Basel IV – Are You Ready?

Basel IV (2023) and updates to the Capital Requirements Regulation (CRR3) (2025) are putting more pressure on banks to deliver credit data accuracy and lineage. Some banks may face significant capital shortfalls; the proposed changes require a shift in approach for measuring risk-weighted assets (RWA) and for internal ratings and regulatory capital floors.

Banks which do nothing are likely to face additional capital requirements and a reduction on return on equity. This is a game changer for the Banking industry. Are you ready?

The European Commission’s Banking Package, published on October 27 2021, is designed to strengthen banking resilience and better prepare for the future. Included are amendments to CRR3 relating to credit risk, credit valuation, adjustment risk, operational risk, market risk and the output floor. Basel IV, meanwhile, focuses on ensuring that the internal models used by banks to calculate capital requirements do not underestimate risk. HM Treasury has expressed support for the 2023 Basel IV implementation date.

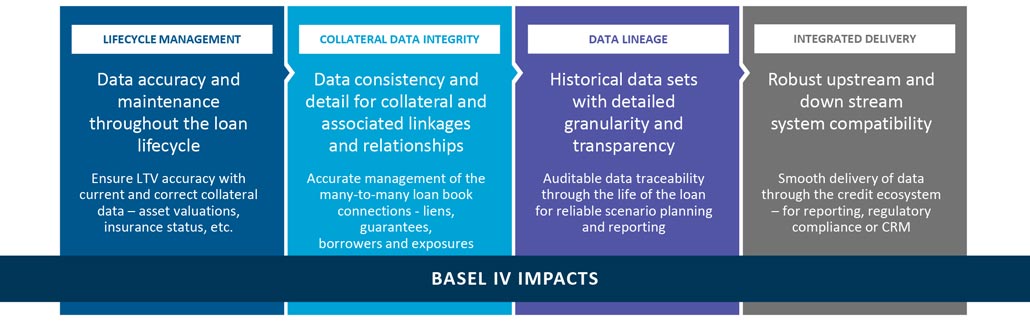

These new steps in regulation are pushing banks to become even more data-centric in their management of credit risk and the many-to-many relationships that exist in the lending ecosystem. To comply, banks are being called on rethink their approaches to credit reporting and data management – and how they can overlay these new requirements on top of existing IFRS and other processes.

Are you struggling with fragmented, dispersed and legacy loan management systems and consequent problems with credit data integrity and detailed regulatory reporting? Maybe we can help.

Under Basel IV, the gap between risk assessed under beneficial Advanced IRB models cannot be less than 72.5% of risk measured by the regulator’s Standardized Approach. Nordea estimates that the European Banking System will need an additional 19% of Tier 1 capital. Addressing poor data quality may give banks a chance to reduce this impact.

We already work with a Tier 1 bank to deliver savings of €20M p.a. based on more efficient capital allocation driven by improved collateral data quality, leading to RWA reductions. Again and again, our experience has shown that our approach to collateral data integrity achieves substantial operational and capital savings.

The disjointed nature of typical bank’s systems results in the Bank being unable to fully capture all of the data linkages in the credit eco system leading to credit risk and heavier capital loading relative to peer banks. Current data is often stale, with broken relationships and gaps. This becomes a problem for detailed regulatory reporting.

For many banks, the issue isn’t identifying whether there is an issue with data integrity, or even the scale of the issue. The challenge is in knowing where to start – and in having a model which learns over time to suggest fixes and cures for the broken data.

Delivering a robust and complete data set to the reporting function is notoriously difficult:

- Credit & core banking systems are not designed to maintain or optimize rich collateral data & linkages through its full lifecycle

- Underlying systems are fragmented and dispersed; loan linkages are often missing or incorrect

The impact of new regulations will vary between geographies, bank type and business model. For instance, banks with significant output floor impacts will have to re-calibrate their business mix or potentially go off balance sheet. Banks with a more diversified portfolio may have to shift but can probably achieve progress with multiple smaller mitigation actions. Some heavy preparation is needed to develop a strategy the minimize with Basel IV impacts.

Some key components of a structured approach for best-in class capital management under Basel IV include

- Improved RWA accuracy and regulatory capital (for example, by reducing capital deductions)

- Business levers to increase capital efficiency/profitability, especially of the loan back book

- Strategic levers to adjust the business model to the new regulatory environment

- Enablers to ensure that the applied levers are sustainable going forward

While some banks are already optimizing RWA accuracy and reporting with a dedicated collateral management solution, for most banks there is still a significant opportunity to review existing technology.

Let us help you deliver a fast and reliable route to credit data integrity with continuously repeating financial benefits.

For more information on how we can support you with credit data integrity for regulatory and capital reporting, please contact: Goncalo Vicente, Senior Director Solution Sales, Broadridge Financial Solutions Ltd at goncalo.vicente@broadridge.com

Let’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |