Pricing and Value Analytic Solutions

Centralized intelligence. Optimized transparency. Streamlined reporting.

-

Access current and historical global pricing insights

-

Perform relevant peer group analysis and benchmarking

-

Develop data-driven product, pricing, and improvement strategies

-

Receive net negotiated fees for global mandates

-

Analyze pricing trends on new wins to facilitate RFP responses

-

Determine demand trends using sales with mandate-level pricing

-

Benchmark product pricing relative to key segments

-

Automatically collect and analyze 15(c), Assessment of Value (AoV), and Consumer Duty data

-

Ensure consistency across multiple jurisdictions

-

Reduce manual effort and errors in compliance processes

-

Generate clear, compelling value assessments for stakeholders

-

Provide transparent performance and fee communications

-

Customize reports for specific board and regulatory requirements

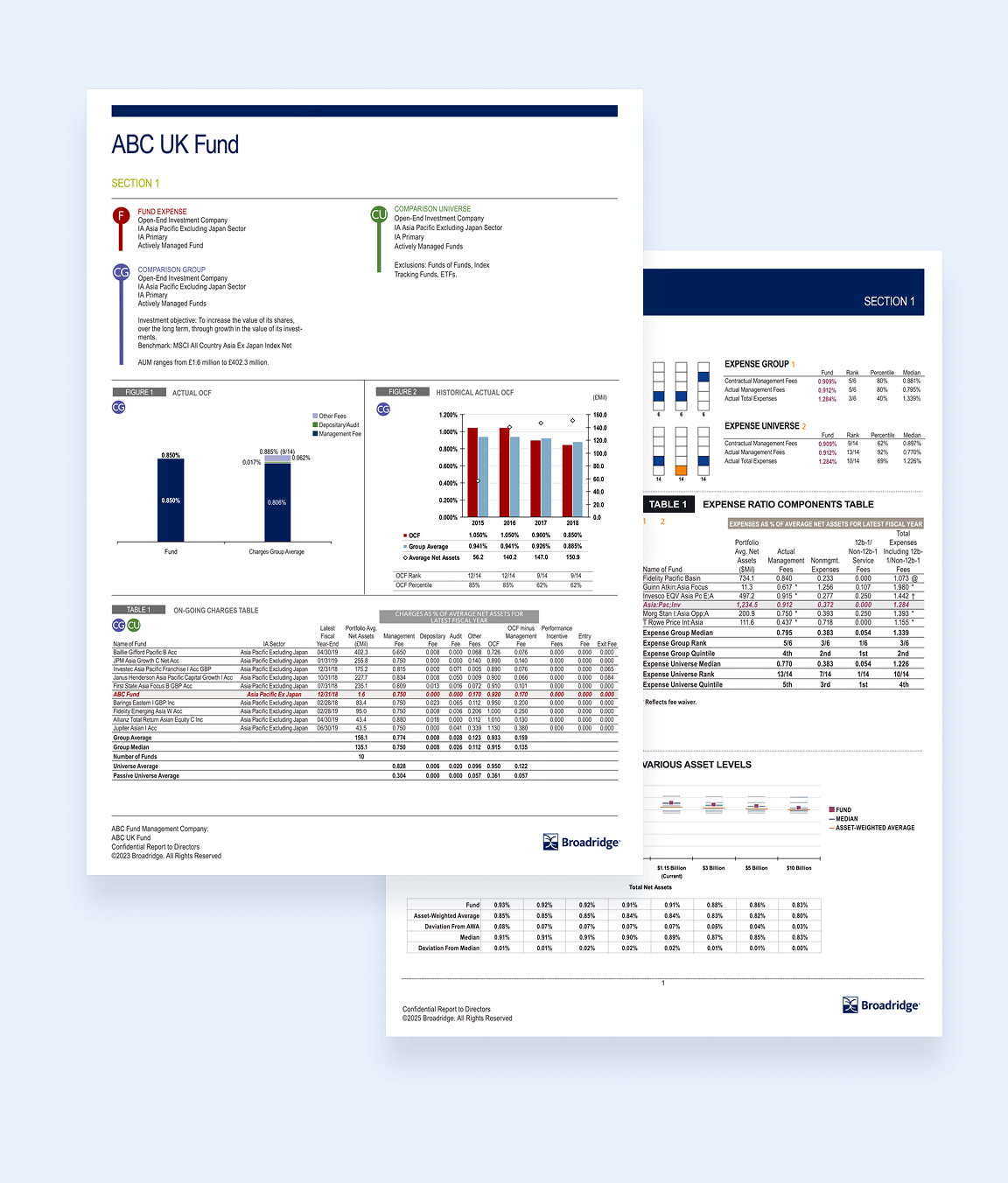

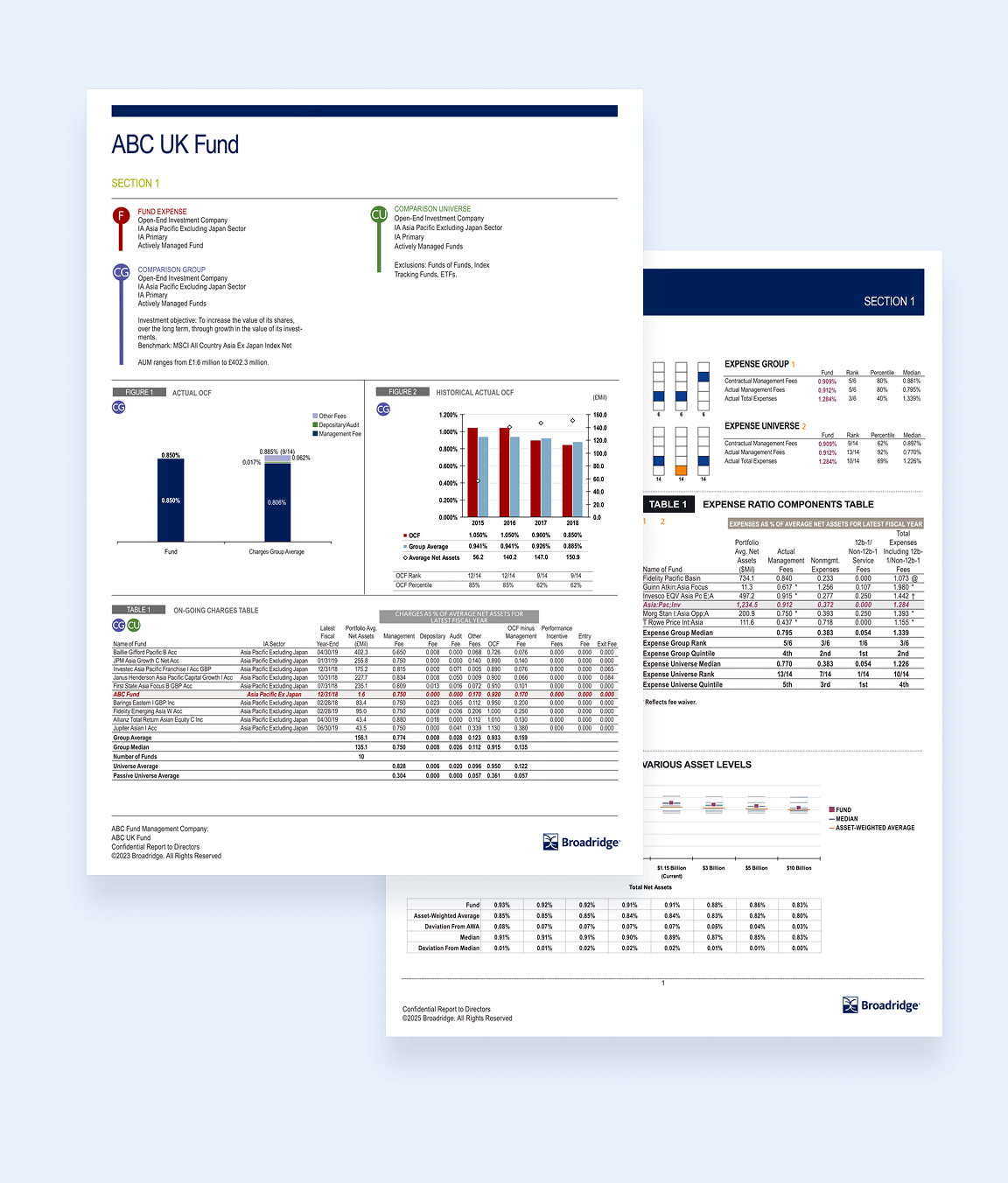

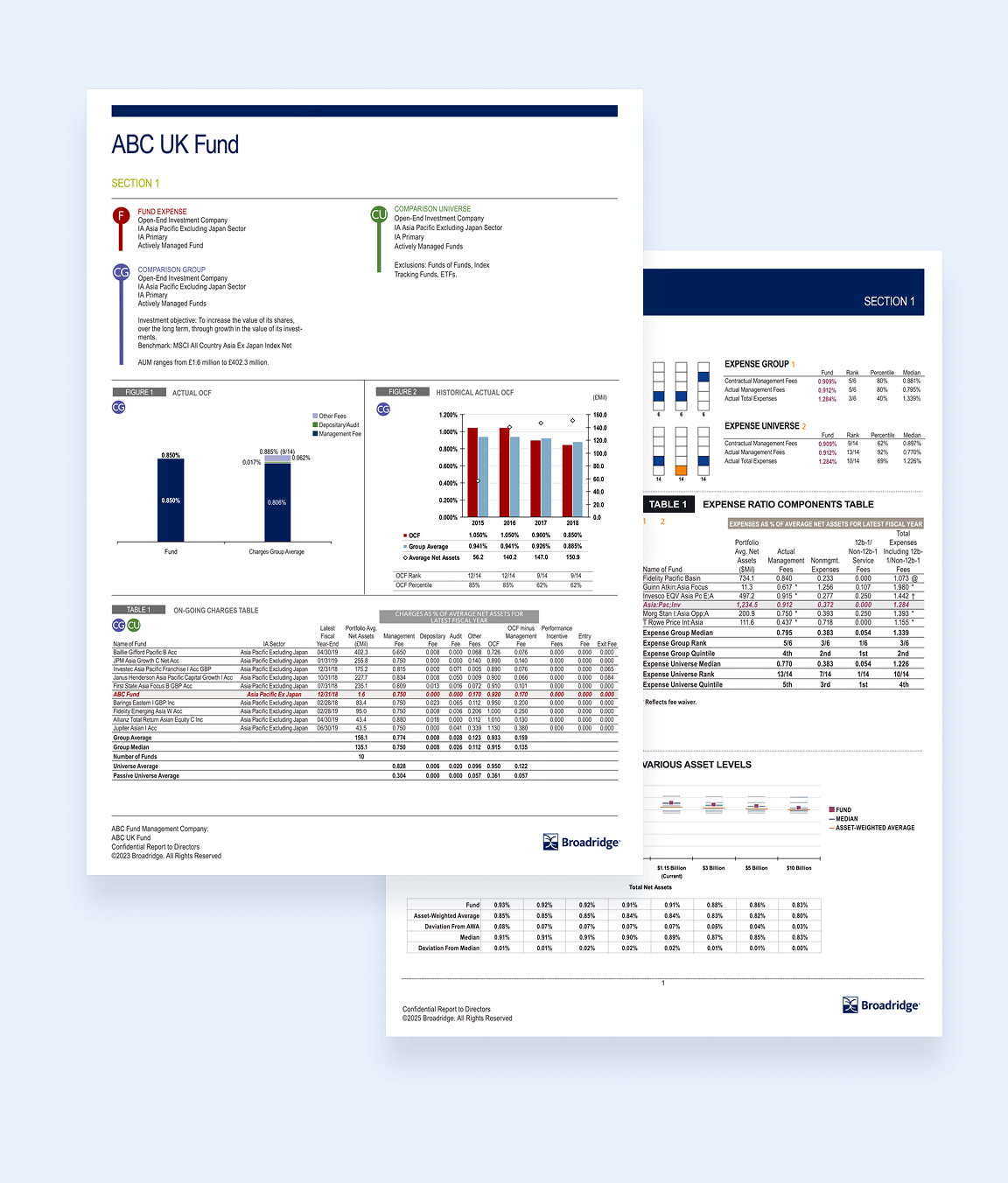

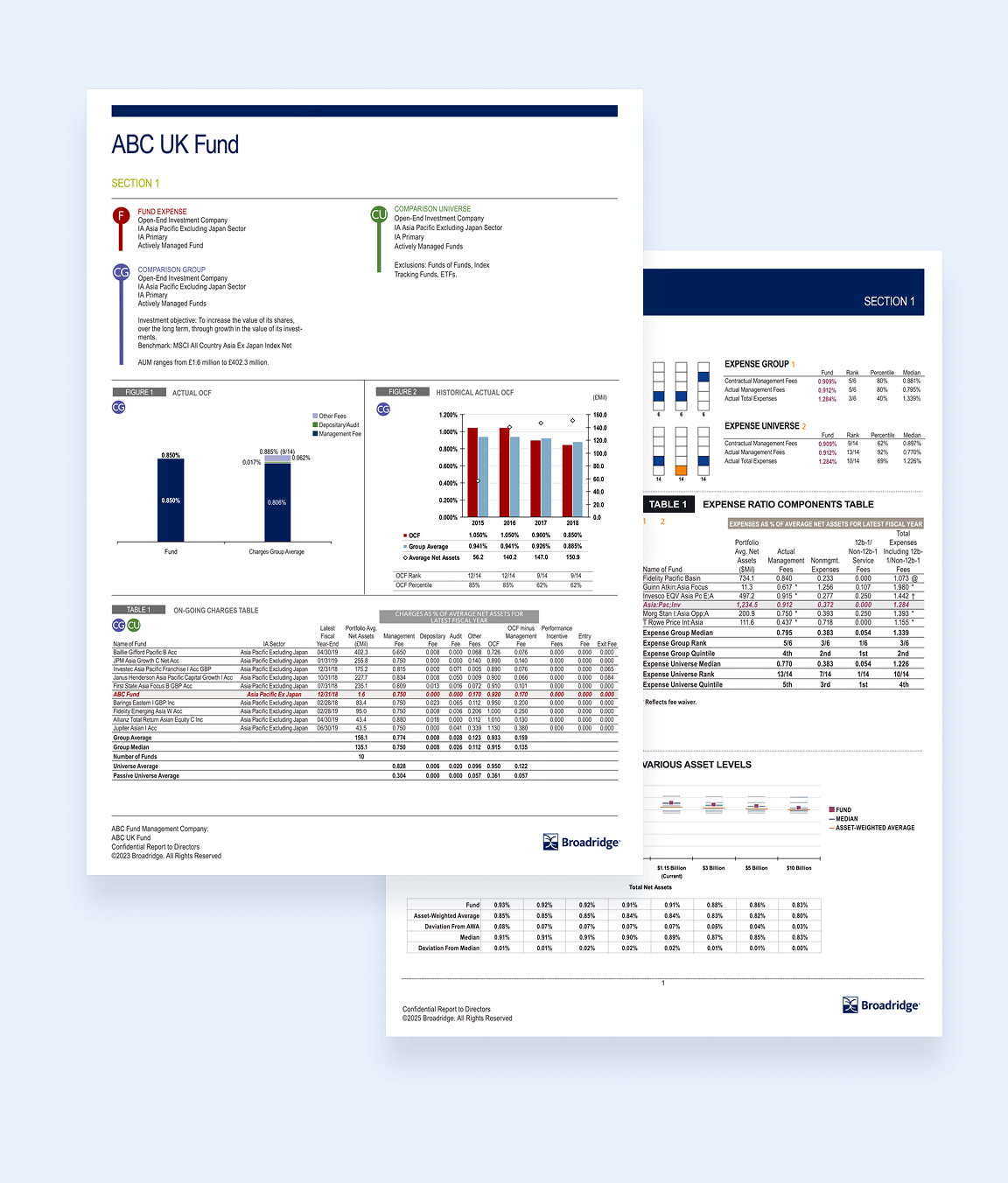

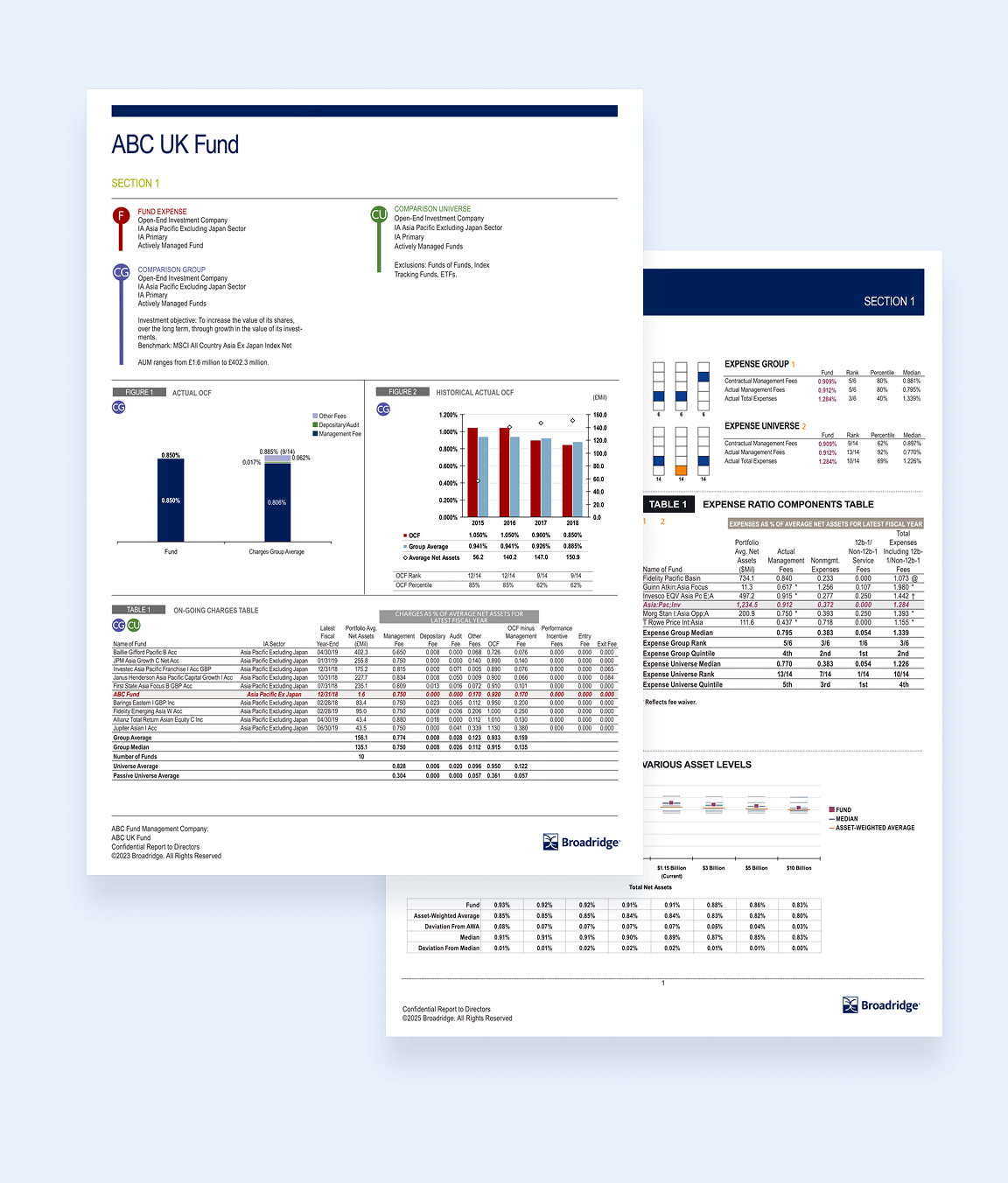

Comprehensive decision-making insights

Automate complex workflows

Efficiently prepare annual reports and reviews with streamlined processes that save time and reduce the risk of manual errors.

Ensure fair value and positive outcomes

Leverage specialized tools to assess and document product value, address potential areas of consumer harm, and demonstrate commitment to retail-investor protection.

Improve retail and institutional pricing decisions

Access comprehensive data to optimize pricing strategies. Analyze pricing movement, benchmark fees, segment sales trends, identify inefficiencies, and build informed product-development strategies.

Align to evolving global regulations

Automate data collection and report generation for multiple regulatory frameworks. Reduce the potential for manual errors and inconsistencies across jurisdictions, even as requirements change.

Experience scalable, flexible cost-efficiency

Performance data and reporting for multiple funds and asset classes. Easy integration and ongoing updates align workflows with market and regulatory shifts, allowing you more time for strategic initiatives.