Transformation by Innovation

Sell-side firms are looking to leverage the latest technology innovation to create clear competitive differentiators across front- and middle-office operations.

Menu

On This Page

Hear from industry experts

Listen to our recent webinar where we dug deeper into the report findings and survey results and the impacts they could have on you and and in depth view into Live AI and DLT use cases.

Executive Summary

Technology has played a vital role in laying the foundation for robust and scalable trading and post-trade infrastructure for decades. Now, sell-side firms are looking to leverage the latest technology innovation to create clear competitive differentiators across front- and middle-office operations.

The biggest demand for innovation is coming from the sell-side firms which have a significant footprint across multiple asset classes and are looking to navigate shifting compliance and risk obligations. This report examines the current state of play for trading technology innovation and identifies key opportunities that sell-side firms are evaluating when faced with various market challenges.

The key findings from this paper are the following:

- Global sell-side firms see opportunities arising from technology innovations, specifically in DLT and AI: Technology has played a pivotal role in shaping the competitive landscape and driving transformative changes in capital markets. For example, DLT has accelerated the opportunity to move assets and payments instantaneously, and AI visualization technologies have unlocked the value associated with unstructured and large data sets. As firms embrace DLT and AI, they position themselves at the forefront of innovation in capital markets.

- Growing customer needs are adding more pressure on the sell-side: Clients are seeking more support around workflow and given today’s difficult and uncertain market environment, want an incremental roadmap to growth, shying away from big-bang infrastructure replacement projects. As they think about applying innovative technology, help in building internal buy-in through clear and impactful use cases is top of mind, as well as applying innovation at a reasonable cost and risk.

- Sell-side is responding through technology innovation: In response to growing customer demands, sell-side firms are leaning on innovative solutions to increase operational efficiency, improve transparency, and enhance their ability to deal with massive amounts of data.

- Sell-side firms are collaborating with technology partners: Sell-side firms are collaborating with their key technology partners who have taken up the challenge of building the core foundation and leveraging customization/configuration of the solution to accommodate individual sell-side clients’ strategy. Sell-side firms can then focus on integration and enhancing scalability to create a competitive advantage.

- Brokers report risk reduction, scalability, and cost as key metrics for judging success in applying innovative technologies: Survey results indicate that sell-side firms view risk reduction as first, increased scalability as second, and cost reduction as third metrics when measuring success for implementing innovative technologies.

Introduction

Technology innovation has enabled broker-dealers of all stripes to create value, and product differentiators to gain a competitive advantage in the market. Next-generation technologies enhance performance and drive profitability by unlocking the value in a business function and improving operational efficiency.

Core use cases exist around the next-gen capabilities of distributed ledger platforms (DLT) and artificial intelligence (AI). DLT-based solutions are transforming the way the industry accesses liquidity and manages cash flows, reducing exposure to operational and counterparty risks. AI including machine learning and robotic process automation-based solutions are solving the problems associated with massive data sets and unstructured data.

Regardless of asset class or regional nuances, global financial institutions of all shapes and sizes are staring down a technological fork in the road concerning technology innovation. The current operating model will be challenged by technology innovations and the sell-side firms that adopt them. Firms globally will no doubt try to lean on innovation to create unique business value, capture cost reduction, increase profitability, and attract talent to secure future growth. Sell-side firms seeking to stay ahead of the growth curve will need to develop a comprehensive multi-year strategy to adopt these innovative technology solutions that align with their overarching corporate goal.

This whitepaper examines the current state of play in technology innovation, as well as factors considered sell-side firms consider when improving their competitive position. This paper focuses on regional differences and commonalities across U.S., European, and Asia-Pacific markets in the following areas:

- Challenges sell-side firms face when embracing technology innovation.

- Increasing customer demands.

- Key initiatives to satisfy customer requirements.

- Key metrics for measuring success in the rollout of technology innovation.

Methodology

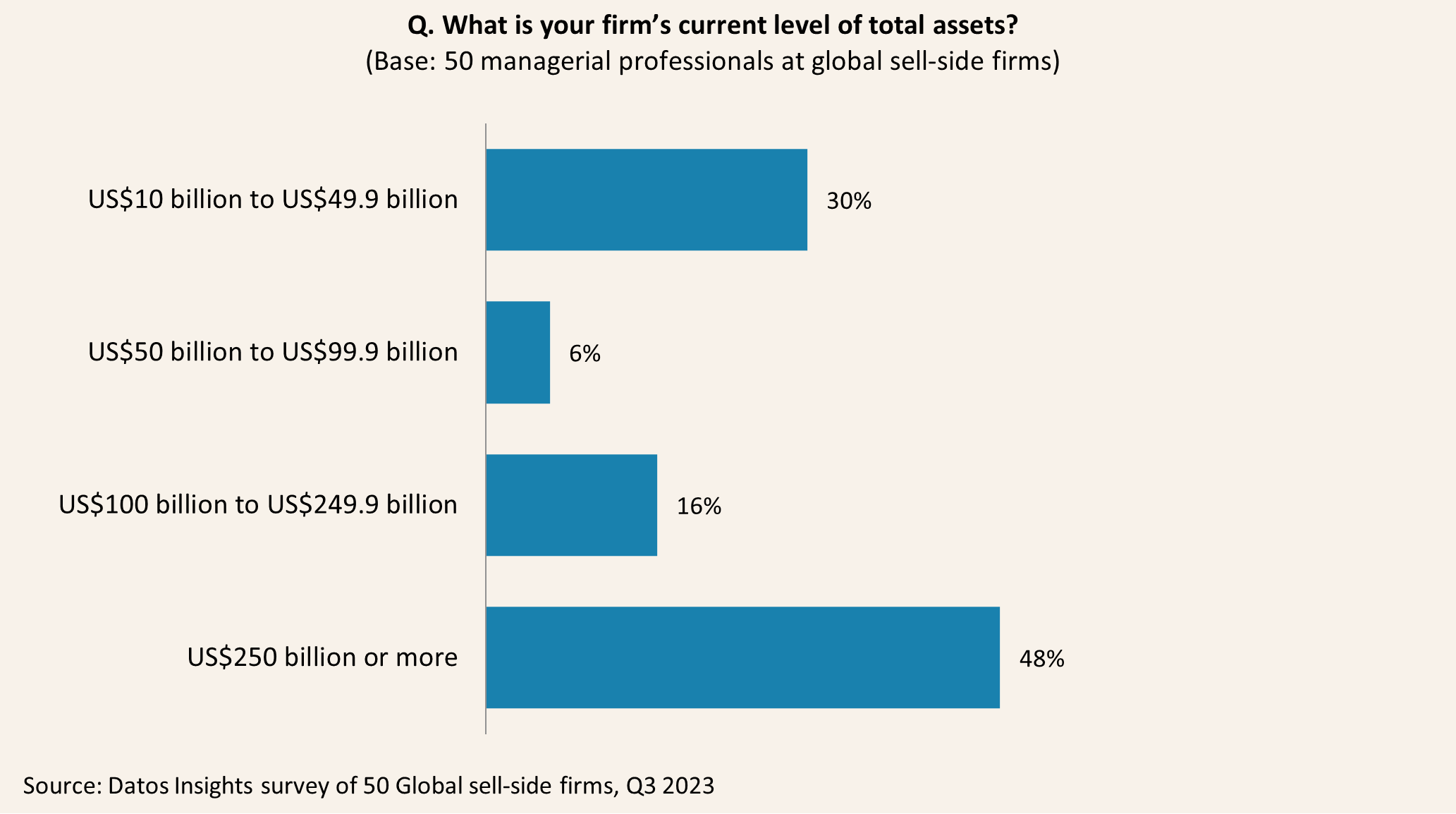

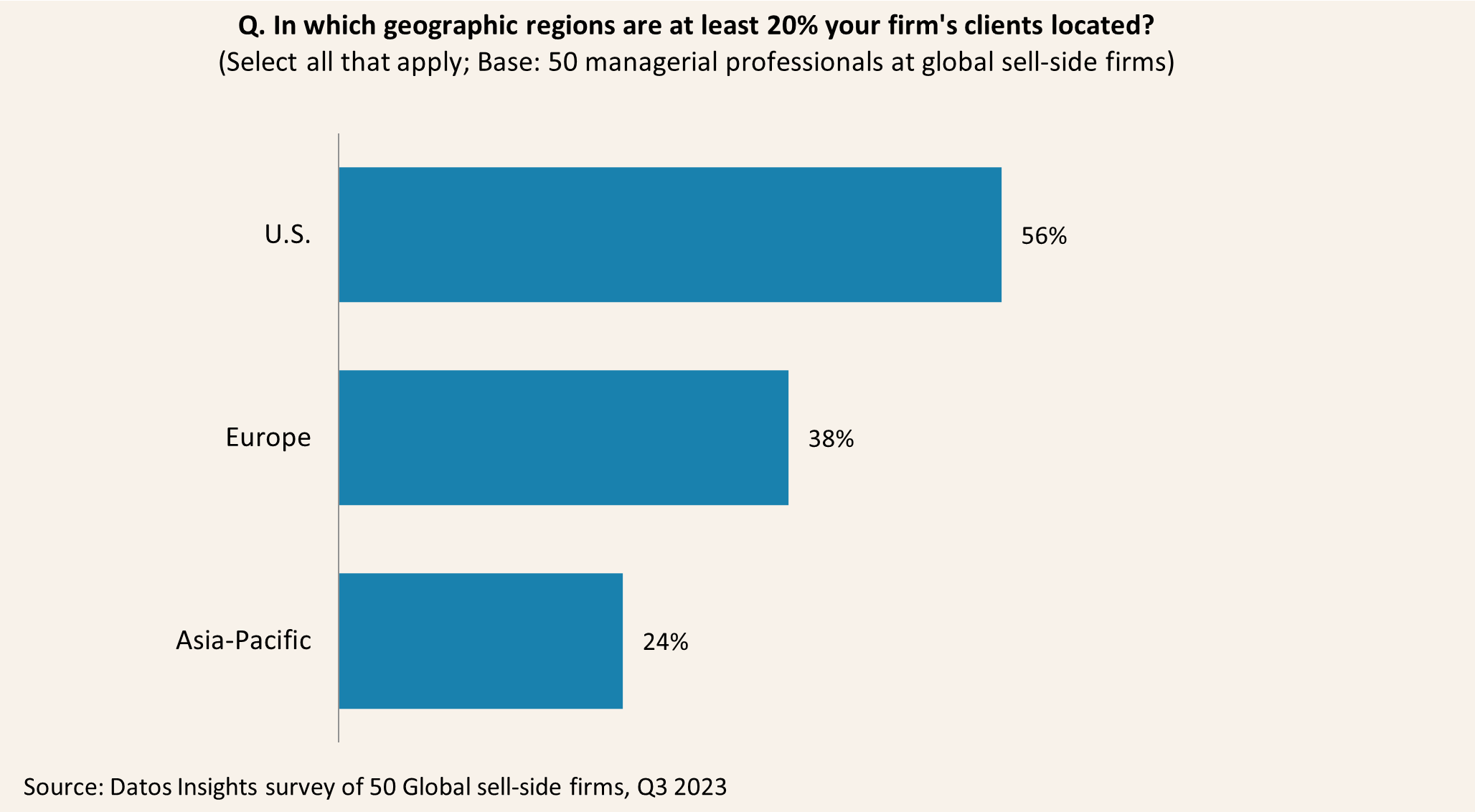

This report uses results from a Datos Insights survey targeting senior technology, operations, and trading executives at 50 sell-side institutions with a global footprint during Q3 2023. In addition to the survey results ― the demographics of which are broken down in Figure 1 and Figure 2 ― Datos Insights also conducted qualitative interviews with senior executives at global and regional banks to gain perspective on key challenges and themes driving their decision-making.

Figure 1: Firms’ Level of Assets

Figure 2: Respondents’ Geography

Market Challenges Associated with Technology Innovation

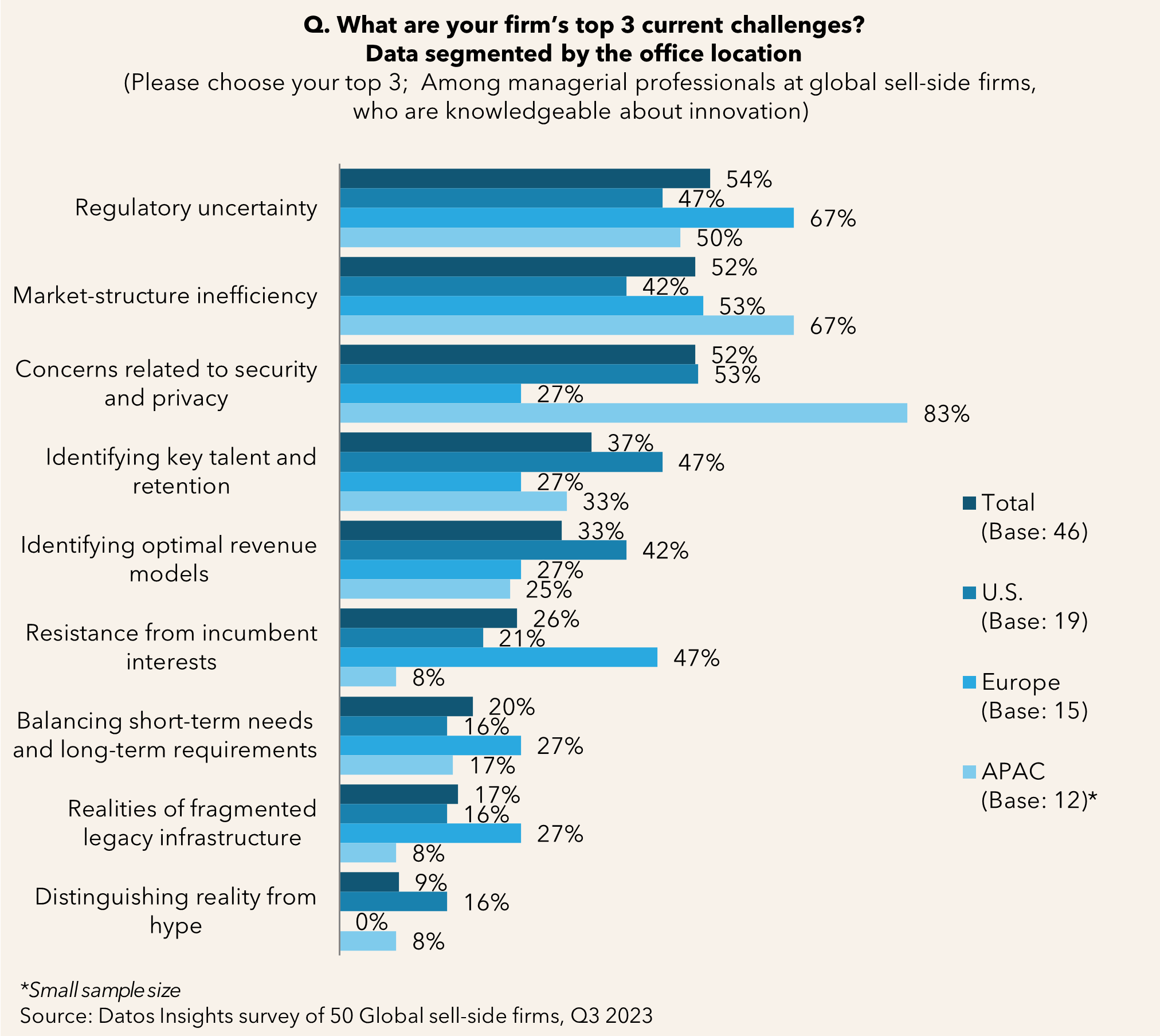

When asked to identify the top three challenges associated with technology innovation, most of the respondents cited regulatory uncertainty as the top challenge. The second position was a tie between market structure inefficiency and concerns related to data privacy and security. Identifying key talent and retention came in as the third-ranked challenge (Figure 3).

Certain regional differences did emerge when examining the top three challenges associated with technology innovation. For example, U.S. and Asia Pacific sell-side firms ranked concerns related to security and privacy as a top challenge, whereas European firms stated regulatory uncertainty as their top challenge (Figure 3).

Figure 3: Top Three Current Challenges, by Region

These responses were similarly reflected in interviews Datos Insights had with senior sell-side executives. Every executive expressed concern over regulatory uncertainty associated with technology innovation. Specific examples included the treatment of tokenized assets and data privacy issues surrounding AI. Those senior executives also highlighted that a key factor in evaluating technology solutions is the difficulty associated with developing an appropriate operating model for innovative solutions while maintaining the current legacy market infrastructure. The challenges executives face today are based on the current underlying market infrastructure which has grown over a period due to the often fragmented and siloed solutions to address emerging issues, and the sell-side firms' unwillingness to take a more strategic approach to dealing with legacy technology.

Although regulators are shaping the regulatory framework around these innovative technologies, the inherent market infrastructure inefficiencies cannot adapt at the same speed as technology innovation. Similarly, privacy and security clearance could sometimes define the boundaries and limitations while adopting advanced technologies, especially when interacting with external data sets. Thus, many sell-side firms prefer to adopt the technical capability of AI with the firm's internal data and avoid interaction with external data sets.

Top Customer Needs

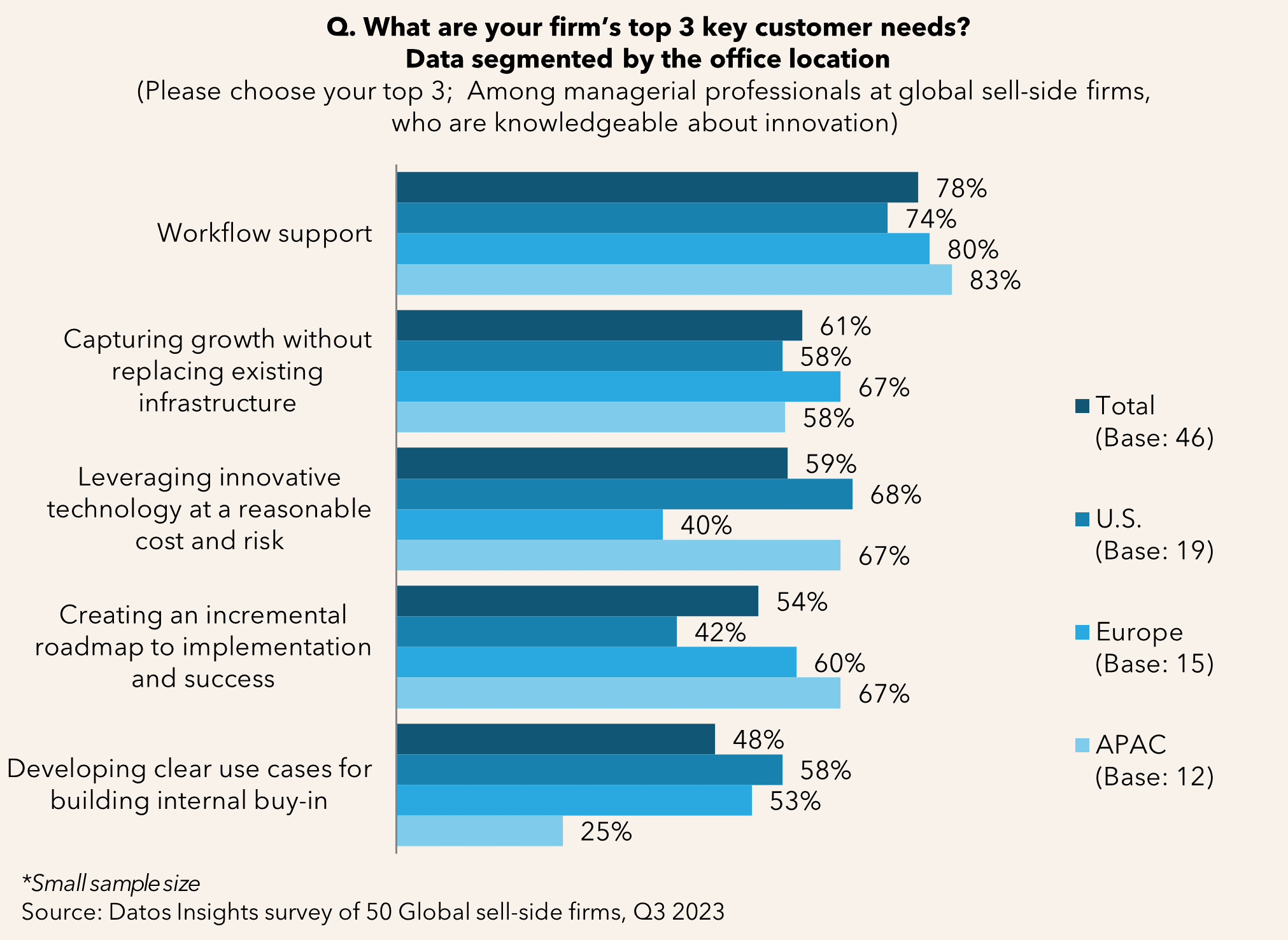

When respondents were asked about the top three key customer needs, workflow support came in first by a significant margin (78% when aggregated across all responses). The second and third most-cited customer needs were close, with 61% of responses “identifying capturing growth without replacing existing infrastructure” and “leveraging innovative technology at reasonable costs and risk” at 59% (Figure 4).

Figure 4: Top Three Customer Needs, by Region

Workflow support was on top of mind for respondents regardless of region, but certain regional differences did emerge when examining the remaining top three client needs. U.S. sell-side firms ranked their second customer need as “leveraging innovative technology at a reasonable cost and risk” (68%), European peers opted for “capturing growth without replacing existing infrastructure” (67%), and Asia Pacific cited “creating an incremental roadmap to implementation and success and leveraging innovative technology at a reasonable cost and risk” (67%) (Figure 4).

Based on Datos Insights interviews, the survey results align with where sell-side firms are prioritizing the need to transform their business. Executives said their challenges included aligning operations and technology models to support legacy infrastructure and adopt innovative solutions in parallel. Many executives mentioned that the most success occurs when technology innovations solve specific business problems.

Firms should not view the application of technology innovation as solely a solution across all asset classes, functions, or issues, however. For example, DLT adoption for equities trading is rarely discussed due to the highly efficient nature of that market. On the other hand, the demand for DLT adoption to meet intraday funding via repo or FX trades remains high. Similarly, innovations from AI need careful consideration from multiple points of view. For example, AI adoption on a small data set may not yield as much value as AI on a large data set and/or unstructured data. The complexity involved in technology innovation adoption, combined with the drive to maintain existing market infrastructure, creates significant pressure on business functions to support additional and often parallel daily activities.

“Technology innovations in the form of DLT and AI can coexist with current market infrastructure to bring transformational change.”

Capturing Opportunities

Technology innovation can be best initiated by experimenting and learning. It needs constant idea generation, followed by rapid investment and ongoing management support to convert the ideas into proof of concept quickly. After a brief validation, a go/no go decision is required to make a further refinement to the proof of concept or move on to the next idea.

The development of technology innovation in a sandbox is often far from solving genuine business problems, even when use cases are validated. A prominent example of this is DLT, which was initially viewed as a disruptive technology that could eliminate the need for essential intermediaries. Instead of becoming obsolete, key intermediaries (such as global custodians) have become strong advocates of DLT initiatives.

Technological innovations cannot occur in a vacuum, however, and should align with existing infrastructure for firms to adopt and scale. For example, AI can be adopted within legacy market infrastructures as well as native DLT environments. Innovation needs creativity; even simple creative designs can make a stark difference. One executive’s example was a simple AI-powered chat box window, that served as a learning tool for C-level executives to explain the benefits of AI.

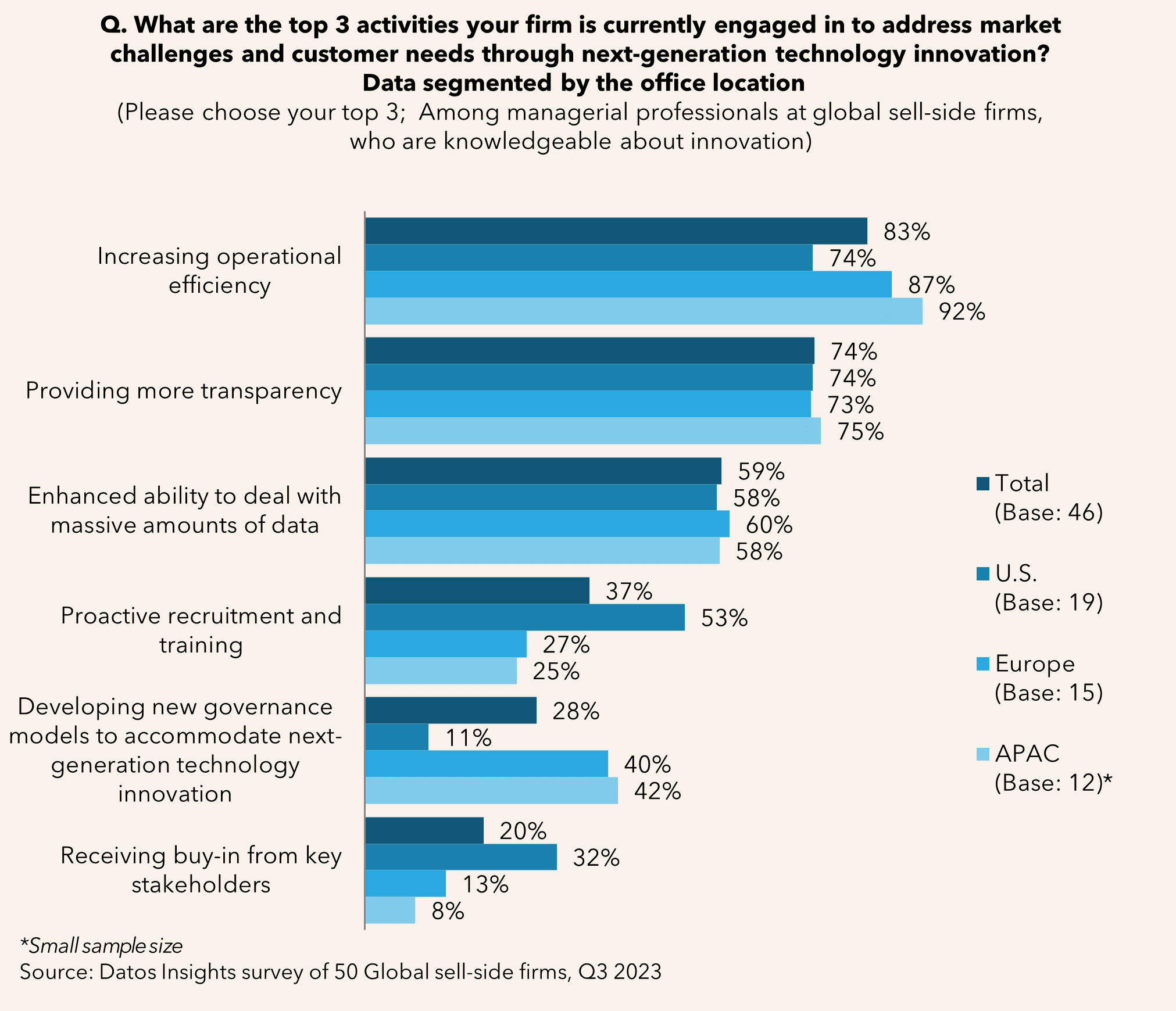

When asked to provide the top three activities they are engaged in to address market challenges and customer needs through technology innovation, respondents focused on three key areas: Eighty-three percent of respondents expressed increased operational efficiency was a top priority, followed by providing transparency at 74% and enhanced ability to deal with massive amounts of data at 59% (Figure 5).

Figure 5: Addressing Challenges and Meeting Customer Needs, by Region

The application of AI and DLT are solid examples of how sell-side firms use the latest innovative platforms to address current challenges and capture growth opportunities:

“Technology innovations provide the opportunity to gain experience by doing and explore the inventive mind as the possibilities with such innovations are endless. ”

AI Use Cases to Meet Demand

A few of the key AI use cases cited by senior executives are the following:

- Intelligent workflow: Integrate client communication into orders to reduce potential trade errors resulting from manually copying instructions from the communication system into the trade order booking system.

- Document management: Streamline data digitization from documents in investment research, corporate actions, investment policies, onboarding, and institutional client billing reducing the time taken to draft.

- Errors and omissions: Automate operational processes to reduce recurring errors and help identify omissions. AI can support reducing the breaks in the reconciliations process by automating the occurrence of errors by the addition of missing data. The AI implementation assists in moving away from simply adding more bodies to the operational infrastructure and directs thinking towards more long-term solutions to further automate the operational process and lessen recurring errors.

- Liquidity discovery: Consolidate unstructured and structured information on illiquid asset class into liquidity discovery to expand the liquidity pool. AI can broaden liquidity access, inform, and expedite vital pricing decisions, and facilitate counterparty selection. For example, BondGPT uses natural language to ask complex questions and provides most responses in less than 20 seconds.

- Settlement efficiency: Identify trade journey in the post-trade processing for example to identify trades due for T+1 settlements. AI can also accelerate research of the next best action, integrate workflow to resolve settlement fails, prioritize key risk items to structure an operations analyst’s day by surfacing the oldest fails, and provide management insights to better manage workflow and teams through dashboards. For example, OpsGPT can reduce research time to identify the root cause of settlement fails and could improve operational efficiency by up to 50% while mitigating risk, increasing costs, and enhancing overall governance.

- Intelligence and insights from large data sets: Conduct trade and communication surveillance and mining annual and other regulatory reports for specific characteristics.

- Accelerating DevOps: Identify errors and weaknesses in coding and automate the data mapping of trade and position files to accelerate development and operations.

DLT Use Cases to Meet Demand

A few of the key DLT use cases cited by senior executives are the following:

- Meet intraday funding needs: Conduct repo trading, secured funding, and FX spot trading over DLT to extend capabilities outside of standard settlement window timeframes.

- Issuance of securities private placements: Reduce operational costs involved in securities issuance by creating a single record of the securities on the DLT platform that can be accessed by all parties involved in the chain.

- Tokenization assets: Represent assets such as loan portfolios in tokenized form over DLT to facilitate the secondary market.

- Settlement of assets and payments: Represent securities in tokenized form and natively to DLT. Similarly, DLT increases the form of payments beyond fiat currency to stablecoins, central bank digital currencies (CBDCs), and cryptocurrencies.

- Repo Clearing: Bring settlement efficiencies in the repo market providing benefit ahead of SECs centrally cleared repo mandates and leverage efficiencies gained through velocity of collateral mobility through immobilization in the DLT repo ecosystem.

- Collateral movement: Redistribute liquidity more efficiently by improving interoperability for pools of collateral.

Key Metrics for Success

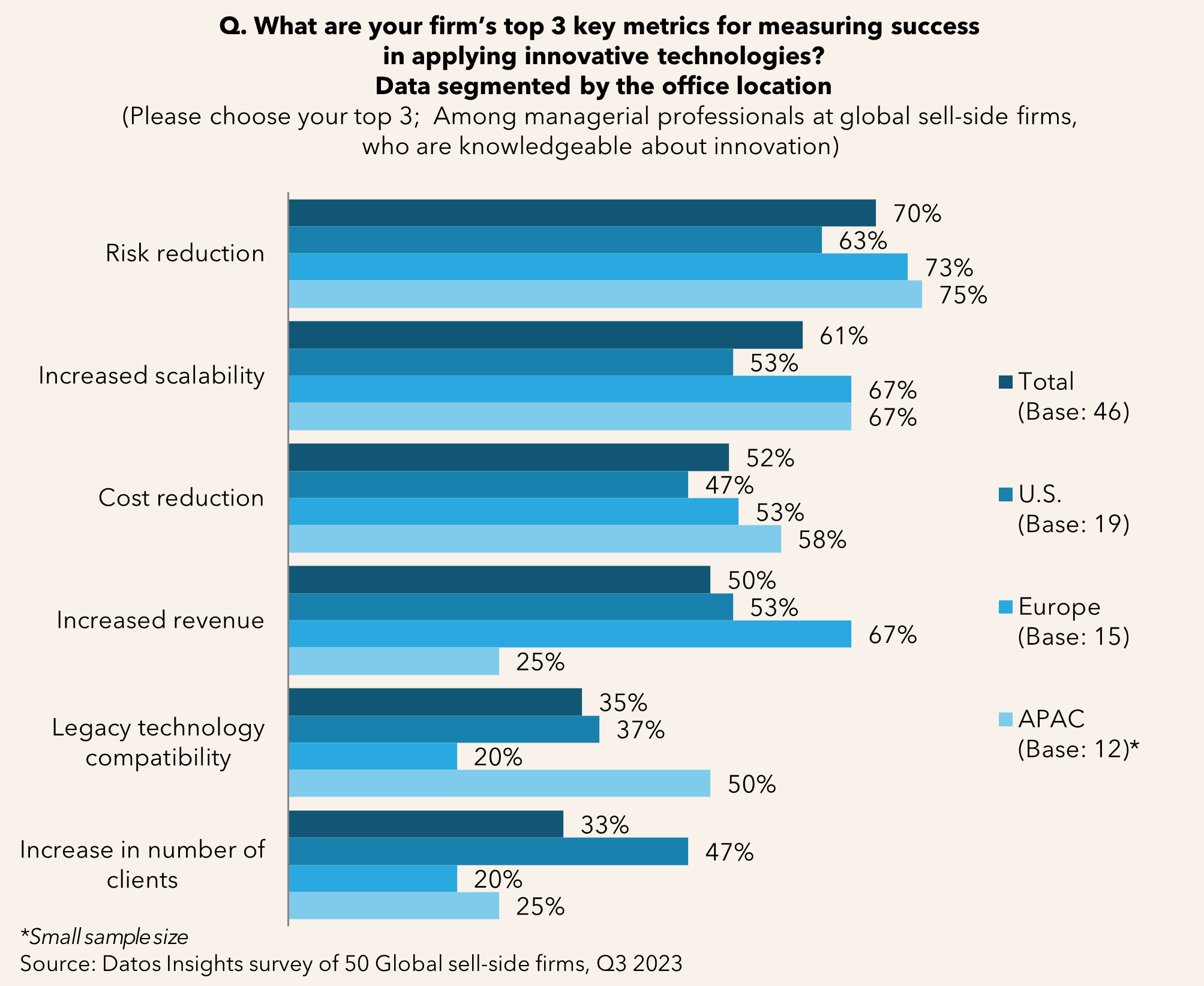

Sell-side firms are dealing with the uncertainty involved in the rollout of innovative technologies and the multifaceted nature of challenges associated with technology adoption in general. However, the survey results show fewer variations in the top three key metrics across the different regions when looking at key factors for evaluating success (Figure 6).

Figure 6: Key Metrics for Success Based on Region

For example, U.S. respondents cited risk reduction (63%), a tie between increased scalability and increased revenue (53%), and then cost reduction (47%) as their top three success metrics. For the European respondents, risk reduction (73%), increased scalability increased revenue (67%), and cost reduction (53%) were the top responses. Asia-Pacific respondents selected risk reduction at 75%, and increased scalability at 67%, followed by cost reduction at 58% (Figure 6).

“Is there potential for disruption? Along regional lines, certainly. It comes down to a trade-off in terms of being cost-effective and what it takes to be up to speed across global market lines.”

Conclusion

Faced with unrelenting external challenges and growing client demand, technology innovations such as DLT and AI have enabled sell-side firms to find ways to do more with less and solve old problems in new and creative ways.

Sell-side firms are overcoming the challenges associated with the adoption of innovative technologies, and are meeting customer demands, progressing towards the overall objective of risk reduction, achieving scalability, and being cost-efficient. To achieve this, sell-side firms are not taking this journey on their own, but rather are partnering with solution providers to accelerate their innovation efforts.

Technology innovation needs adoption and scalability to succeed, and the best way is to learn by doing as firms are attempting to navigate through uncharted territory. Undoubtedly, first movers in today’s market environment have the best chance to succeed and create a huge competitive edge for long-term growth.

“Technology innovation should complement the existing processes for faster adoption and scalability. ”

About Broadridge

Broadridge Financial Solutions (NYSE: BR), a global fintech leader with more than $6 billion in revenue, provides the critical infrastructure that powers investing, corporate governance, and communications to enable better financial lives. We deliver technology-driven solutions that drive business transformation for banks, broker-dealers, asset and wealth managers, and public companies. Broadridge’s infrastructure serves as a global communications hub enabling corporate governance by linking thousands of public companies and mutual funds to tens of millions of individual and institutional investors around the world. Our technology and operations platforms underpin the daily trading of more than $10 trillion in equities, fixed income, and other securities globally.

About Datos Insights

Datos Insights is an advisory firm providing mission-critical insights on technology, regulations, strategy, and operations to hundreds of banks, insurers, payments providers, and investment firms―as well as the technology and service providers that support them. Comprising former senior technology, strategy, and operations executives as well as experienced researchers and consultants, our experts provide actionable advice to our client base, leveraging deep insights developed via our extensive network of clients and other industry contacts.

On This Page

Let’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |