T+1: 9 Critical Lessons for Asian Firms and the Work That Lies Ahead

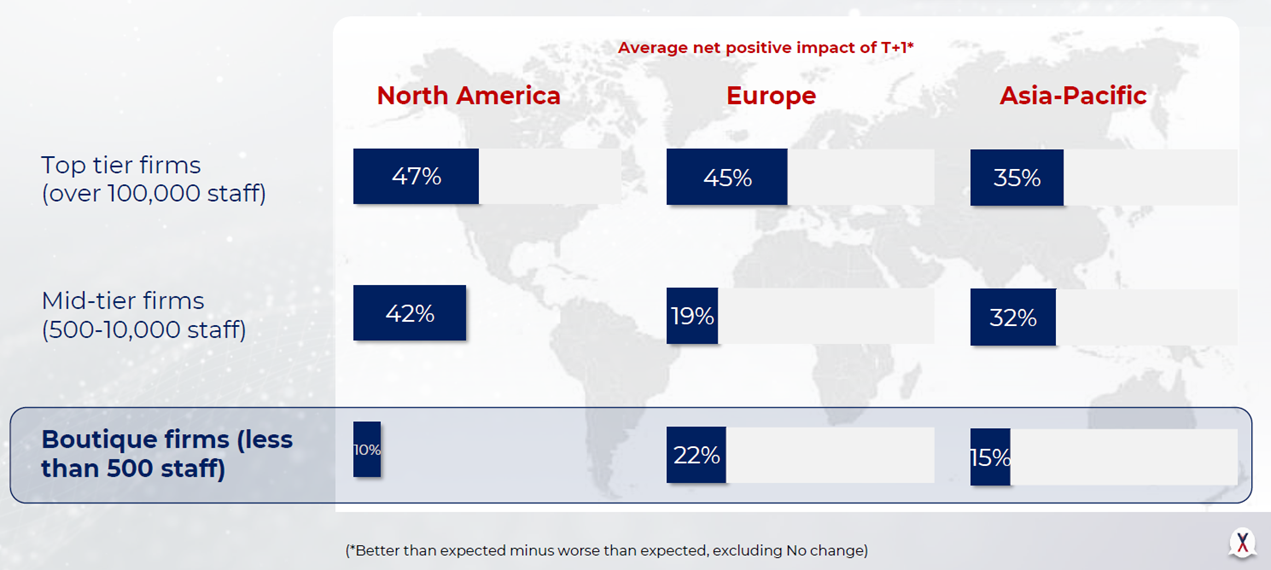

On May 27/28th, Asian back offices saw up to half of their daily, cross-border volumes accelerate by 83% - due to the transition of American, Canadian, Mexican and other regional markets to T+1 settlement cycles. After much preparation and anticipation, the move appears to have gone smoothly but, as new, hidden costs begin to emerge across the trade cycle, new learning points are becoming very clear for investors and their service providers across Asia-Pacific.

This article, leveraging research from the ValueExchange, highlights nine key insights for Asian firms:

1. T+1 went better than expected in Asia – and trade fails didn’t spike

After “39 months” of preparation, testing and war rooms, the “hyper-care” that the industry afforded to the T+1 was a stand-out success. During the immediate transition, trade fails remained stable at approximately 1.8% globally – leaving 39% of Asian market participants pleasantly surprised by the transition overall. This was a powerful example of how successfully the industry can manage transitions when there is a shared focus.

2. Preparing for T+1: don’t under-estimate the preparation

Just because there was plenty of time to prepare for T+1 doesn’t mean it was seamless. In 2023, 28% of firms considered the transition to T+1 to be significantly impactful on their organizations, which rose to 44% in 2024 (immediately after the transition). The automation work needed to avoid increases in trade fails, inventory mismatches, failed securities lending recalls and funding gaps may seem straight forward with one year still to go before transition, but the evidence is that this work should not be under-estimated. Looking ahead, this means that firms must use the time to prepare internal processes and platforms – not to mention clients and counterparties – well ahead of any deadlines being announced around the world. We should be preparing for T+1 in our own markets today.

3. Trade date allocations and affirmations were the main driver of success

Underpinning the extensive communications during T+1 was the significant increase in trade-date activity by all global investors – cited by 65% in Asia as the #1 driver of success. In allocating and affirming trades on T+0 (and ensuring that T+0 ends with a fully matched set of trade instructions between the fund manager and the broker), firms have successfully accelerated their settlement processing and reduced their settlement risk. As we look to new market transitions elsewhere globally, the availability of match T+0 instructions will be a critical enabler to progress.

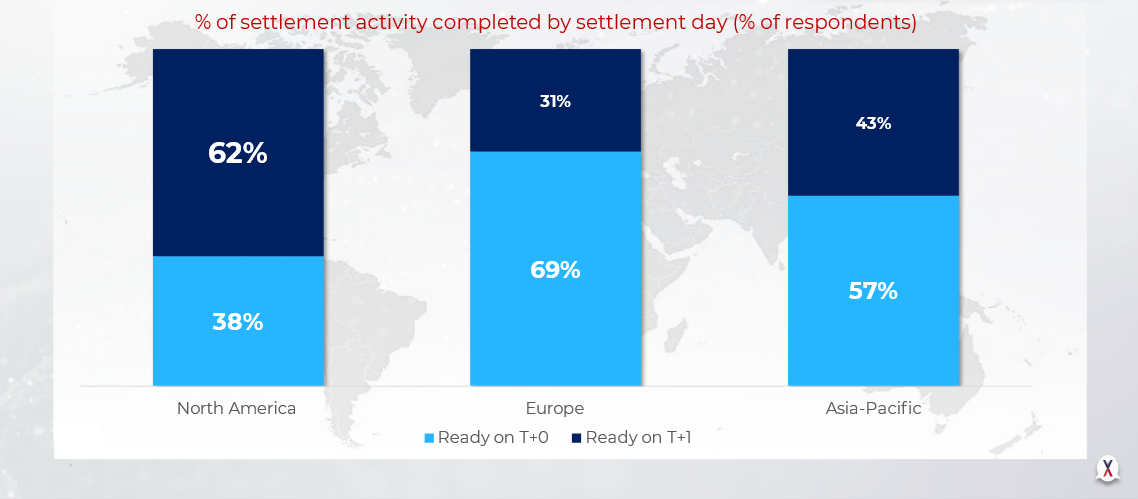

4. 57% of our North American settlement activity is now on T+0 for Asia

Whilst those in North America continue to run the majority (62%) of their settlement activity on T+1, firms in Asia do not have that luxury. Following the T+1 transition, 57% of settlement activity is now being handled on T+0 – meaning that the majority of trade processing now has to happen on the day of execution. Without the comfort of an overnight run in the middle of the settlement process, this acceleration is putting heavy pressure on Asian back-office systems – and making any batch processing runs a critical point of vulnerability. Real-time processing of US transactions by Asian firms is no longer just desirable, it is essential.

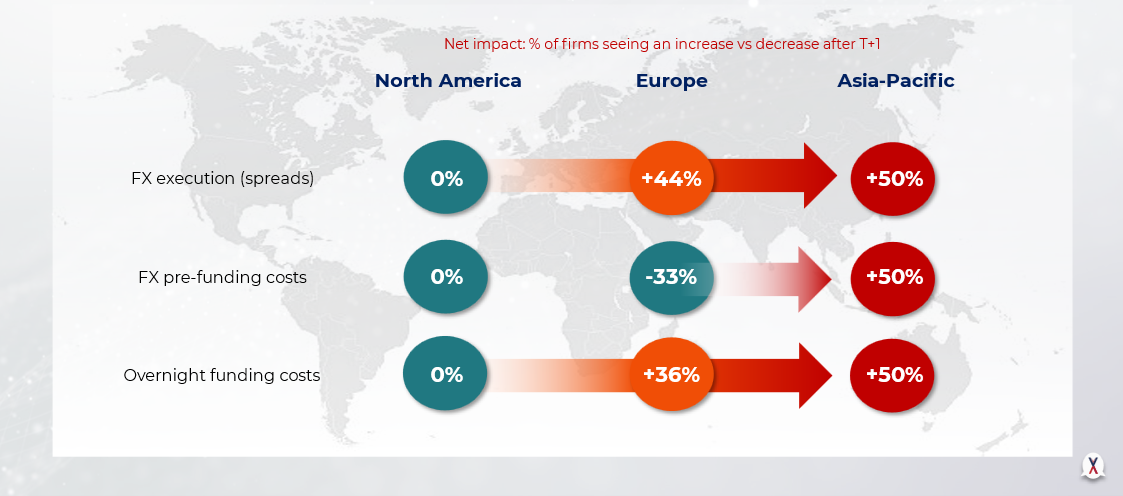

5. Time-zones matter: Costs of funding have spiralled in Asia

One of the unavoidable consequences of the North American transition was that the costs of market variance would increase, for as long as other markets remain on T+2 cycles. 50% of fund managers in Asia have seen their overnight funding costs grow since the T+1 transition, with new incremental costs of around 2 basis points every time they sell Asian stocks to buy American ones. How they fund this cost varies (some firms are carrying the cost in their fund, others are paying brokers and banks for products that continue to offer T+2 settlement cycles) – but the cost of market dislocation is ultimately unavoidable for now.

6. SBL deadlines don’t seem to matter in Asia

In the run-up to the T+1 transition, extensive resources were dedicated to establishing clear deadlines for the instruction of securities lending recalls – at 3pm ET and 7pm ET. Given the potential risks that failed lending recalls could have on downstream settlements, these deadlines were seen as critical in giving agents and brokers sufficient time to recall stocks and settle trades safely. However, after the T+1 transition, only 50% of recall instructions are being received by these deadlines (21% by 3pm ET and 29% by 7pm ET), meaning that there continues to be a significant amount of bilateral risk in the lending and borrowing world today. Whilst we have seen few consequences of these risks so far, the question of how we would scale to handle periods of major market volatility is still unanswered.

7. Only 21% of Asian firms are more automated than they were before T+1

Given all of the above pressures on overnight processing, treasury management and securities lending, the biggest risk coming out of the T+1 transition is our continuing reliance on manual processes. Across Asia, only 21% of firms are more automated now than they were before T+1 – with areas such as funding, securities lending and collateral all almost entirely unchanged. Whilst around a quarter of our T+1 automation and project work lies ahead (in 2025), our short-term reliance on people risks creating a major limitation on our ability to scale and to handle any spikes in market volumes in the near future.

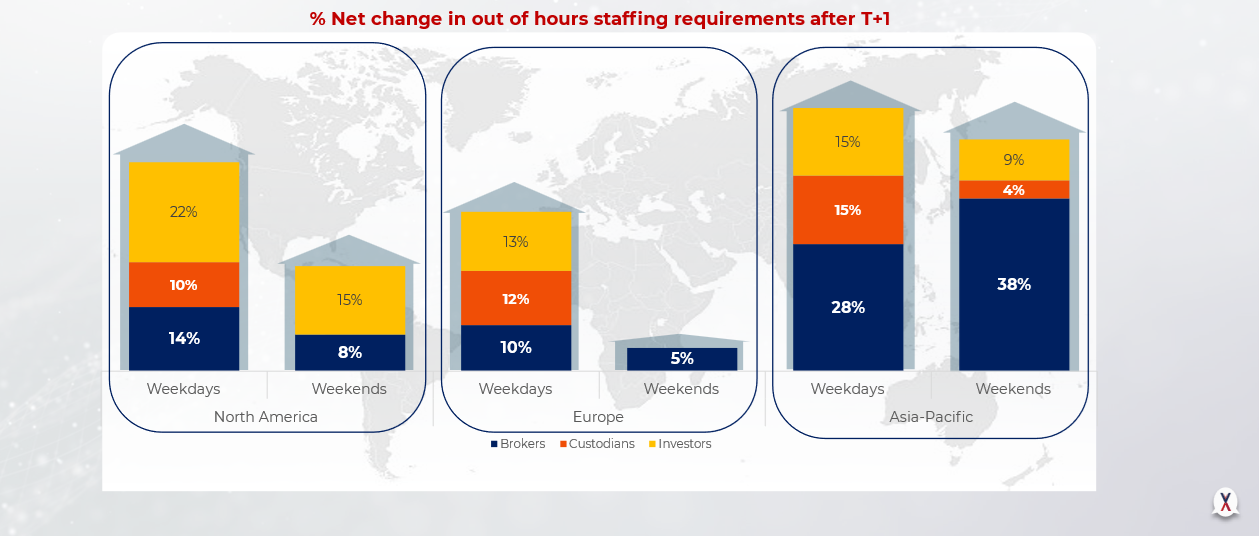

8. Staff costs have gone up by 20% (on weekdays) and up to 38% on weekends

Manual processing doesn’t just mean risk – it also means costs. Since the T+1 transition, out-of-hours staffing costs for Asian firms have risen sharply – by about one fifth for overnight staff during the week and by more than a third for weekend staff. If system automation has not yet reduced the volume of tasks that are needed to be managed overnight (or on Saturday morning), then more people are inevitably going to be needed as we accelerate those tasks. Whilst hopefully limited to the short term, these levels of cost increase risk undermining Asian fund performance and creating a competitive disadvantage for firms that fail to automate quickly.

9. A full roadmap – leading to 2027

As markets, regulators and firms now turn their attention to future T+1 transitions across the world, 2027 is emerging as a key date. More than 50% of firms expect to see T+1 transitions complete by 2027 not only in the UK and Europe, but also in Japan, Hong Kong and Singapore. This leaves scarce time to remediate based on the learning points from the North American T+1 transition (in 2025) and to then prepare for a global wave of T+1 activity across more than 13 time-zones (in 2026). We cannot afford to delay.

This article was produced in collaboration with The Value Exchange.

Work with a trusted,

award-winning partner

WINNER 2023

Lending Transformation & Overall Winner

IDC FinTech Real Results

LEADER 2023

Digital Experience Platforms

Everest Group PEAK Matrix

WINNER 2023

Best Overall US WealthTech Provider

WealthTechAmericas

WINNER 2023

Best Innovative Client Solution (Canada)

WealthTechAmericas

LEADER 2022

Credit Lending Operations

Chartis RiskTech Quadrant

LEADER 2022

Wealth Management Products

Everest Group PEAK Matrix

Stay ahead with industry insights

Connect with our experts about the future of wealth management

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |