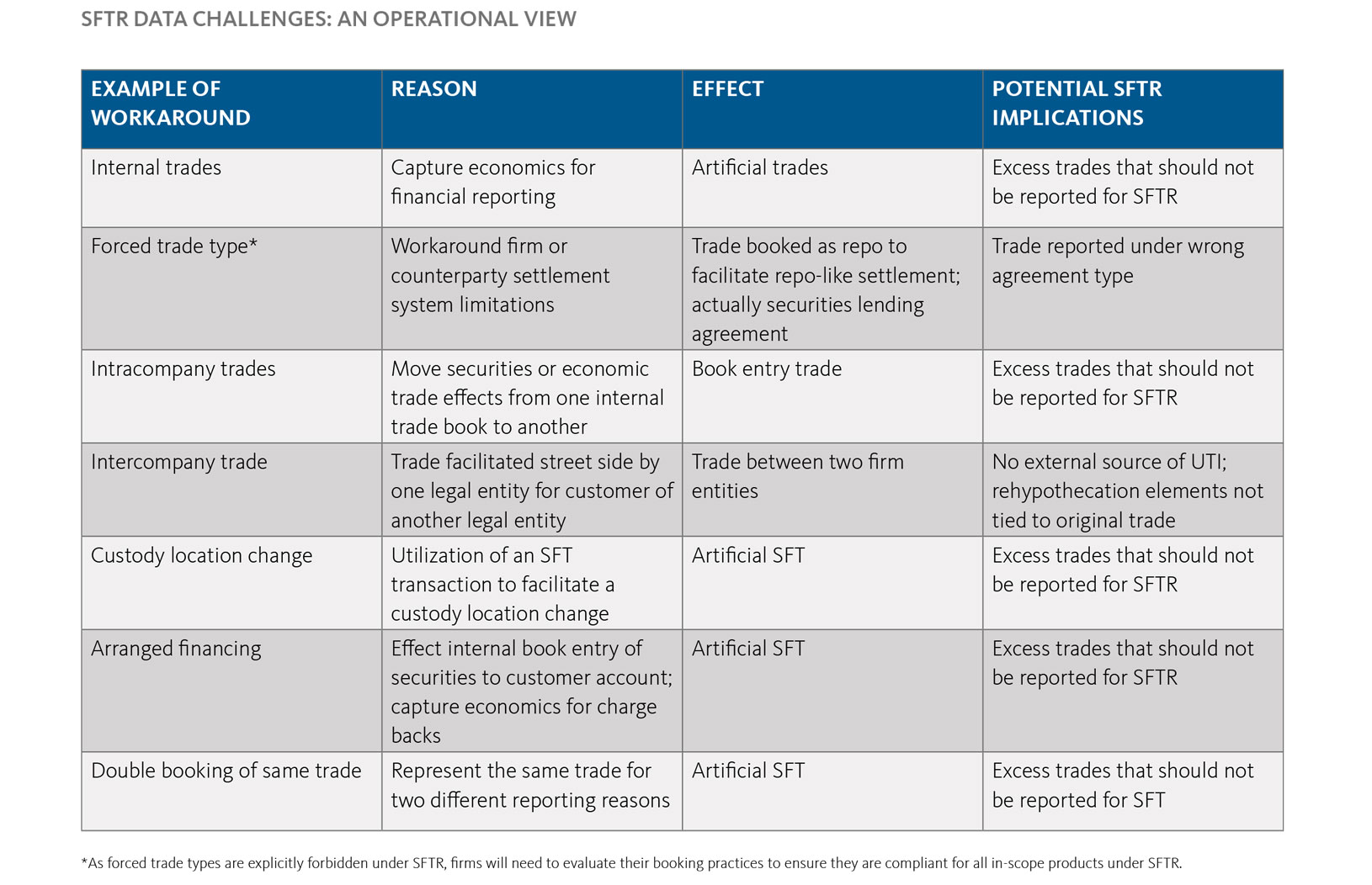

One of the most difficult challenges the SFTR program manager/steward has in assessing the scope of SFTR reporting is identifying all the buckets of trades that may exist in the firm. Firms are still wrestling with channeling their individual unique workflows, data sources and granularity into data components and traceability for SFTR reporting. Below are workarounds Broadridge has used to help firms identify scope in our work with them on SFTR.

The three key data concepts/reporting fields causing the most discussion among firms working on SFTR reporting are sourcing, handling and reporting. For example, Master Agreements are not an issue per se, but they are important for the trade repository (TR) pairing and matching. The TR requires the two LEIs, UTI and Master Agreement. The Master Agreement is also important for reporting collateral on a net exposure basis.

Key areas causing challenges for SFTR data collection and reporting are:

- LEIs - for example, intercompany trades with counterparties with the same LEI are not reportable under SFTR

- UTIs

- Master Agreements

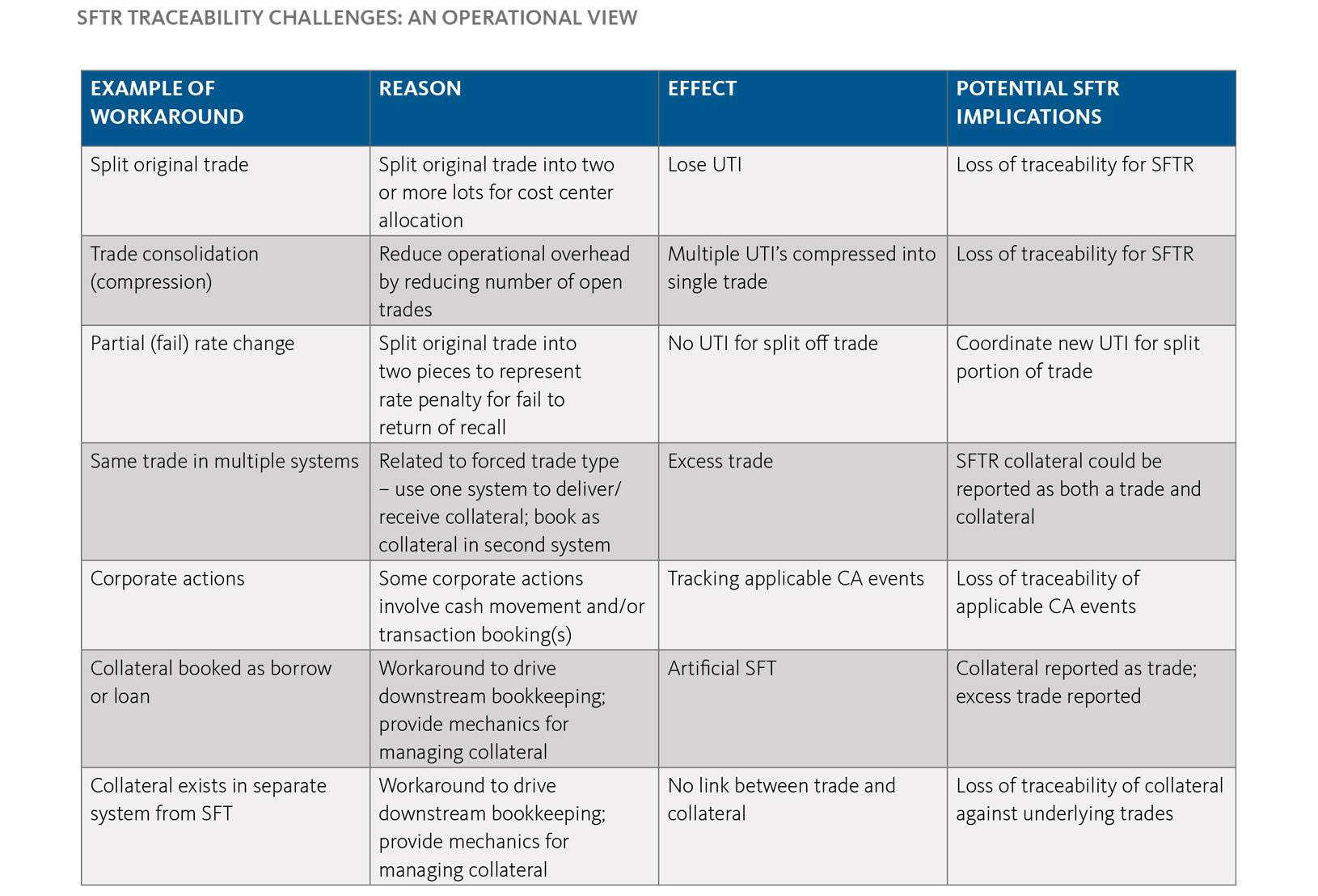

The operational view of traceability challenges below helps key SFTR impacted stakeholders understand the details at a hands-on level for identifying and quantifying reportable workflows. Of particular note, solving loss of traceability issues under SFTR is a complex issue which each firm is grappling with separately given their unique starting point. While common practices are beginning to emerge, each firm’s starting point is (at least in these early days of SFTR readiness at the time of writing) creating more bespoke solutions than industry standards for SFTR reporting solution adoption on traceability.

Top Six Challenges Firms Are Facing for SFTR

- Identifying the full scope of business impacted by SFTR reporting for end-to-end global SFTs

- Determining the best data source/capture and traceability options for a firm’s LEIs and UTIs

- Identifying all internal existing data sources - corporately supported and not, such as Excel and Access, for use in SFTR filings

- Determining sound technology solutions/workflow assistance a firm requires from third-party suppliers for all facets/phases of SFTR, as many of the vendor solutions are still works in progress

- Avoiding a tactical-only approach to resolving SFTR in the short-term and planning instead for the long-term robust solutions that optimize reporting needs and leverage technology and data spend

- Adopting a strategic reporting solution that will not only cater to SFTR but also to other global jurisdictions that will inevitably follow the EU

Conclusion

Despite the first wave of SFTR reporting scheduled for some firms in April 2020, many (especially non-tier 1 banks) are still planning/strategizing and examining solutions gaps. Even fewer non-tier 1 banks are positioned for cohesive end-to-end strategic solutions for all scheduled SFTR phases to ensure SFTR reporting does not become an operational burden to support on an ongoing basis. The complexity of the reporting requirements, lack of centralized data sets and need to adapt multiple technology solutions for SFTR reporting are making short-term and longer-term optimized solutions elusive.

Beyond creating consistency in the data reported to the regulators by market participants, it is anticipated SFTR will also ramp up pressure on the industry to adopt more standardized trade booking and lifecycle management practices. The challenges around the back-loading and matching concepts of SFTR will only accelerate this industry dialogue. The common domain model approach being discussed by industry associations could result in significant long-term benefits for the market as a whole, while also posing short-term challenges around its definition and implementation.

Broadridge Consulting Services can help you expedite a gap analysis and an SFTR strategy for both minimum viable business and robust options to adhere to near-term and longer-term deadlines. We can assist in a review of all impacted business areas on an end-to-end basis to help with risk management planning and completing business case preparation. Our knowledge of SFTR common/evolving practices combined with knowledge on industry offerings, work-arounds for interim solutions and longer-term optimization reporting for SFTR, we can assist your firm with expedited strategic planning.