Journey to 10,000: The evolution of Virtual Shareholder Meetings

William Kennedy, VP Product, Corporate Issuer Solutions, Broadridge

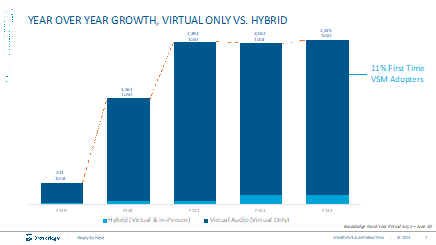

This past proxy season Broadridge successfully hosted its 10,000th Virtual Shareholder Meeting (VSM). More than 85% of those meetings occurred in the past three years, and VSMs are now commonplace among issuers and shareholders.

First launched in 2009, our VSM platform made shareholder meetings more efficient to conduct while providing another avenue for companies and shareholders to interact.

Nevertheless, some institutional investors and governance proponents were skeptical about meetings held fully online. They worried that VSMs might erect a technology wall between shareholders, directors, and management. Even though we were adding the features and functionality they asked for, acceptance was slow to build.

Fast forward to proxy season 2020 and a devastating COVID pandemic where social distancing regulations made in-person gatherings impossible or inadvisable. In this context, the virtual format was the best option for shareholder meetings. And the industry looked to Broadridge to quickly scale up its VSM service so that corporate governance could proceed without interruption.

The pandemic led to a major spike in VSM adoption and few companies are returning to an in-person meeting format even with “employee return-to-office” policies growing among many firms.

VSMs are here to stay. Our clients are sticking with VSMs because the technology is making shareholder meetings more efficient, more secure, and more convenient for their shareholders. The benefits are compelling including, among others, the following:

- VSMs make shareholder meetings more accessible, not less. Shareholders and registered guests can join meetings and engage the board from anywhere. It is easy for authenticated shareholders to ask questions and vote.

- VSMs reduce the effort to plan and manage shareholder meetings. In-person meetings can involve complex logistics such as arranging suitable venues, travel and accommodations. VSMs eliminate the work and worry.

- VSMs are more secure. In-person meetings can entail physical security risks, including unauthorized access or disruption. VSMs eliminate the need to hire security personnel, screen in-person attendees, and respond to incidents.

Based on our experience in hosting over 10,000 VSMs, there are at least five best practices companies should consider:

1. Provide participants with clear instructions and guidance. Companies should educate shareholders on what to expect and how to participate. Consider giving participants step-by-step guidance on how to log in, vote, ask questions, and access materials. Use plain language and distribute across multiple channels: email, web, and the VSM platform itself.

2. Be proactive — and coach the board. Preparing the board and management team is just as crucial as preparing shareholders. Offer training sessions or rehearsals to familiarize them with the VSM platform and its features. Encourage board members to practice delivering their presentations and responding to questions in the virtual format.

3. Make it easy to participate during the event. The success of a VSM hinges in part on the ease of participation. Simplify the entry process by providing direct links and clear log-in instructions. Ensure that all shareholders can join the meeting and provide log-in hand holding where appropriate.

4. Choose the right VSM platform — and partner. Evaluate VSM platforms based on their reliability, security, user-friendliness, and scalability. Make sure the VSM can adapt to your specific needs and provide proactive support. And look for a partner with the right experience to help manage even the most complex events.

5. Stay connected after the event. Engagement doesn't end when the VSM concludes. Share the meeting's recording and transcripts, allowing those who couldn't attend the meeting to view it. Encourage feedback and questions post-event to address any lingering concerns.

What’s next. Our VSM platform can be deployed for special meetings and investor-day events as well.

Special meetings. Issuers can quickly convene special meetings when critical decisions require shareholder consent for M&A transactions and other solicitations. In this context, real-time interaction, information dissemination, and stakeholder engagement can be facilitated by the platform.

Investor day events. Virtual investor day events are another avenue to engage with shareholders outside of the annual meeting process. The platform can enable dynamic presentations, the use of multimedia content, and in-depth financial discussions. The platform can assist companies in reaching out to current as well as potential new investors, along with analysts and other stakeholders worldwide.

Related Solutions

Let’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |