Lead Generation & Nurturing Best Practices

An effective, engaging process to convert prospects to clients.

Download White PaperOpens a new window

The Importance of Lead Nurturing

According to a 2019 study conducted by Broadridge, lead generation is one of the highest priorities of financial advisors nationwide, with growth-focused advisors gaining 20+ new clients annually.1 These successful professionals are intensely focused on client acquisition, and their client acquisition rates and AUM numbers demonstrate the return that’s available from investing in marketing programs.

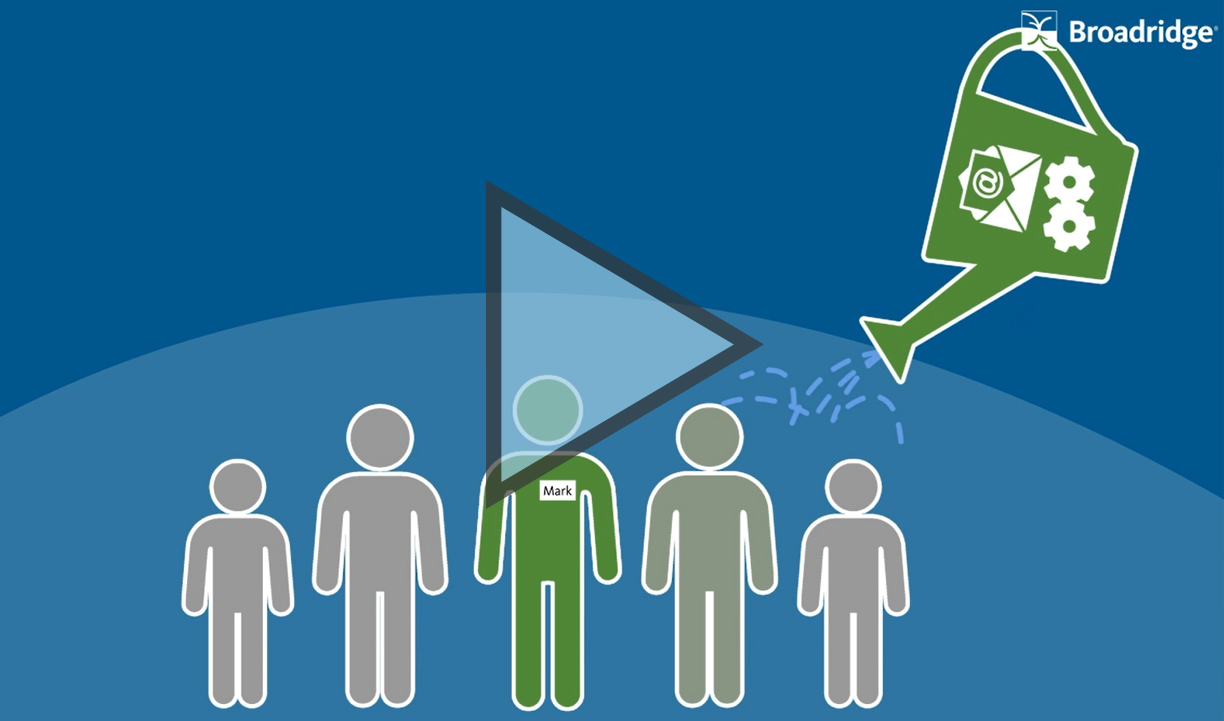

But it’s important to note that lead-generation efforts alone will not translate into success. Once a new lead is captured, the work has truly just begun. Incoming leads are seldom ready-to-buy prospects. The individuals may range from “somewhat interested” to “highly motivated” or somewhere in-between. And while everyone is unique in his or her needs and interests, all incoming leads have one thing in common: They need to be carefully nurtured before they are potentially onboarded as new clients.

Did You Know?

"80% of new leads never translate into sales, and companies that excel at lead nurturing generate 50% more sales-ready leads at 33% lower cost".2

A successful lead-nurturing process incorporates meaningful touches through multiple communication channels. These communications must be perceived as credible, current and compelling to prompt action. The process must be intentional and well-thought-out to garner success.

Broadridge is here to help improve the lead-nurturing process. With this guide, you can develop a thoughtful, effective leadnurturing program so you can turn your newly captured leads into clients — and ultimately advocates.

The Nurture Process

Here are seven necessary components for a successful lead-nurturing program. Best practices for each component are highlighted throughout this guide.

- Set realistic goals

- Identify your target audience

- Leverage engaging content

- Employ multi-channel marketing

- Create a consistent, replicable process

- Score your leads

- Review, analyze and augment for best performance

1. Setting Realistic Goals

As is true for most endeavors, the first component for your lead-generation and nurture program is to set reasonable goals and expectations.

It’s important to have realistic goals. If you currently obtain one new client a year, it’s not likely you will gain 20 new clients next year. However, as you build your brand presence, increase your knowledge and refine your process to become effective and efficient, you will be able to increase your results over time.

So, what is a realistic goal? Start with an open and honest assessment of your current success rate. Ask yourself: What is my close rate by prospecting method/channel? (This includes all your prospecting efforts and the people you meet.) And remember also to factor in the associated cost for each effort.

Here are some close-rate averages experienced by many:

- Existing Client Referral: 60%

- Seminar Prospecting Event: 14%–20%

- Email and Other Digital Marketing: 1%–4%

Broadridge surveyed a group of financial professionals in May 2019 and found that new client acquisition ranged from 0 to 20+ new clients, depending on the professional’s annual marketing investment and channels of focus. The most successful individuals reported using a range of channels for their marketing, including digital (website, social media) and in-person events. Download the results of the study here.

2. Identifying Your Target Market to Create Advocates

While it’s tempting to target everyone with every effort, success begins to emerge when you take the time to identify your target market so you can focus your efforts on the qualified prospects who are the most likely to convert into advocates for your practice.

What is a Qualified Prospect?

A simple definition of a qualified prospect is an individual who has:

- A need, such as retiring someday without compromising standard of living

- The ability to achieve his or her financial goals through income, investments and possibly an inheritance, or possibly a combination of all three

- The pain and willingness to take the next steps, hopefully with you as financial partner

You must accept that not everyone is a qualified prospect. For example, everyone wants to retire without compromising their standard of living. However, many people arrive at or near retirement age with too little income or too few assets to retire without compromise. Even the most experienced financial professional is unable to help these prospects realize their goal. Alternatively, prospects may have the need and the ability, but if they are satisfied with the status quo and not motivated to make the necessary changes to their financial strategies, they will cause you to be busy but not productive.

Did You Know?

"Prospects who want to achieve their financial goals, have the resources to achieve their goals and are highly motivated to do what is necessary by following a professional’s advice become more than just clients – they become advocates for the financial consultant".

How to Identify Your Ideal Target Market

One of the best ways to determine your ideal target is to evaluate your book of business. Identify your top 10 to 20 clients and understand what they have in common. In most instances, the top 20 clients represent approximately 80% of the revenue in your practice. You will likely discover they have a very narrow age range, a minimum level of investable assets and a minimum amount of annualized household income.

Demographic criteria for you to evaluate include:

- Age range

- Investable asset minimum

- Marital status

- Business owner, professional or individual

- Vocation

- Educational background

- Behavioral characteristics including hobbies and interests

- Common Centers of Influence (COI) affiliations

- Organizational memberships

Broadridge partner Pareto Systems has also developed a proven approach to classify clients. Through their Triple A approach, financial professionals use a detailed classification system so they can better service their top clients, attract more qualified introductions and increase their income. This is done by evaluating Assets, Attitudinal qualities and Advocate qualities. Within the Attitude category, you can ask the following questions to determine if clients are a good fit:

- What is my client’s attitude toward me?

- Does my client focus on the cost of my services or what I am worth?

- Does my client treat me like a personal CFO, or does my client insist on having investments with other financial consultants?

- Does my client have an informed attitude on the way markets work?

- Does my client try to micromanage my work?

- Is my client respectful toward my staff?

By drilling into Assets, Attitude and Advocate, your ideal client profile starts to take shape. Contact Broadridge to learn more about how we can help with your client classification process.

3. Leveraging Engaging Content

One key requirement in nurturing your clients is to send them topical, personalized and event-driven content. Because most financial professionals offer the same or similar solutions and services, this thought leadership emerges as a true differentiator. Engaging, credible content keeps you top-of-mind with clients and prospects, especially as they encounter life events and when there’s the anticipation of the movement of money. Will you be top-of-mind as events evolve? If you lack effective communications, the answer is probably no.

This content should be unique and have a goal to develop your brand and upsell clients and prospects. These content-driven communications open the door for follow-up conversations that lead to increased engagement.

Personalization of Content

Personalization is a key theme that you find in various marketing articles. In this instance, we suggest personalizing in two ways. First, include a custom message from you, the financial expert. This helps to reinforce your brand and establish yourself as the thought leader. Second, you can customize based on the topic, ensuring the subject matter is appropriate for the recipient. You can do this by creating a library of topical themes that will attract and hold the attention of your prospect as your relationship develops over time. Identify what keeps you up at night and share content accordingly.

This could include:

- Market volatility

- Retirement at risk

- Transition to retirement

- Countdown to retirement

- 401(k) or IRA rollover

- Basic succession

- Socially responsible investing

- College funding

- Roth conversion

Content Types

Along with personalization, it’s important to vary your content type. People have three primary learning styles — auditory, visual and practical — and the content we share should touch on these three learning styles. Potential types of content include:

- Articles

- eNewsletters or print newsletters

- Videos

- Calculators

- Checklists

- Flipbooks or presentations

Topics to Address

The content subject matter should also be varied to help touch on a variety of interests from numerous angles. This could include:

- Market alerts

- Macro-economic pieces

- Behavioral and interest-based content that includes commentary

- Investing basics and other timeless topics

The Power of a Content Partner

We understand the challenge around developing unique content, especially when it’s in video or graphic format. This is where the power of a partner comes into play. Find a partner that allows you to incorporate your brand, and add a brief intro note to make it your own. Looking toward your broker-dealer or a third-party content provider will help supplement the available content and increase the number of communication touch points you can accomplish throughout the year. Broadridge offers an extensive content library that is shareable through email and social media.

4. Employing Multi-Channel Marketing

An important component to the lead-nurturing process is where you share your content. It’s important to give your contacts the ability to access your content through a variety of communication channels. This is commonly known as multichannel marketing.

With multi-channel marketing, companies interact with consumers through a combination of direct and indirect communication channels, such as websites, direct mail, email, social media, phone, retail storefronts and more. This is a term you hear time and time again for one simple reason: It gets results.

Did You Know?

"Multi-channel customers spend 3 to 4 times more than single-channel customers".3

People are on the go these days and have short attention spans. With multi-channel marketing, you get in front of your customers no matter where they go for information. As the number of channels continue to grow, it’s important to find a way to integrate as many of them as possible. Here is a sample of the many channels we see financial professionals use to establish a presence:

- In-person events and community organizations

- Phone

- Print newsletters and other direct mail

- Local ads

- Website

- eNewsletters

- Social media

- Search engines

- Third-party websites

- Mobile apps

- Podcast

Digital Channel Optmization

When expanding your channel coverage, keep in mind that it’s not enough to simply be there. You also want to ensure you’re doing it in a way that will make it easy for your clients and prospects to interact with your message. This is especially true when it comes to websites, social media and email, as consumers will primarily access these channels on their smartphones. With that in mind, it is important to keep your digital communications and channels mobile-friendly. If it’s difficult to read your digital message on a phone, it simply isn’t going to get read.

You also need to evaluate your communications and channels in conjunction with one another. Your contacts will be accessing your messages in several channels, and you want to ensure that your messages work together instead of competing with each other. One way to accomplish this is by turning your website into your brand hub. Devote time to optimize the message on your website and use that as the example for the rest of your channels. Download our Website Design Checklist for an overview of which messaging to include.

Did You Know?

"Financial consultant use of digital channels for client contact is directly correlated with increased investment. In fact, professionals who use frequent digital communications (four or more touch points) are 50% more likely to see increased investment from clients than when no digital contact is initiated".4

Staying Ahead of Your Competitors

A parting thought before we move on to the next section of this guide: If you’re not communicating and engaging via multi-channel marketing, it’s almost guaranteed that your competitors are using this method. If you do not use it as well, you may find your high-net-worth clients on the move. After all, 57% of high-net-worth clients who have a financial consultant were considering moving in 2016.5 And the message that speaks to them the loudest is likely the one that will attract their attention.

5. Creating a Consistent, Replicable Process

When creating ongoing content engagement across multiple channels, how do you bring it all together while maintaining your other responsibilities — serving existing clients, monitoring the market and more? The answer is automating your process with systemized communications cadences.

Did You Know?

"80% of high-growth sales development teams engage in a triple-touch process that includes phone, email and social media. Lead form follow-up within the first 4 hours results in 72% conversion for an initial meeting".6

Top-producing financial professionals are successful with their interpersonal engagements. They leverage technology to augment their efforts and gain more time with their clients, understanding it takes more than two emails and a phone call to turn a prospect into an office visit.

Asking prospects to trust you with their life savings, future retirement and next-generation plans tak more than three interactions. Not only are you aiming to build trust, you’re also relying on a life event or pain point to occur to motivate prospects. You need to be top-of-mind when life events happen. That’s the purpose of an automated communication cadence, like the one illustrated below.

As you can see from the example cadence, there is a manual component to the communications. Phone calls must be placed, notes must be mailed and content must be shared. But by embracing technology, some components are easily automated. For example, partnering with a third-party content provider like Broadridge will give you immediate access to engaging content. Through the Broadridge Advisor Portal, you can access more than 2,500 pieces that are easily delivered via email, social media and PDF.

TIP: Download our Nurture Communications & Engagement Toolkit, for a variety of cadences to fit different interests, life events and client relationships!

Once you’ve documented your cadences, you can leverage your entire team. You don’t have to complete each step. Many tasks can easily be completed by other team members. Once you set the standard for communications, it’s easy to replicate for each incoming lead.

Given the importance of personalization and of life events, one nurture cadence is not going to fit all needs. We have put together an extensive toolkit outlining a variety of cadences based on client interest, life events and their relationship to you (lead, new client, existing client). Contact us to request your copy.

6. Scoring Your Leads

At its basic level, lead scoring is the act of classifying leads according to prospect characteristics or activities to help you identify where to concentrate your greatest lead-nurturing efforts. This helps you identify client fit and interest so you can optimize the ROI of your marketing efforts. If a prospect isn’t a fit or displays low interest, then you can confidently shift your focus elsewhere.

Eliminate Bad Leads

First and foremost, you’ll want to separate spam leads from legitimate leads. Look at the basic information you’ve collected to help determine which leads are motivated individuals who are looking to connect with you.

- Does the name appear legitimate, or have you also seen it associated with a cartoon character?

- Is the email address legitimate, or do you receive bounce notifications?

- Is the phone number legitimate? Word of caution: With landline phones declining, you may start to see an increase in mobile phone numbers that are not local to your business. This alone should not prompt you to dismiss a lead.

Scoring Based on Demographics

As you start to interact with your leads, you will gain additional demographic insights. As this happens, think back to the target market attributes you previously identified. Based on the information you collect throughout the lead capture and nurturing process, you will start to expand your knowledge of each lead to help classify whether it is the right fit for your practice. You can also use social media profiles as a starting point:

- Do the demographics in their profile align with your target market?

- What does the content they share reveal about their interests and goals?

Scoring Based on Interest

You should also pay attention to their responsiveness to each step of your lead-nurture cadence. Start checking to see if your leads have done any of the following:

- Downloaded or requested information through your website

- Opened your emails

- Clicked on email links

- Followed you on social media

- Interacted with your content on social media

- Answered your phone calls

- Attended your webinar, seminar or other event

When you score behaviors, take into consideration “high effort” versus “low effort.” It takes relatively little effort to open an email, submit an online form or follow someone on social media. It takes considerably more effort to engage in a phone call or attend an event. The amount of effort a lead has demonstrated will help you gauge his or her level of interest and willingness to take the next steps.

Scoring Based on Previous Success

You should also look at your past efforts. Start to analyze the demographics and behaviors of your newer clients to glean indicators for your incoming leads. Ask yourself:

- How did these clients first interact with your brand?

- How receptive were they to your nurturing communications?

7. Reviewing, Analyzing and Augmenting

As is the case with many efforts, results will vary based on a professional’s skills, strengths and weaknesses and his or her professional practice. This is why it’s critical to take the time to review and analyze your efforts, and to do so often. After all, your clients will change, you will change, the market will change and, inevitably, your results will change.

Document all the aspects of your lead-nurture program. Successful individuals have a cursory review every quarter and make small changes to their approach, understanding that marketing campaigns take time and data is needed for analysis. Much like investing, don’t panic but prompt change. It’s important to augment and refine your program based on data, not gut feeling.

Key Metrics

Here are some of the metrics to consider when reviewing your lead nurturing and marketing strategy:

- Number of new leads

- Number of leads converted to appointments

- Number of new clients

- Number of total clients (to identify attrition)

- Change in AUM

- Cost of new client acquisition (marketing dollars spent on prospecting efforts/new clients)

- Communication metrics — email open rate, email click rate and social media interactions (clicks, likes, shares, comments)

Ongoing Improvements

Embrace the concept of Kaizen — “change for the better” or “continuous improvement” — and test a new marketing strategy each year. Allocate a small piece of your annual budget to try something new and put that strategy to the test. Use the results to determine whether to expand that strategy in the coming year.

Benchmarking

It always helps to review current marketing research to see how your efforts stack up against others. Our 2019 study, Marketing Practices of Growth-Focused Advisors, includes self-reported findings on new clients and marketing spend to help gauge how your efforts align with those of your peers. You can download the results of the study here.

Additional Pathways to Marketing Success

Broadridge can help you strike the right balance, optimizing digital and other channels to achieve a competitive edge. Learn how you can tap into a wealth of proven resources and expertise at broadridge.com/advisor.

Through our Insights section, you gain access to a library of marketing resources, including articles, checklists, white papers and on-demand webinars.

You can also stay abreast of our latest findings by following us on LinkedIn, Facebook and Twitter. Discover how partnering with Broadridge will help you stay ahead today and get ready for next - call +1 800 233 2834, or visit broadridge.com/advisor.

- Broadridge Financial Solutions, Inc. “Marketing Practices of GrowFocused Financial Advisors.” May 2019.

- Saleh, Khalid. “The Importance of Lead Nurturing – Statistics and Trends.” Invesp. https://www.invespcro.com/blog/lead-nurturing/

- SAS. https://www.sas.com/en_us/insights/marketing/multichannel-marketing.html

- J.D. Power. “2020 U.S. Full-Service Investor Satisfaction StudySM,” March 2020.

- Forbes. “Financial Advisors Should Ask: What Would Amazon Do?” September 2016. https://www.forbes.com/sites/richdaly/2016/09/27/financial-advisors-should-ask-what-wouldamazon-do/#7626cf163f09

Let’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your request has been successfully submitted. A representative will contact you shortly.