For global banks and broker-dealers, asset servicing has long been seen as a high-risk, high-cost function, consuming up to half of operating budgets, leading to significant losses and missed opportunities. This problematic status quo is the result of fragmented technology systems requiring manual intervention and point-to-point integrations, and it is exacerbated by the fact that individual business units — in capital markets, asset management, wealth management, and global custody — each execute asset servicing functions in isolation from each other, using unique datasets and technology. Just as the technology is fragmented, so are attempts to modernize and streamline.

Reimagining Asset Servicing

A bold new vision

Larry Bajek, Vice President, Strategic Wealth Solutions

As we plan for the eventuality of T+0, there is no room for inefficient redundancy: now is the time for a transformative overhaul of asset servicing. There is a compelling opportunity to unify the tech stack and data engine across businesses and teams, for more streamlined, effective enterprises.

That’s why Broadridge has reimagined asset servicing from start to finish: eliminating silos and mitigating risks and improving the user experience from front-to-back, across the full operations ecosystem. Our modular, accessible platform operating on a single data source gives you transformation on your terms. As our clients face an onslaught of pressures — margin compression, aging systems, regulatory change, increasing volumes, and disruption from new technologies and asset classes — the old, fragmented way of doing things won’t work much longer. Since asset servicing is a key differentiator for many firms operating in otherwise commoditized spaces, it’s even more crucial to innovate today.

We can replace the complex, costly, and error-prone status quo with a smarter, simpler, more streamlined and modern approach with modular flexibility. Here, we offer our view on what it will take to succeed.

1. Rethink the meaning of “integration” to operate more holistically

The word “integration” has typically carried unpleasant associations, as it has been shorthand for the difficult work of stitching together disparate solutions. We are redefining the idea of integration, both conceptually and technically. Conceptually, to meet today’s investor demands we must now think more broadly and address the entire asset lifecycle on a single platform — going beyond corporate actions and income. We must move away from linear conveyor-belt processes to a holistic and horizontally integrated approach across all associated functions.

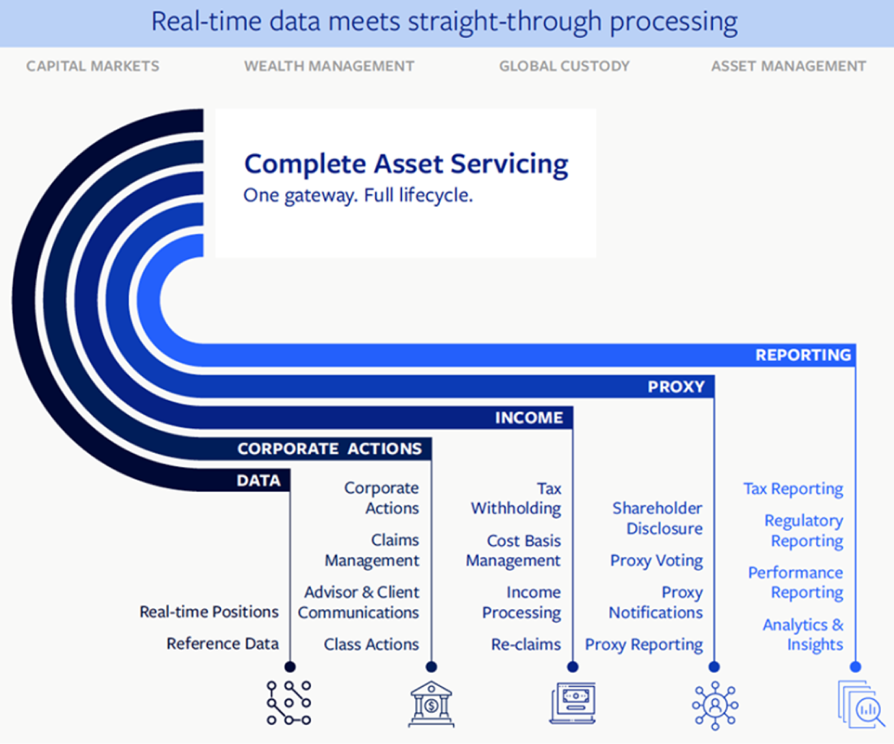

Technically speaking, to execute on the holistic concept of integration, we have completely transformed our approach to asset servicing solutions — with a unified platform powered by a real-time, golden dataset, incorporating tax and performance reporting, cost basis, proxy, class actions, reclaims, and global custody. A single streamlined solution across all of these functions helps firms strengthen their client relationships as well as their operational processes — enhancing automation; improving straight-through processing; and optimizing accuracy, speed, and risk mitigation.

The most revolutionary aspect of this new platform is its “Single Gateway” model for onboarding and scaling. Our flexible design enables you to integrate one component to start, which then creates an easy integration journey for future components as you need them — and drives the accumulative power of a single data source for all asset servicing processing. This modular approach helps clients transform their overall experiences at a pace and in a direction that suits them.

Creating a unified and responsive asset servicing ecosystem not only meets customer and regulatory demands but also positions firms to differentiate and capitalize on strategic opportunities in a competitive marketplace.

Broadridge’s platform delivers powerful benefits, including:

- The ability to consolidate and reconcile data more efficiently across the entire business, eliminating friction and minimizing financial and reputational risk

- A simplified tech stack to help users maximize straight-through processing

- A foundation for advanced, generative artificial intelligence (AI) that provides predictive and operational analytics, driving efficiency and real-time decision making.

Adopting a truly integrated platform serves as a growth catalyst for firms looking to scale.

2. Think tax-smart from end-to-end

Consider some practical benefits. Tax is one of the most significant opportunities for enhancing the value of asset servicing. The traditional notion of investment returns has focused on earnings and growth. But with investors and advisors looking to optimize portfolios while navigating more diverse asset classes and complex tax circumstances, we need to dramatically broaden our view — to define returns as what we earn plus what we retain and recover.

Investors and advisors now expect fully integrated relationships that are proactive and strategic, that incorporate all available intelligence in real-time to maximize investment portfolio’s value. Because the net amounts that investors get to keep after taxes are as important as topline growth, tax efficiency should be top-of-mind throughout the investment journey and asset lifecycle.

Embracing a tax-smart mindset clearly has downstream implications on cost basis, withholding, and reporting processes, but a smart unified platform can also leverage real-time data upstream to help advisors and asset managers formulate tax-savvy investment decisions and maximize investor returns. A typical tax solution might provide accurate reference data on a client’s withholding rate for a particular security, but the real question is whether this is a security that should be held or sold.

By bringing tax-related data and strategic insights forward in the investment journey, we can activate a holistic understanding of the asset, the customer, and the jurisdictional requirements impacting each. For instance, by understanding how a Corporate Action event is tax-affected, and what certain corporate actions indicate for a particular holding, we can improve classification, withholding, retention strategies and customer payment terms — making for a deeper client relationship and greater reinvestment opportunities while reducing the burden of post-settlement processing.

3. Swap out data silos for data standards

Rather than struggling to maintain disparate data models across business units and teams, banks and broker-dealers instead need to harmonize data at the source with common standards and ontology on a single platform.

At Broadridge, we have long championed establishing and adopting industry-wide standards to ease innovation (in collaboration with key partners such as DTCC and others). Internally, we have invested in building a common data ontology across our whole technology platform, normalizing the attribution required by each specialized processing engine. This crucial step of harmonizing data end-to-end, across the full process, delivers significant benefits to our clients — reducing risk, friction and reconciliations, and increasing interoperability and efficiency. Not to mention the follow-on benefits for AI and other applications.

Our platform’s data standards drive value in many ways, for example:

- Flexible modularity – Clients can choose any solution as their starting point. Integrating once with a single component kicks off an easy integration journey as the client adds more components as they need them.

- Cumulative reusability – The more data that gets added, the smarter the platform becomes, and common data points can be reused across applications (e.g., proxy data can be used for corporate actions or tax data can be used for class actions).

- Greater speed and accuracy – By harmonizing data across all processes, asset servicing is made faster and more reliable. Automating workflows, reducing discrepancies and pushing accurate information to decision-makers more easily improves investment decisions, election participation, and deepens the client relationship.

- Real-time risk management – A single, persona-driven UI for all operations, driven by a single source of real-time data, empowers users to monitor all activities in a unified view, so they can identify and address issues more easily.

- Effortless scalability – Once clients onboard any portion of our ecosystem, it’s easy to turn on other modules and capabilities, tapping into a powerful network effect.

In a rapidly changing landscape, common data standards help us better serve our collective clients’ needs.

4. Componentize to modernize more quickly

No firm has the time or appetite for "big bang" multi-system replacement projects; it’s not feasible to pause operations for months or years in order to onboard a complete new, end-to-end platform. But when legacy tech stacks are aging rapidly across the enterprise, how can firms respond?

The answer is componentization: you can de-risk and accelerate your tech modernization approach by approaching it incrementally.

Broadridge has designed an agnostic “Single Gateway” API Hub that enables clients to start with one high-priority function and gradually transform from there as they need to. With this modular approach, you can choose a point of entry, wherever your business needs it most, and then choose to add more modules as you go. Over time, each incremental module adds to a harmonized golden dataset across your business, helping you realize cumulative benefits.

Corporate actions may be a major pain point for you because of time-consuming manual processes. Perhaps your tax solution is causing unending reconciliation work and costly error rates. Or you’ve been looking to outsource your proxy voting because it’s become too expensive to manage in-house. Wherever you want to begin, with API-enabled modules at the ready, Broadridge Global Asset Servicing makes it easy to scale once you’ve started your transformation.

5. Harness AI to optimize humans’ time

By generating a single, real-time data source, our new Global Asset Servicing Platform is designed to be a powerful springboard for harnessing artificial intelligence. AI promises to make every user’s workflows and decision-making easier, faster, and smarter — but only if the underlying data is up to the task.

On the more routine side of operations, AI can easily automate time-consuming processes, ingesting and structuring data for more efficient reviews by human stakeholders. For example, accelerating the day-to-day work of managing corporate actions, class actions, and proxy votes with AI frees team members to focus on higher-value tasks.

In other areas of asset servicing, AI can play a more strategic role in surfacing insights and ideas. For example, with the right historical and reference data, we can use AI to proactively predict a fund’s cash flow, whether it will reclass, and how that will affect an investor’s outcomes and tax burden. That level of insight helps position advisors as holistic, trusted partners, enabling them to anticipate and answer client needs.

Additionally, AI driven by our data model can help banks and broker-dealers improve their appeal for current and potential employees. As more seasoned team members age out of the workforce, and companies engage in the fierce war to retain and recruit top talent, candidates will opt for roles that offer more interesting and impactful responsibilities. A modern technology platform is likely to be a critical decision factor for this cohort.

6. Stay ahead by taking the first step now

In the new world of asset servicing, the time to act is now. Market dynamics, such as increasing scale, the rise of digital assets, the individualization of investor demands, and the increasing burden of regulatory requirements, are colliding with technological advances in AI, blockchain, and cognitive technology, creating a swirl of pressures that legacy thinking and point-solution technology cannot withstand.

The switch is on. Industry leaders are adopting a straight-through, single platform model across the full asset servicing lifecycle. As firms consider how to modernize, a growing number are turning to outside partners to accelerate their efforts. According to a 2023 Deloitte Asset Servicers Survey, 87% of respondents planned to collaborate with FinTechs and IT system providers to tackle market challenges instead of building in-house capabilities (up from 50% in just two years). As a longstanding partner to leading banks and broker-dealers, Broadridge has the industry expertise and the harmonizing Global Asset Servicing Platform to help you plan a successful, modular transformation on your terms in an increasingly digital and data-driven environment.

Let’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |