The State of Alternative Investments in Asset & Wealth Management

Nicsa's State of Alternative Investments in Asset & Wealth Management Report

This paper explores the critical factors driving the adoption and success of alternative investments. It highlights the role of education, technology, and operational excellence in equipping industry professionals to meet the challenges and opportunities presented by this rapidly growing segment.

The paper draws on key insights from Nicsa’s Asset & Wealth Management Summit. These insights are supplemented with industry data from Broadridge’s 2024 Investor and Financial Advisor surveys.

Nicsa is a leading not-for-profit association striving to connect all facets of the global asset and wealth management industry in order to advance leading practices. Learn more about Nicsa here.

INTRODUCTION

Alternative investments (alts) are transforming the asset and wealth management industry. Once primarily accessible to large institutions, these innovative asset classes are now gaining traction among a broader range of investors, including retail participants. This shift underscores the growing demand for expertise in understanding market trends, navigating operational complexities, and adapting to evolving regulatory frameworks.

This paper draws on key insights from Nicsa’s Asset & Wealth Management Summit to explore the critical factors driving the adoption and success of alternative investments. It highlights the role of education, technology, and operational excellence in equipping industry professionals to meet the challenges and opportunities presented by this rapidly growing segment. These insights are supplemented with industry data provided by Broadridge, Nicsa member and industry partner, via their 2024 Investor and Financial Advisor surveys.

RISING DEMAND FOR ALTERNATIVE INVESTMENTS

The demand for alternative investments has expanded dramatically as advisors and their clients seek to diversify beyond traditional 60/40 portfolios. Market volatility, inflationary pressures, and the desire for uncorrelated returns have positioned alts as essential components of resilient investment strategies. Institutional investors, high-net-worth clients, and increasingly retail investors are drawn to the unique risk-return profiles of alts.

The shift from democratizing alts to institutionalizing them within wealth management highlights a pivotal trend. Wealth managers are creating proprietary alts vehicles to simplify access, align with client goals, and differentiate their offerings. This evolution reflects the industry’s commitment to balancing traditional financial offerings with innovative investment solutions.

The increasing demand for alternative investments is driving advancements in access, education, operational solutions, and regulatory frameworks. Given the typically illiquid nature of these assets, it is essential to conduct thorough client suitability profiling to assess risk tolerance.

BROADENING ACCESS TO ALTERNATIVE INVESTMENTS

The alts landscape has long been dominated by institutional players due to high minimum investment thresholds, intricate onboarding processes, and extended lock-up periods. However, recent innovations are reshaping this dynamic, creating opportunities for a broader range of investors while maintaining operational integrity.

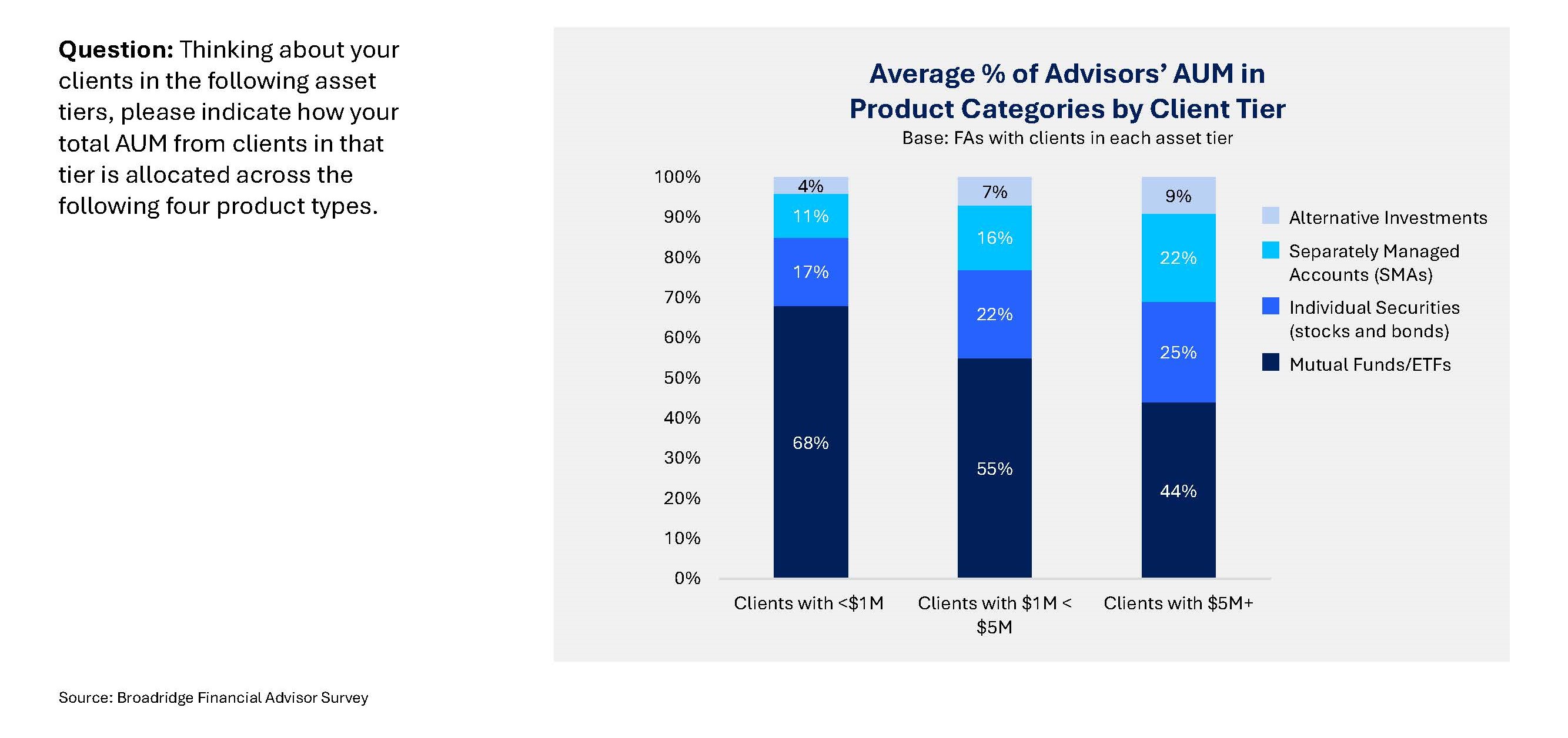

According to a new industry survey by Broadridge, financial advisors allocate more to alternatives for clients in higher asset tiers.

