Myth Busting Investor Demographics: How New Tech and Tools Have Upended Age-Old Archetypes

For the past several years, academics, market researchers and business leaders have struggled to fully capture the scale or quantify the impact of the massive changes occurring in the financial services industry. Catch-phrases like “The Great Wealth Transfer” have put a spotlight on the major demographic shifts affecting the investor pool. Concepts such as robo-advice and gamification have helped illustrate the role that technology is playing in changing the way people interact with financial markets. Cultural phenomena like the meme stock movement and the crypto boom have demonstrated how quickly investor sentiment can swing.

When you put all those things together, however, it becomes clear that a larger cultural phenomenon has taken root, one where increased access—to information, asset classes, trading tools, and execution venues—has fundamentally changed the game. Along the way, conventional notions about investor demographics and stereotypes have been challenged. What does that mean for the future of wealth management?

This Investor Pulse insight dives into key data points from our Broadridge U.S. Investor Pulse 2024 study, along with insights from our Retail Investor Survey and Financial Advisor Survey to offer a data-driven perspective on the evolution of the retail investor.

Thinking Beyond Higher Education

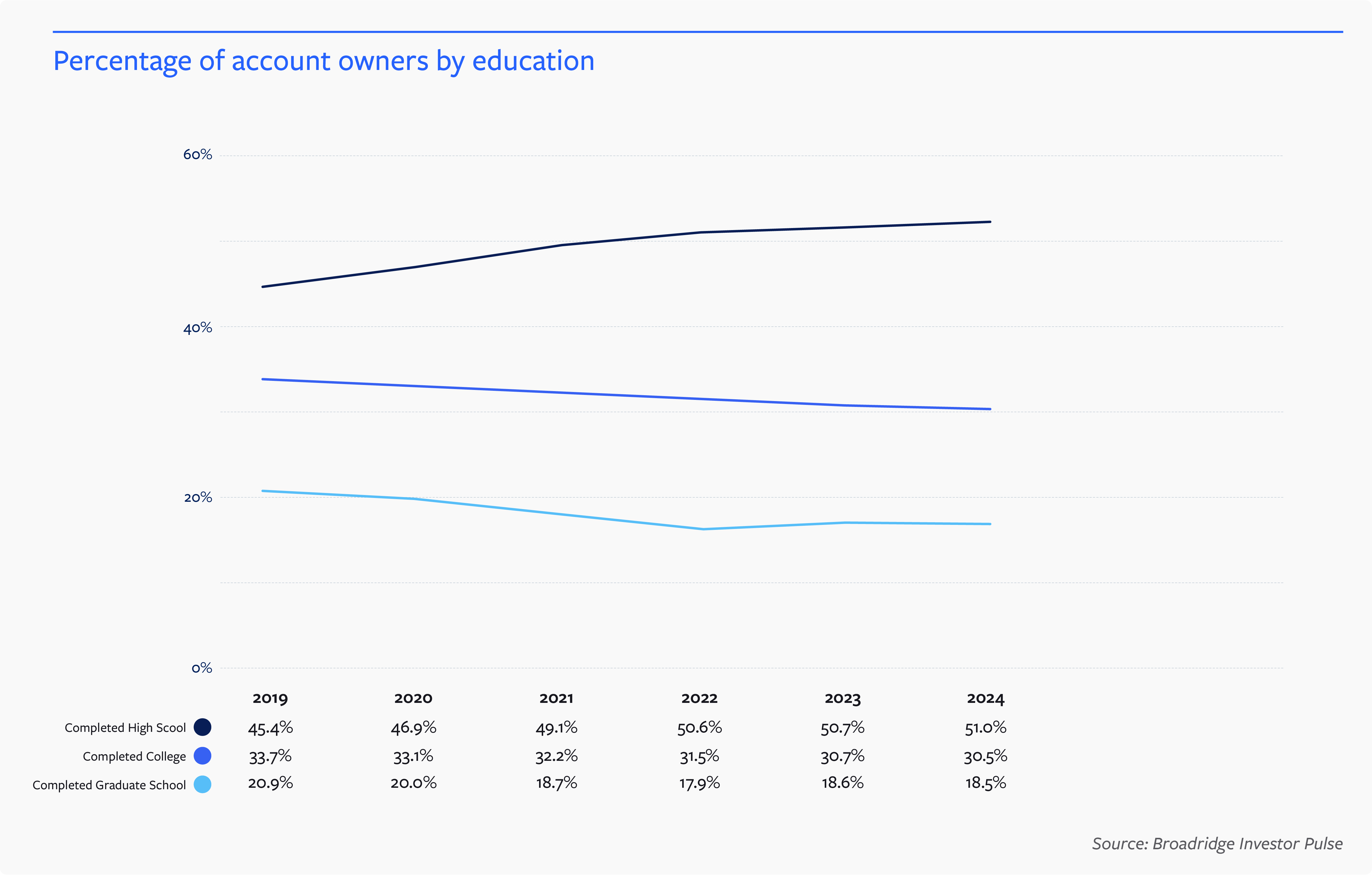

One of the breakthrough trends we’ve been tracking in Investor Pulse is the fact the number of investors without college or advanced degrees has been growing for the past five years, and now accounts for the majority of total retail investors. Through 2024, 51% of investors in individual stocks, ETFs and mutual funds, were non-college educated. Among the 49% of investors who have completed college, just 18.5% also completed graduate school.

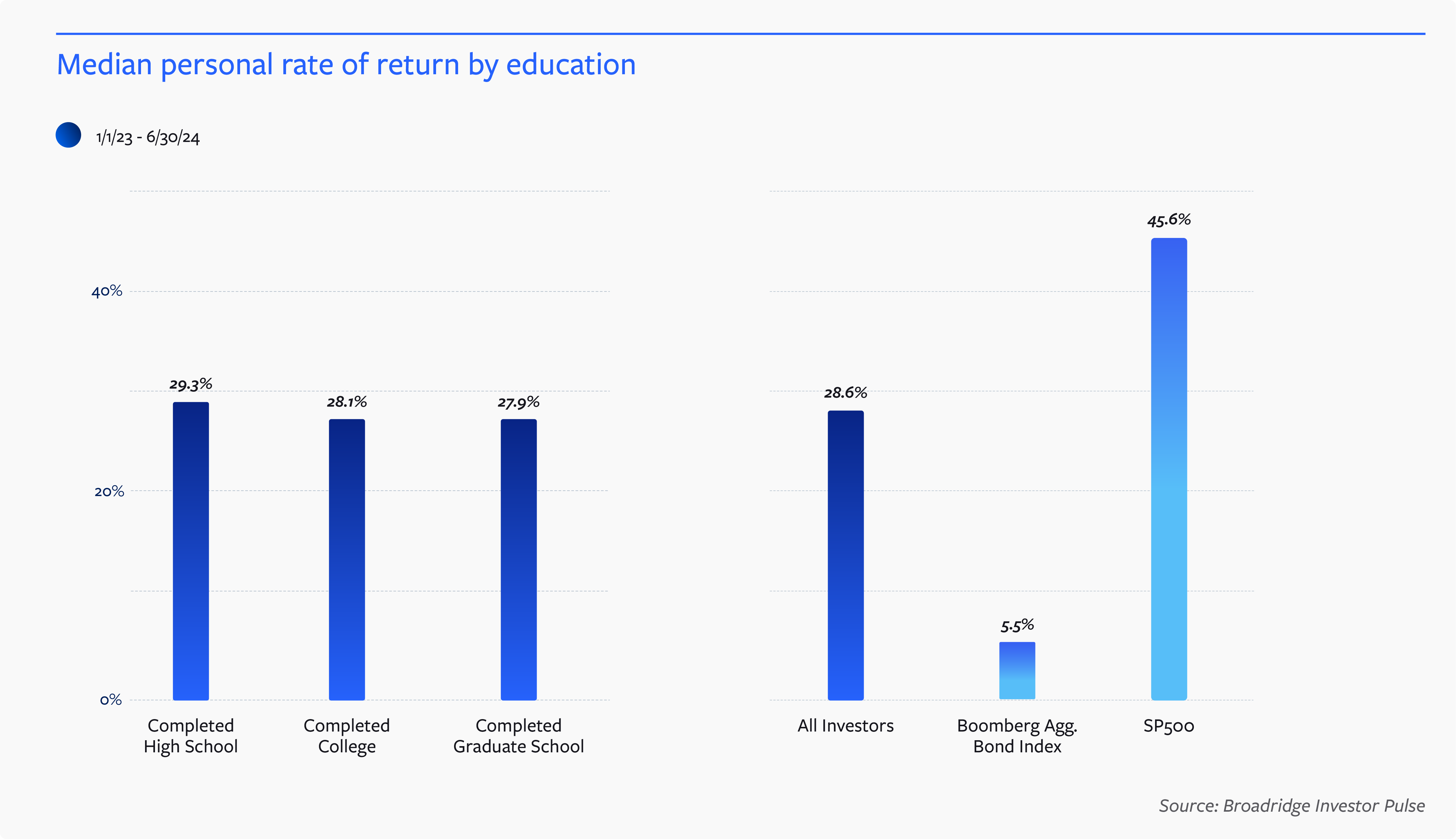

That’s not all. When it comes to performance, the brokerage portfolios of non-college-educated investors are faring better than those of investors with college degrees. Between January of 2023 and June of 2024, non-college-educated investors had a median personal rate of return of 29.3%, which compares to a rate of 28.1% among college-educated investors and 27.9% among those who completed graduate school.

There could be several drivers of this phenomenon. One key variable is the fact that, on average, the non-college-educated cohort in our study is also considerably younger than those who completed college or graduate school. The average age for non-college-educated investors in our study is 47, which compares to an average age of 59 among those who completed college and 64 among those who completed a graduate degree. Accordingly, the high school-only group has a higher risk profile and more concentrated holdings, which would help account for their strong performance during a period of record growth in equity markets.

Investing for the Fun of It… With a Safety Net

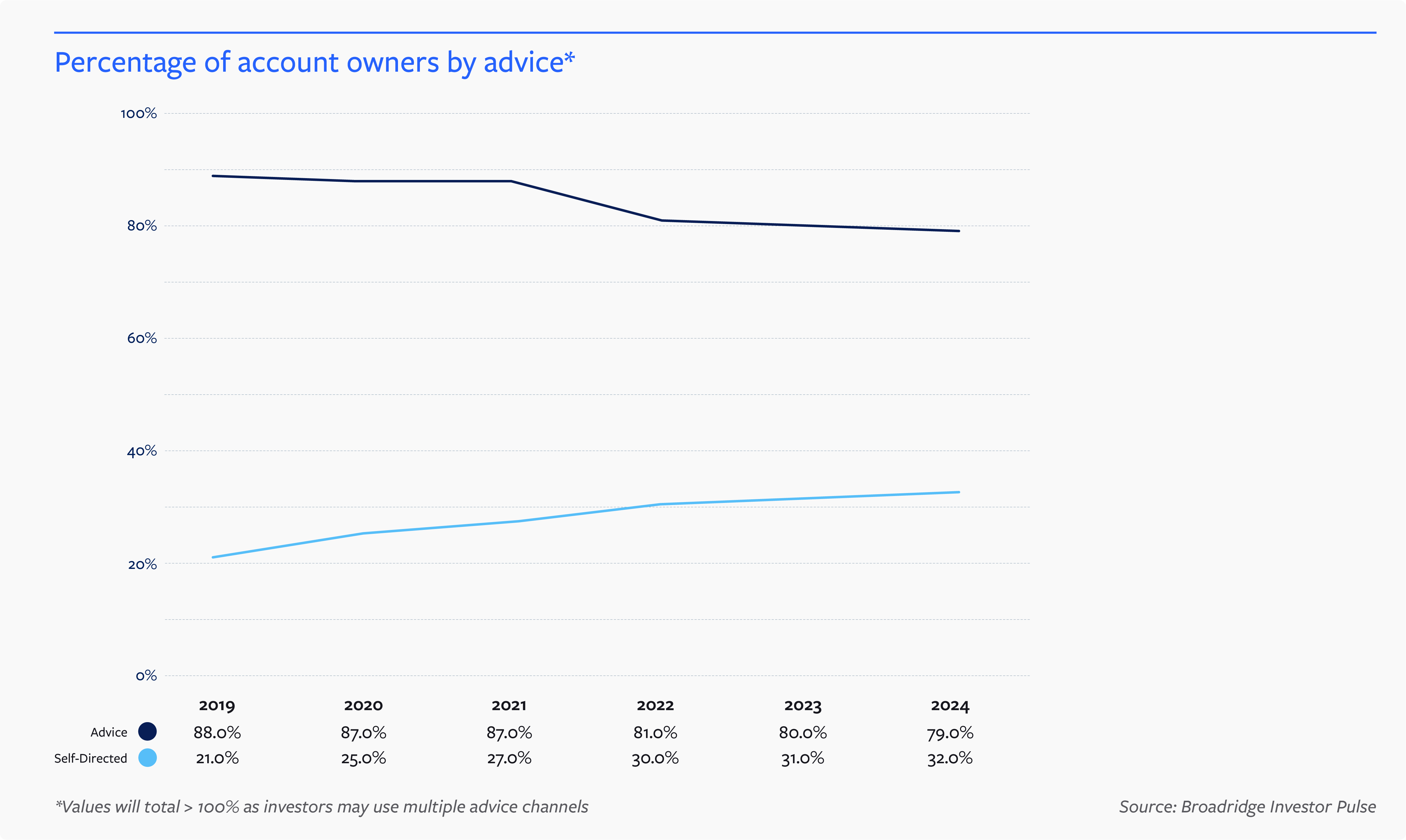

Another important, but widely misunderstood investor trend that’s been unfolding over the past several years has been the growth of self-directed, DIY accounts. Thanks to widespread availability and accessibility of online brokerage accounts, the removal of trading fees, and easy-to-use interfaces, more investors than ever are using self-directed accounts. According to our data, 32% of retail investors now have a relationship with an online discount brokerage firm, up from 21% five years ago. During the same period, the percentage of investors who have a relationship with a full-service firm has declined to 79% from 88%.

While full-service is still the dominant channel, investors are increasingly tapping online discount brokers to construct their own portfolios. Asset share of this channel reached 23.3%, its highest level yet.. Increasingly, we’re finding that the current investor psyche around full-service and DIY channels does not see the relationship as an either/or choice. Today’s investors want both.

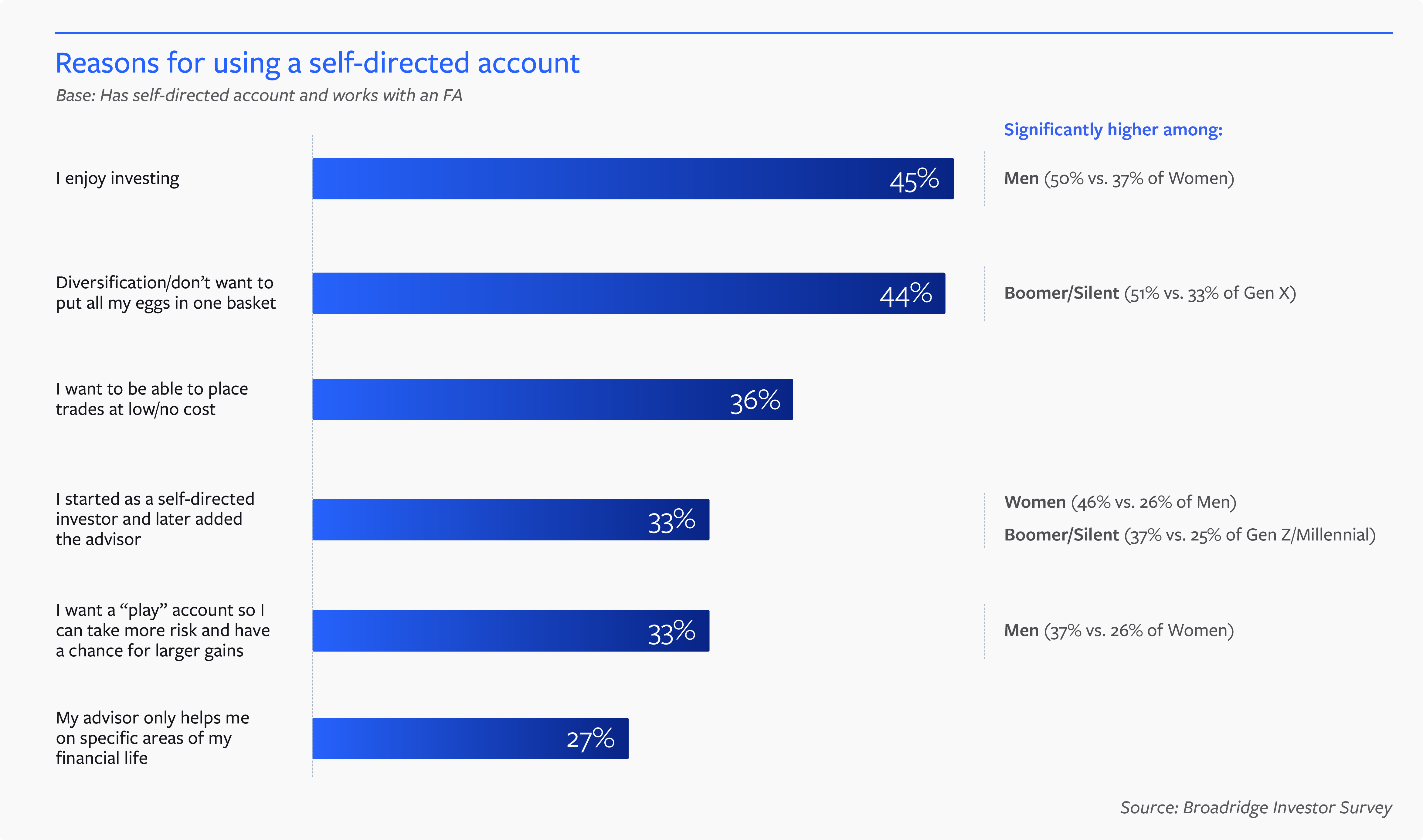

In fact, when we dig deeper into this phenomenon in our Broadridge Investor Survey, we find that the top reason advised investors gave for maintaining a self-directed account on the side was simply that they enjoyed investing. Other key drivers were diversification, ability to place low/no cost trades, and the desire to keep a “play” account to take more risk.

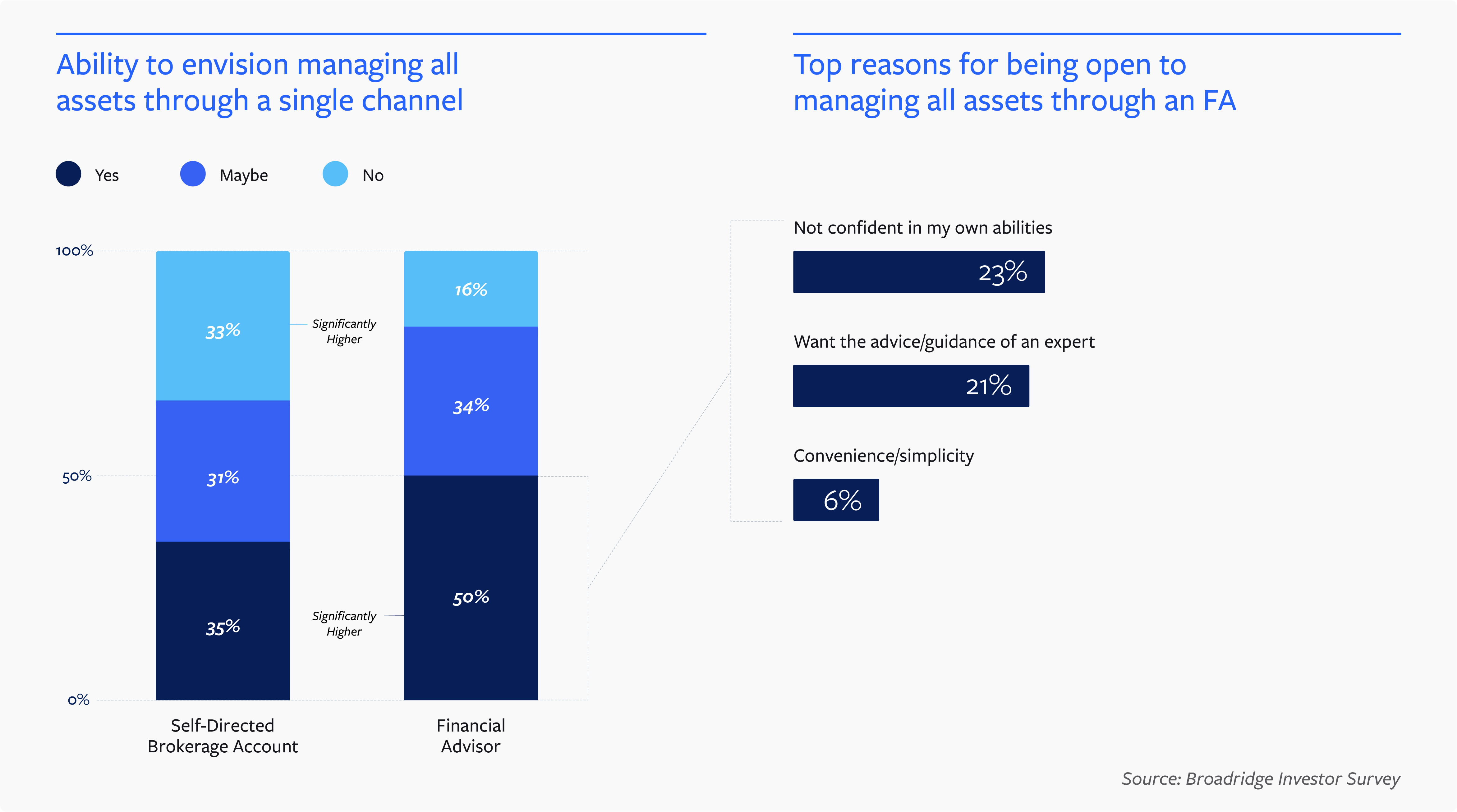

Further, when we asked investors if they would rather manage all of their assets with a financial advisor or manage all of their assets through a self-directed account, 74% of investors indicated a preference for working with an advisor. Reasons given included lack of confidence in their own abilities (23%), desire for guidance from an expert (21%) and convenience/simplicity (6%).

No Such Thing as a ‘Typical’ Investor

The shifts occurring in the retail investor landscape are much bigger and far more nuanced than any of the simple catchphrases or psychographic profiles that have been developed over the years can truly capture. Sure, we’re seeing clear evidence of the democratization of information and its influence on access and execution across generational cohorts. We’re seeing the longer-term effects of gamification and app-based trading on investor attitudes toward risk and embrace of self-service channels. But we’re also seeing a heavy reliance on advisors and a growing appreciation for the full-service channel as a higher-value service that performs a crucial role in the overall investment mix.

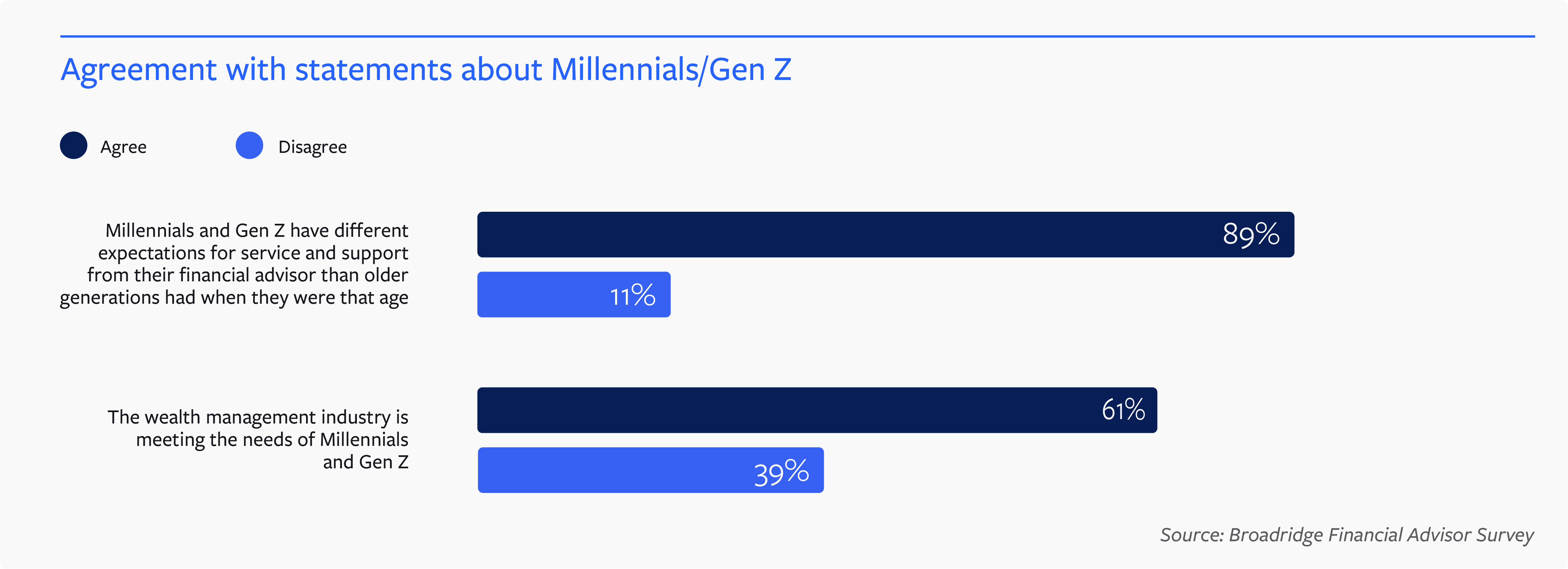

The challenge for the wealth management industry right now is recognizing these nuances and seizing these widespread variations in investor attitudes and goals as an opportunity to deliver highly specialized service. Right now, many are not doing this. Instead, they are seeing the fragmentation of the marketplace as an obstacle. According to our Broadridge Financial Advisor Survey, 89% of advisors agree that younger generations have different expectations for service and support but 39% feel the industry is not currently meeting those needs.

Ultimately, as we continue to study the individual behaviors of retail investors, and analyze those behaviors over time, we’re making the case for an increased focus on personalization. This goes far beyond the base level customer segmentation exercises and profiling efforts of the past. The wealth management industry needs to understand investors down to a segment of one and offer flexible solutions that take their unique needs into account.

Find Out More

Please contact andrew.guillette@broadridge.com to learn more about Broadridge Investor Pulse and related research.

Let’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |