Value assessment and Consumer Duty: How can fund houses navigate the new rules?

How to approach and manage new requirements introduced as part of the FCA's Consumer Duty rules

On July 16, 1969, people all over the world huddled around their televisions sets to watch the launch of the Apollo 11 rocket. Even though NASA’s team of expert engineers, scientists, and technicians had spent the previous five years meticulously laying the groundwork for their mission to land a human being on the moon, many of those watching on, both at the launch site and at home, felt a sense of trepidation, and feared that things may not work out as planned.

No matter how well-laid a plan is, there will always be some sense of unease when it comes time to launch. Many asset managers may be experiencing this sense of trepidation as they approach the implementation stage of their own multi-year preparatory journey, regarding their duty of care to consumers.

Despite investing significant resources in the production of Assessment of Value (AOV) reporting since the introduction of new regulatory legislation in September 2019, many managers continue to feel a sense of uncertainty as to whether their management information and processes are mission-ready as they strive to take every reasonable step to deliver good outcomes for their retail customers.

July 31, 2023 was the launch date for the Financial Conduct Authority’s (FCA) new Consumer Duty for existing products and services across all authorized firms with a material influence over retail customer outcomes. The new Consumer Duty regulation is a framework comprising several elements: a new consumer principle, cross-cutting rules, and a series of four expected outcomes. The entire framework is underpinned by a concept of reasonableness.

On March 24, 2023, the Central Bank of Ireland (CBI) published a “Dear CEO Letter” reiterating the importance of policies and governance procedures that review and minimize undue costs and charges to investors.

On May 31, 2023, the European Securities and Markets Authority (ESMA) published guidance highlighting the importance of periodic independent reviews of cost and fee structures to ensure fees paid by investors are commensurate with the returns and risk profile of the fund. There is now an increased expectation on managers to deliver effective and efficient price and value reporting to customers.

So now that the moment is here, how is your implementation progressing?

What is Consumer Duty and Why is it Important?

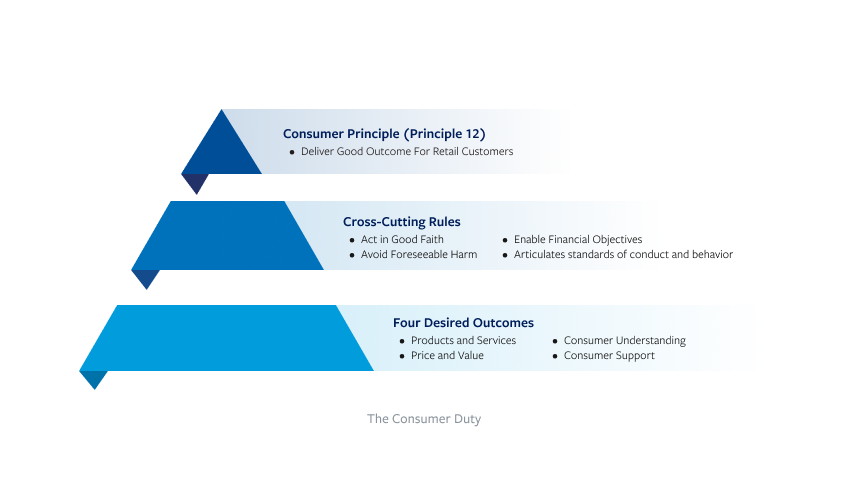

The new Consumer Duty regulation is an attempt by the FCA to provide a better framework for regulating fiduciary care of consumers by financial institutions. The Consumer Principle sets the overarching expectation that firms will deliver a good outcome to retail customers. New cross-cutting rules outline a set of anticipated behaviors, designed to lead to improved outcomes for consumers in four areas:

- Products and Services

- Price and Value

- Consumer Understanding

- Consumer Support

The Duty applies to all FCA-regulated entities that wield a material influence over retail customer outcomes across the distribution chain and throughout the full lifecycle of products and services. Furthermore, it requires asset manager governing bodies to properly embed the Duty by making senior managers accountable for the outcomes under the Senior Manager & Certification Regime (SMCR).

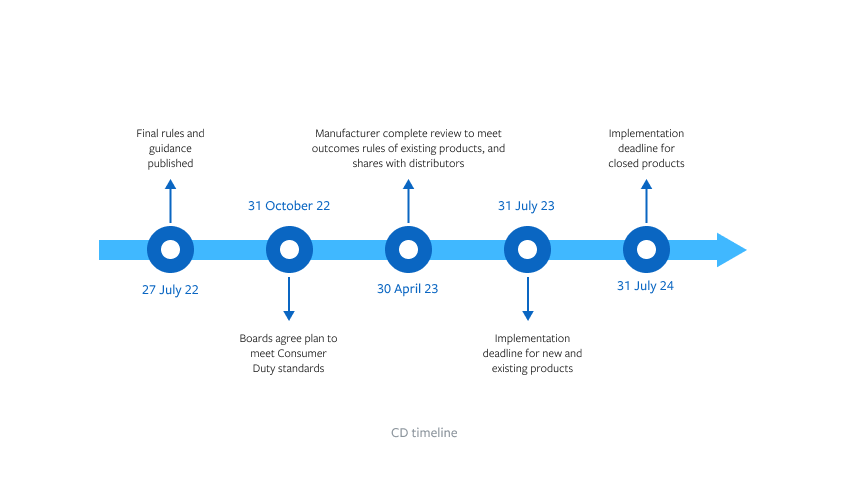

- 27 July 2022 - final rules and guidance published

- 31 October 2022 - Boarsd agrees plan to meet Consumer duty standrads

- 30 April 2023 - Manfactuere complete review to meet outcomes rules of existing products and shares with distributors

- 31 July 2023 - Implementation deadline for new and existing products

- 31 July 2024 - Implementation deadline for closed products

- Consumer principle Principle 12- Deliver good outcome for retail customers

- Cross Cutting Rules-Act in good faith, Avoid foreseeable harm, enable financial objectives, articulates standarsd of conduct and behaviour.

- Four Desired Outcomes-Products and services, price and value, consumer understanding, consumer support

Based on the broad summary of the regulation above, regulated firms and the FCA will face considerable challenges in monitoring, supervising, and enforcing the new Consumer Duty regulation. Moreover, ensuring success will require significant cultural and behavioral changes. To give one example, in addition to reactive tracking, firms will now have to undertake extensive proactive testing and tracking of outcomes for both existing and vulnerable customers.

The Implementation Challenge

The FCA required all firms to be substantially ready by 31 July 2023 and expects boards to take full responsibility for ensuring the Duty is properly embedded and senior managers are fully accountable throughout the lifecycle of products and services. This is not a straightforward process. For example, the distribution chain for products may involve multiple intermediaries comprising various platforms and financial advisers, who, in turn, service multiple retail customer groups. Identifying and remedying areas of weakness within this distribution chain will be a huge communicational and logistical challenge.

Some of the main challenges facing firms are data collection, managing metrics and management information systems, monitoring and documenting assumptions, and testing customer outcomes. All of these will require significant investment in resources and systems. It would be naive to underestimate the additional effort needed to discharge the vulnerable customer responsibility given the potential size of this segment and its multiple touchpoints throughout the lifecycle of related products and services. According to 2020 Financial Lives Survey data, 46% of UK adults, equivalent to 24 million people, were found to show one or more characteristics of vulnerability.

As the FCA enforcement satellite orbits the Duty, it will be equally challenging to supervise and enforce the outcomes across all regulated firms. To assist firms in evaluating a fair value framework, the FCA published findings from its reviews in May and August 2023. The areas it recommended for further considerations were:

- Address gaps identified from prior year’s gap-analysis. Implementation should include monitoring, evidencing, embedding requirements, prioritizing mitigation plans with clear accountability across all products and customer groups. Finally, integrate value assessment into product development and governance processes.

- Consistent alignment of decisions with the underlying quantitative data. Ensure the board’s decision, justifications, and validation processes are robustly discussed and documented with clear evidence of what was challenged and how decisions were reached.

- Commensurate costs to fund performance. Evaluate not only comparable market rates, but also all the other AOV criteria, for example, share class and quality of services. Document methodology and discussions to justify why fees are proportionate and commensurate.

- Consider economies of scale savings. Extend fee comparison beyond competitor fees in similar funds. Evaluate fees in line with costs, to ensure profitability is commensurate to fund risk and performance.

- Encourage and document challenges from Independent non-executive directors. Provide non-executives with objective data including independent benchmarking of peers as it becomes increasingly prevalent, so they can make the right decisions.

Based on the expectations outlined in the guidance, as well as the implications of the language used, it is likely that Price and Value assessment reporting will become the central focus for monitoring fair value outcomes to customers. This will consist of a combination of internal and external benchmarking of products, fees charged commensurate to costs, customer expectations of value delivered, and the risks of harm to vulnerable customers – including plans to address the risks.

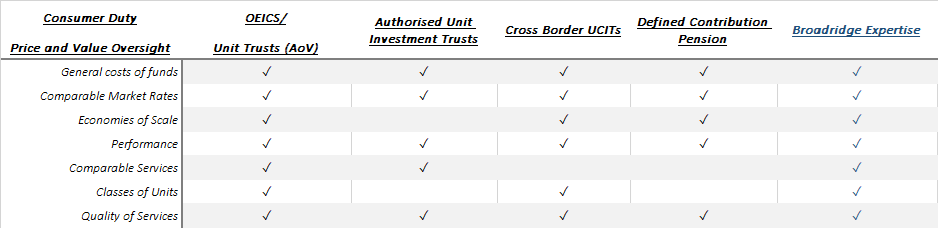

Value for money requirements are similar to the US rule 15(c), whereby independent directors are tasked with reviewing fund costs and performance to ensure investors’ best interests are protected. The Price and Value outcome outlined as part of the Consumer Duty dictates that firm must benchmark products and services against similar products in the markets for all their customer groups, including vulnerable customers. This marks an expansion of oversight beyond the AOV requirements that went into effect in 2019. This does not technically apply to investment trusts, defined contribution pension products, or cross-border UCITS sold to UK retail investors, Broadridge believes these offerings must review price and value in light of Consumer Duty.

To assist our clients, we have established detailed price and value reporting solutions for these additional product types that are modelled on the AOV criteria. For each offering, adjustments have been made to address structural differences between product types, as well as the availability of data.

- General Cost of funds: Unit Trust AOV, Authorized Unit Investment Trust, Cross Boder UCITS, Defined Contribution pension, Broadridge Expertise

- Comparable market rates:Unit Trust AOV, Authorized Unit Investment Trust, Cross Boder UCITS, Defined Contribution pension, Broadridge Expertise

- Economies of scale:Unit Trust AOV, Cross Boder UCITS, Defined Contribution pension, Broadridge Expertise

- Performance:Unit Trust AOV, Authorized Unit Investment Trust, Cross Boder UCITS, Defined Contribution pension, Broadridge Expertise

- Comparable services:Unit Trust AOV, Authorized Unit Investment Trust, Broadridge Expertise

- Classes of units:Unit Trust AOV, Cross Boder UCITS, Broadridge Expertise

- Quality of services:Unit Trust AOV, Authorized Unit Investment Trust, Cross Boder UCITS, Defined Contribution pension, Broadridge Expertise

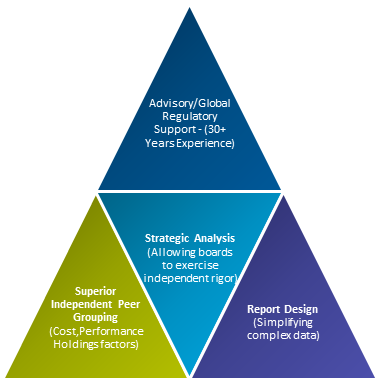

Overall, our AOV board reporting solution, as well as the modified versions for additional products, offers clients a robust methodology and framework around four key components: report design, deep qualitative analysis, independent peer grouping benchmarking, and shareholder reporting solutions. The components Broadridge has created result in tighter alignment with shareholder information and allow the board to fully review funds and ask management the tough questions regulators are expected to address.

- Advisory/Global Regulatory Support - 30+ years of experience

- Superior Independent Peer Grouping- Cost Performance Holdings Records

- Strategic Analysis-allowing boards to exercise independent rigor

- Report Design- Simplying complex data

Beyond the capabilities of supporting regulatory oversight related to cost and value, asset managers continue to face an on-going fee pressure from passive products, ETFs, segregated mandates, and other wrappers. For the purpose of AOV, these offerings are considered part of comparable services; however, for products outside the scope of AOV, or for new offerings, understanding pricing competitiveness will become strategically important for asset manager product teams.

Broadridge’s Global Pricing Intelligence product offering utilizes the same data that powers our AOV offering, to empower product teams to measure the competitiveness of fees without the additional metrics that our regulatory solutions provide.

So What’s the Message for Consumer Duty Reporting in 2023 and Beyond?

To answer this question Afzal Amijee, Product Director, EMEA, suggests:

“The UK’s Consumer Duty took effect in July, and no doubt the debate and evolution regarding classifications of fairness, what constitutes good outcomes, and Price and Value peer groupings for benchmarking will continue throughout and beyond 2023. Though lessons can be learned from other frameworks such as US rule 15(c) board reporting, independent analysis and metrics validation will provide a meaningful common platform for the board and management to review, discuss, and determine if a fund is providing fair value to its customers. This will mean that boards could be challenged on their convictions and beliefs when making choices on selecting benchmarking peers and justifying fees. Regardless, each of us in the investment industry has a role to play and an obligation to build trust with our customers and strive for quality and integrity in delivering good outcomes for all our customers.

“The key for us as an industry as we face scrutiny is not only if we are reasonably delivering good outcomes to our customers in 2023 and beyond, but at all times learning and reaffirming that what is being reported actually represents reality. Delivering fair value to consumers is here to stay and will become extremely important across Europe given the recent announcements from the Central Bank of Ireland European Commission of their plans to also introduce fund cost and performance benchmarks.”

This article was first published in FT Adviser.

Let’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |