Being T+1 ready comes with significant costs. The best resourced organizations will need to add teams in North America or to their overnight trading desks at home. Even for enterprises that can sustain those costs, the transition will require a thorough assessment of the workflows around the lifecycle of a trade. Organizations should look toward automation to help them keep pace.

T+1: Not an obstacle — but an opportunity

The implementation of T+1 settlement cycle in North America will have far reaching benefits globally. Shortening the settlement time from T+2 to T+1 will improve market efficiency and reduce counterparty risks, as well as improve capital efficiency. Settling trades faster will reduce costs to investors and mitigate risks to banks and broker-dealers.

Investors will be able to access their funds earlier, leading to enhanced liquidity and expedited recovery from market volatility. The shift to T+1 settlement will also pave the way for future advancements in market infrastructure.

The successful implementation of T+1 largely depends on the industry's readiness and cooperation. Although progress is being made, challenges may arise in adapting to the new settlement process. In a T+2 environment, the industry has a full business day to process trades and address errors. This involves:

- Trade allocations

- Matching and affirming allocated trades

- Transacting any currency trades if a counterparty needs to access U.S. dollars

- Managing exceptions

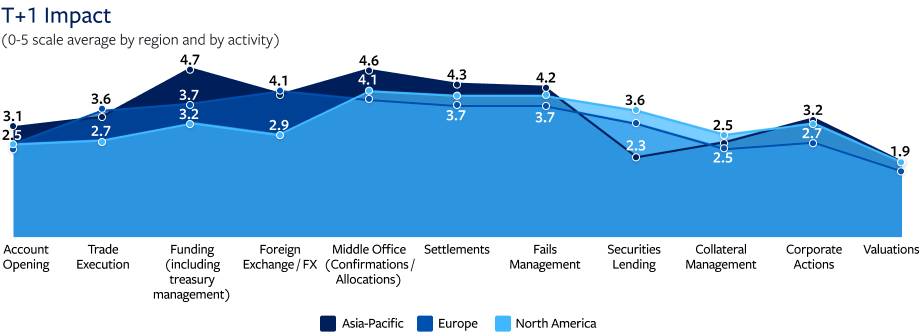

With T+1, firms will no longer have the luxury of that full business day, increasing the risk of failed trades. APAC firms will have to complete the confirmations and allocations processes for their U.S. trades by 11:00 AM local time on the settlement date to allow North American trades to settle on time.

The challenge of failed trades for APAC firms

For U.S. and European investors, failed trades usually result in financial costs. Firms have treated small numbers of fails as an acceptable cost of doing business. For the past several decades, the industry has experienced very low interest rates, so funding the cost of failed trades was low. T+1 means that firms that aren’t prepared will face more fails while operating in a macro regime in which the cost of funding is now above 5%, making fails more expensive.

Along with heightened fail risk, T+1 also creates stress on funding. Non-U.S. firms must understand their cash flow on an intraday basis to manage settlement obligations. Otherwise, they risk a cash crunch. In the worst case, they may have to raise funds through the repo market or lines of credit.

Working in a post-T+1 world

The shift to T+1 settlement will also pave the way for future advancements in market infrastructure.

Firms should also keep an eye on the possibility of the world’s trading systems moving to same-day settlement (T+0). Advances in artificial intelligence and digitalization could make this possible.

There are already practical examples at play. Distributed ledger technology is being used to process repo transactions, an improvement versus existing workflows. In Asia, Hong Kong Exchange and Clearing has adopted a blockchain-based system1 to help U.S. investors match the T+0 environment that already exists in mainland China’s securities markets. Hong Kong and Singapore monetary authorities continue to back pilots including blockchain-based bond issues2 and using central-bank digital currencies3 to serve as cash legs.

Whether or not the U.S. securities market makes a push to T+0, the work that APAC firms are doing to prepare for T+1 will help ensure they’re ready for whatever moves their own governments decide to do on this front.

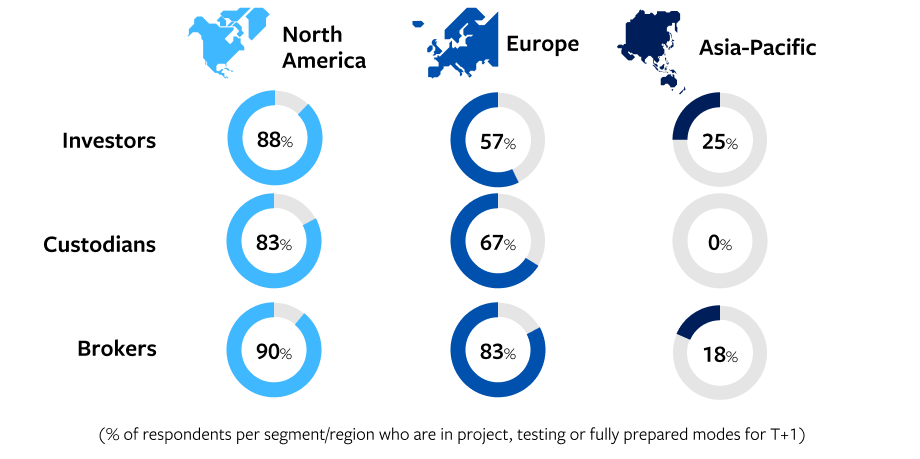

T+1 readiness around the world

Getting ready for North America’s T+1 transition

There are three steps firms in APAC can do take ensure they are ready for the arrival of T+1 in North America by May 28, 2024.

- Assess the entire workflow of pre- and post-trading to identify problematic counterparties. If a client or counterparty is routinely late in sending trade details and allocations, now is the time to engage with them to improve the workflow.

- Identify internal bottlenecks. This is where smaller firms may have an advantage over larger, better resourced ones because they may have a simpler business model. Workflows may consist of multiple systems that must move data across servers and departments which need to be mapped and understood.

- Determine all manual aspects of operations and processing. Any manual touchpoints should be automated if possible. Risk controls and supervisory processes must be implemented for all manual processes, and they should be flagged for future investment in automation.

1 HKEX Launches Synapse, A Settlement Acceleration Platform For Stock Connect. Mondovisione.com. Retrieved November 27, 2023, from https://mondovisione.com/media-and-resources/news/hkex-launches-synapse-a-settlement-acceleration-platform-for-stock-connect/

2 Hall, Ian. “HKMA Publishes Bond Tokenisation Blueprint.” Global Government Fintech, 30 Aug. 2023, www.globalgovernmentfintech.com/hkma-publishes-bond-tokenisation-blueprint-to-unlock-potential-of-dlt/. Accessed 27 Nov. 2023.

3 Chiang, Sheila. “Singapore to Pilot Use of Wholesale Central Bank Digital Currencies in 2024.” CNBC, 17 Nov. 2023, www.cnbc.com/2023/11/17/singapore-to-pilot-wholesale-central-bank-digital-currencies-in-2024.html. Accessed 27 Nov. 2023.