SEC Central Clearing Rule Changes

Understanding the impact and ensuring readiness.

By Sujoyini Mandal, Vice President, Strategy and Business Development, and Michael Gibbons, Senior Director, Professional Services

Introduction

The $26T U.S. Treasury market is about to undergo a post-trade transformation. Back in July 2010, the Securities Exchange Commission (SEC) required securities and derivatives to be centrally cleared. Then, in December 2023, the SEC adopted rule changes, expanding the existing clearing requirements to include certain secondary market transactions including most cash and repo Treasury trades. As one of the deepest, most liquid markets globally underpinning a significant portion of capital markets activity, the rule changes are designed to reduce systemic risk, enhance protection, and improve efficiency in the U.S. Treasury market.

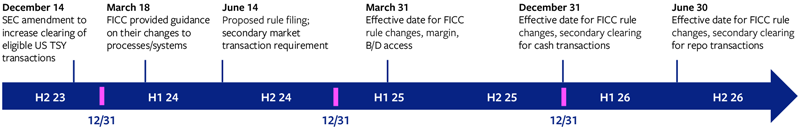

The changes will go into effect for Treasury trades on December 31, 2025, and for repo trades six months later on June 30, 2026. According to the rule changes, eligible transactions will be mandated to clear through a Covered Clearing Agency (CCA). The FICC (Fixed Income Clearing Corp) is currently the only CCA in the industry. However, this is likely to change.

The SEC’s initiative seeks to fortify the U.S. Treasury market, making it more robust, efficient, and transparent. As SEC Chair Gary Gensler puts it, this move will contribute to a market that is not only deep and liquid but also resilient.1 Understanding the nuances of the rule changes and assessing the impact on the various industry players, including both direct and indirect participants, is expected to be a time-consuming complex process. By pursuing a thoughtful approach to adapting to the new rules with a focus on assessment, testing, and implementation, institutions can more easily navigate the evolving regulatory landscape and take advantage of the impending structural changes for their business. As market participants across the sell side, the buy side, and market utilities will be impacted, now is the time to understand, plan, and prepare for the changes.

Improving Treasury Market Dynamics

- Risk mitigation: Mandating central clearing helps to reduce risk exposure. Currently, 70% to 80% of the Treasury funding market and at least 80% of the cash markets remain uncleared.2 Clearing these transactions through central counterparties enhances stability and resilience while reducing the impact of a sole counterparty’s creditworthiness and liquidity.

- Efficiency and competitiveness: The new rule changes enhance customer clearing and broaden the scope of transactions that clearinghouse members must clear. This introduces uniformity in U.S. Treasury clearing practices across a wide spectrum of market participants.

- Resilience: Central clearing ensures transactions continue smoothly, in spite of market stress, disruptions and expanding trade volumes in U.S. Treasuries. It bolsters the market’s ability to withstand shocks and maintain liquidity.

- Transparency: Requiring certain specified secondary market transactions to be centrally cleared introduces pricing transparency in the Treasury market. Participants can better assess risks and make informed decisions.

- Customer protection: The amendments introduce standardized margin and customer asset protection practices.

Impact on Market Participants

The impact of the rule changes will vary depending on whether a firm is:

- A direct participant (of FICC)

- An indirect participant:

- Either as an indirect FICC member transacting through a direct member via Sponsorship or

- Clearing their activity at the FICC indirectly via a relationship with another entity submitting on their behalf via the Agency Clearing Model

The rule amendments encompass most of the U.S. Treasury market, including banks, broker-dealers, and other sell-side entities alongside registered and private funds, and other buy-side participants (with some exemptions). For both direct and indirect participants, significant preparation efforts are necessary and will require key decisions regarding clearing capacities, access models to provide or utilize, legal documentation updates, and ensuring operational platforms can handle clearing counterparties.

While the immediate focus for market participants is expected to be adapting to the new rules and their impact within the current primary CCA, the landscape is evolving. The CME Group has already taken steps towards applying to become a CCA for the U.S. Treasury market, while London Clearing House (LCH), and Intercontinental Exchange (ICE) have expressed similar interest.3,4 The potential entry of new competitors could introduce additional complexities for market participants, navigating variations in transaction pricing across different CCAs, adapting to potentially differing policies and procedures, and potentially requiring further infrastructure modifications to handle connections with multiple clearinghouses.

All FICC members, regardless of direct or indirect participation, will face material changes. They will need to adapt their trading practices to comply with the new rules, which could necessitate shifts in trading patterns and pricing structures, alongside infrastructure changes for trade clearance and settlement routing. Furthermore, direct participants may require a ‘repapering’ process, where existing client trades are renegotiated to fit within the new central clearing framework. While ‘repapering’ will be driven by the direct members, indirect members should prepare to have these conversations with their sponsors. Further, the nature of these discussions, coupled with the size of an indirect firms’ U.S. Treasury business, could justify a potential shift to direct FICC membership.

Margin practices will undergo a major change for both direct and indirect participants. The new rule mandates collection and separation of margin between the client and firm, providing a clear distinction between a firm’s exposure and that of its clients. Today, many direct participants do not collect margin from their U.S. Treasury clients. The amendments might necessitate the development of operational and technical infrastructure to facilitate margin collection and segregation. Additionally, direct participants should assess the potential benefit of including the client margin deposited at the CCA as a debit in their customer reserve calculation. Indirect participants should anticipate providing margin to their FICC sponsor. This represents a potential new “cost of business” for many firms. Like their sponsors, indirect participants must assess the impact on their operational and technical processes to ensure compliance with the new margin requirements.

Ensuring Readiness with a Three-Pronged Approach

In the short term, it is crucial for affected market participants to monitor developments closely and engage with regulators and clearing agencies to ensure readiness for mandatory clearing. As FICC prepares to implement the new rules, market participants should assess the impact on their businesses and take proactive steps to comply and adapt to the evolving clearing environment. As an immediate next step, impacted institutions should look to convene a team representing diverse functions in the organization across trading, finance, operations, and technology to begin monitoring and assessing the rule change, current clients, and trading volumes. They should model different scenarios to assess market opportunity and overall go-forward strategy and assess if current technology and operational processes can comply with new rule amendments.

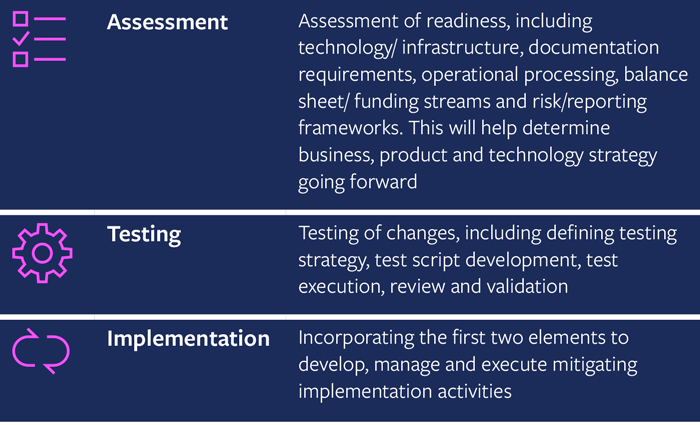

To ensure readiness and compliance with the phased timeline, market participants must focus on a three-pronged approach:

By following a comprehensive three-pronged approach focused on assessment, testing, and implementation, institutions can ensure a smooth transition to adapting to the rule changes.

Navigating the Rule Changes with an Industry Partner

Broadridge is a leader in fixed income processing and innovation. Our systems process $10T in equity and fixed income trades per day and we currently support 20 of 24 U.S. primary dealers. Our platforms support trade processing, clearing and settlement, submission to FICC and collateral management, and our innovative DLT-enabled Distributed Ledger Repo (DLR) solution supports global repo market infrastructure.

We have put together a taskforce and are working with our extensive client base and key industry groups to understand the rule changes and how we can best help firms not just comply, but also take advantage of the market restructure to benefit their own business. We believe that the regulation will impact the industry and create potential collaboration opportunities in the following areas.

- We expect that volumes of trades that will be submitted for clearing by existing players and new entrants will increase substantially. Broadridge’s sponsored repo solution offered through our DLR platform provides significant settlement cost savings, improvements in efficiency and reduction of operational risks for clients. As sponsored repo volumes continue to grow, DLR’s proven benefits and cost savings are expected to continue to increase.

- We expect increased complexity in managing more clients, more collateral and potentially more CCPs. Broadridge is developing a lightweight, standalone solution for CCP access and mark-to-market file receipt, as well as other potential value-added services.

- We expect it will be challenging for institutions to assess, test and implement changes needed to comply. Broadridge’s consulting services have extensive experience in helping firms transform their operating model and can partner with firms in these key areas.

The regulatory changes set forth by the SEC represent a significant shift in the structure of the U.S. Treasury market and will require market participants to navigate new complexities in central clearing processes. Market participants will need to prepare for these changes and adjust their operations accordingly. Assistance is available not only to ensure compliance and continued efficiency in U.S. Treasury transactions, but also to take advantage of potential business opportunities resulting from the impending structural changes.

Contact Us

For more information speak with our leadership team:

Uday Singh,

Managing Director,

Head of Broadridge Consulting Services

David Smith,

Managing Director,

Banking & Capital Markets Practice Lead,

Broadridge Consulting Services

Horacio Barakat,

Head of Digital Innovation,

Capital Markets and General Manager, DLT

References

1https://www.sec.gov/news/press-release/2023-247

2https://www.sec.gov/news/press-release/2023-247

3https://www.ft.com/content/4693d21d-b3dd-43a5-8fec-4b898fc2ac57

Let’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |