NEW YORK, NY – September 30, 2020 – A new report from Broadridge Financial Solutions, Inc. (NYSE: BR), a global Fintech leader, reveals a growing investor demand for active managers to introduce new environmental, social and governance (ESG) funds to the market. In the U.S., net flows to long-term responsible funds quadrupled in 2019 to $20 billion, from $5 billion in 2018, and continued to grow during the first half of 2020 to reach $21 billion. A majority (68%) of ESG assets in the U.S. are now in actively managed funds.

Changes in the makeup of the ESG market over the last five years have important implications for asset manager strategies. Since 2015, best-in-class/positive screening, sustainability/thematic and integration/engagement funds have all increased their share within the market. In the same time period, exclusions-based funds have dropped from 36% to 7% of the market. Impact investing funds have remained consistent, at 10% share in 2015 and 8% share in 2020. Similar shifts are occurring within the U.S. market.

“From both a supply and demand perspective, we have witnessed a shift toward achieving positive environmental and social outcomes alongside competitive investment returns,” said Jag Alexeyev, Director Distribution Insights at Broadridge Financial Solutions. “Active managers are in the driver’s seat when it comes to ESG, but in order to maintain their edge in this segment, they need to highlight their agility to proactively manage risks, leverage active ownership, pursue dynamic high-conviction strategies and deliver sustainable outcomes.”

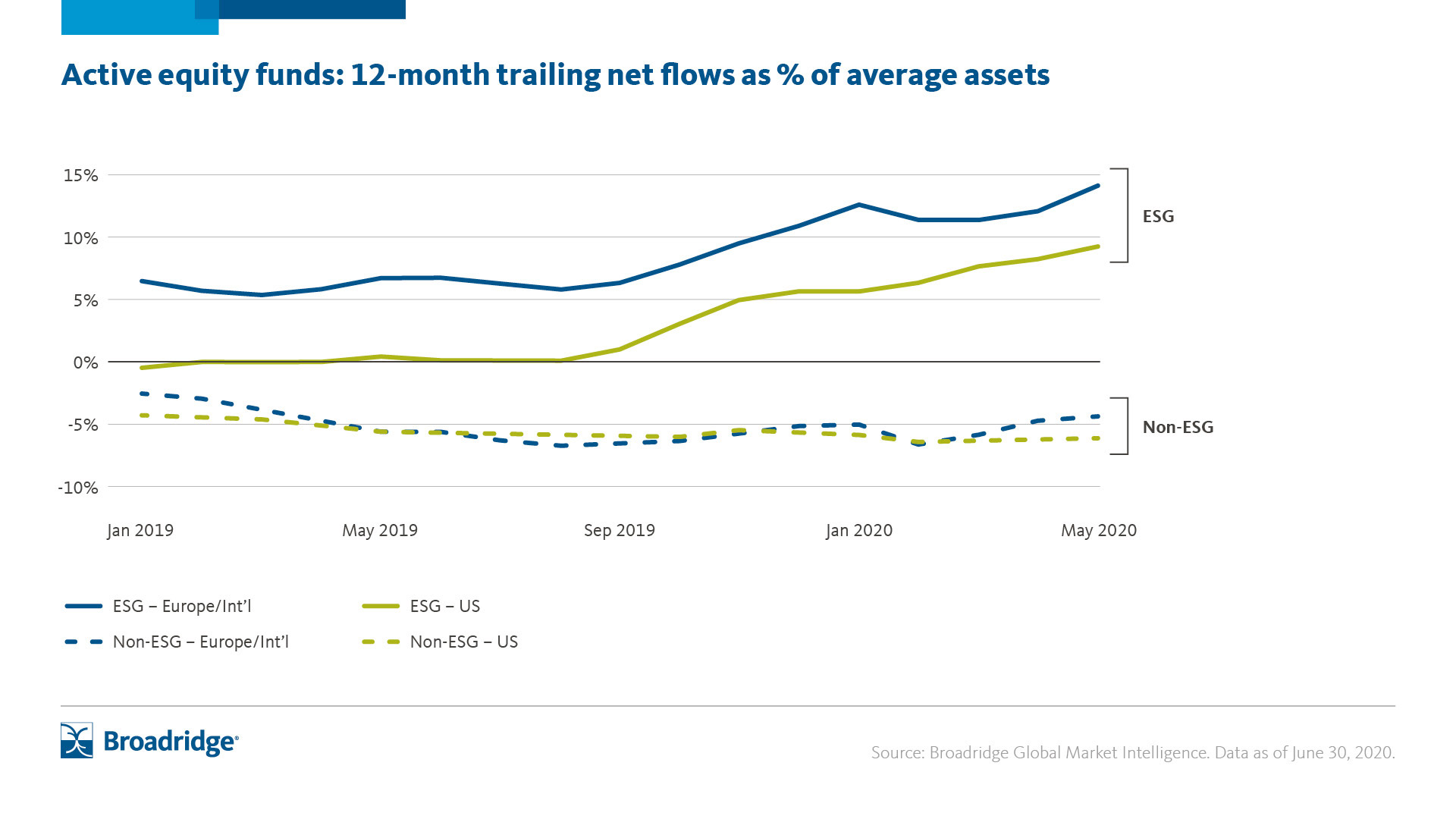

ESG Strategies Outpace Non-ESG Peers in Competition for Active Equity Flows

ESG strategies represent an attractive segment for active managers, especially in equity strategies. Flows into ESG active equity funds during the trailing 12 months reached 15% of average assets in Europe and International cross-border markets, and 10% in the U.S.

Financial Advisors Seeking ESG Support to Fill Investor Demand

According to a separate survey from Broadridge of over 400 financial advisors, 81% of wirehouse advisors have assets in ESG products today, followed by the IBD (68%) and RIA (60%) channels. As a result of the COVID-19 pandemic, almost a quarter of financial advisors (24%) reported that they saw an increase in client interest in ESG.

Generational divides were present in the study findings, with 69% of advisors under the age of 35 using ESG mutual funds and ETFs today – a number expected to jump to 83% in two years. Meanwhile, just over half (56%) of advisors over the age of 55 use ESG mutual funds and ETFs today. Older advisors appear to recognize the appeal and demand for ESG products, as 74% of that group expect to use ESG mutual funds or ETFs in two years.

Methodology

This report was conducted using Broadridge’s Global Market Intelligence platform. Broadridge’s proprietary Global Market Intelligence platform provides an integrated analytics solution for the asset management market tracking institutional and retail products globally. Broadridge provides insights into $76 trillion of tracked assets, covering every market in every region, and 80,000 globally tracked funds.

The Broadridge survey was conducted by 8 Acre Perspective Corp. and is the latest in a series of financial advisor surveys that reveal how advisors are adapting and changing their business models in response to market volatility and the pandemic. A total of 401 U.S. financial advisors across wire, regional, IBD and RIA channels completed the survey, which was fielded from July to August 2020.

For further details on survey methodology, please contact a Broadridge media representative.

About Broadridge

Broadridge Financial Solutions (NYSE: BR) is a global technology leader with the trusted expertise and transformative technology to help clients and the financial services industry operate, innovate, and grow. We power investing, governance, and communications for our clients – driving operational resiliency, elevating business performance, and transforming investor experiences.

Our technology and operations platforms process and generate over 7 billion communications per year and underpin the daily trading of more than $10 trillion of securities globally. A certified Great Place to Work®, Broadridge is part of the S&P 500® Index, employing over 14,000 associates in 21 countries.

For more information about us, please visit www.broadridge.com.