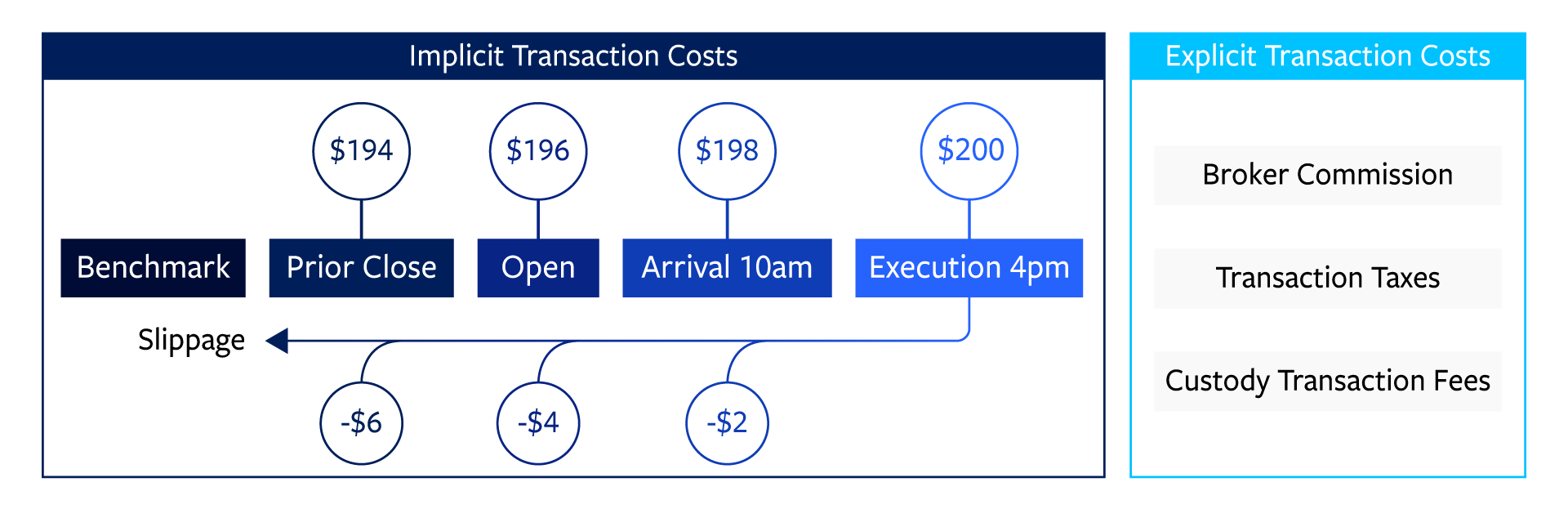

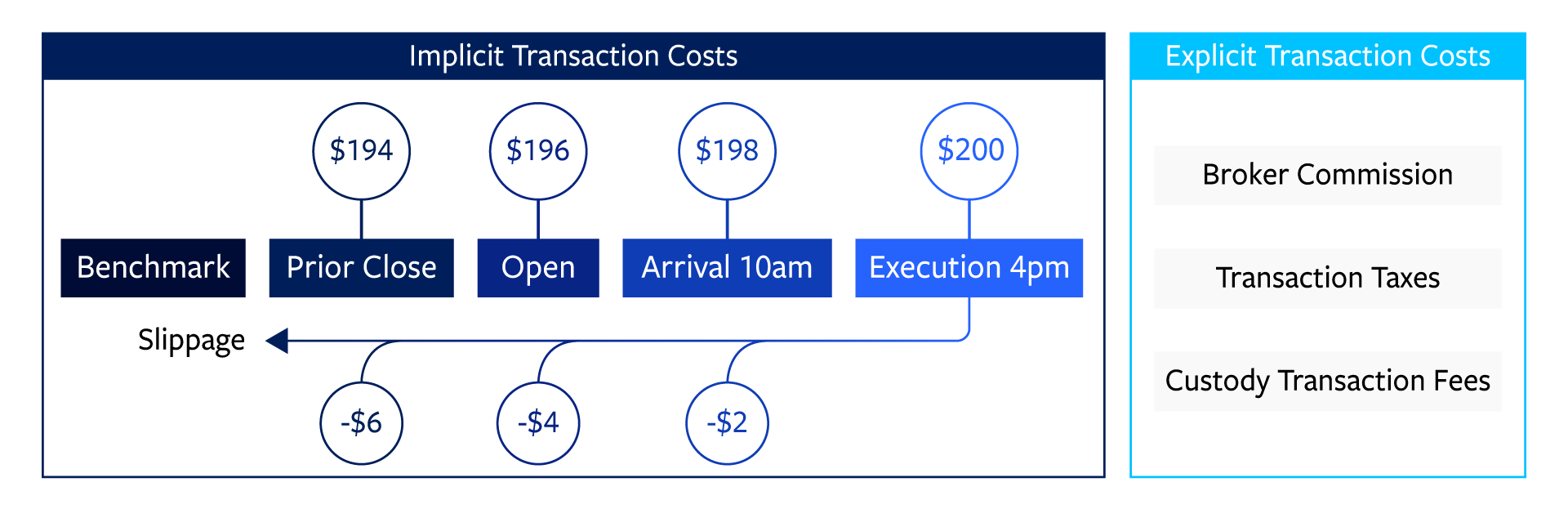

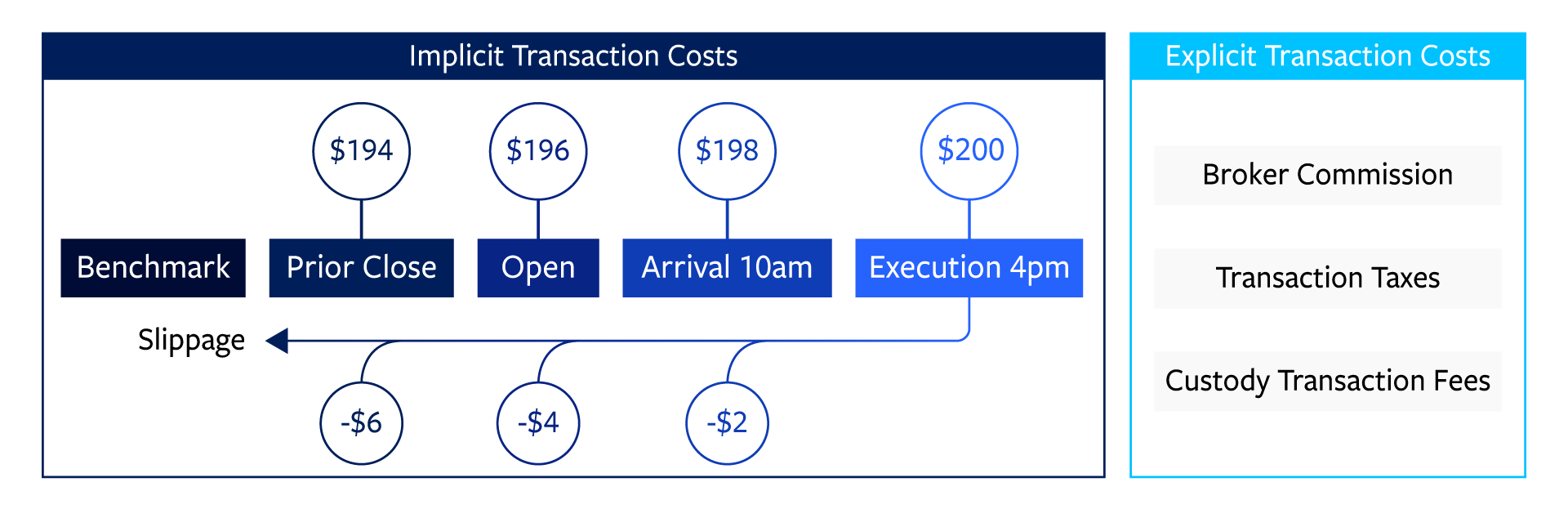

Since the introduction of the PRIIPs and MIFID II regulations, we have developed industry-leading methodology for transaction cost calculations with the use of arrival price data. Our years of experience in overcoming the challenges of sourcing accurate data and developing robust calculation engines, have positioned us to provide solution that delivers accuracy and precision in managing transaction costs to support your PRIIPs, MiFID, DCPT and CTI reporting requirements.

Fulfilling your accuracy requirements

As of the beginning of 2025, as per the Annex VI of EU 2017/653, implicit transaction costs calculations must include Arrival Pricing as part of their methodology. While many global asset managers may have already adopted this approach Broadridge is well placed to support any market participants who are still yet to transition to this required process.

Why is the regulator insisting on this requirement:

- Asset managers, administrators, and order management systems (OMS) often lack capabilities to capture and store arrival prices.

- Where arrival prices are unavailable, managers default to fallback prices or benchmark spreads.

- This approach leads to incomplete data and potential compliance risks.

Our benefits at a glance

Overcoming the challenges you are facing

One of the key difficulties facing asset managers is the fast-approaching deadline for fully transitioning to arrival price methodology for transaction costs.

Compounding the challenges of the looming deadline are the problems that surround accurate data, especially when it involves illiquid instruments such as emerging market debts where arrival price data can be hard to source. After a rigorous selection process Broadridge selected a provider to source arrival price data from, a provider who over the years has demonstrated their ability to gather accurate information from numerous sources across multiple instruments. In addition to this, our proprietary validation systems mean that you can rely on us to identify any erroneous data points.

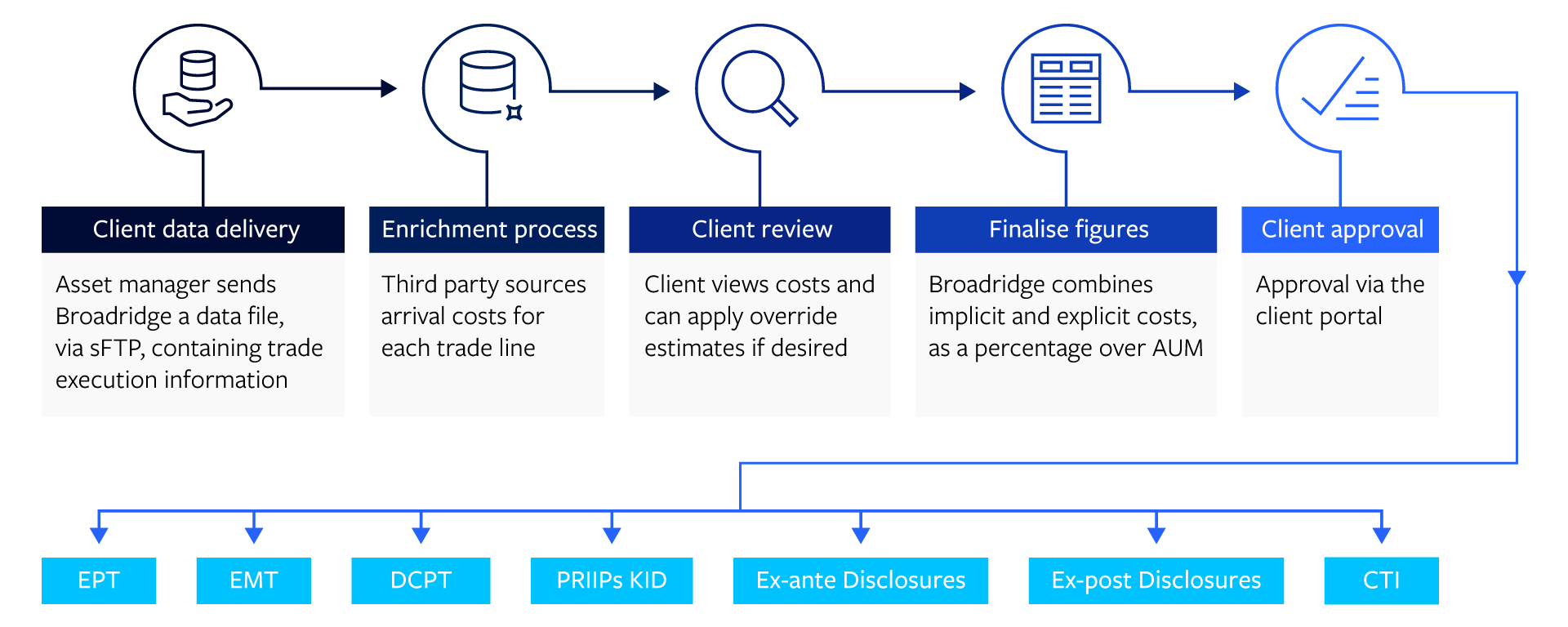

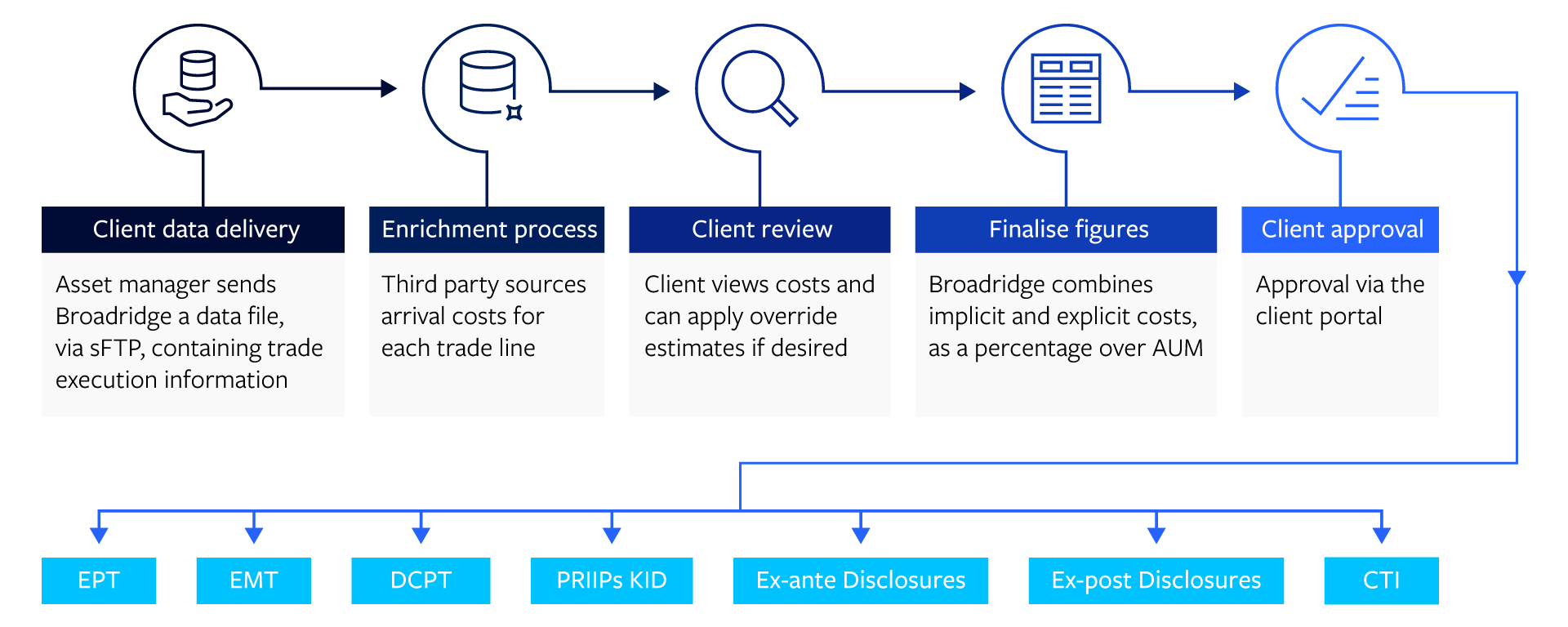

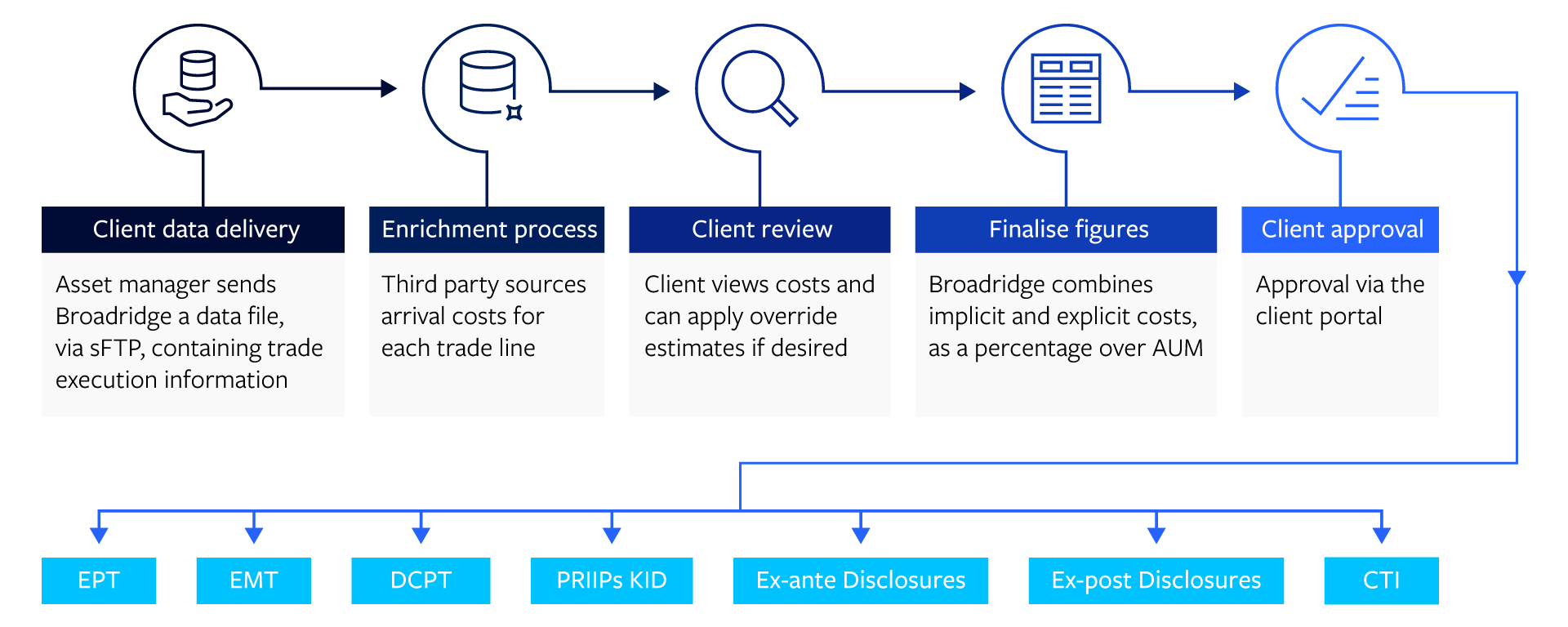

Now is the time to partner with us and benefit from the years of experience we have had working with clients to develop a streamlined implementation process. Our tried and tested solution collects your trade data, enriches it with arrival costs and via an initiative portal allows to fulfill your regulatory requirements for PRIIPs and MIFID.

Transform regulatory burdens into a competitive advantage

As the financial landscape continues to evolve, let us be your trusted partner in navigating regulatory complexities, enhancing operational efficiency, and maintaining the highest standards of transparency and compliance. Together, we can turn regulatory challenges into opportunities for growth and excellence in asset management.