Even as GenAI makes waves, the majority of executives still prioritize day-to-day transformation initiatives, such as data management, cybersecurity, cloud platforms, and human talent. The reason for this is multifold: GenAI is new, its use cases are still being figured out, and firms need the foundational technology, risk processes and staff skill set to make the most of this emerging field.

The vast majority of respondents to the Broadridge 2024 Digital Transformation and Next-Gen Technology Study, which included 500 global C-Suite and senior executives across the buy- and sell-side, are eager to invest in GenAI. Their overwhelming focus is still on more established technologies like cloud, cybersecurity, and data analysis, however they're pursuing a careful balancing act between investing in emerging and existing technologies.

GenAI is posed to change the way we work, but it’s not ready to take over financial services firms’ transformation agenda. The reasons why are complex, but practical: there’s foundational work to do.

Early excitement, cautious investments

When ChatGPT sprung to life in 2022, financial organizations saw the opportunities from generative artificial intelligence (AI) to deliver back-office efficiency gains, exciting new product innovation, and new business models. As in many other industries, GenAI was heralded as transformative, a game-changer. The race was on.

Contrast this early enthusiasm with the results from this year’s study, which shows only 4% of firms are making a large investment into GenAI — and 39% making no investment at all.

The reason for lower investment figures could come down to practicalities. Many institutions struggled to overhaul aging systems only a few years ago. In 2023, more than 40% of respondents said they’re held back by legacy systems — a challenge that businesses have to overcome first before focusing extensively on future tech. Three-quarters are confident their transformation is on the right track this year, likely because they’re investing heavily in core technologies to get there.

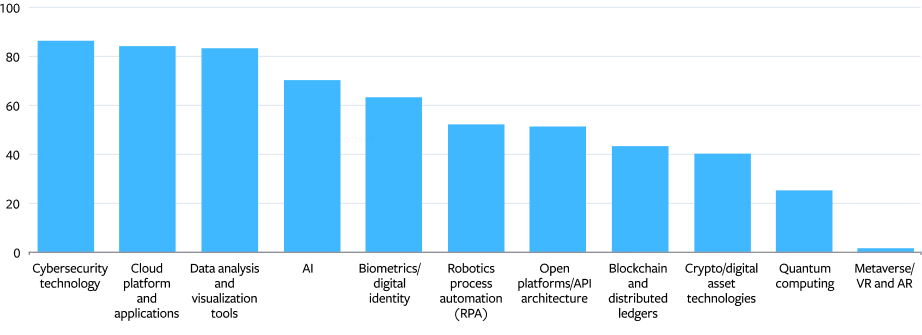

Percentage of leading firms currently making moderate to large technology investments

Proceeding with cautious optimism

Even though GenAI investments may not be the major focus for most firms in 2024, this nascent technology is still on most firms’ radar. Last year, respondents said they would dramatically expanding the use of AI and automation across their enterprise if given a magic wand to accelerate transformation.

Fast-forward to 2024, and the desire to spread AI through their businesses has only been amplified by GenAI’s capabilities.

“Even with minimal coding or AI experience, you can use powerful pre-trained models to make fast, compelling progress on previously stalled use cases and pilots,” says Joseph Lo, Head of Enterprise Platforms at Broadridge. “It’s also relatively inexpensive to start with an abundance of high quality, affordable commercial models.”

This technology might be the magic wand executives were looking for. It makes it easier to expand AI across the business, is simpler to implement, and can give non-experts the ability to incorporate it into their daily tasks.

Leading firms are pushing hard to use GenAI to differentiate themselves from their competitors. Many others, however, are holding back and taking a wait-and-see approach, considering the security and compliance aspects of GenAI in a heavily regulated industry.

Priority areas for AI investments — now and throughout the next two years

Easy to start, hard to deliver

With some questions still unanswered about GenAI in the workplace, it’s no wonder some firms are holding back on their investments. Those that are making large investments aren’t likelier to have a clear strategy in place, either. This makes for an unsure environment for going big on GenAI — at least not yet.

Regulations are on the horizon, too. The European Parliament adopted the Artificial Intelligence Act in December 2023, which includes obligations for banking services, among other “high-risk systems.” The EU and U.S. have agreed to draft an AI code of conduct as well, which signals more legislation to come.

These trends shouldn’t stymie GenAI efforts, however. Working with safe AI principles in mind can help ensure projects stay on track and deliver a return on investment.

“You need to have the proper cross-functional risk management processes in place for safe and responsible AI,” says Lo. “That means robust AI governance policies and controls, including cyber resilience, privacy, and data security.”

A matter of practicality

Another reason firms may not be going all-in on GenAI spending could be because they don’t have the capacity to make the most of it yet. “It can be easy to get to a prototype solution that works 70–80% of the time with GenAI,” Lo says. “Prototypes can be made in a matter of weeks.”

Pushing to get to a client-ready solution can be incredibly difficult, and may take a year or more. Firms might not even make it with the current technology available.

“It’s not a data shortage problem. Financial institutions have plenty of valuable data. It’s being able to access the data at the velocity that is required to feed these models and the use cases. That’s the challenge,” Lo says.

Hiring and training the right people

Firms are still figuring out a path forward with their AI talent strategy. Most don’t have a clear plan for training in GenAI and reskilling staff to manage the impact of AI on the workforce.

Financial organizations of all sizes struggle to develop a workforce with the right skillsets across the business. Only 25% of organizations are training staff in how to use GenAI, which makes any amount of spend on actual GenAI initiatives a potential obstacle if there’s not enough talent to work on initiatives.

Rob Krugman, Chief Digital Officer at Broadridge, says, “The reason that we don’t see more firms at an advanced stage of digital transformation is a lack of disruptive leadership where they are willing to make the bets that will transform. Without that, companies continue to be focused on tactical efforts rather than strategic efforts. You need to be able to set a benchmark for where you want to be in three or five years.”

GenAI investing: keeping it practical

GenAI will reshape life as financial organizations know it, and it’s worth investment and focus due to the productivity gains it promises. But there is a clear risk in moving too fast, too soon, and taking the focus and investment away from other technology projects that can deliver greater and more-certain returns for the company and its customers.

The financial services industry is taking a reasoned and pragmatic approach, investing broadly in more conventional elements of digital transformation rather than putting everything into chasing the next big thing. Whether that will pay off — or if digital natives will seize the investment gap — is something predictive analytics can’t decipher yet.

1European Parliament. (2024, March 13). Artificial Intelligence Act: MEPs adopt landmark law.

2 Peets, Marianna Drake, Marty Hansen, Lisa. “EU and US Lawmakers Agree to Draft AI Code of Conduct.” Inside Privacy, 9 June 2023.