2023 Q3: Fixed Income Client Newsletter

Menu

On This Page

Innovative Fixed Income Solutions

Distributed Ledger Repo (DLR)

DLR is a groundbreaking solution powered by Broadridge blockchain technology that transforms the way you manage repurchase agreements. By automating repo processing, DLR streamlines operations, significantly reduces operational and settlement costs, and enhances liquidity in the securities lending market, all while minimizing risk and creating a secure record of trade details.

Read our article in Forbes: Broadridge Now Conducts $70 Billion Of Blockchain Repo Trades Per Day

Smart Pair Offs

Utilizing the capabilities of Distributed Ledger Technology (DLT), the Smart Pair Off service transforms the pair-off process through Smart Contract matching. It efficiently addresses various intervals, from intercompany pair offs within impact, within systems, and bi-lateral pair offs with the street. This service not only streamlines operations but also minimizes manual interventions and ensures consistent results across multiple platforms and fortresses. The result is a significant advancement in processing efficiency and accuracy.

Key Benefits of the Smart Pair Off Functionality:

- Automated transaction matching and display of unmatched exceptions

- Eliminates the need for Operations to manually mark items to be paired off

- Ability to match and communicate pair off results across BR fortresses (impact, BPS, and Gloss) and client platforms

- Automated process optimizes the number of pair offs performed, while reducing fails and fees associated

First Bi-Lateral Intraday Use Case

Distributed Ledger Technology (DLT) has revolutionized intraday repo trading, offering rapid, transparent, and secure transactions, with major banks now executing trades on Broadridge’s DLR platform.

The advent of DLT-based intraday repo could save banks and broker-dealers millions by providing short-term funding solutions, mitigating the costs of the overnight interest for account deficits that last only a short duration.

Read our whitepaper on intraday repo and our article in Securities Finance Times.

New Initiatives

Sponsored Repo

With DLR’s Sponsored Repo, Broadridge streamlines collateral management by consolidating depository locations, leading to significant savings on clearing costs. Sponsored members can reduce capital usage, realize savings on clearance costs and apply lower risk weights to their capital ratios. In contrast, sponsoring members benefit from:

- Improved Balance sheet optimization

- Deepened customer relationships

- Reduced liquidity risks

Learn more about our sponsored repo use case.

15c3-3

The DLR platform introduces an automated solution to address operational inefficiencies in the 15c-3-3 collateral lock up process, streamlining the pricing and segregation of collateral to provide collateral optimization thus reducing liquidity buffer requirements. Stay tuned for more information on this exciting use case.

Fixed Income Product Updates

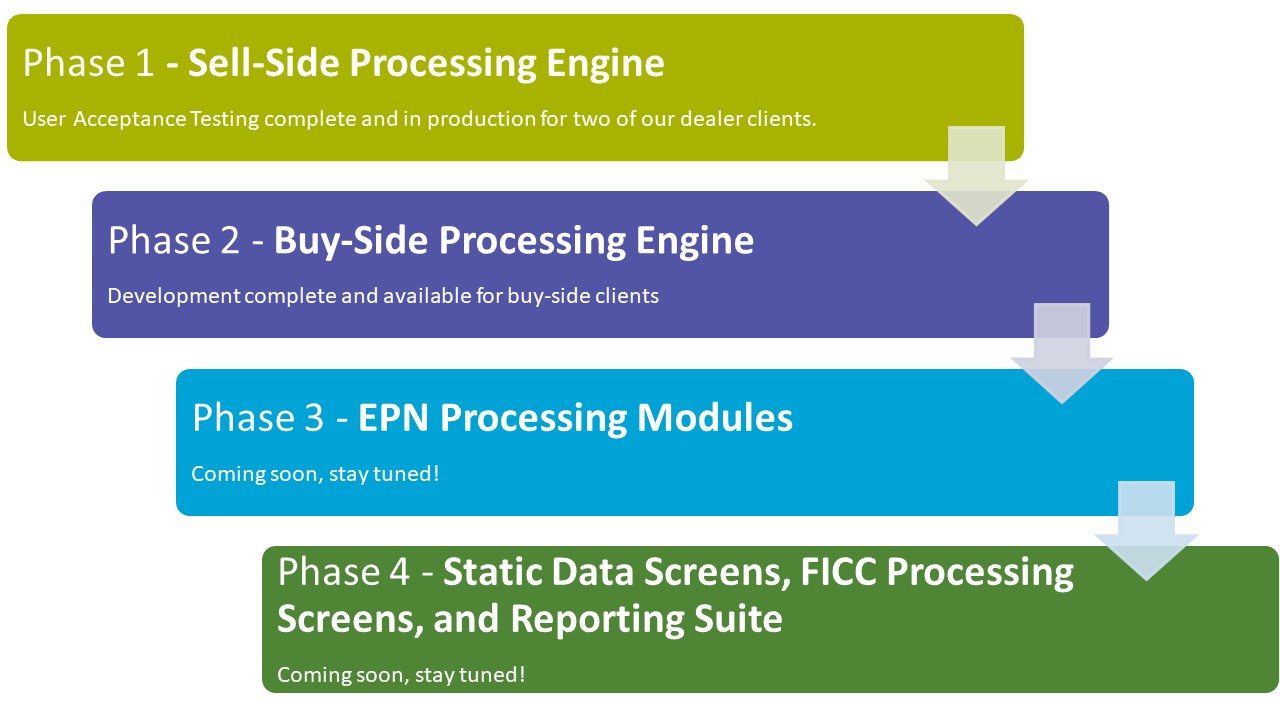

Mortgage-Backed Securities Expert (MBSE) 2.0

For more than twenty years, MBSE has been the TBA Trade Management and Allocation system of choice for the dealer community, supporting full FICC netting members, asset managers, and mortgage originators. This group of clients' accounts for a major portion of the MBS trade processing on the street, as well as settlements through the FICC Net.

To better serve these clients, Broadridge has undertaken a rewrite of MBSE, taking advantage of some of the technologies not yet available in its inception. These changes allow for a more robust, data-intensive experience, providing allocators with an improved UX/UI and stronger tools for bringing trading, allocations, and settlements a clean experience.

- Phase 1 - Sell Side Processing Engine

- User acceptance testing complete and in production and in production for two of our dealer clients.

- Phase 2 - Buy Side processing engine

- Development complet and available for buy side clients

- Phase 3 - EPN processing modules/li>

- Coming soon, stay tuned!

- Phase 4 - Static Data screens, FICC Processing Screens, and Reporting Suite

- Coming soon, stay tuned!

We look forward to making this rich experience available to all. Please reach out to Anand Lakshmiratan or John Rafferty for more information on MBSE 2.0.

Trade Assignment Portal (TAP) and PDF Reader

In an ongoing effort to create a more straight-through process for the settlement of MBS securities, the MBSE team has created an application whose purpose is the streamlining and simplification of the trade assignment process. TAP and the PDF Reader are currently in production.

TAP is a tool used by buy-side clients to mitigate settlement risk by leveraging the relationship they have with the dealers. By contractually assigning the dealer trades, they remove themselves from the process and the Dealers now face each other. These Assignment Letters are currently communicated by email or fax, which creates inefficiencies through the need to download/sign/scan/ and resend each document to the next person in the chain.

Through the utilization of TAP, portal members can interact with the assignment without the need to download and upload if all the parties are portal participants. The application allows the user to create emails with the assignment letter attached for non-portal members, containing a link into TAP to perform their acceptance or rejection of the assignment.

TAP also has an AI-based PDF Reader that will take emails sent to a portal participant, consume the .pdf file, and translate that information directly into the application for matching and processing to TBAs. This greatly speeds up assignment processing for the user.

The MBSE team will be reaching out to clients in 2024 to assess their potential need for this application. If you have comments or feedback on this proposal that you would like to discuss with the MBSE team, please reach out to anand.lakshmiratan@broadridge.com

Resiliency as a Service (RaaS)

The cyber threat landscape is evolving fast and growing wider as cyber-attacks on financial services institutions are becoming more frequent, targeted, complex, and sophisticated.

This underscores the need for financial services organizations and their technology providers to ensure their readiness for a coordinated response and recovery for critical services is as robust as possible.

The native technology of our fixed income application is inherently less susceptible to malware, specifically ransomware attacks and our installed protections are very robust. Nonetheless given the fact that this platform is systemically critical to the fixed income ecosystem, Broadridge has developed and decided to invest in an innovative solution to recover from a cyber-attack more quickly in the unlikely event that a successful attack occurs.

Broadridge is leading efforts to create a detailed response and recovery strategy - providing a unique and innovative Recovery as a Service (RaaS) solution in partnership with its clients, custodian banks, and central securities depositories.

While this solution leverages some characteristics of industry leading defense mechanisms like “air gapping”, it is largely a proprietary model and provides a first-mover advantage for our clients.

This unique solution can provide recovery times that are less than half any other solution available in the market today thereby providing near-seamless business continuity.

If you are interested in learning more on how to protect your firm, please reach out to the fixed income product team or your account manager.

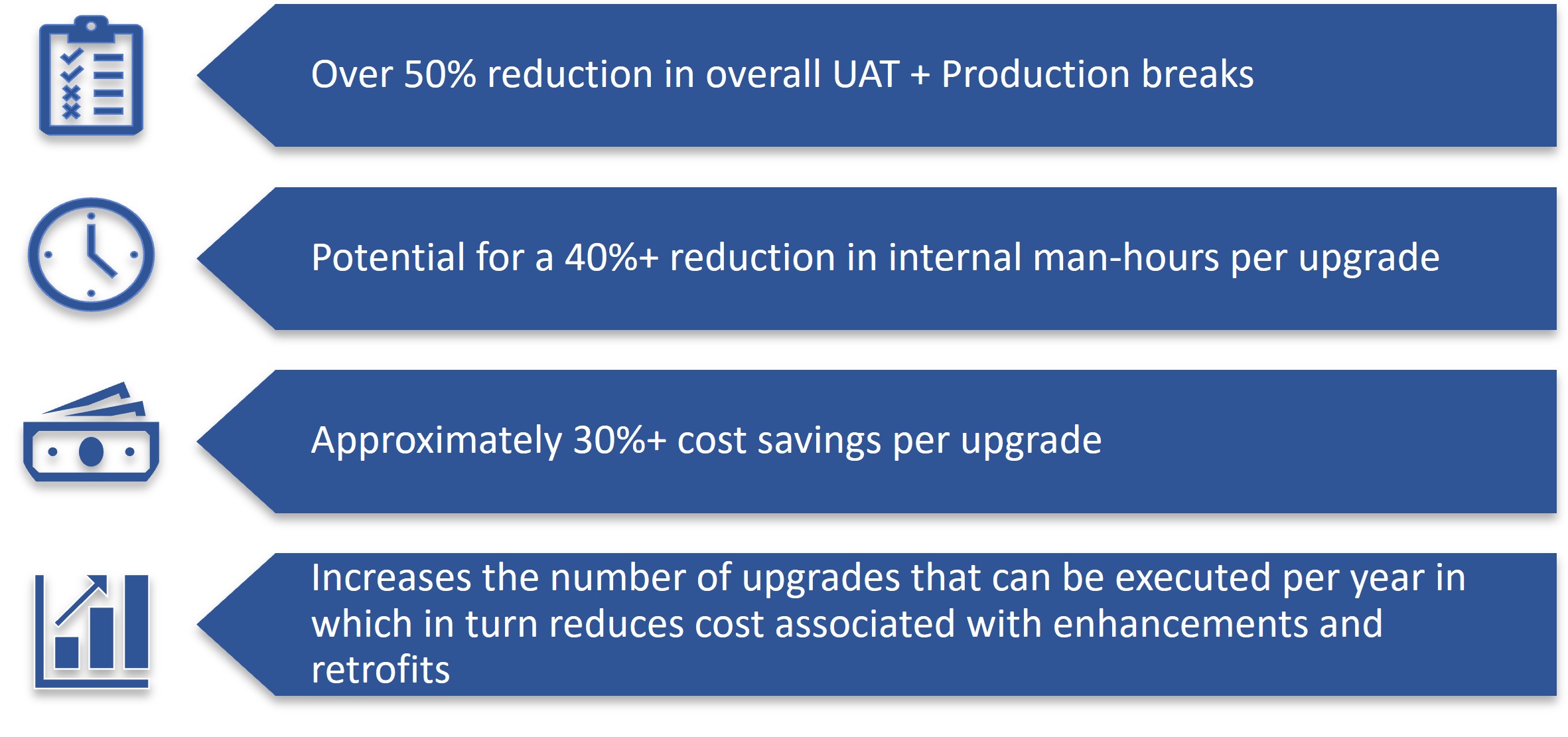

ProPlay

ProPlay is a service offered to our fixed income clients to assist with their regular system upgrades by massively reducing upgrade efforts and the internal costs associated with it. ProPlay captures and replays a full day’s worth of almost all production messages and inputs in both the client’s current platform version as well as the future version.

A Broadridge SME then performs a comparison and analysis of each output and provides explanations and resolutions for any expected and unexpected breaks. This service can be performed at multiple intervals, such as start of month or end of month.

ProPlay includes, but is not limited to:

- Multiple uploads comparisons (customer, security, outright and financing trade, etc.)

- Settlement and clearance messages from multiple depositories and entities

- Newest features include comparisons of outgoing messages to the above-mentioned depositories and entities, as well as refining the comparison of manual actions in the platform

Benefits:

- Over 50% reduction in overall UAT + prodction breaks

- Potential for a 40% + reduction in internal man-hours per upgrade

- Approximately 30% + cost savings per upgrade

- Increases the number of upgrades that can be excuted per year in which in turn reducescosts associated with enhancements and retrofits

See a full list of the services provided with ProPlay.

Industry Initiatives

SEC Rule Proposal on Clearing of Treasuries

The SEC has proposed rule changes to enhance risk management for central clearinghouses in the U.S. Treasury market. The changes aim to increase liquidity and provide further resilience of Treasury Securities transactions, update membership standards for clearing agencies, and reduce risks. The proposed rules mandate clearing agencies to adopt policies requiring members to clear specific secondary market transactions.

These include certain repurchase agreements, interdealer broker transactions, and transactions between clearing agency members and registered broker-dealers, government securities entities, hedge funds, or specific leveraged accounts. The proposal also addresses customer margin, allowing inclusion of clearing agency-held margin in the customer reserve formula, with conditions.

Clearing agencies must calculate margin separately for house and customer transactions and ensure access for indirect participants. The rule filing is expected to be announced in October 2023.

See the Fact sheet: Improving Risk Management and Increasing Clearing in U.S. Treasuries.

T+1

The financial services industry, in coordination with its regulators, is planning to shorten the settlement cycle for equities, corporate bonds, municipal bonds, unit investment trusts, and financial instruments comprised of these security types (e.g., ADRs, ETFs), from the current cycle of trade date plus two business days (T+2) to trade date plus one business day (T+1). The benefits behind the move include a reduction in costs, increase in market efficiency, and reduction in settlement risk. The industry has received a final regulatory ruling, and this industry-wide initiative is expected to take place on May 28th, 2024.

Some of the major recommendations provided by the Industry Steering Committee (ISC) include:

- Change to the affirmation deadline from 11:30 AM on T+1 to 9:00 PM on T

- NSCC will implement changes to its Universal Trade Capture (UTC) system and to its Exchange Traded Funds (ETF) creation and redemption system to update the rules these systems use to assign the settlement date to transactions to T+1

- ID Net transactions affirmed by 9:00 PM on trade date will be sent to CNS for processing. Members have until 9:15 PM to exempt or authorize any changes impacting a net position settling in the night cycle

- Ex-date calculation for regular way dividend processing will shift from one day prior to the record date to the same day as record date in a T+1 settlement cycle

- Many trade processing and settlement activities and deadlines will be impacted by T+1, either directly or indirectly

Please check out the official T+1 DTCC site for all information.

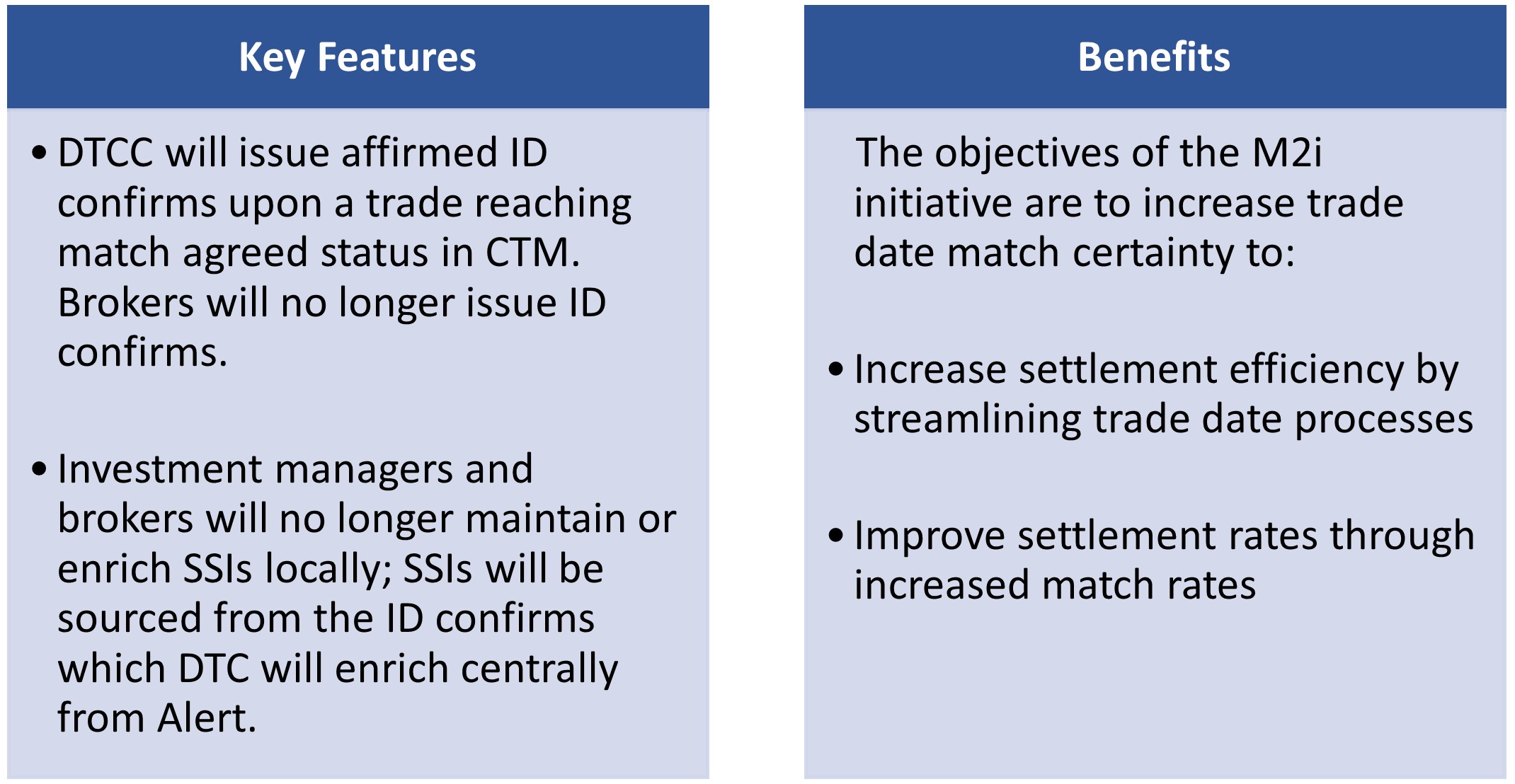

Integration with DTCC’s Match to Instruct (M2i)

DTCC has launched the Match to Instruct (M2i) initiative designed to improve the trade match and settlement processes within their CTM system. In this new process, DTCC will facilitate a “single match” on trade date which will become the “golden source” trade record that flows through to the settlement agents.

- Key Features

- DDTCC will issue affirmed ID confirms upon a trade reaching match agreed status in CTM. Brokers will no longer issue ID confirms.

- Investment managers and brokers will no longer maintain or enrich SSIs locally; SSIs will be sourced from the ID confirms which DTC will enrich centrally from Alert.

- Benefits

- The objectives of the M2i initiative are to increase trade date match certainty to:

- Increase settlement efficiency by streamlining trade date processes.

- Improve settlement rates through increased match rates

Changes on impact:

- Addition of new values on uploads, screens, downloads, reports, vendor feeds (M2i Eligibility Indicator, Broker Confirmation Number (BCN), and Client Allocation Reference Number (CARN))

- Transmission of the above fields to the BPS system for GPS clients

- Support revisions of M2i trades via uploads

- Suppress the generation of ID confirms (out of impact)

- Internally match the incoming confirm and affirmation messages using the new above-mentioned references

- Introduce new “buckets” on the Clearance Dashboard to identify the status of M2i eligible trades (confirmed, unconfirmed, affirmed, unaffirmed, unmatched, etc.)

- Broadridge is investigating the potential to provide 10b10 confirm enrichment data via an API to our clients. More to come on this in the near future

DTCC has recommended this initiative as part of its best practices for T+1. Learn about DTCC’s initiative.

If your firm is interested in the M2i changes, please reach out to your account manager.

FINRA TRACE Reporting

A rule change to amend FINRA Rule 6730 (transaction reporting) to enhance TRACE reporting obligations for U.S. Treasury Securities – time of trade execution

- To improve the granularity and consistency of transaction information for U.S. Treasury Securities, FINRA is implementing a change that requires members to report the Time of Execution to the finest increment of time captured by the execution system (e.g., millisecond, microsecond)

- Amended rule would not require FINRA members to update execution systems for U.S. Treasury Securities—instead members must update their reporting systems, if necessary, to ensure that their TRACE reports reflect the finest increment of time captured by the execution system (but not finer than a microsecond)

- As impact is a pass-through system, we are making changes to support the granular timestamp requirement to be able to ingest a finer time and pass that along to clients’ reporting systems.

This requirement is effective November 6th, 2023. For any questions on this change, click here to learn more or please feel free to reach out to your account manager.

Bilateral Repo: OFR Reporting

On January 5, 2023, the US Department of the Treasury’s Office of Financial Research (OFR) proposed a rule that would require certain financial companies to submit daily transaction-level data on outstanding non-centrally cleared bilateral repos.

The collected data would be used to support the work of the Financial Stability Oversight Council (FSOC) and its member agencies to identify and monitor risks to financial stability.

Currently, OFR collects data for centrally and non-centrally cleared tri-party repos and centrally cleared bilateral repos. A pilot program was launched in 2014 to collect non-centrally cleared bilateral repo data, consequently leading to a proposal to fill the data gap in the repo market by providing regulators with full transparency of market activities in the noncentralized bilateral market.

This proposal is not yet approved by the industry, but Broadridge has begun analysis to determine what this change would entail for our clients.

Check out OFR’s Proposed Data Collection Fact Sheet

Coming Soon

Fixed Income API Store

Want to take advantage of impact’s robust calculations within your own applications? The Broadridge Fixed Income API Store is opening soon for business, to provide that and more.

The Broadridge team is currently working on a proof of concept (POC) to make impact business functionality available as microservices via REST API, using JSON message formats.

Types of services that will be made available include:

- Robust calculations, such as coupon, interest, principal, amortization, calculations, and more.

- Data retrieval, providing the client with the ability to pull data. This will complement the data delivery mechanisms we already have in place to make the optionality around data retrieval complete.

- Update actions, allowing clients to perform business action (ex. Fail a trade, manually settle a trade, etc.) that would otherwise be performed using the impact UI.

The services will address different functional areas – cash management, clearance and settlement, financing, possession and control, reference data and trading.

We have successfully completed a POC with several APIs in our developmental environment. As we move forward, our focus will shift to refining infrastructure, preparing for production, and mapping out our strategic roadmap. Stay tuned for further developments.

On This Page

Let’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |