Case Spotlight: Boohoo Group plc ESG-related Litigation

The Class Action Case Files

Portfolio monitoring and asset recovery of growing global securities class actions can be daunting.

Broadridge can help simplify the complex.

Just the Facts

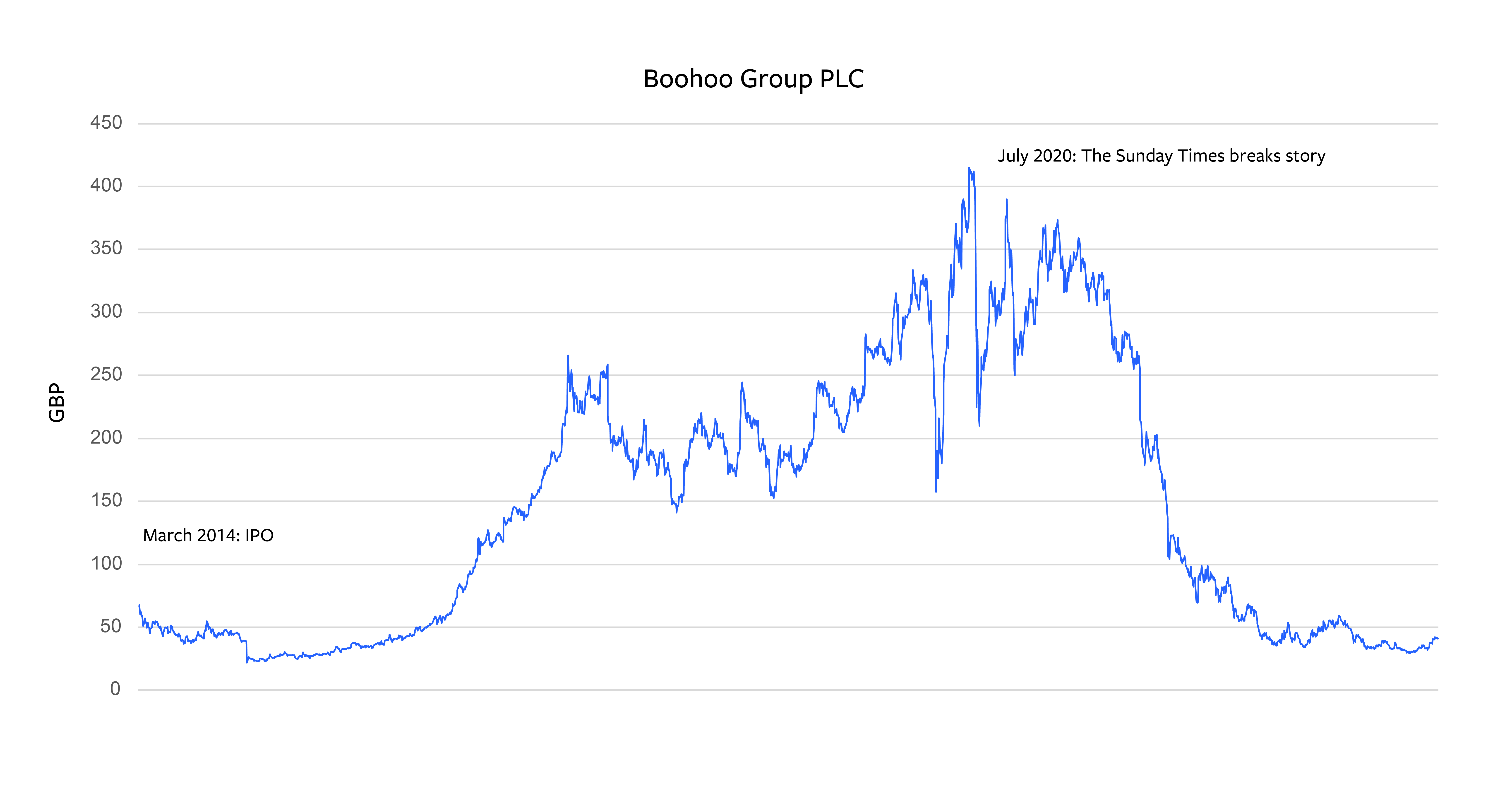

Boohoo Group plc (LSE: BOO), founded in 2006, is a British fast fashion retailer headquartered in Manchester, England. Boohoo is accused of ESG (Environmental, Social and Governance) related violations, highlighted by The Sunday Times in an exposé that alleged illegal working conditions in the company’s Leicester supply chain, including reports that its factory workers were being paid below minimum wage and violations of Covid 19 protocols established by the British government.

These alleged violations have prompted several shareholder claims before the High Court of Justice in London, including by a group of shareholders represented by Fox Williams, which recently filed a complaint on May 17, 2024. The complaint asserts that Boohoo’s share price plummeted when media outlets began exposing Boohoo’s ESG-related failures, despite the company’s longtime awareness of these issues and promises of fair production. The claim is brought under the Financial Services and Markets Act 2000, which imposes liability for any person responsible for listing particulars and prospectuses that include false or misleading statements or omissions and provides statutory redress for those who suffer losses as a result.

ESG-related litigation has been on trend for several years now, largely fueled by a change in investor behavior, with institutional investors increasingly viewing class and collective actions rooted in ESG principles as an effective mechanism to uphold and implement their ESG policies and objectives. As noted by Fox Williams, the “claim represents an opportunity for investors in Boohoo […] to discharge their stewardship obligations to support robust governance standards across supply chains in the ‘fast fashion’ sector.”1 The firm further asserts that this litigation will promote UK public companies to “improve the governance of working conditions and […] reduce ‘blue washing’ in the fashion industry.”2

Investors who transacted in Boohoo securities since its March 2014 IPO must act with haste to preserve their interests and rights as the relevant limitations period is looming. Please reach out to Broadridge today for personalized assistance with your claim.

Case challenges

UK OPT-IN LITIGATION

As part of the UK’s opt-in litigation mechanism, if an investor wishes to participate in one of these actions, it must proactively join the litigation from the outset. Claimants will be required to liaise directly with a law firm and litigation funder, and the process can be longer and more involved. Further, there are multiple cases that could proceed on parallel tracks. In order to weigh their various options, claimants must understand the differences between the cases, legal theories, damage calculations, and potential outcomes. They must also understand how their trading patterns may impact their losses, which requires a detailed individual review. Finally, the various firms and funders may have different or preferable contractual terms.

ENGLISH LAW AND CLAIM FILING

As part of the UK’s opt-in litigation mechanism, an investor must proactively join the litigation before the case is filed in Court via a process known as “opting in.” Depending on the particular claim(s) being pursued, claimants may also be required to demonstrate “reliance” as part of their claim, and further, the claimant’s identity may be discoverable as interested parties may access the list of claimants on petition to the court. Thus, to weigh the various options, claimants must fully understand the differences between the cases and any specific requirements for bringing a claim.

LITIGATION COSTS

Participating in an opt-in litigation may involve additional costs and additional contractual relationships. Unlike a US class action, each potential claimant is treated separately, and each individual case has its own funding and paperwork requirements. Typically, there are fees associated with filing in these matters. Funding agreements and costs will differ depending on the case, the law firm and litigation funder.

DOCUMENTATION REQUIRED

Registration in an opt-in proceeding often requires all investors to submit supporting documentation to prove their claim in advance of settlement. Other documentation usually requested is corporate information proving legal entity status. Failure to provide adequate supporting documentation may lead to an incomplete registration. Institutions that had many relevant transactions for example, will need significant planning and clean preparation work to prove their claims and maximize recovery.

OLD RELEVANT PERIOD

Most financial institutions and individuals typically keep copies of statements, broker confirmations and house data relating to their accounts for 7 years. Here, the relevant period began 10 years prior. Consequently, it may be difficult for potential claimants to (a) provide transaction information beyond 7 years, and (b) provide all required supporting documentation.

Each year billions of dollars are being left on the table.

Find the right advocate who can help you maximize recoveries.

1 Andrew Hill et al., Fox Williams Files a Group Litigation Claim Against Boohoo on Behalf of Investors who Suffered Losses, Fox Williams (June. 4, 2024), https://www.foxwilliams.com/2024/06/06/fox-williams-files-a-group-litigation-claim-against-boohoo-on-behalf-of-investors-who-suffered-losses/.

2 Id.

Let’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |