T+1: What Comes Next as the World Wakes Up?

North American market participants may be a little nervous over the impact on US and Canada trades because of the recently implemented T+1 shortened settlement cycle, but those in Europe and Asia may be waking up in a cold sweat as they get to grips with the implications for trades they make in US securities.

Since the Securities and Exchange Commission (SEC) adopted the rule to shorten the settlement cycle to T+1 for most US securities transactions that settle through the Depository Trust & Clearing Corporation (DTCC), the short-term focus of market participants is on whether the new plumbing works, and whether pessimistic predictions of market disruption about its impact will prove to be accurate.

“Beyond meeting the T+1 deadlines, capital markets participants across the world must seize the opportunity to make a great leap forward in modernizing capital markets infrastructure and gain a long-term competitive advantage,” said David Turmaine, Vice President Broadridge Consulting Services.

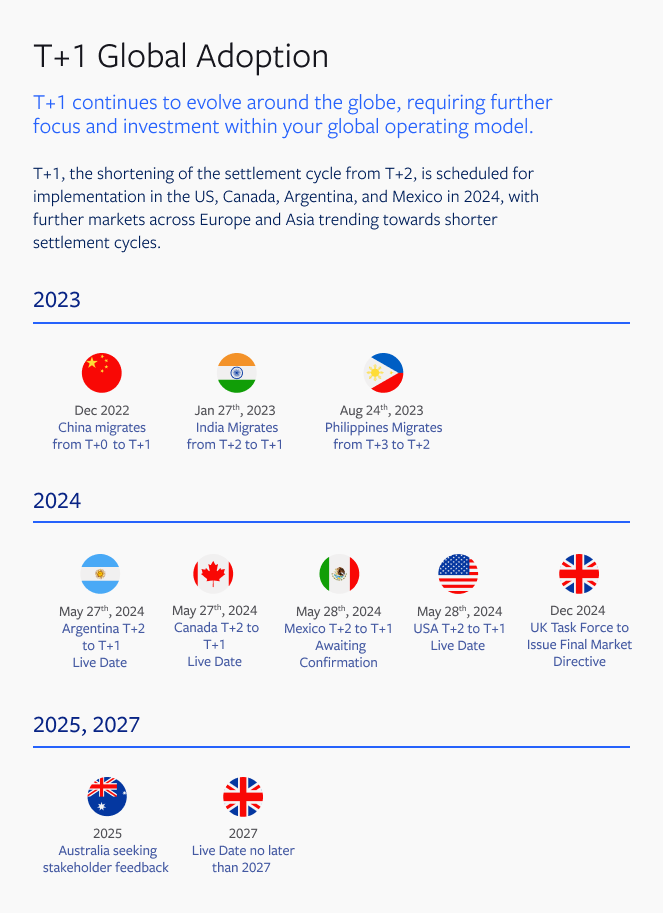

As the chart below depicts, many global markets are on a shorter settlement flightpath. Argentina is aligning with North America on the same day, and Australia is considering a similar move. India led the way to T+1 – albeit through a phased process 18 months ago.

With that in mind, what should firms in the capital markets trade lifecycle around the world do after May 28th?

North America: a broadly smooth road with potential potholes?

The US’s T+1 timetable is in synch with the Canadian Capital Markets Association (CCMA), which will transition to T+1 a day earlier. Mexico’s capital markets will also make the switch on May 27th.

“This kind of alignment is just one reason why North American participants are in the strongest position globally,” explained David. “They face a compressed environment around settlement, but they are operating in less fragmented markets and the working-day clock is not against them as it is for European and Asian market participants trading US securities.”

Most North America firms will now be focusing on implementation plans and contingency plans for when they go live, ensuring these plans have been communicated internally.

There may be some bumps in the road for smaller market participants, but the predictions of widespread disruption is unlikely.

Looking further ahead, some US and Canada firms are still using different types of technology when it comes to back-office systems, and T+1 will force a mindset change.

Europe: sleepwalking on T+1?

Europe’s capital markets are not expected to transition to T+1 immediately, but the implications for any investors trading US securities take effect on May 28th, and some participants remain a little blasé about this change.

The short-term concern in Europe is currently focused on currency headaches. A European investor buying dollar-denominated securities needs time to include the funding of the trade in USD and has a day less to complete the transaction . In practice, they have even less time because they are already five or six hours closer to the end of the day than their US counterparts. There are concerns that the tighter timeframes of T+1 could spark a return to bilateral FX settlements, which could lead to market instability in the days ahead.

As a result, some European firms are facing later nights and longer hours in the office, and even relocating staff to the US, as this buys more time to complete same-day FX reconciliation.

Two of the largest index providers, MSCI and FTSE Russell, are balancing their global indexes in the same week as T+1. MSCI’s rebalance is traditionally the busiest week of the year for US equities, so European firms rebalancing equity allocations and implementing faster, novel, FX processes could have a very busy, long weekend.

Further ahead

Looking further ahead, it’s unclear if and when EU countries will shift to T+1. In Europe, it has been framed as a valuable initiative to align with North America, but also an opportunity to improve the competitiveness and attractiveness of the European Union (EU). However, in a recent consultation on the subject by ESMA, the EU’s financial markets regulator, this was questioned by some market participants.

Fund managers have also been urging European regulators to mirror the move to T+1, and the Financial Times is reporting many are warning of a “major and serious risk” to the continent’s capital markets if regulators don’t copy the US and Canada by cutting settlement cycles.

ESMA is expected to submit its final report to the European Commission on or before January 25, with some estimates of an implementation date giving a minimum delay of 32 months before they go live – in which case, late 2027 would be a target date.

“It’s surprising that having set the pace on regulation, Europe seems to be really dragging its heels on T+1,” said David.

Across Europe as a whole, the hope is that the EU is able to replicate the level-playing field implementation of the Digital Operational Resilience Act, or DORA. That is by no means certain.

The UK

The Accelerated Settlement Task Force, which was established to look at UK transition timing, says T+1 would “improve market resilience, bring cost savings for investors and reduce the risks associated with having an extended period between trading and settlement. It is self-evident that increasing efficiency in our capital markets processes is essential to maintain our international competitiveness.”

The UK seems set on a path to T+1 culminating by 2027, but, in practice, a lot of the infrastructure is already in place to execute T+0 transactions.

“I can see the UK leapfrogging T+1 and moving straight to T+0,” said Turmaine. “The decision will be as much political as technological.”

APAC

Two of the region’s largest capital markets – China and India – have been in the vanguard of moves toward T+0. But when it comes to trading US securities, time is not on Asian investors’ side. Given Asia time differences of up to 14 hours – longer for Antipodean offices – APAC investors have no choice but to complete all their processing for North American trades on trade date. All trades will need to be pre-funded, matched, and ready to settle before the end of the local trading day. This acceleration of processing will have a significant impact across the entire front-, middle- and back-office operations in Asia, and, therefore, demands significant preparation and change.

Looking Beyond May 28th

Just because T+1 settlement is now live, it doesn’t mean market participants should rest and slow down the pace of change.

Following are implications and corresponding necessary actions for the buy side and sell side in the months ahead:

1. Ditch the manual.

T+1 signals that manual processes are becoming obsolete. Compressing the trade settlement cycle from two days to one day is a much bigger leap than the transition from T+3 to T+2.

“In a T+1 environment, the previous strategy of throwing additional bodies at manual functions is simply not sustainable,” said Turmaine. “Sell-side and buy-side firms won’t have the necessary time to execute essential functions manually.”

Legacy applications need to be transformed to more digital solutions that support real-time data flows because there are simply not enough hours in the day. Firms that plan ahead should be able to use T+1 preparedness as a springboard toward more automated trade and settlement processes and, ultimately, to straight-through processing.

2. Seize the moment.

Market participants should not just breathe a sigh of relief once they get past May 28th unscathed. They must seize the technological, operational, and behavioural opportunity. The arc of the settlement universe is long, but it bends toward shorter settlements. Market participants in non-US securities outside the US regime should recognize that T+1, or even T+0, is coming to their home markets relatively soon.

3. Think strategically and be future proof.

Focusing entirely on individual fixes for T+1 is like patching up leaks with duct tape. It's much smarter and more cost effective to direct money and time to bigger capital improvements that will enhance the organization’s overall efficiency.

Many firms run on legacy systems that have been cobbled together through multiple mergers and over many years. Now these firms are amid digital transformation initiatives designed to break down siloed systems and eliminate fragmentation. One of the primary goals of these projects is to facilitate the free flow of timely and reliable data across organizations. In that sense, T+1 can be more opportunity than crisis.

4. Innovation is salvation.

Innovation has provided a host of new solutions, such as robotic process automation (RPA) and artificial intelligence (AI) which did not exist or were not widely available during the T+2 transition. Sell-side and buy-side firms should carefully complete an impact assessment on the implications of T+1 across the trade cycle and identify the changes they will have to make to technology, operations, and control processes. They will have to swiftly implement these process changes to be fully prepared for T+1 and inevitably for T+0.

Conclusion

T+1 presented some short-term headaches and nervousness ahead of the May 28th deadline. It also presents cost for operations and tech, truncates time frames for reconciliations outside the US, erodes securities lending revenue, and will likely increase trade fails in the short term.

It also provides an unprecedented motivation (and budget) to bring capital markets into the future. If there was ever a catalyst for the automation AI and transformative tech can deliver, T+1 is it.

SEC Chairman Gary Gensler compared T+1 to upgrading the market’s plumbing from bronze to copper pipes. He is right; this is a key moment for firms to simplify trade lifecycle and optimize operational efficiency for the future. T+1 offers a golden opportunity to bolster post-trade processing capabilities to achieve a long-term competitive advantage.

Learn how Broadridge Consulting Services can help support your T+1 efforts.

Let’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |