Is Asset Management Aligning With Consumer Duty?

On July 31 2024 it will be one year since the Financial Conduct Authority introduced the consumer duty regulation.

The milestone provides an opportune moment to reflect on the progress made in the asset management industry’s consumer duty journey to deliver “good” outcomes to consumers.

As an industry, we must assess what we have learned so far, evaluate the challenges, and determine whether the regulation has had its intended effects of increasing transparency, ensuring good outcomes, building consumer and regulator trust; and ascertain whether the consumer duty regulation is reaching a regulation-market fit.

Similar to product-market fit, regulation-market fit focuses on aligning a product or service with the regulatory environment and compliance requirements within a specific market.

"On closed books the regulator will expect a higher level of compliance after a year of implementing for open products."

For consumer duty, has the regulation resulted in managers developing a robust consumer duty strategy roadmap?

Can managers track the progress – in other words do they have quality data, and is it actionable?

Finally, can outcome success metrics be defined for all principal stakeholders, and what does 'great', 'good', and 'not-so-good' look like?

Consumer duty strategy

As a reminder, the FCA's consumer duty regulation came into effect on July 31 2023.

This regulation prioritised positive customer outcomes, with expectations that retail investors will receive fair value, suitable products, adequate support, clear communication, and proactive prevention of harm.

The FCA’s guidance was thoughtful, and its expectations have evolved around three key themes:

- Consumer duty strategy: Is the consumer duty strategy embedded within the overarching business strategy of asset management firms?

- Data: Is all reasonably available internal and external data being identified, reviewed, and evidenced to determine customer outcomes?

- Alignment: Are consumer duty outcome decisions reasonably aligned with the underlying data and do they support the decisions reached?

Besides a clear consumer duty strategy roadmap, implementation plans, identification of gaps and mitigation plans, there is also a focus on consumer vulnerability and an expectation that good outcomes should be monitored and delivered over the lifetime of products.

As the regulators and market participants learn, both the proposition and implementation guidelines need to evolve.

For example, on July 31 2024, we are about to see the second wave of implementation, focused on closed products.

The regulator naturally expects a higher level of compliance after a year of implementing for open products, even though closed books of legacy business were designed years ago under different rules and expectations and as such may have added complexity.

The FCA’s expectation is that firms should already have identified products and/or operational areas where consumer harm could occur on both open and closed products, and have plans in place to remediate the gaps.

Additionally, firms will need to demonstrate how good outcomes are being created and delivered for customers, especially with products that may historically have had potentially unfavourable terms or opaque fee structures.

Sourcing quality data

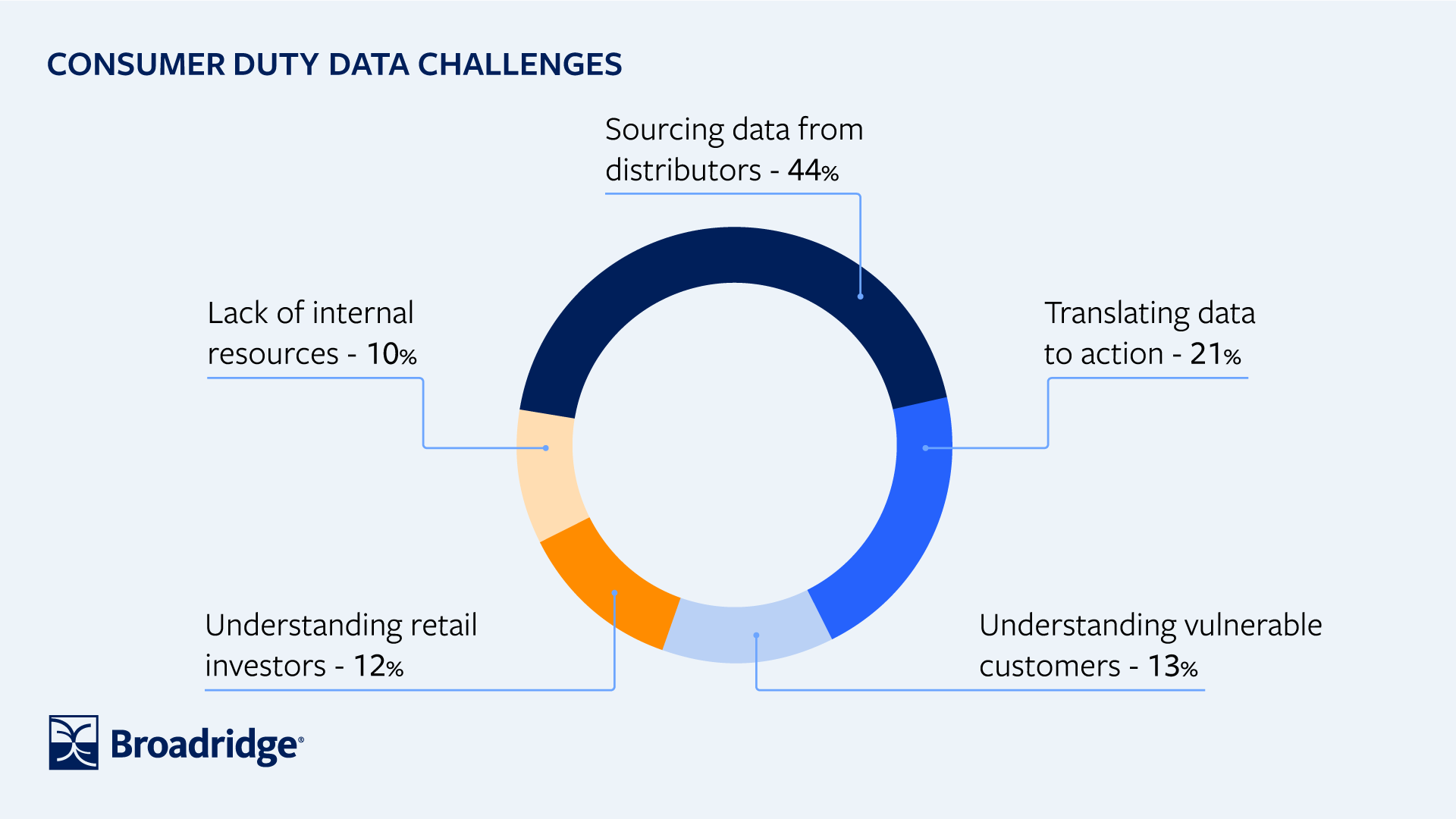

A recent Broadridge market survey identified that the biggest data challenges that asset managers face are around sourcing data from distributors and translating the myriad of data into actionable insights.

Source: Broadridge consumer duty webinar, February 2024

The FCA has highlighted that it would like to see improvements in sharing of relevant data across the same distribution chain between distributors and asset managers.

In the case of consumer duty data, there are two significant hurdles.

First, the complexities relating to data integration, where the disintermediated product distribution chain necessitates combining data from various internal and external sources; and second, data analysis where the diverse data sets make it challenging to understand correlations, determine causation, and extract meaningful insights.

Furthermore, the data then needs to be peer benchmarked, to identify rankings, opportunities, and gaps in outcome delivery.

So, deriving actionable insights from this complex data landscape poses an enormous challenge for managers implementing consumer duty regulations.

Success metrics

Evaluating the success of consumer duty implementation is a complex and demanding process.

The key metrics for measuring success can be categorised into five main areas: price and value, product suitability, consumer understating, consumer support, and vulnerability.

One significant step towards assessing the price and value outcome is the annual publication of the assessment of value report for UK domiciled funds.

This report serves as an important tool in measuring success in this category.

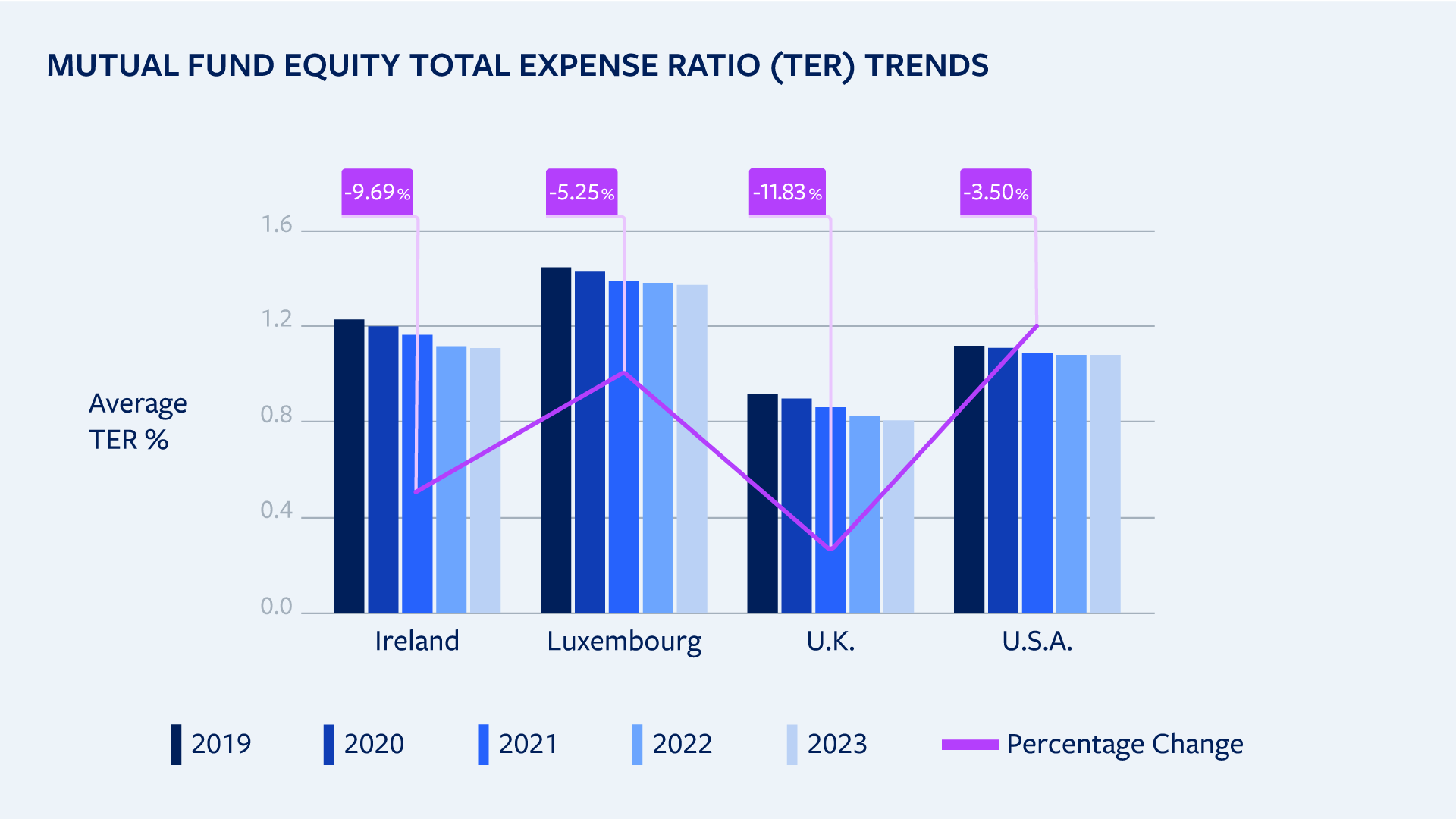

At Broadridge, we have monitored total expense ratio data for five years.

Compared to European and US peers, UK mutual equity funds show greater average price compression.

While not directly correlated to regulation, increased transparency may be driving greater awareness and market competition.

Source: Broadridge global pricing intelligence

To evidence the other consumer duty outcome success metrics, though not explicitly mentioned in the regulation, a closer examination of the FCA finalised guidance from July 2022 suggests the following metrics might be suitable to demonstrate and evidence outcomes:

- Price and value: performance, costs, risks, peer comparison and benchmarking.

- Product suitability: outcome goals alignment, risk alignment, suitability reviews/complaints, peer benchmarking.

- Consumer understanding: communication effectiveness, outcome alignment, customer complaints.

- Consumer support: complaint handling, satisfaction, channels, accessibility and peer benchmarking.

- Vulnerability: vulnerability levels, affordability, tailored support.

Having reached the consumer duty regulation’s first anniversary, boards and consumer duty champions will evaluate the progress made to date.

Determining the success of these metrics will require an ongoing dialogue with regulators to establish industry-wide standards for what looks good, great, and not-so-good.

Conclusion

So, what does the consumer duty scorecard look like after one year as we usher in closed products?

Are we nearing regulation-market fit?

Based on our discussions and observations, asset managers are demonstrating and embedding their consumer duty strategy roadmap and implementing plans into their overall business strategy.

Nevertheless, enormous challenges are emerging around data integration and data analysis that is necessary to derive actionable insights.

Furthermore, significant variability exists in investors’ perceived success and value metrics, making it challenging to objectively and succinctly demonstrate that outcomes are being delivered.

Despite the above-mentioned challenges, a successful consumer duty implementation is imperative.

For asset managers, building trust with the regulator and end investors is a must.

If the industry gets it right, then asset managers have an opportunity to differentiate products and services through the quality of their consumer duty outcomes, and by doing so build a competitive advantage.

No doubt, we are on a long road, and as an old Brazilian saying goes, 'everything works out in the end. If it didn’t, it’s because it hasn’t come to an end yet'.

First published on FT Adviser on the 23rd July

Related Solutions

Contact Us about what’s next for you

Contact UsLet’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |