Expansion Into Private Markets Fuels Outsourcing Demand

Asset managers structure their operations to drive growth, reduce costs, mitigate risk and enhance performance.

Abstract

As cost and performance pressures continue to escalate, traditional and alternative asset managers are looking for ways to drive growth. In many instances, this is being achieved via product diversification. For example, there is an abundance of long-only and hedge fund managers launching private equity, private debt or even infrastructure products. Although diversification or hybridization does have strategic advantages, it only works if the process is well thought through. Accordingly, investment firms need to think carefully about how they structure their operations when moving into the highly esoteric world of private markets. A sensible approach to outsourcing will therefore be necessary if managers are to achieve reduced costs, risk mitigation and performance enhancements.

Active Funds Feeling the Strain

Performance at actively managed funds has been largely subdued ever since the financial crisis, with numerous investment firms unable to beat their benchmarks. Morningstar analysis found that just 40 per cent of active funds outperformed their passive rivals in the 12 months leading up to June 2022.1 Although hedge funds did face performance challenges following 2008, the US$4tn industry is now producing decent returns amidst volatile markets, geopolitical tensions and soaring inflation. In 2021, hedge funds returned 9.9 per cent on average, while the industry has so far successfully preserved capital this year.

This erratic performance among active managers has been exacerbated by wider macro trends. After a decade of low interest rates, central banks are now increasing rates once again to combat the growing scourge of inflation, which is currently at a multi-decade high.

As a result of the inconsistent performance across active funds, investors have applied growing pressure on the fees they pay managers. Data from Investment Metrics found active managers’ fees fell by 4 per cent on average in 2021, although global equity managers saw their median fees drop 11 per cent.2 While hedge funds have regathered their momentum, the once pervasive 2 per cent management fee and 20 per cent performance fee now stand at 1.36 per cent and 16.1 per cent — the lowest on record.3 In other instances, investors are repositioning their portfolios by withdrawing capital from active funds and hedge funds and deploying cash into cheap passives such as index trackers. According to Bloomberg analysis, passives could potentially overtake active funds on AuM (assets under management) terms by 2026.4

Notwithstanding the volatile market conditions and sharp fee compression, the cost of doing business has also increased. Much of this is a direct consequence of global regulation, especially in the USA and EU. COVID-19 has also dented profitability. Having spent huge sums on making their operations more resilient against disruptive events, fund managers are now confronted with unprecedented labor shortages sparked by the so-called ‘Great Resignation’. Fueled by several factors, including COVID-19-induced digital burnout and isolation, 4.5 million Americans voluntarily quit employment in November 2021 — with job openings at levels unseen since 2000.5 Aside from having to remunerate talent more generously — with fund manager compensation expected to rise between 10 per cent and 15 per cent,6 firms are also allocating increasing amounts of their budget to staff training due to the high turnover.

The Private Markets Come Calling

With actively managed funds and hedge funds facing an assortment of challenging macro headwinds, many firms launched strategies focused on private markets to diversify their income streams in what had until recently been a low rate environment. This is because performance in private markets has been solid. For example, JP Morgan Asset Management notes private equity has delivered between 1 and 5 per cent in excess annualized returns (net of fees) over and above the Standard and Poor’s (S&P) 500 since 2009.7 Other providers concur that private equity has produced an impressive performance. Preqin highlights that the asset class generated a net initial rate of return (IRR) of 18.8 per cent in the five years leading up to March 2021.8

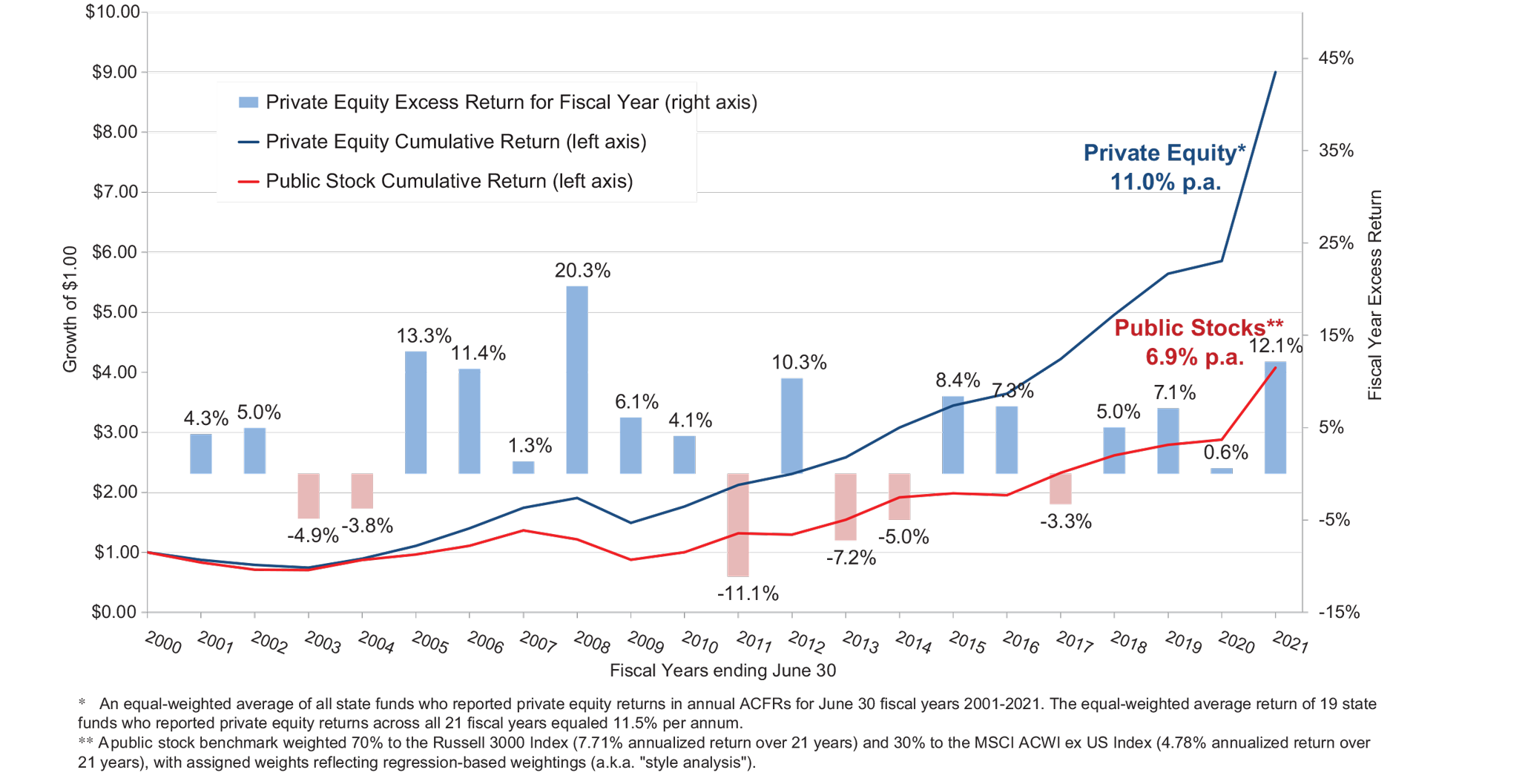

Private equity has consistently outperformed public markets (see Figure 1).9 Private debt has also enjoyed solid performance over the last few years as investors looked to capture yield further down the credit spectrum amid the low rates in traditional fixed income instruments. With bank lending desks under continuing pressure, there are still compelling opportunities for private debt funds in the direct lending markets.

Investors are certainly happy with the returns on offer at private capital. Preqin notes that 90 per cent of limited partners (LPs) said private capital performance either met or exceeded their expectations — compared with 72 per cent of hedge fund investors.10

Given the high satisfaction levels among LPs invested in private capital, fundraising activity in the sector has been strong. The successful fundraising in private markets is prompting long-only managers and hedge funds to launch illiquid products of their own. Not only can this provide them with more working capital, but it will enable managers to bring a wider range of investors into their funds. In the case of private equity, AuM reached US$6.3tn in 2021 — although this was largely driven by asset appreciation.11 However, Preqin anticipates private equity capital raising will continue on its strong growth path moving forward — forecasting inflows of US$645bn in 2022 and US$813bn in 2026,12 in what should propel the strategy’s AuM past US$11tn by 2026 — corresponding to half of the alternative industry’s total AuM.13 Interest in private debt is also on the ascent. After a decade of growth averaging 13.5 per cent, private debt AuM stood at US$1.21tn in 2021 and Preqin anticipates it could reach US$2.69tn by 2026.14

Be Mindful of Operational Changes

While the decision to diversify into private markets can stimulate performance and enable managers to target a larger pool of investors, there are operational issues firms need to consider. In contrast to liquid assets, managing esoteric or illiquid asset classes can be highly complex, requiring different operational capabilities at investment firms. When transitioning into private debt — for example — it is vital that managers appoint individuals with experience on lending desks and an understanding of how credit works. Similarly, the operational processes synonymous with private capital are often alien concepts to most long-only or hedge funds. Activities such as drawdowns (i.e. capital calls) and distribution waterfall calculations do not happen at long-only or hedge funds, so managers will need to educate themselves about these unfamiliar procedures. Accordingly, this growing crop of hybridized managers needs to ensure they have the right people and third-party service providers to support them with these new processes. A failure to do so could result in operational issues emerging. Recalibration of operational processes carries with it significant costs. These need to be carefully managed by private capital firms, if they are to successfully grow their businesses.

Striking the Right Balance

Although many firms have strengthened their internal teams when diversifying into private markets, firms need to strike the right balance between in-sourcing and outsourcing operational processes. Engaging with a third-party provider with deep expertise in multiple asset classes is vitally important, as it can allow managers to consolidate relationships, rather than dealing with multiple counterparties. In addition to simplifying and rationalizing managers’ operations, this approach can also enable firms to benefit from sizeable cost savings at a time when margins are falling. However, it is critical managers ensure they conduct thorough risk oversight and due diligence on third parties. For instance, managers should check that providers have things like high-quality cybersecurity protections in place.

Technology is also critically important. Many managers do not have the resources or bandwidth to continually invest and re-invest in technology systems to accommodate their different reporting requirements. As a result, automation continues to be a challenge for countless firms with organizations still firmly wedded to manual processes and legacy technology — which creates added costs and increases the chances of mistakes creeping into operations. This is a problem for managers as investors increasingly demand that reports and information be shared with them in near-real-time. Simultaneously, investors are also becoming very tech-savvy, especially as more digital natives assume positions of responsibility within asset allocators, forcing managers to alter how they report to clients. In previous years, paper-based reporting would have been entirely acceptable. Investors now want information shared with them digitally or via mobile phones and smart device apps. This is prompting more managers to leverage the technology at service providers, enabling them to keep up with the digital expectations of clients while simultaneously achieving economies of scale (Table 1).

Regulators are also pushing managers towards outsourcing middle office functions. Private funds — including private capital firms — are being subjected to greater regulatory reporting — most notably in the USA. Revisions to Form PF (Private Fund), a reporting template introduced under Dodd–Frank, will require private equity advisers to file reports within one business day of events that indicate significant stress at a fund which could harm investors or signal risk in the broader financial system.15 In addition, the US Securities and Exchange Commission (SEC) reduced the AuM threshold for private equity Form PF reporting to US$1.5bn from US$2bn.16 The SEC also told private equity firms that it wants the industry to be more transparent about the fees it charges investors.17 As a result of this added regulation, more private equity firms are likely to turn to outside vendors for support.

Outsourcing to the right provider can also help firms manage their operational resilience. COVID-19 and, more recently, the war in Ukraine, have exposed the frailties of global supply chains. The initial COVID-19 disruption and imposition of remote working, for instance, alerted financial institutions to the dangers of outsourcing too many core back-office processes to individual, low cost markets. Many firms are now scoping out providers who can demonstrate that they are resilient and geographically diversified. By operating out of multiple geographical locations, outsourcing providers can rapidly transfer their operations to another business center in the event of a crisis. As investors and regulators probe managers of all stripes about their business continuity plans (BCP) and oversight of third-party providers, it is essential that firms work with suppliers that put operational resilience at their core.

Table 1: How Outsourcing Can Facilitate Efficiencies

Technology and outsourcing: Case study 1 |

Technology and outsourcing: Case study 2 |

|---|---|

|

A US$4bn + alternative investment manager faced technology hurdles with its current providers and searched for an opportunity to mutualize technology and operations with one provider to achieve economies of scale, efficiency across product and operations and bundled cost savings. Broadridge was selected to provide portfolio management applications, including position management, analytics and portfolio risk modules, along with business process outsourcing to manage critical processes, such as trade affirmation and allocation, corporate action processing, static data maintenance and reconciliations (position, cash, NAV [net asset value] and market value). |

A start-up investment manager, formed as a joint venture between two large-scale asset managers, selected Broadridge from an RFP for technology and operations support with CLOs (collateralized loan obligations) and loan administration. As a new investment manager, this firm required immediate operational subject matter expertise, global resilience and technology and operational support that could be implemented swiftly and scaled quickly to meet significant growth expectations over a two-year period. At the same time, the provider needed to offer ramped pricing to alleviate cost concerns in year one of the new firm’s existence. Through this relationship, Broadridge provides technology modules for private debt and CLOs and operations support managing the firm’s CLOs and underlying loans. The services include but are not limited to recording loan agreements, creating covenants, ensuring terms, payments and remittance details are accurate and managing reconciliations |

Making the Most of the Opportunity in Private Markets

As a strategy subset, private markets are producing excellent returns and attracting eyewatering sums of investor capital despite the wider market volatility, so it is easy to see why more active fund managers and hedge funds are starting to pile into these asset classes. Although hybridization is a useful diversification tool — both in terms of new return sources and investors — it can be a difficult undertaking from an operations perspective. Firms need to make sure that they fully understand private markets before they tackle what can be a very complex and challenging asset class. Fund managers making the transition into private markets need to work closely with competent service providers who are equally well versed in the asset class and have a compelling technology proposition and a demonstrable commitment to operational resilience. If fund managers take this approach and engage with strong partners, their chances of success will increase. In contrast, failing to understand private markets or collaborate with credible service providers could spell serious trouble.

Byline Author

Kevin Moran has over 20 years of global industry experience and has led operational and strategy teams to drive business growth, organizational optimization and digital transformation. Kevin’s experience encompasses diverse products and he is an expert in securing operating risk, increasing efficiency and providing innovative solutions within firms and for clients. Since October 2018, Kevin has served as the Global Head of Broadridge Business Process Outsourcing, which provides an operations managed service for capital markets, asset management and wealth management in more than 90 markets globally. Prior to joining Broadridge, Kevin spent 15 years at BNP Paribas, where he held multiple executive leadership roles in the Americas and Europe, including Head of Transformation and Head of Operations. Kevin is an active member of the financial services industry, holding roles across multiple committees and forums associated with operations, technology and financial literacy.

References

(1) Morningstar (27th September, 2022) ‘Market Volatility Hasn’t Helped Active Funds Beat Their Passive Peers’, available at https://www.morningstar.com/articles/ 1080782/market-volatility-hasnt-helped- active-funds-beat-their-passive-peers (accessed 4th October, 2022).

(2) Zhang, H. (28th February, 2022) ‘Active Management Fees Fell Further in 2021’, Institutional Investor, available at https://www.institutionalinvestor.com/article/ b1wz5149l3phq6/Active-Management- Fees-Fell-Further-in-2021 (accessed 30th March, 2022).

(3) Hedge Fund Research 25th March, 2022) ‘New Hedge Fund Launches Rise as Industry Capital Surpasses Historic Milestone’, available at https://www.hfr. com/news/new-hedge-fund-launches- rise-as-industry-capital-surpasses-historic- milestone (accessed 30th March, 2022).

(4) Seyffart, J. (11th March, 2021) ‘Passive Likely Overtakes Active by 2026, Earlier if Bear Market’. Bloomberg, available at https://www.bloomberg.com/ professional/blog/passive-likely-overtakes- active-by-2026-earlier-if-bear-market/ (accessed 30th March, 2022).

(5) Editorial Board (1st February, 2022) ‘The Great Resignation Is Not Going Away’, Financial Times, available at https://www.ft.com/content/857bdeba-b61b-4012- ab82-3c9eb19506df (accessed 30th March, 2022).

(6) Schmitt, W. (13th August, 2021) ‘Asset Manager Compensation Expected to Rise’, CityWire, available at https://citywireselector.com/news/asset-manager-compensation-expected-to-rise/a1541924 (accessed 30th March, 2022).

(7) Segal, J. (3rd July, 2021) ‘Private Equity Still Outperforms Listed Stocks But It’s Losing Its Edge’, Institutional Investor, available at https://www.institutionalinvestor.com/article/b1sk0t9kg78dlv/Private-Equity-Still-Outperforms-Listed-Stocks-But-It- s-Losing-Its-Edge (accessed 30th March, 2022).

(8) Private Equity Wire (12th January, 2022) ‘2021 Private Equity Deal Value Surpasses pre-Lehman Brothers Peak, Says Preqin’, available at https://www.privateequitywire.co.uk/2022/01/12/311047/2021-private-equity-deal-value-surpasses-pre-lehman- brothers-peak-says-preqin (accessed 30th March, 2022).

(9) Cliffwater (13th June, 2022) ‘Long Term Private Equity Performance 2000-2021’, available at https://www.cliffwater.com/Resources (accessed 6th October, 2022).

(10) Preqin (16th March, 2022) ‘Preqin Investor Outlook: Alternative Assets H1 2022’, available at https://www.preqin.com/insights/research/investor-outlooks/preqin-investor-outlook-alternative-assets-h1-2022 (accessed 6th October, 2022).

(11) McKinsey (24th March, 2022) ‘Private Markets Annual Review’ , available at https://www.mckinsey.com/~/media/mckinsey/industries/private%20equity%20and% 20principal%20investors/our%20insightsmckinseys%20private %20markets%20annual%20review/2022/mckinseys-private-markets-annual-review-private-markets-rally-to-new-heights-vf.pdf (accessed 15th October, 2022).

(12) Preqin (12th January, 2022) ‘2021 Private Equity Deal Value Surpasses Pre-Lehman Brothers Peak’, available at https://www.preqin.com/Portals/0/Documents/PE%20Globals%20PR%20FINAL.pdf?ver=2022-01-12-084739-123 (accessed 15th October, 2022).

(13) Preqin (12th January, 2022) ‘Alternative Assets to Reach $23.21 Trillion in 2026’, available at https://www.preqin.com/Portals/0/Documents/Alts%20in%202022 %20PR%20FINAL.pdf?ver=2022-01-12084244-293 (accessed 30th March 2022).

(14) Preqin (12th January, 2022) ‘Private Debt AUM Set to Double to $2.69 Trillion by 2026’, available at https://www.preqin.com/Portals/0/Documents/PD%20Global%20PR%20FINAL.pdf?ver=2022-01-12-084704-817 (accessed 30th March, 2022).

(15) SEC (26th January, 2022) ‘SEC Proposes Amendments to Enhance Private Fund Reporting’, available at https://www.sec.gov/news/press-release/2022-9 (accessed 30th March, 2022).

(16) Ibid.

(17) Lim, D. and Bain, B. (5th February, 2022) ‘SEC to Push Private Equity Firms for More Robust Fee Disclosures’, Bloomberg, available at https://www.bloomberg.com/news/articles/2022-02-05/sec-to-push-private-equity-firms-for-more-robust-fee- disclosures (accessed 30th March, 2022).

Related Information

Contact Us about what’s next for you

Contact UsLet’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |