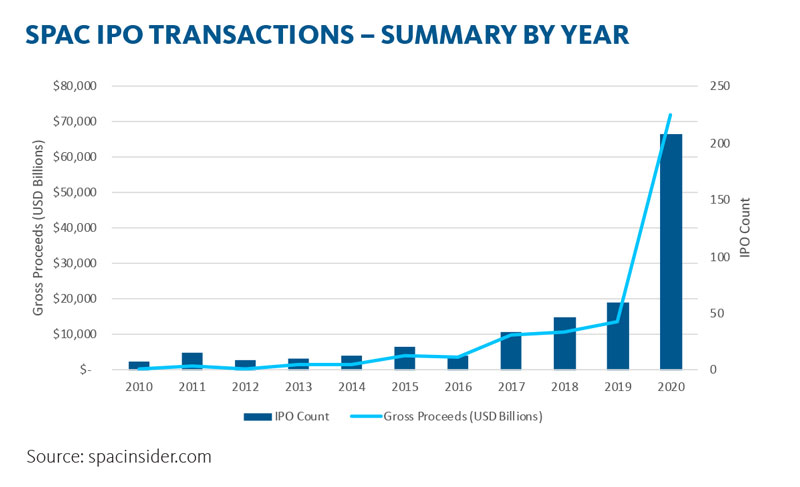

A gradual recovery in SPAC volumes followed, although it enjoyed an impressive resurgence starting in 2017. However, 2020 has been a record year for SPAC listings, with 208 IPOs totaling $71.8 billion taking place so far. In comparison, there were 59 SPAC IPOs in the whole of 2019, raising $13.6 billion, and 46 in 2018 which accumulated $10.8 billion. A number of brand-name private equity and hedge fund managers have since jumped in on the action, with the likes of Pershing Square Capital Management, Fir Tree Partners and Apollo Global Management all launching SPACs.

The cost-economics behind launching SPACs are very appealing for investment managers. This is because reverse mergers typically do not require as much upfront capital as a conventional leveraged buyout (LBO). As SPACs are publicly traded, it also enables managers to tap into a much wider investor demographic instead of having to raise money from limited partners. It is widely expected that buy-side interest in SPACs will be a trend that continues beyond COVID-19. Aside from the benefits which SPACs bring to acquiree companies, they are also rather enticing for investors.

An article by law firm Ogier says the “redemption return on pre-acquisition SPAC shares offers a relatively attractive yield with minimal risk (given the security of the trust account and redemption rights). As pre-acquisition SPAC shares typically trade at a discount and carry the right to the accrued interest in the trust account, their pre-acquisition redemption yield is comparable to US treasuries.” Moreover, as SPACs are listed and traded, investors also benefit from added liquidity

GETTING THE OPERATIONS RIGHT

Traditional and alternative asset managers have a long track record of pursuing strategy diversification. The last few years, for example, have seen widespread hybridization occurring between illiquids (i.e., private equity, private debt, infrastructure, real estate, venture capital, etc.) and hedge funds as managers attempt to broaden their institutional investor target markets and return sources. To successfully diversify, fund managers need to ensure their operations can cope with the unique requirements presented to them by these new strategies. Running a SPAC fund is no exception. As more asset managers enter the burgeoning SPAC market, they must re-think how they handle their lifecycle workflows and valuations of the underlying SPAC holdings.

This will require investment firms to assess whether their exist- ing portfolio management systems (PMS) can track liquidation dates and trust factors, ensure accurate P&L calculations, and identify where the SPAC is in terms of its investment lifecycle. Without a flexible, multi-asset class PMS, asset managers (and their underlying investors) could incur a number of unnecessary risks and costs. The absence of effective, scalable technology will require managers to revert to manual processes - such as Excel Spreadsheets - when monitoring their SPAC transactions. This amplifies the likelihood of managers making avoidable mistakes such as error-laden P&L calculations or inaccurate investor reporting. With investors becoming increasingly selective when making allocations, it is vital that such errors, along with substandard reporting practices, be rooted out, something which can be facilitated by automation.

“Leverage Broadridge multi-asset class portfolio management to support investing in SPACs.”

The refusal to transition away from high-cost, high-maintenance legacy technology when participating in complex asset classes like SPACs can also potentially give rise to firm-wide inefficiencies. Manual processing and Excel tracking require enormous amounts of human intervention. Through automation, staff resources can be freed up, allowing managers to focus more of their attention on revenue-generating activities. Asset managers globally face heightened cost pressures due to increasing operational demands, fee compression, and added regulation. By pivoting away from manual processes and embracing digitalization, managers will be able to net meaning- ful operational savings allowing them to augment their overall performance.

Many of the tools required to support SPACs are already available on the market and are offered by providers such as Broadridge. This means firms looking to launch or invest in SPACs can leverage their existing providers at little or no additional cost, as long as the provider has deep-rooted expertise in servicing multi-asset class portfolios, as offered by Broadridge. By leveraging external vendors who fully understand complicated asset classes such as SPACs, fund managers will achieve greater scalability and cost optimization.