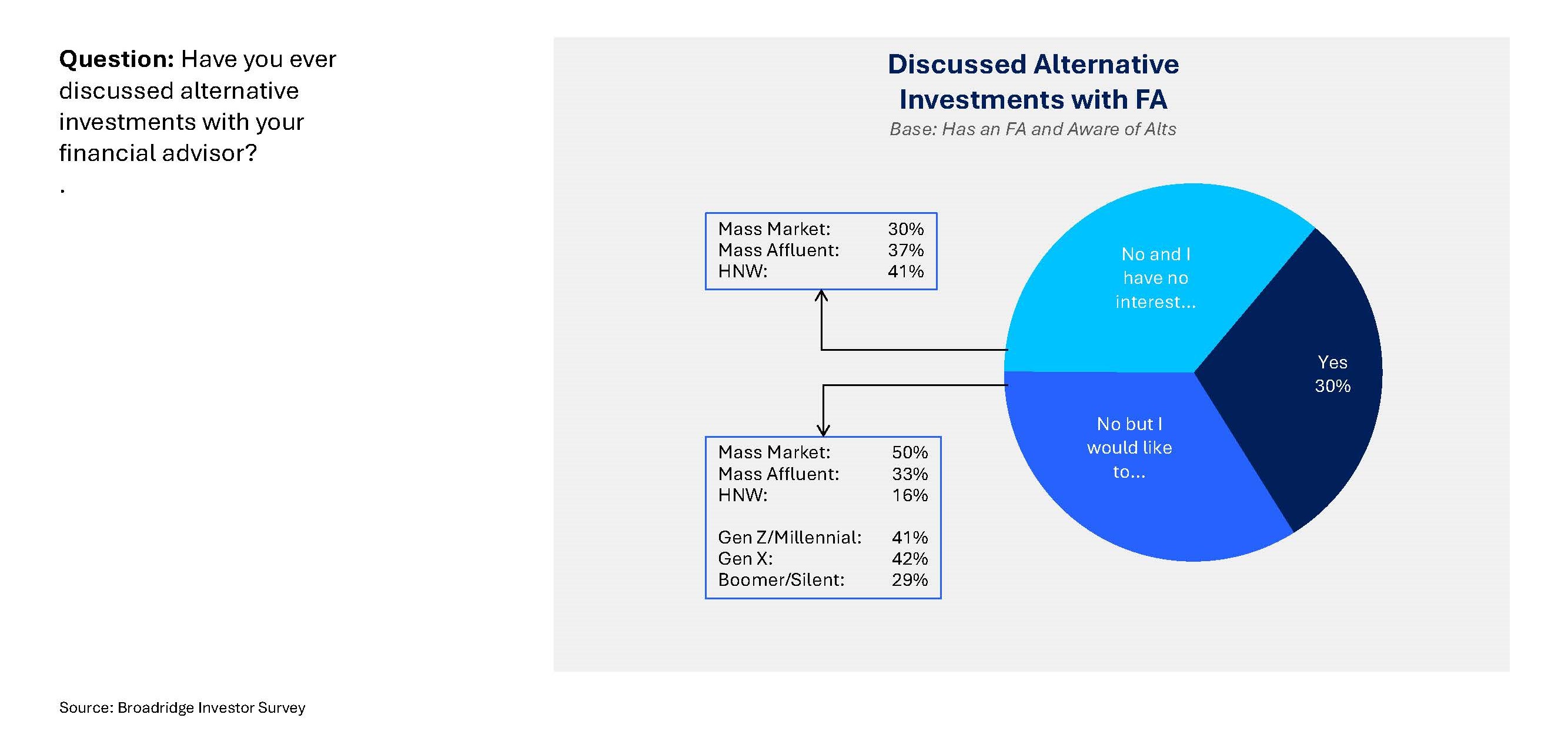

While alternatives traditionally have been more popular among wealthier clients, financial advisors have an opportunity to discuss them with younger and mass-market investors.

Lowering Barriers Through Innovative Structures

New fund structures and technological advancements are lowering the barriers traditionally associated with alts. Evergreen fund structures can offer continuous capital deployment, eliminating the need for frequent re-commitments and simplifying investor participation.

Vehicles such as interval funds and tender offer funds offer greater flexibility, making it feasible for high-net-worth individuals and even retail investors to participate. These structures can provide periodic liquidity windows either through scheduled redemption periods or through periodic tender offers, thus helping to preserve the long-term investment horizon essential to alternative strategies.

Advisors have additional options for helping clients invest in alternatives. For instance, Exchange-Traded Notes (ETNs) specializing in alternative investments are becoming increasingly popular among advisors because of their simplicity and user-friendly nature.

These innovative structures cater to the evolving expectations of investors seeking both accessibility and a seamless investment experience, aligning well with industry priorities to enhance client engagement and retention.

Tokenization and the Role of Blockchain

The goal of tokenization is to convert ownership rights into digital tokens on a blockchain (or distributed ledger). Such “tokenized assets” are redefining ownership models within the alternative investments arena.

By enabling fractional ownership, tokenization enhances liquidity in otherwise illiquid asset classes and introduces a new level of transparency and security. Fractional ownership also allows for increased accessibility. Tokenization allows smaller investors the possibility to participate in asset classes previously accessible only to high-net-worth individuals or institutions.

Similar to how stocks trade on exchanges, tokenized assets can also be traded on secondary markets, allowing for real-time settlement. Unlike cryptocurrencies, however, security tokens are often compliant with regulations like Know Your Customer (KYC) and Anti Money Laundering (AML).

For industry professionals, these developments not only represent operational efficiencies but also align with broader efforts to modernize and diversify the alternative investment ecosystem.

Driving Adoption Through Education

Despite myriad advancements, awareness and understanding of alternative investment structures remain limited among advisors and clients.

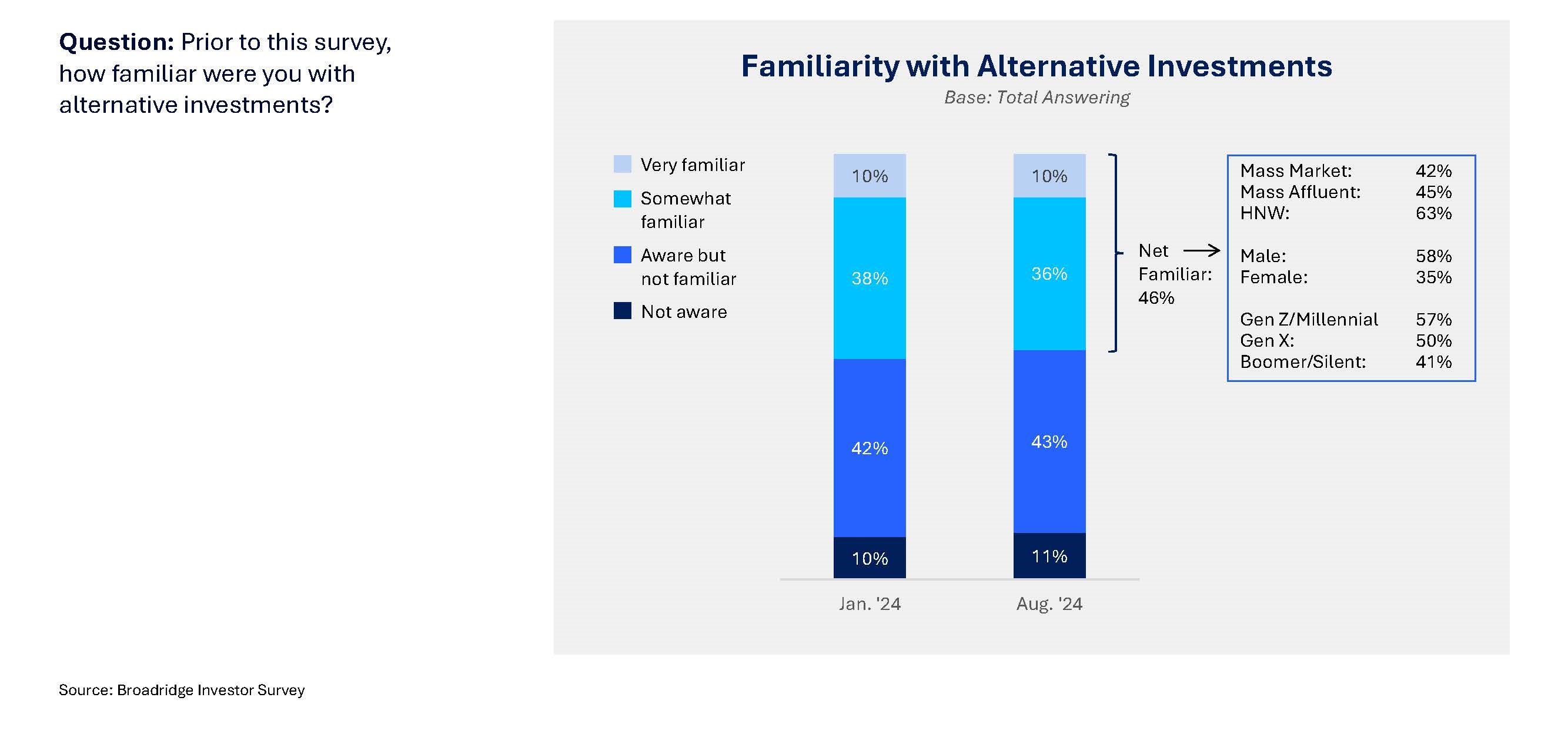

Recent Broadridge survey data reveals that while nearly half of investors are familiar with alternatives, few are very familiar with them. HNW, men and younger investors report the greatest familiarity. Industry leaders are focusing on targeted education initiatives to close this gap.

Efforts include creating accessible educational materials, hosting industry seminars, and conducting digital outreach campaigns to ensure both advisors and their clients are well-equipped to navigate the expanding alternative investment landscape.

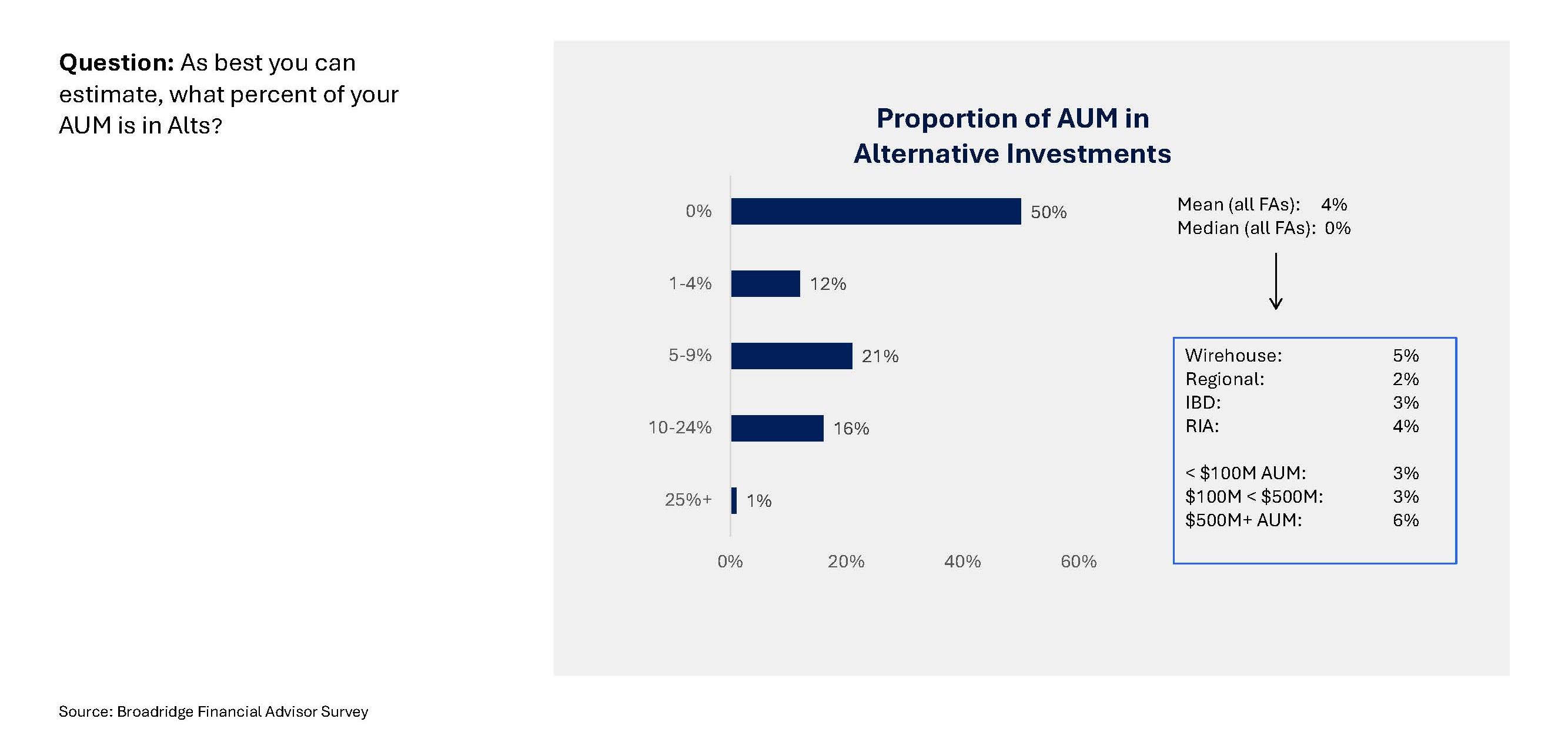

Alternative investments, on average, account for less than 5% of total assets under management (AUM), presenting upside potential for the asset and wealth management industry.

A Path to Wider Adoption

These developments are not just about democratizing access—they represent a strategic evolution in the alts market. By addressing historical barriers and focusing on education, the industry is paving the way for wider adoption and sustained growth. For asset and wealth management professionals, the challenge lies in integrating these innovations into existing frameworks while maintaining the high standards of diligence and client service that the alternatives space demands.

ADVISOR EDUCATION AS A STRATEGIC IMPERATIVE

Advisor education is a cornerstone for driving deeper integration and adoption of alts within client portfolios. While alts offer diversification and risk-adjusted return potential, their inherent complexities—ranging from unique liquidity structures to intricate regulatory considerations—require advisors to possess a high level of proficiency. Firms must prioritize strategic, tiered educational initiatives to ensure advisors can confidently incorporate alts into their practice.

Building Expertise Across Experience Levels

Educational efforts should be tailored to advisors’ varying levels of experience. For newer advisors, foundational programs that demystify alts and provide an overview of their key features are essential. For seasoned professionals, advanced training that delves into technical aspects, such as modeling illiquid asset cash flows or navigating compliance for private equity funds, is critical. Established designations like the Chartered Alternative Investment Analyst (CAIA) credential and practical resources such as case studies and interactive webinars are valuable tools for enhancing expertise.

Positioning Alts as Client-Centric Solutions

Education should focus on positioning alternative investments as tools for solving specific client challenges. For instance, interval funds can provide liquidity options for clients wary of long lock-up periods, while infrastructure investments can offer predictable income streams. By framing alts within goal-oriented frameworks— such as portfolio diversification, inflation hedging, or income generation—advisors can more effectively align alts with client needs, making these strategies relatable and actionable.

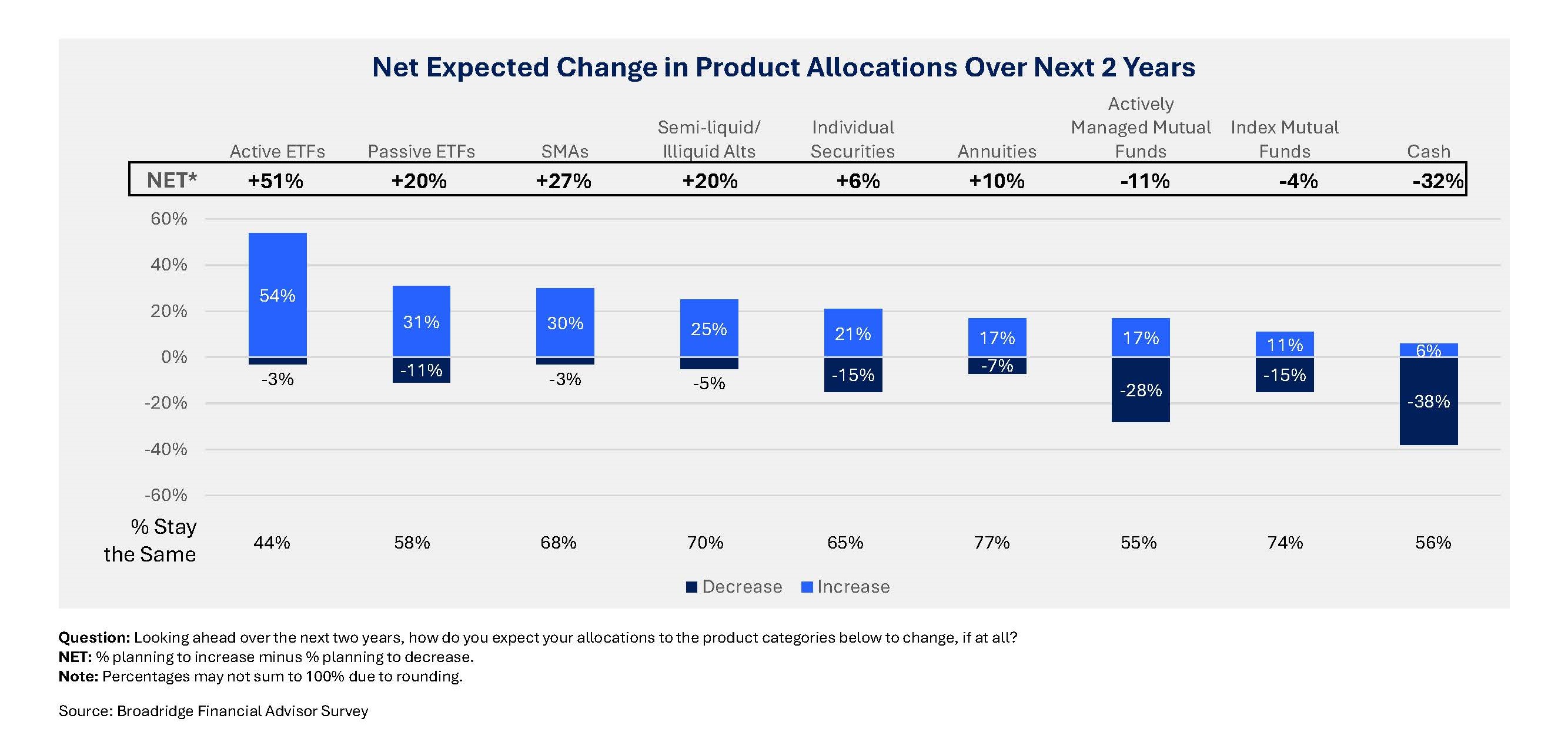

According to Broadridge’s survey, 25% of financial advisors plan to increase their allocation to alternatives over the next two years.

Debunking Misconceptions

A critical component of advisor education involves addressing and correcting persistent myths about alts. Misconceptions that alternatives are excessively risky, overly complex, or accessible only to ultra-high-net-worth clients can deter adoption. Clear, data-driven evidence—such as risk-reward profiles or the increasing availability of retail-accessible products—can be used to dispel these myths. This approach helps advisors approach alts with a balanced perspective and communicate their value effectively to clients.

Segmented Educational Strategies

To maximize impact, educational programs must be tailored to the unique needs of different advisor segments. For example, advisors in wirehouse environments may benefit from technology-driven, on-demand modules that integrate seamlessly into existing workflows, while independent advisors might prefer in-person workshops that allow for peer exchange. Personalized and accessible education fosters engagement and positions advisors as advocates for alternative investment strategies.

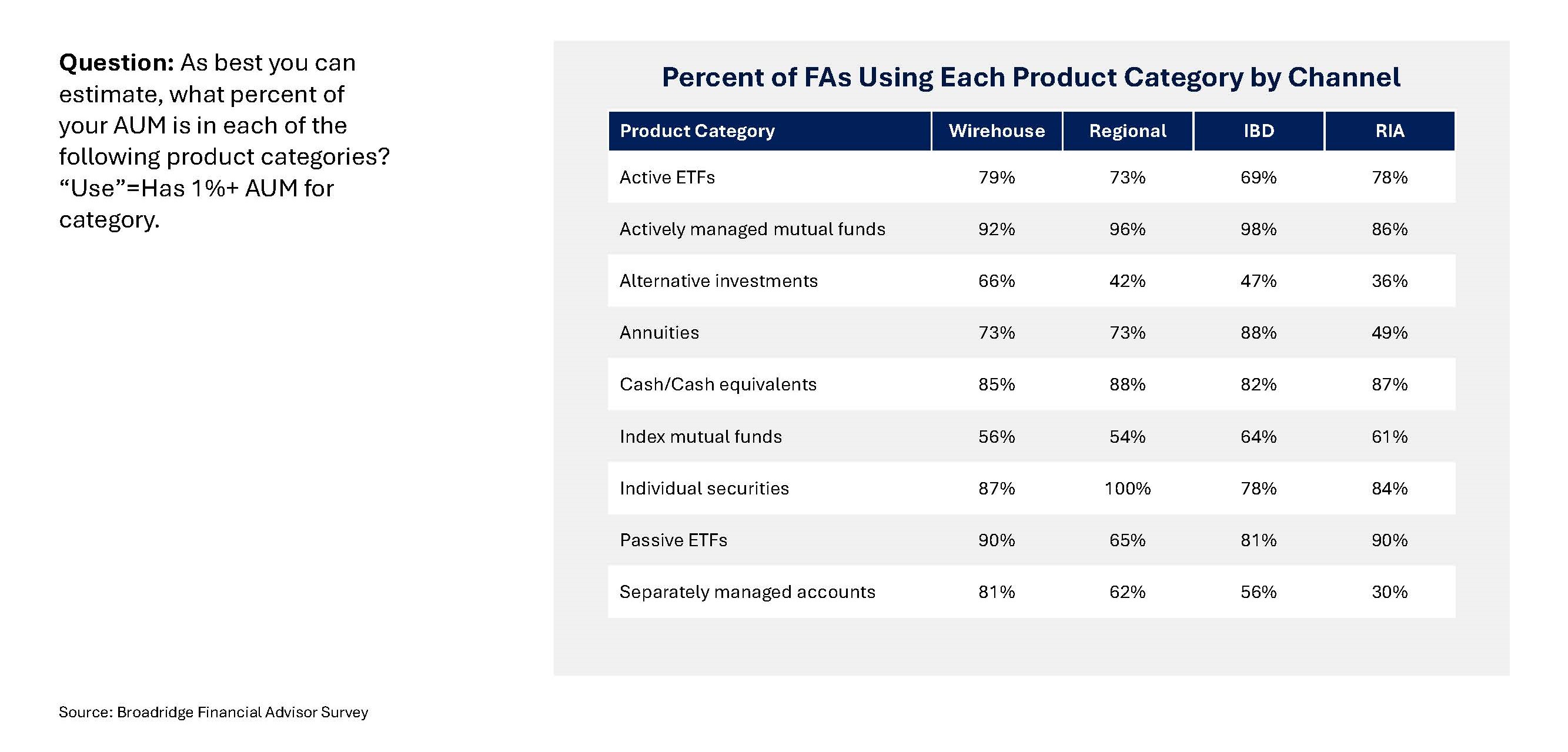

According to advisor responses gathered by Broadridge, adoption by FAs varies by segment, with wirehouse and IBDs outpacing their counterparts in use of alternative investments as investor solutions.

Empowering Advisors, Unlocking Growth

By investing in comprehensive, segment-specific educational initiatives, firms can empower advisors to confidently navigate the complexities of alts. In doing so, they not only enhance advisor expertise but also accelerate the broader understanding of alternative investments, driving growth and innovation within the industry.

OPERATIONAL CHALLENGES AND TECHNOLOGICAL SOLUTIONS

Integrating alternative investments into traditional advisory workflows presents significant operational challenges, often necessitating specialized approaches to address their unique characteristics. These investments often lack the standardized processes found in traditional asset classes. Issues such as irregular valuation cycles, limited liquidity, regulatory compliance, and complex reporting requirements demand a tailored operational framework.

Challenges in Valuation, Compliance, and Reporting

Valuation processes for alternative assets are frequently opaque and require expert judgment, making them difficult to standardize. This complexity increases the risk of errors and inconsistencies, especially when multiple stakeholders rely on the data. Compliance, too, can be daunting, given the varying regulatory requirements across jurisdictions and asset types. Furthermore, reporting requirements for alternative investments often demand intricate data aggregation and presentation capabilities, which can strain traditional advisory systems.

Technology as a Catalyst for Transformation

To address these operational hurdles, firms must leverage cutting-edge technologies. Blockchain technology, for instance, is emerging as a transformative force. By enabling tokenization, blockchain not only enhances transparency but also increases liquidity in typically illiquid markets. This facilitates fractional ownership and broadens access to alternative investments, allowing a wider range of investors to participate.

Automation and Advanced Analytics

Automated platforms streamline critical processes such as investor onboarding, compliance monitoring, and transaction processing. By minimizing manual intervention, these platforms reduce the likelihood of human error and enhance operational efficiency. Data analytics and machine learning bring additional value by providing deeper insights into asset performance, optimizing valuation methodologies, and improving risk management strategies. These technologies empower firms to make informed decisions with greater speed and accuracy.

Collaboration and Infrastructure Development

Overcoming these operational challenges requires proactive collaboration with fintech platforms and a commitment to investing in specialized infrastructure. Partnering with technology providers allows firms to access innovative tools and frameworks without the burden of developing them in-house. Additionally, adopting robust operational frameworks ensures scalability and resilience, enabling firms to handle increasing volumes of alternative investments while maintaining high standards of accuracy and compliance.

Unlocking the Full Potential

Ultimately, the integration of advanced technologies and robust operational strategies is crucial to unlocking the full potential of alternative investments. Firms that successfully navigate these challenges can offer a seamless client experience, position themselves competitively in a growing market, and capitalize on the expanding demand for alternative asset classes. By addressing these operational complexities head-on, firms not only enhance their operational efficiency but also build the foundation for long-term success in a rapidly evolving investment landscape.

NAVIGATING THE REGULATORY LANDSCAPE

The regulatory landscape for alternative investments remains a complex terrain that demands careful navigation. Many alts products fall outside the purview of the Investment Company Act of 1940 (the “40 Act”), leading to varied compliance obligations based on the structure, jurisdiction, and nature of the product. This diversity in oversight introduces challenges for firms seeking to manage alts efficiently while maintaining regulatory adherence.

Patchwork of Regulations

Alternative investments encompass a broad spectrum of asset types, each subject to distinct regulatory requirements. Private equity and hedge funds, for instance, often fall under exemptions rather than traditional fund frameworks, while real estate and infrastructure investments may be regulated differently depending on the jurisdiction. The lack of a unified regulatory approach forces firms to address a patchwork of overlapping and, at times, conflicting standards.

Emerging Global Standards and Regional Variations

While some jurisdictions, such as the European Union, are advancing regulatory clarity through frameworks like the Markets in Crypto-Assets (MiCA) regulation, the U.S. continues to grapple with regulatory ambiguity in areas like tokenized assets and digital securities. Firms must balance compliance with both established regulations and emerging guidelines, requiring constant vigilance and adaptability.

Leveraging Technology for Compliance

To address these complexities, firms are turning to technology-driven solutions. Blockchain analytics tools provide enhanced transparency and traceability, facilitating compliance with anti-money laundering (AML) and know-your-customer (KYC) requirements. Regulatory technology (RegTech) platforms enable real-time monitoring of compliance obligations, reducing manual burdens and improving accuracy.

Proactive Engagement and Strategic Planning

Staying ahead of regulatory developments demands active engagement with policymakers, legal experts, and industry groups. By participating in industry discussions and forums, firms can anticipate changes and adapt strategies accordingly. Additionally, scenario planning—modeling the impact of potential regulatory shifts— enables firms to remain agile and prepared for sudden changes in the landscape.

Regulatory Clarity as a Growth Catalyst

Clear and consistent regulatory frameworks are essential for fostering investor confidence and unlocking the full potential of institutional capital. A forward-looking approach to compliance not only minimizes risk but also positions firms as leaders in an evolving industry. For professionals managing alts, navigating the regulatory environment effectively is both a strategic necessity and an opportunity to differentiate their offerings in an increasingly competitive market.

CONCLUSION

Alternative investments are reshaping the future of asset and wealth management. Rising demand, broader access, and technological advances are driving this transformation, while education and regulatory clarity remain critical to sustained growth. Firms that embrace these trends and invest in innovation will be well positioned to deliver value to their clients and thrive in a competitive landscape.

Product Spotlight

Analyze data from the actual holdings of nearly 50 million U.S. retail investors.

Explore nowLet’s talk about what’s next for you

Contact UsLet’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |