The combination of lower costs to serve and growing investor demand is pushing the market to meet the moment and bring direct indexing to the masses. Large industry players and robo-advisors are well positioned to embrace direct indexing’s potential. Smaller firms, on the other hand, may need to get creative to stay competitive.

What’s old is new again

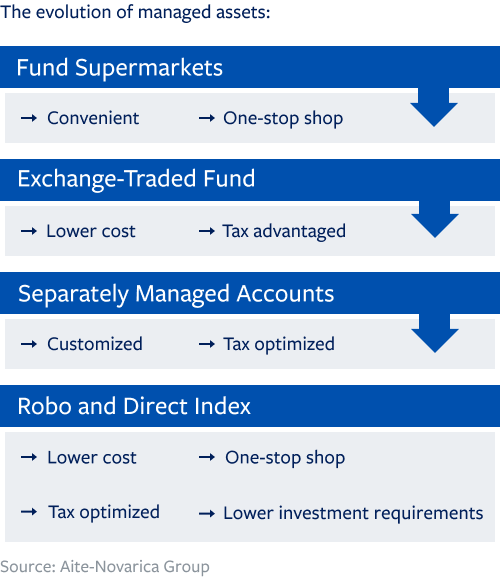

The expansion of the direct indexing market is the result of three noteworthy developments in wealth management:

- Fractional share ownership and low trading costs, pioneered by digital brokerages but now widely available

- Advances in portfolio management technology that allow for automated portfolio construction and rebalancing to be done at low cost (and at scale)

- Growing investor demand for customized strategies

Large, established players such as Charles Schwab, Fidelity, and BlackRock have begun to launch offerings that target the lower end of the net-worth spectrum. For example, with a $5,000 minimum from Fidelity4 and just $2,000 from Altruist,5 retail investors can build and customize their own direct indexing portfolio.

The appeal for investors

Direct indexing involves using a (typically taxable) SMA to buy the underlying positions that make up an index — essentially mimicking the performance and risk of the index. This can now be done at smaller asset levels through the use of fractional shares and can be accomplished with lower transaction costs.For investors, direct indexing offers important benefits over traditional index-tracking funds, specifically customization and tax-loss harvesting. To facilitate tax-loss harvesting, algorithms can automatically sell losing positions and replace them (for 30 days, according to wash-sale rules)6 with similar positions to mitigate tracking error (such as selling Pepsi and buying Coca-Cola).

These losses can be used to offset gains from other parts of the investor’s portfolio, or from within the direct indexing portfolio itself. This allows the investor to lower their tax bill and reduce the buildup of unrealized gains in their portfolio. By contrast, an ETF investor owns interests in the fund, not the individual securities, and therefore does not have an option to recognize tax losses on individual components.

Direct indexing also allows investors to customize the index based on personal views or portfolio positioning. For example, environment, social, and governance (ESG)-conscious investors could tweak the S&P 500 index to exclude oil and gas companies. Alternatively, an investor with significant holdings of their employer’s stock may want to limit that exposure in their investment portfolio by excluding it from the index. Investors can even make their direct index account more like an actively managed fund by overweighting or underweighting certain sectors based on economic outlook. Performance reporting tools can then provide an impact assessment of how the investor’s choices impacted returns.

The state of the industry

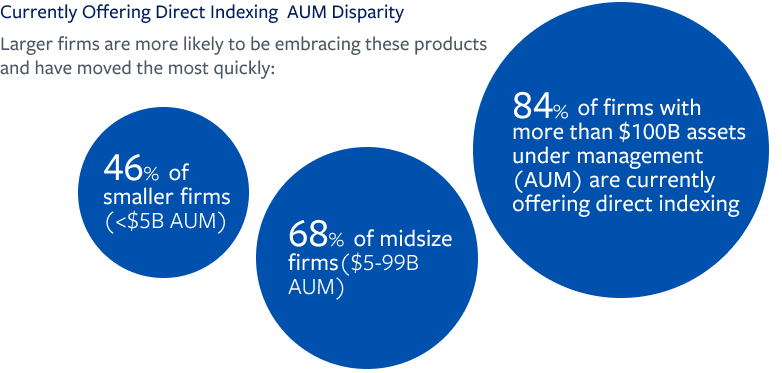

Broadridge’s 2022 direct indexing survey polled executives, financial advisors, and portfolio managers at more than 1,000 wealth management firms. Of that group, 47% said they were knowledgeable enough about direct indexing to complete the survey. Within that subset, around two-thirds (66%) said they were currently offering direct or custom indexing, while 27% said they were planning to offer these strategies. A majority (84%) of firms with more than $100 billion in assets under management are already offering direct indexing, compared to 68% of mid-sized firms ($5 billion to $99 billion) and 46% of small firms (less than $5 billion).

Think smart, move fast

Much in the way that ETFs took substantial market share from mutual funds over the past 20 years, direct indexing is now poised to grow at a faster rate than ETFs and mutual funds.7 Among Broadridge’s survey respondents, 85% of those currently offering or planning to offer direct indexing also saw “moderate to high replacement of ETFs.”Those that are familiar with direct indexing are moving quickly, with 93% currently offering or planning to offer the strategy to clients. Larger industry players have spent significant acquisition and development dollars over the past several years to be the early movers in this space. These firms will be marketing their solutions aggressively in order to take share from smaller, slower rivals.

This leaves most medium-sized and small firms with two choices: build or partner. Smaller firms are more likely to be using (42%) or looking to use (57%) outside partners — seemingly a prudent choice that allows them to prioritize speed and limit upfront costs. Medium-sized firms, on the other hand, are choosing to build in-house tools at roughly the same rate as large firms — a strategy that may create more setbacks than benefits. Time will tell which strategy wins out.

Big firms go all-in on direct investing

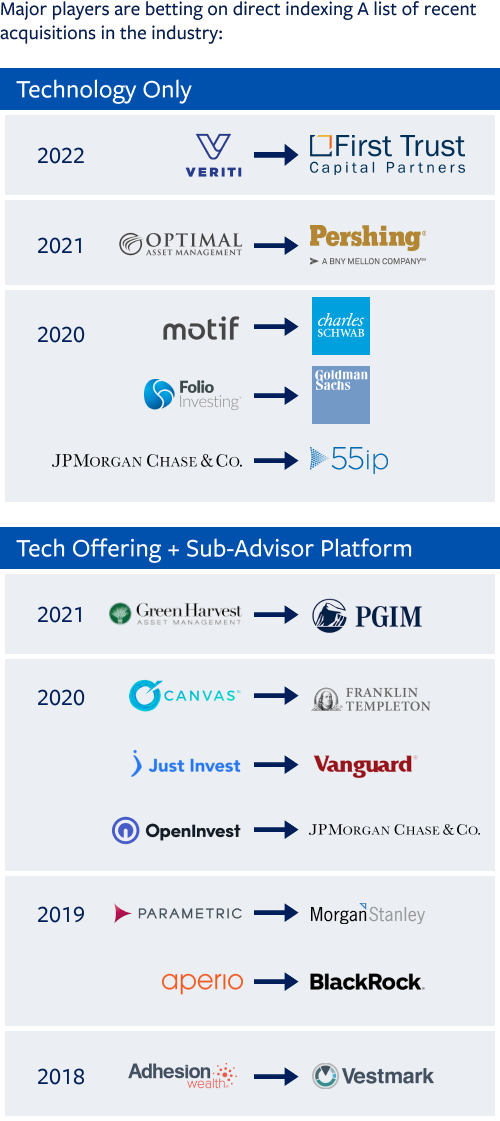

Since direct indexing was first introduced 30 years ago, several niche companies have sprung up to tackle the complexities involved in supporting the strategy. In the past few years, most of those providers have been acquired by large firms who identified the competitive differentiation that having an in-house offering could provide.

Major players have been acquiring smaller firms with strong direct indexing capabilities rapidly. JPMorgan Chase kicked off the acquisition spree by agreeing to purchase 55ip in 2020, and was followed by Goldman Sachs, Charles Schwab, Vanguard, Blackrock, and multitude of other big name brokers and asset managers.8

Major players have been acquiring smaller firms with strong direct indexing capabilities rapidly. JPMorgan Chase kicked off the acquisition spree by agreeing to purchase 55ip in 2020, and was followed by Goldman Sachs, Charles Schwab, Vanguard, Blackrock, and multitude of other big name brokers and asset managers.8Bigger firms have gained an incumbent’s advantage by moving quickly. Although some, like Vanguard, still have six-figure minimum investment levels, the goal for them and others is to bring down minimums to the retail level. Expense ratios for direct indexing also continue to fall. Whereas years ago, the strategy could only be offered for low single-digit percentage fees, typical fees are now 0.4% or lower. By contrast, an actively managed ETF or mutual fund will typically have fees north of 0.5 – 1.0%. Passive funds still tend to be less expensive (0.05 – 0.15% on average), but don’t offer the tax and customization benefits of direct indexing. Fees for direct indexing may continue their downward trend as they become more competitive with passive funds.

Smaller firms play catch-up

Smaller firms will face implementation challenges and may need to find partners to help them navigate their direct indexing journeys. Forty-two percent of smaller firms surveyed (less than $5 billion in AUM) with a solution in market are working with partners. Contrast this with the strategy of their larger counterparts, where 69% have an offering in market and are tapping internal capabilities to do so.“The number of acquisitions by large firms in this space in recent years speaks to the complexity of building this technology in-house. Smaller firms will have to get creative in how they bring a competitive solution to market,” says Isaac Schuman, Director of Corporate Strategy at Broadridge.

Offering direct indexing requires firms to up their game from an operational and technological perspective. It necessitates comprehensive data management (for the many tax lots that will be created) and automated tools to handle portfolio construction, tax optimization, rebalancing, tracking error management, and performance reporting.

Seizing direct investing’s moment

The growth of direct indexing represents a significant opportunity for wealth and asset management firms. One half of the industry is moving quickly to gain a first mover advantage, while the other half is still coming to grips with the concept. All money managers should be evaluating and making plans now to stay ahead in an increasingly competitive marketplace. Younger cohorts of investors are open to the concept, and soon will be expecting it. Firms that have a plan in place will come out ahead.

Getting started on the road to creating a direct indexing offering is complex. Key considerations include whether to build, buy, or outsource; how to create value for clients, advisors, and the firm; and how to integrate the new offering into a firm’s existing product and service mix. Ultimately, firms need to be attuned to how direct indexing works, how they can offer it at scale (and with low fees), and where the client demand exists. Those who get it right will prevail — those who don’t may have to play catch-up.

1 Simpson, S. D. (2023, October 22). A brief history of exchange-traded funds. Investopedia. https://www.investopedia.com/articles/exchangetradedfunds/12/brief-history-exchange-traded-funds.asp

2 Charles Schwab. (2022, September 13). No matter the weather: Despite a perfect storm of market disruptions, Schwab Study finds investors continue to favor ETFs | Charles Schwab. https://pressroom.aboutschwab.com/press-releases/press-release/2022/No-Matter-the-Weather-Despite-a-Perfect-Storm-of-Market-Disruptions-Schwab-Study-Finds-Investors-Continue-to-Favor-ETFs/default.aspx

3 Cerulli Associates. (2022, December 1). Cerulli Associates Projects Direct Indexing Assets to Top $800 Billion by 2026 While Outpacing Growth of ETFs, Mutual Funds, and SMAs. https://www.cerulli.com/press-releases/cerulli-associates-projects-direct-indexing-assets-to-top-800-billion-by-2026-while-outpacing-growth-of-etfs-mutual-funds-and-smas

4 Fidelity Managed FidFoliosSM | Professionally Managed Stock Investing. (n.d.). Digital.fidelity.com. Retrieved October 24, 2023, from https://digital.fidelity.com/prgw/digital/msw/overview/a

5 Braham, L. (n.d.). Altruist Breaks the $2,000 Barrier for Direct Indexing. Www.barrons.com. Retrieved October 24, 2023, from https://www.barrons.com/advisor/articles/altruist-direct-index-portfolio-advisors-51650459049

6 Taylor, Kelley R. “The Wash Sale Rule: Six Things You Need to Know.” Kiplinger.com, 18 July 2022, www.kiplinger.com/taxes/604947/stocks-and-wash-sale-rule. Accessed 30 Oct. 2023.

7 https://www.cerulli.com/press-releases/cerulli-associates-projects-direct-indexing-assets-to-top-800-billion-by-2026-while-outpacing-growth-of-etfs-mutual-funds-and-smas

8 Kephart, J. (2023, April 6). The direct-indexing landscape in 3 charts. Morningstar, Inc. https://www.morningstar.com/funds/direct-indexing-landscape-3-charts