Public Market Solutions

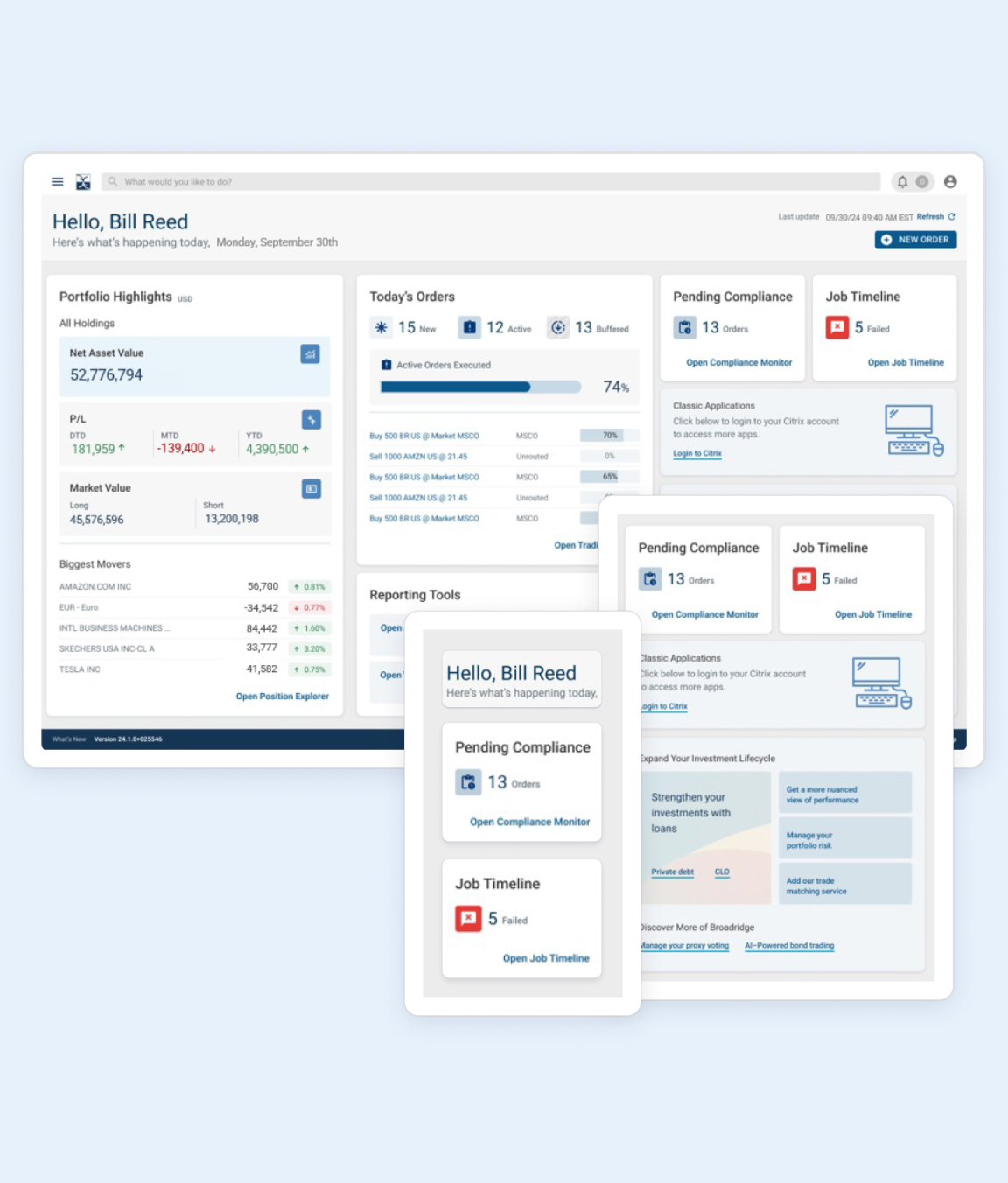

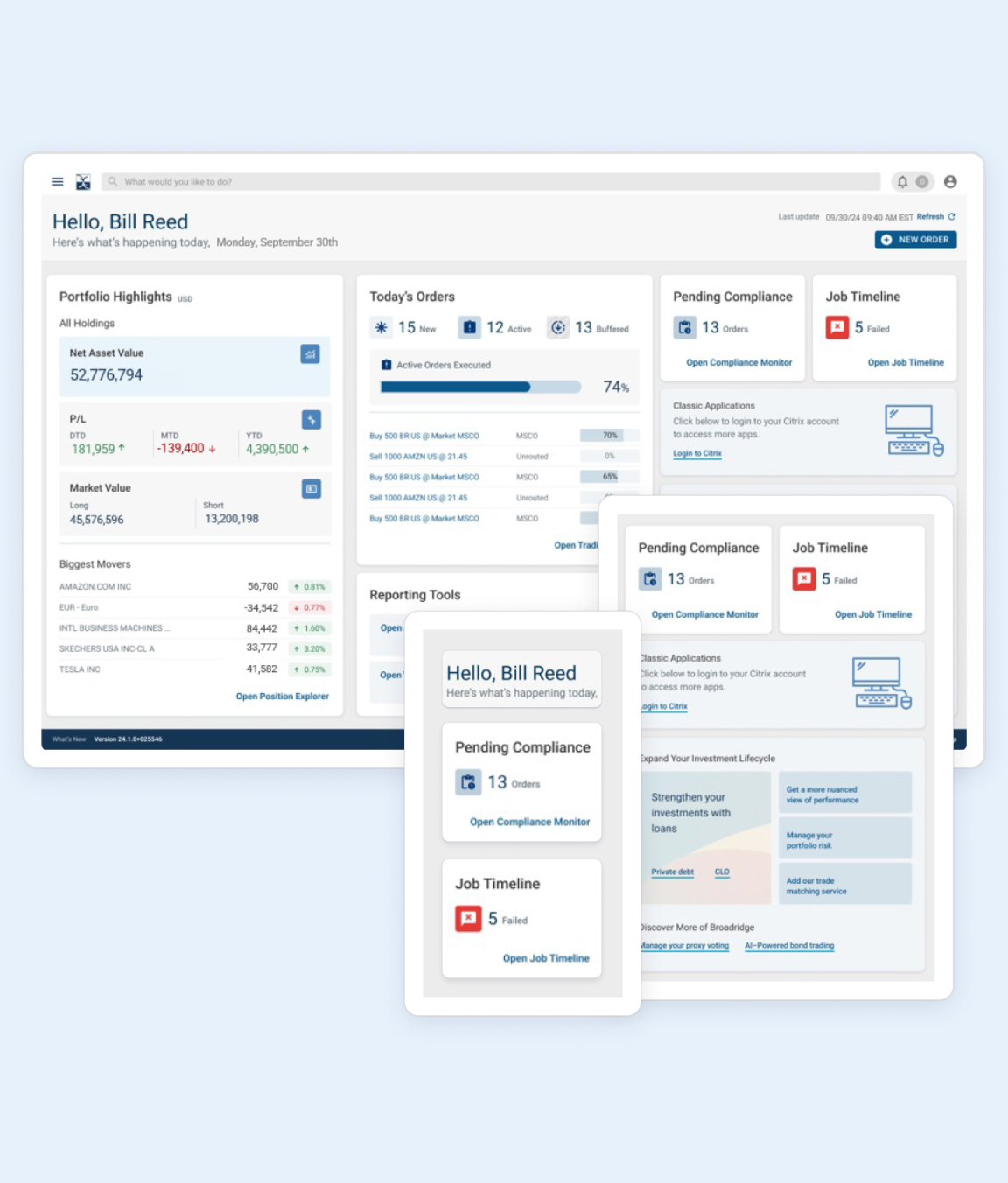

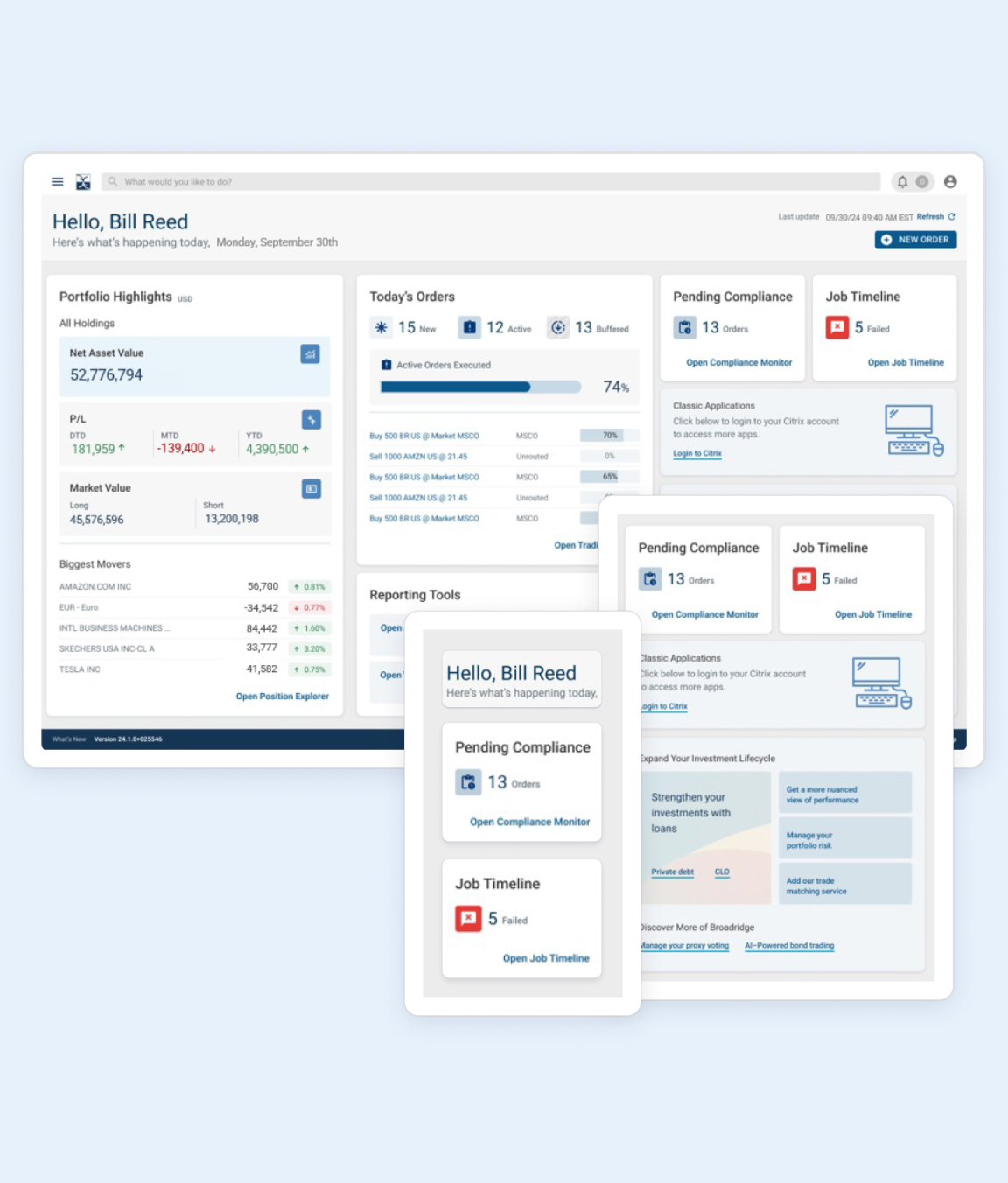

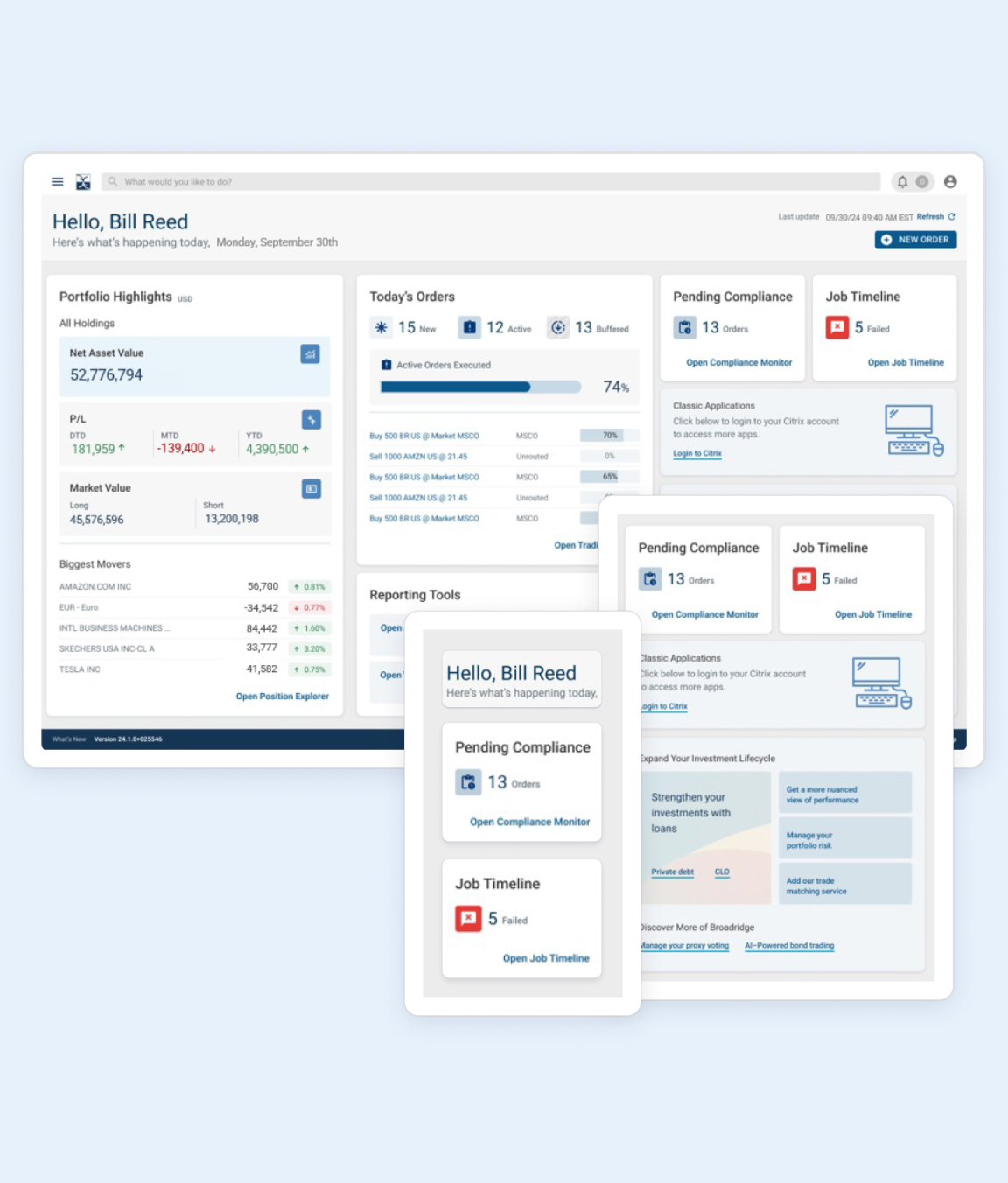

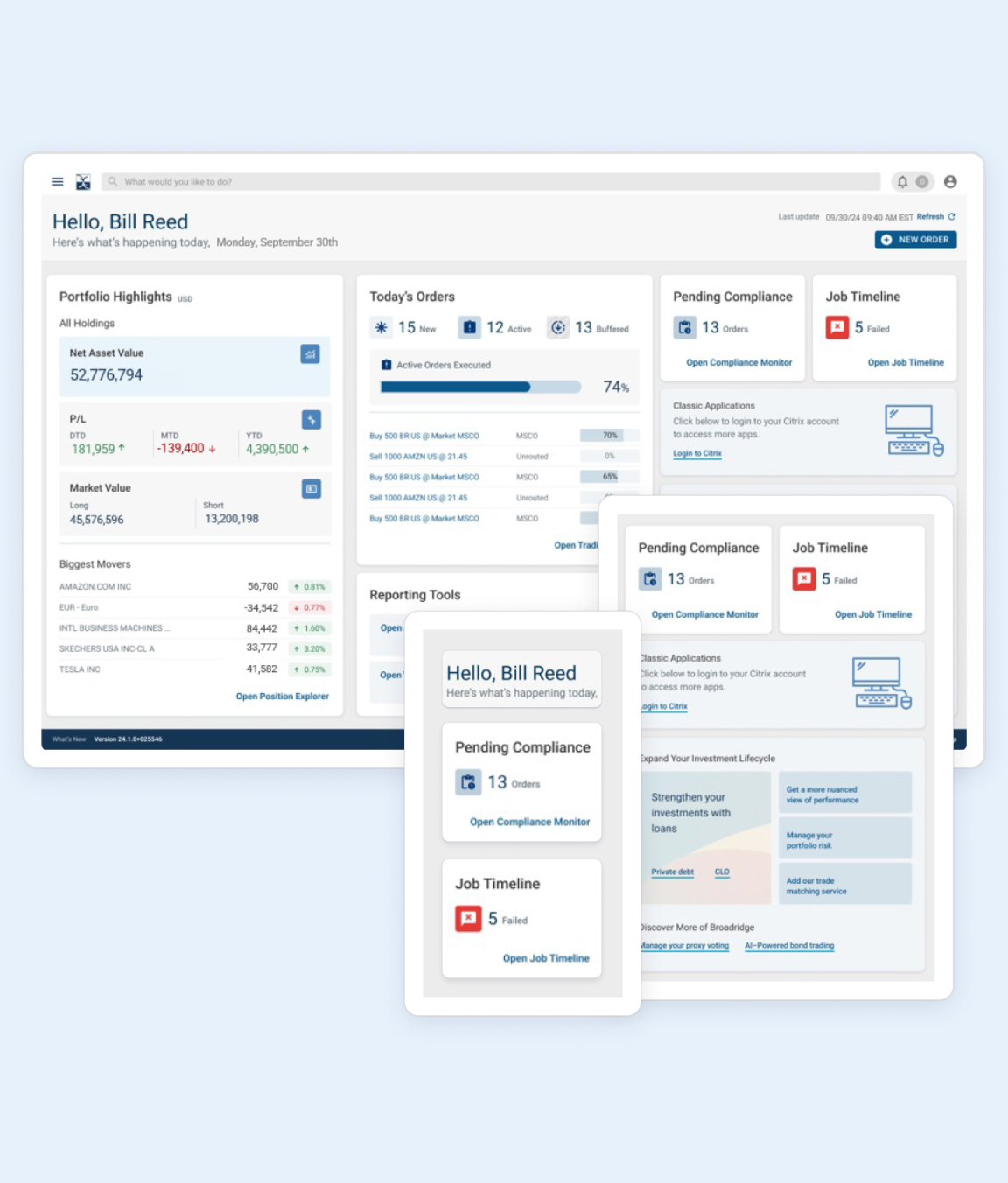

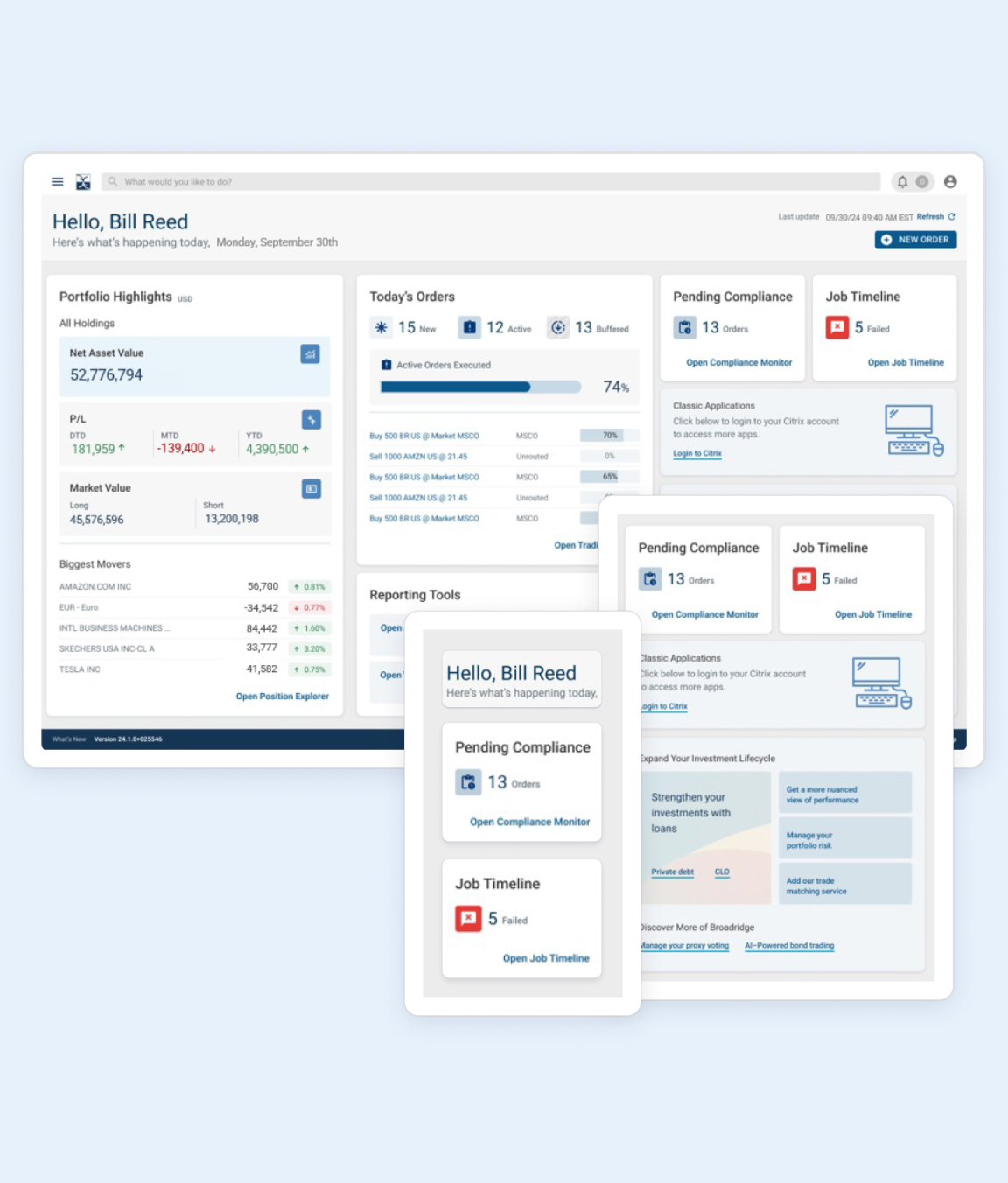

Real-time portfolio monitoring and execution

-

Track positions, exposures, P&L, and cash balances in real time

-

Facilitate timely decisions with up-to-the-minute data

-

Enhance operational transparency

-

Centralize activities across asset classes

-

Enhance transparency, efficiency, and agility

-

Eliminate data silos and improve collaboration

-

Evaluate and mitigate risks in real time

-

Run sophisticated analyses, value-at-risk (VaR) calculations, and more

-

Monitor portfolios according to custom criteria

-

Rectify potential regulatory issues using custom alerts and rules

-

Ensure compliance with complex regulations

-

Generate custom reports for different stakeholders

Advanced multi-asset monitoring and analysis

Proactive risk reduction

Sophisticated tools perform scenario analysis, value-at-risk calculations, and sensitivity analysis to mitigate risks before they harm your portfolio.

More valuable views

Real-time insights on positions, exposures, transactions, and more support informed decisions and enhanced collaboration.

Seamless connections to third parties

Timely data from multiple sources in one accessible place facilitates more reliable performance and risk assessments.

Strong compliance confidence

Real-time alerts, customizable rules, and advanced tracking and reporting features empower you to maintain compliance, even as regulations change.

Higher client satisfaction

Automated reporting and reconciliation features make it easy to deliver timely communications and maintain client trust.

Allocation optimization

Dynamic adjustments optimize portfolio alignment according to market conditions and strategic objectives.