“You better start swimmin’ or you’ll sink like a stone, for the times they are a-changin’.”

- Bob Dylan

In 2024, the world voted for change—not just in elections, but in the way markets moved, companies innovated, and financial services adapted to mega trends. In 2025, we stand at the threshold of that change transforming into action, rippling through economies, businesses, and regulations in both subtle and dramatic ways.

Returning for its second year, our predictions for 2025 highlight insights from 10 of our senior leaders, offering perspectives on the macro trends shaping the financial services industry. From quantum computing to regulatory evolution, the rise of startups in emerging markets to the human transformation overtaking digital, this is your guide to navigating the opportunities and challenges in 2025.

1. Quantum comes of age, supercharging AI

“Any sufficiently advanced technology is indistinguishable from magic.”

- Arthur C. Clarke

Quantum computing is stepping out of the realm of science fiction and into financial services, where it’s poised to become a game-changer—especially when paired with AI. Together, these technologies could redefine how firms approach portfolio optimization, algorithmic trading, and risk management, unlocking possibilities previously unimaginable. A fundamentally new method of computation, quantum computing taps into the ability of matter at the smallest scales to occupy multiple states simultaneously. This unlocks an unprecedented ability to rapidly process staggering amounts of data.

In 2025, financial firms will take quantum-AI integrations seriously, potentially pushing beyond proofs of concept toward real-world experimentation. Some firms are already piloting quantum-AI solutions to fine-tune risk predictions, streamline trading algorithms, and unlock entirely new strategies.

Quantum computing also poses challenges to today’s cybersecurity ecosystem. Many of the cryptographic schemes that protect systems today can be broken by quantum algorithms. This threat necessitates a proactive response, including the development of post-quantum cryptographic standards and that withstand the computational intensity quantum computers will enable.

While we may not see full-scale deployment in 2025, it will be a pivotal year of breakthroughs. The quantum-AI nexus is no longer just a future aspiration—it’s the starting line of a mega trend that will reshape financial services.

2. Regulation refocused

“The measure of intelligence is the ability to change.”

- Albert Einstein

2025 is poised to be a year where regulation in financial services shifts toward clarity, and proactive, forward-looking approaches to ensure compliance.

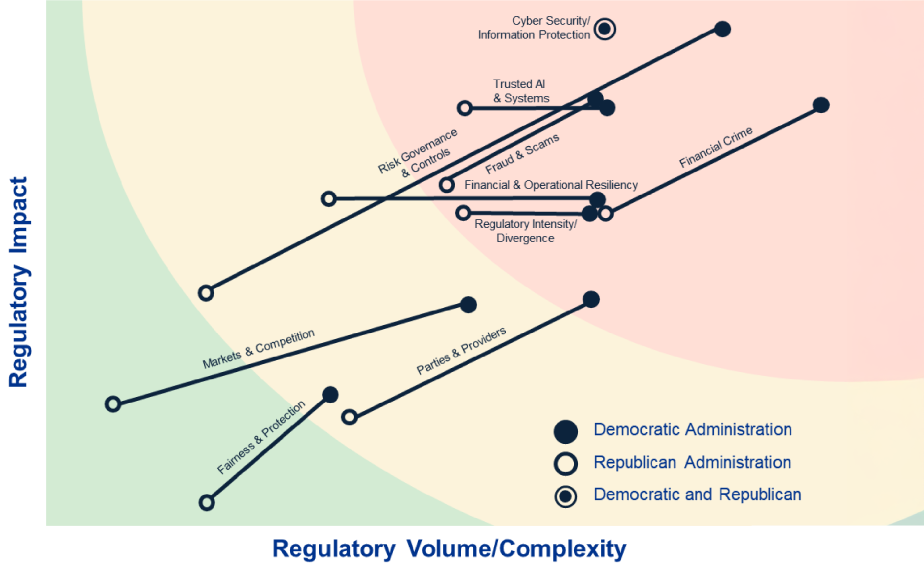

The infographic below from KPMG highlights the nuanced differences in regulatory priorities across regions, particularly in the U.S. But one thing is clear: regulation is not vanishing—it’s adapting to practical protection of investors and the financial ecosystem.

Key areas like cybersecurity, trusted AI, client communications, and financial crime are likely to experience increased regulatory activity globally. Emerging technologies, particularly AI, are not only being regulated but also being leveraged as tools for compliance. AI will play a pivotal role in identifying risks and streamlining adherence to evolving rules, turning a potential compliance burden into an efficiency gain.

What is likely to change is the practice of “regulation by enforcement,” where firms face retroactive penalties for long-standing and common practices that suddenly come under scrutiny and retroactive fines are issued. Instead, the future of regulation lies in proactive rule-setting—crafting clear, actionable guidelines that firms can follow with confidence, reducing uncertainty and fostering trust.

While the U.S. regulatory focus may shift under new leadership, global momentum, especially in Europe and emerging markets, continues to push for robust frameworks that prioritize fairness, operational resilience, and sustainability. The regulatory landscape isn’t losing its structure—it’s simply being refined to better navigate the complexities of a modern financial world.

Strong, sensible rules will remain a cornerstone of progress in financial services, ensuring stability and fairness as the industry evolves.

Potential 2025 Regulatory Shifts in the U.S.

Source: KPMG Regulatory Insights, August 2024

3. Human transformation overtakes digital

“Life is either a daring adventure or nothing at all.”

- Helen Keller

Much has been written about next-generation technologies and the disruption they bring to businesses, economies, and nearly every aspect of our lives. But as we dive deeper into these tools, a more profound story is emerging: the human opportunities that arise from these shifts. In 2025, transformation will evolve from being a technology conversation to also include a human one. We may still talk about tech roadmaps, but we will also need to build out human capital roadmaps.

This shift is already underway. Artificial intelligence, for example, doesn’t function in a vacuum—it requires skilled talent to train, deploy, and collaborate with it. According to our own Digital Transformation study, 45% of financial services firms are empowering their teams to use GenAI and 46% have a reskilling plan in place. For marketers, AI is increasingly seen as a “first draft” tool, enabling them to focus on editing, strategy, and storytelling or a way to accelerate the concepting and design process. For software engineers, the role is evolving toward being prompt engineers, leveraging AI to generate code while they focus on refining and problem-solving.

This transformation pushes leaders and teams alike to ask a critical question: “Where can I add the most value right now?” Those who answer this question—and evolve alongside the technology—won’t just survive the shift. They’ll thrive in the human-centric future of work.

4. Digital assets and tokenization get a seat at the table

“Innovation distinguishes between a leader and a follower.”

- Steve Jobs

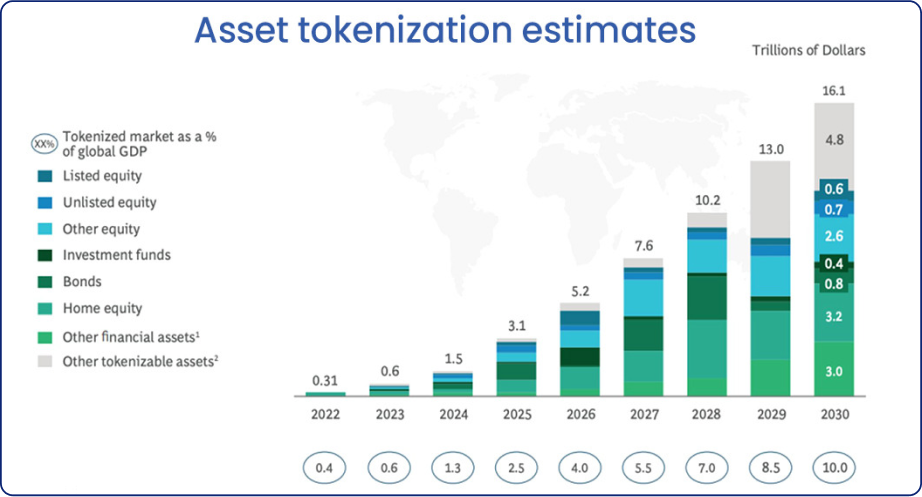

In the world of FinTech, digital assets and tokenization have long been topics of discussion, debate, and experimentation. This year, we’ll witness an acceleration of this macro trend. Significant progress was made last year, highlighted by landmark events like the approval of spot Bitcoin ETFs. In November, Goldman Sachs announced plans to explore a potential spin out of GS DAP, its blockchain-based technology platform, transitioning it into an “industry-owned” platform. This move reflects confidence in the projected dramatic growth of the tokenized asset market, which Boston Consulting Group estimates could reach $16 trillion by 2030—10% of global GDP, compared to just 1.5% in 2024.

Source: Finance Magnates, BCG, ADDX

Much of this momentum will come from the U.S., spurred by the incoming administration’s prioritization of digital assets. In line with its stated goal to make the U.S. the “crypto capital of the planet,” the administration announced in early December a new White House role leading its AI and crypto efforts.

However, the U.S. is far from alone in this space. Europe is forging ahead with the implementation of its Markets in Crypto-Assets (MiCA) regulation, while Asia, led by Singapore and Hong Kong, continues to set the pace for institutional adoption. As global jurisdictions increasingly embrace digital asset innovation, the era of tokenization is becoming a worldwide reality—one that will be fully embedded before we know it with the potential to unlock tremendous value for financial services firms.

5. Your team of personal assistants moves in

“The secret of getting ahead is getting started.”

- Mark Twain

Imagine walking into your office and being greeted not by one assistant but by an entire team of personal helpers, each with their own specialties, ready to tackle your day. This is the future AI is building—advanced assistants that don’t just wait for commands but actively take the initiative to make your life easier.

These AI systems, often called agents, are evolving from helpful sidekicks, all from different ecosystems, into proactive partners. They won’t just remind you about meetings; they’ll analyze the data, draft your reports, prioritize your inbox, and even anticipate the next steps in your projects. It’s like having a team of experts who never sleep, never forget, and work seamlessly in the background. But it’ll be your job to coach them into acting as a single team.

The transformation doesn’t stop there. In 2025, these assistants will start to operate directly on your devices, ensuring faster response times and enhanced privacy—lessening the need for worry about sensitive data floating around in the cloud. This is especially critical in industries like finance, where security, precision, and privacy are non-negotiable.

As these AI-powered collaborators integrate into our workflows, they’ll redefine productivity, shifting from tools we use to partners we trust. This isn’t just an upgrade; it’s a revolution in how we work. Get ready to share your workload with the smartest, most tireless team you’ve ever had.

6. The digital maturity gap widens

“The secret of change is to focus all your energy not on fighting the old, but on building the new.”

- Socrates

In 2025, the gap between digital leaders and laggards in financial services is set to grow even wider. Technology and innovation are no longer optional—they’re the keys to survival. Firms with strong digital foundations and cutting-edge tools will thrive, while those clinging to outdated systems may struggle to keep up in an increasingly competitive market.

The real game-changer isn’t just about exciting technologies like AI or blockchain—it’s about creating cohesive, platform-based strategies that bring everything together. The firms that succeed will be the ones that shift from fragmented systems to unified platforms, enabling them to innovate and adapt faster.

For years, many organizations have relied on siloed products and complex integrations, which has often led to inefficiencies and missed opportunities. But we’re reaching a point where those challenges can no longer be ignored. The path forward lies in a platform approach: centralizing data, standardizing processes, and building systems that connect seamlessly across the organization.

At Broadridge, we’ve embraced this strategy by developing a platform that standardizes APIs and uses a shared data model. This approach isn’t just about simplifying operations—it’s about laying the groundwork for future innovation. With a unified platform, scaling services or integrating emerging technologies becomes faster and easier.

Meanwhile, evolving regulations like the EU’s Digital Operational Resilience Act (DORA) are raising the stakes. Staying ahead means modernizing systems, ensuring operational resilience, and keeping data integrity airtight. The message is clear: those who embrace and plan for change will pull ahead.

Source: Broadridge 2024 Digital Transformation & Next-Gen Technology Study

7. The AI-powered employee: time to upgrade yourself

“Dream big and don't be afraid to fail.”

- John Denver

Each tech giant has its metaphor for artificial intelligence. Sundar Pichai calls it the new electricity; Reed Hastings compares it to the next internet; and Sam Altman likens it to the transistor. While the metaphor may vary, one thing is clear: in 2025, AI will become a near-ubiquitous part of daily life—especially for knowledge workers.

For many employees, this rapid rise of AI can feel like a threat—a force poised to replace them. But the truth is, AI represents an unprecedented opportunity to grow, innovate, and succeed. Forward-thinking organizations are helping their employees move from fear to empowerment by actively integrating AI into their workflows. At Broadridge, for example, we launched BroadGPT in 2024, a proprietary internal AI tool built on large language models. The results have been remarkable! Employees are now encouraged to experiment, problem-solve, and identify ways to use AI to amplify their contributions.

This shift is about more than just tools; it’s about fostering a culture of adaptability and curiosity. When employees view AI as an ally, not a rival, they expand their vision of what’s possible. AI can automate repetitive tasks, freeing up time for more strategic, creative, and fulfilling work. It can enhance decision-making, improve efficiency, and spark innovative solutions that push individuals and companies to new heights.

As we prepare for the year ahead, the path forward is clear: success belongs to those who embrace change with curiosity and ambition. The future of work isn’t about being replaced by AI; it’s about partnering with it to achieve more than ever before. Good luck!

8. Firms will find their balance on both ESG issues and environmental risks

“Balance is the perfect state of still water. Let that be our model.”

- Confucius

As financial firms look to navigate the opportunities and risks of 2025, one age-old theme stands out: the need for balance. ESG (Environmental, Social, and Governance) and climate considerations remain important to many market participants, but the approach to addressing them requires a steady hand as we move into 2025. Shifting regulatory and political dynamics may ease some pressures, yet the global push for action on these issues continues.

The challenge lies in managing competing priorities. In Europe, ESG expectations are only growing, with regulators and investors demanding stronger commitments and measurable outcomes. Meanwhile, in the U.S., there’s a recalibration underway. Concerns over the returns on ESG-focused funds and dissatisfaction with high fees are leading to a more cautious stance. Financial firms will need to strike a careful balance—meeting these diverse demands without overcommitting or sidelining key stakeholders.

This balancing act is further complicated by global disparities in investor expectations. Firms must deliver meaningful ESG initiatives to satisfy European standards while addressing U.S. calls for transparency, accountability, and performance. Success in 2025 will depend on finding a thoughtful middle ground—an approach that aligns with both global ambitions and local realities. More than ever, balance will be the key to driving progress without overreach.

9. Startups thrive in emerging markets

“Dreams are not what you see in sleep; dreams are the things which do not let you sleep.”

- Dr. A.P.J. Abdul Kalam

Next year could mark a turning point for startups in emerging markets. Armed with unprecedented access to advanced technologies and cloud-based tools, these businesses are no longer just keeping pace—they’re redefining innovation and growth. Once constrained by limited resources, they are now poised to compete on a global stage, leveraging the power of generative AI, data-driven strategies, and agile operations to drive transformation and economic impact.

The shift to cloud-based services has been a game-changer, empowering startups and small businesses to access sophisticated computing power without the need for heavy infrastructure investments. For firms in emerging markets, this opens doors to greater efficiency, enhanced client experiences, and streamlined operations. By adopting AI tools, these companies can deliver better customer outcomes while maintaining the agility that gives them an edge over larger competitors.

Consider the story of India’s Zolve, a financial services firm that bridges the gap for international banking needs. By harnessing cloud infrastructure and AI-driven insights, Zolve has scaled its operations while personalizing services for a global customer base. Similarly, IDfy, a startup that provides risk and fraud solutions, built its systems using the latest in machine learning-based anomaly detection, machine vision, and identity authentication techniques, showcasing how startups can innovate at speed to meet market demand.

What’s especially promising is how these technological advances empower startups to innovate faster and focus on their core strengths. With data-driven strategies and personalized offerings, they’re uniquely positioned to thrive. Emerging markets, often rich in entrepreneurial spirit, are set to become hotbeds of innovation in 2025, with startups playing a pivotal role in driving economic growth and transformation.

10. The year of election makes way for the year of impact

“The only way to make sense out of change is to plunge into it, move with it, and join the dance.”

- Alan Watts

2024 was a historic year of elections, with more than 70 nations holding national elections, covering almost half of the world’s population. The global electorate has signaled the desire for change. Newly elected administrations across the globe have renewed remits to deliver on a shift in priorities. As these new governments settle in, 2025 will be the year of impact—where directives turn into action, requiring businesses, particularly financial firms, to adapt rapidly.

Regulatory change is set to become front and center—regulation that extends far beyond compliance. This year will require the agility to navigate change, manage operational ripple effects, and find opportunity in the challenges. DORA, for instance, is raising the bar for cyber and operational resilience, with similar measures emerging in Asia and other jurisdictions. On the other hand, cryptocurrency deregulation will also bring new challenges.

Firms must now navigate a patchwork of global regulations that are increasingly demanding in scope and complexity. How do you operationalize these changes? What opportunities and risks emerge from these rapidly changing guardrails?

The sheer volume of change means firms can’t handle everything alone. Success will hinge on partnerships—with technology providers, consultants, and legal experts—to mitigate risks, manage obligations, and uncover opportunities. With the right strategy, change doesn’t have to be a burden—it can be a catalyst for innovation and transformation.

Navigating the year ahead

One theme becomes clear for 2025: change isn’t just inevitable—it’s full of potential. With shifts in regulation, breakthroughs in technology, and new opportunities in emerging markets, the financial services landscape is more dynamic than ever.

Navigating these changes requires not just resilience but foresight. Firms must embrace adaptability, forge the right partnerships, and make proactive decisions to stay ahead. Whether it’s operationalizing AI, managing regulatory complexities, or exploring untapped markets, success will belong to those who see change as a springboard for growth.

At Broadridge, we’re committed to helping our clients, partners, and team rise to these challenges and seize the opportunities they bring. Together, we’ll navigate the complexities of this transformative year and build a foundation for continued success in the years to come.

2025 is here—let’s make it a year of impact.