Case Spotlight: Perrigo Company plc Litigation

The Class Action Case Files

Portfolio monitoring and asset recovery of growing global securities class actions can be daunting. Broadridge can help simplify the complex.

Just the Facts

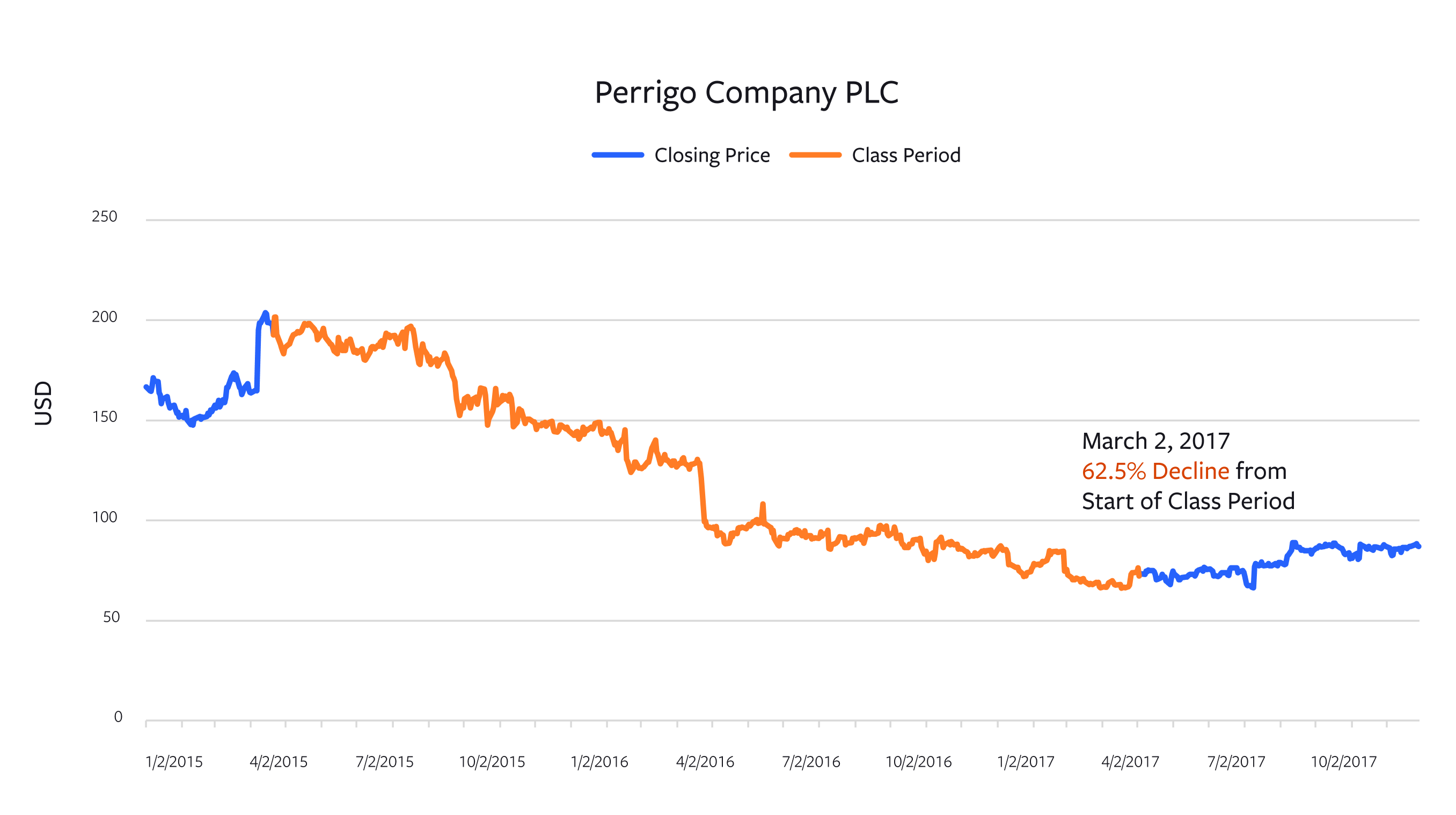

Perrigo Company plc (“Perrigo”) (NYSE; TASE: PRGO) is one of the largest over-the-counter pharmaceutical companies in the world. In April 2015, to defeat a hostile tender offer made by Mylan N.V. (“Mylan”), Perrigo allegedly made claims to its shareholders stating, among other things, that Mylan’s offer was undervaluing the company, that Perrigo was on track to have an organic revenue growth on its own, and that a recent acquisition by Perrigo would produce additional positive financial results. The bid was rejected by Perrigo shareholders in November of 2015.

In 2016 Perrigo issued two quarterly reports showing results directly opposite of what Perrigo claimed would happen if the tender offer was rejected. Shortly thereafter, on May 18, 2016, plaintiffs filed their securities class action complaint alleging violations of Sections 10(b), 14(e), and 20(a) of the Securities Exchange Act of 1934 and parallel provisions under Israel Securities Law, 1968, against Perrigo alleging that the representations made to shareholders for rejecting Mylan’s tender offer were false and misleading.

In 2019, the court appointed the lead plaintiff Perrigo Institutional Investor Group1 as class representative, its counsel Pomerantz LLP and Bernstein Litowitz Berger & Grossman LLP as class counsel, and certified the following three classes: (i) all persons who purchased Perrigo’s publicly traded common stock between April 21, 2015, and May 2, 2017, on the New York Stock Exchange (NYSE) or any other trading center within the United States; (ii) all persons who purchased Perrigo’s publicly traded common stock between April 21, 2015, and May 2, 2017, on the Tel Aviv Stock Exchange (TASE); (iii) and all persons who owned Perrigo’s common stock as of November 12, 2015, and who held the same through 8:00 a.m. ET on November 13, 2015 (whether or not a person tendered their shares in response to Mylan’s tender offer).

The certification of the second group presented an interesting challenge, as in 2010 the United States Supreme Court held in Morrison v. National Australia Bank that United States securities laws do not apply to transactions by non-United States investors who use a foreign stock exchange to purchase shares of a foreign company (commonly known as “F-Cubed” actions”).2

As Perrigo is legally headquartered in Ireland3 and the second certified class is made up of Israeli investors who purchased their Perrigo common stock on the TASE, it would seem as if Morrison would prevent United States securities laws from being applied to this subclass. However, since Israel incorporates all United States securities requirements and regulations into the Israeli Securities Law, 1968, the country’s equivalent of the Securities Exchange Act of 1934, and because Perrigo was listed on a United States exchange concurrently with its TASE listing, this unique “dual listing” regime made it permissible for the court to certify the class,4 and the class was subsequently certified on November 14, 2019.

On April 23, 2024, the court preliminarily approved a settlement of $97 million. A fairness hearing is scheduled for September 5, 2024. The claim filing deadline to participate in the settlement is August 26, 2024, and any objections must be submitted by August 6, 2024.

The court’s decision to certify this subclass, combined with the significant settlement reached, underscores the importance of monitoring litigation globally and being ready to act in order to maximize recoveries.5 The Global Securities Class Action Services at Broadridge monitors developments like these, working hard to identify recovery opportunities in every case and for every investor.

Case Challenges

Complicated Loss Formula or Plan of Allocation

The approved Plan of Allocation is complicated as it requires different damages calculations based on which sub-class Class Members are part of, and the time in which the members purchased their respective shares. For class members who purchased shares on either the NYSE or the TASE between April 21, 2015, and May 2, 2017, the plan of allocation is broken up into 4 groups, where damages are calculated differently depending on when the stock was bought or held. Further, two of the groups require that Class Members or Administrators determine their Recognized Loss by using the lesser amount between the price inflation on the date of acquisition or the “90 Day Lookback Value” of Perrigo common stock. In depth calculations like these increase the amount of time needed for claimants to accurately assess what they are owed. Additionally, it can lead to more incorrect calculations which in turn can cause claims to be rejected. These complex calculations further make it harder to accurately check and challenge Administrators’ determinations.

International Exchange(s)

The dual listing of Perrigo common stock on both the NYSE and the TASE requires class members to take a closer look at their transactions to confirm which exchange they owned the security on. It also creates an additional challenge in that securities on the NYSE are listed in United States Dollars, while securities on the TASE are listed in New Israeli Shekels, adding a further challenge in calculating your claim’s recognized loss(es).

Under Multiple Securities Laws

Although most United States securities class actions seek recovery under either the Securities Act or the Exchange Act, it should be noted that eligibility for this settlement also included claims based on Israeli Securities Law for transactions in Perrigo common stock on the TASE. This essentially doubles the work needed to be done, requiring the precise preparation and calculation of distinct claims to maximize potential recovery. Furthermore, a more significant impact is seen during the claims filing process, particularly when addressing any deficiencies identified by the administrator. To ensure the highest possible recovery, it is imperative to engage in meticulous monitoring, comprehensive claim preparation, and efficient data management.

Not Simply a Purchaser Class

Class members who did not purchase any Perrigo shares during the Class Period, but instead held shares from November 12, 2015, through expiration of Mylan’s tender offer at 8:00 a.m. ET on November 13, 2015, may also be entitled to recovery. This makes the process of monitoring portfolios even more complicated, and extra attention must be given when preparing claims to ensure all eligible transactions are included, including any transactions that may have occurred well before the class period.

Old Class Period

Here, the class period began as far back as April 2015, which means individuals may have claims over 9 years old. As most financial institutions typically keep records for 7 years, it may be difficult for some class members to provide transaction details and supporting documentation to support their claim. Consequently, class members may overlook eligible transactions, potentially affecting their ability to claim recognized losses. Nevertheless, proactive preparation and the implementation of a robust data management solution can help address this issue.

Each year billions of dollars are being left on the table.

Find the right advocate who can help you maximize recoveries.

1 The group is comprised of Migdal Insurance Company Ltd, Migdal Makefet Pension and Provident Funds Ltd., Clal Insurance Company Ltd., Clal Pension and Provident Ltd., Atudot Pension Fund for Employees and Independent Workers Ltd., and Meitav DS Provident Funds and Pension Ltd.

2 Morrison v. Nat’l Austl. Bank Ltd., 561 U.S. 247, 269 (2010) (theorizing that if Congress intended section 10(b) to apply to “F-Cubed” classes, the statute would have included what to do when there are conflicting laws, as the probability of such incompatibility was obvious).

3 Though as plaintiffs argue, Perrigo has significant ties to the U.S., including that the company was founded in Allegan, Michigan and only later redomiciled to Dublin, Ireland.

4 In a letter written by the Israel Securities Authority (ISA) to the SEC in 2011, the ISA supported the idea that the Supreme Court’s reasoning in Morrison is flimsy when applied to cases regarding TASE investors. The ISA argued that because Morrison’s reasoning is heavily reliant on the conflict of law between United States and foreign jurisdictions, as Israel directly incorporates United States law, the holding should not prohibit Israeli holders of dual listed securities from being included in United States class actions. Additionally, the Israeli Supreme Court in Damti v. Mannkind Corp. has affirmed that United States law applies both to Israeli reporting duties and liability. Civil Appeal Petition 17/8737 Damti v. Mannkind Corporation (16 Oct. 2018).

5 In fact, several courts have reached similar conclusions regarding the exercise of supplemental jurisdiction for foreign TASE transactions. In In re Teva Sec. Litig. the District Court of Connecticut held that supplemental jurisdiction was allowable for Israeli plaintiffs as even the Israeli Supreme Court held the Securities Exchange Act of 1934 establishes liability under the Israel Securities Law, 1968. In re Teva Sec. Litig., 512 F. Supp. 3d 321 (D. Conn. 2021) (citing Roofers’ Pension Fund v. Papa, No. 16-2805, 2018 U.S. Dist. LEXIS 125885 (D.N.J. July 27, 2018). In Costas v. Ormat Techs., Inc. the District Court of Nevada held that it was permissible to apply United States securities law to dual listed Israeli securities as both United States courts and Israeli courts supported this proposition. Costas v. Ormat Techs. Inc., No. 3:18-CV-00271-RCJ-CLB, 2019 U.S. Dist. LEXIS 211349 (D. Nev. Dec. 6, 2019).

Let’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |