Asset Owners Continue To Increase Private Debt Investments

Look to gain better insights into performance and risk.

Amid the challenging return conditions, asset owners globally are searching for new sources of alpha. Increasingly, these investors are boosting their exposures to private market strategies, especially private debt, as they look to shore up returns.

As more asset owners allocate to private debt and other illiquid asset classes, they will need to meet the new operational requirements of tracking their expanded portfolios, including overseeing and consolidating investments handled by external managers.

Facing the New Reality

Market volatility is making it harder than ever for asset owners, such as pension funds, to obtain consistent returns.

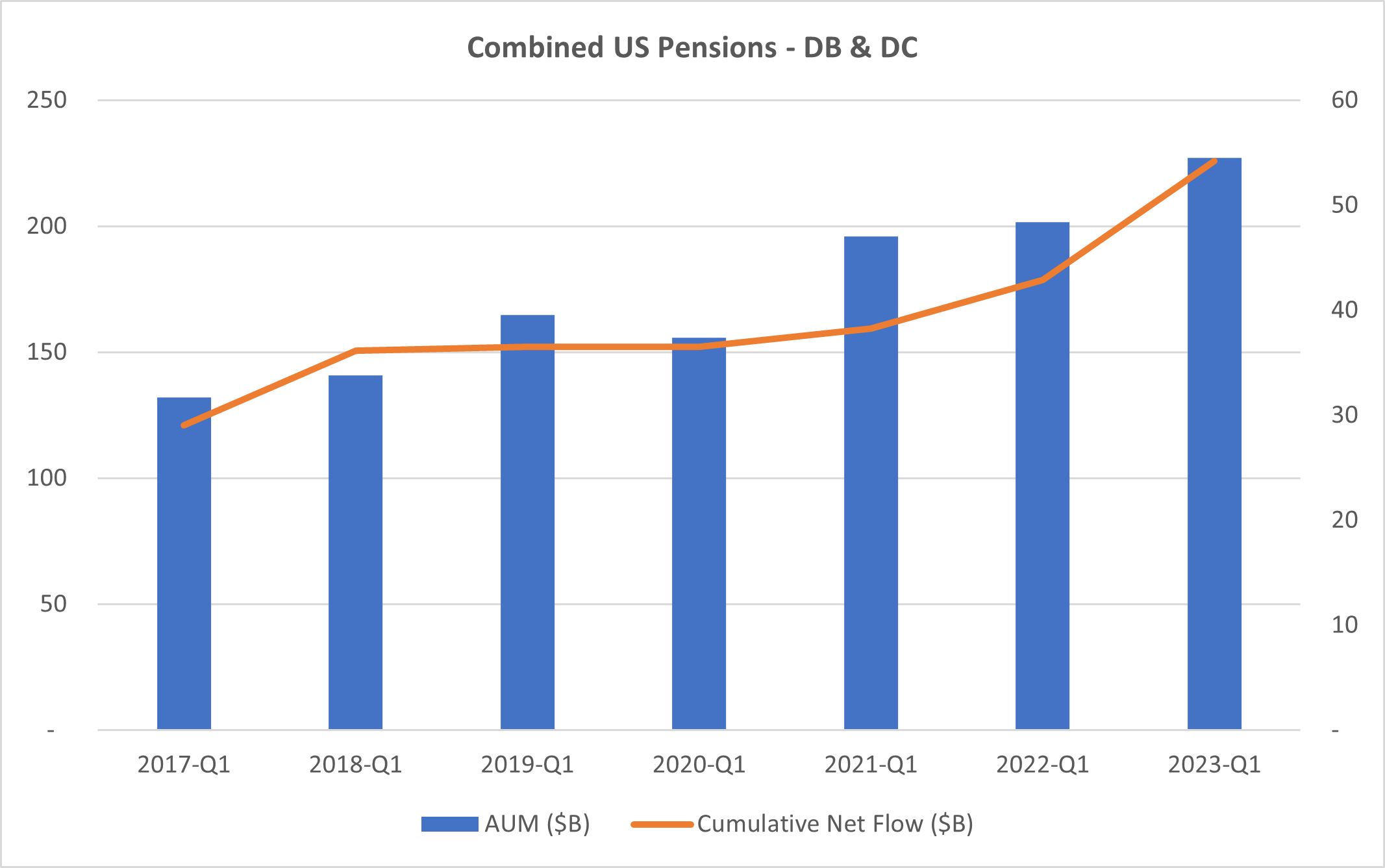

Given the uncertain state of some of these pension schemes’ finances, this is a serious problem for retirees. Although data from Broadridge shows strong flows into US pensions (see chart below), the funding ratio, namely the difference between assets and liabilities, continues to be poor – especially among public sector pension plans.

Analysis by Equable Institute, for example, found unfunded liabilities at US public sector plans grew to $1.57 trillion off the back of poor investment returns in 2022, bringing the funding ratio to 75.4%.1

To overcome these cash shortfalls, pension funds worldwide are tapping into the private markets, an asset class, which according to Bain & Company, is now running close to $12.8 trillion. Reports show public pension allocations into private markets jumped from 6% in 2010 to almost 9% in 2021.2

This trend shows no sign of decelerating.

In the UK, several defined contribution pension plans, including L&G and Aviva , recently pledged to increase their exposures to private markets.3 While private equity accounts for a large proportion of these pension fund inflows, so too does private debt.

Rallying Around Private Debt

A number of high-profile pension funds – including the $313.9 billion California State Teachers’ Retirement System (CALSTRS), the Chicago Public School Teachers Pension & Retirement Fund and the San Diego City Employees’ Retirement System – are ramping up their holdings of private debt.4

Despite strong fixed income returns, research by Pensions & Investments found the top 200 US retirement plans increased their private credit holdings by 12.5% to reach $98 billion (as of September 2022).5

But what is prompting these inflows?

The answer lies overwhelmingly with performance, with private debt portfolios typically generating returns of anywhere between 7% - 10%.6

In addition to the illiquidity premia, investors point out that strategies such as private debt provide regular, less volatile income streams relative to fixed income. Private debt’s floating rates are also appealing to investors as they can help shield returns against rising inflation and interest rate risk.

Unsurprisingly, investors are very satisfied with the returns at private debt, with 90% of global allocators telling Preqin that the performance of the asset class had either met or exceeded expectations in 2022, while a further 45% intend to increase their exposures over the next year.7

Pensions Need to Monitor Their Holdings

As indirect lenders into private debt, it is vital that pension funds proactively monitor their underlying portfolio investments. Increasingly, pension funds are asking managers to provide them with a view of their total portfolio exposures at a loan level, as well as positions on a fund-by-fund basis.

By doing so, pensions can measure various KPIs across their entire portfolio and even specific managers. Through enhanced oversight of their private debt positions, asset owners will gain better insights into performance and risk across their portfolios, in the same way they have historically viewed exposures in their more liquid holdings.

1 Equable Institute analysis finds US public pension funding shortfall unlikely to meaningfully improve in 2023 due to underperforming investments

2 Cadwalder – March 18, 2022 – The rise and rise of public pensions in private equity

3 Pitchbook – July 11, 2023 – UK plans to unlock $97 billion of pension funds for private capital

4 Pensions & Investments – May 22, 2023 – Institutions boost exposure to private credit

5 Pensions & Investments – May 22, 2023 – Institutions boost exposure to private credit

6 Rothschild &Co – February 14, 2023 – Private debt – an attractive investment opportunity in the current market context

7 Preqin – August 22, 2023 – A quarter of surveyed investors plan to increase the pace of private capital allocations as market confidence grows

Let’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |