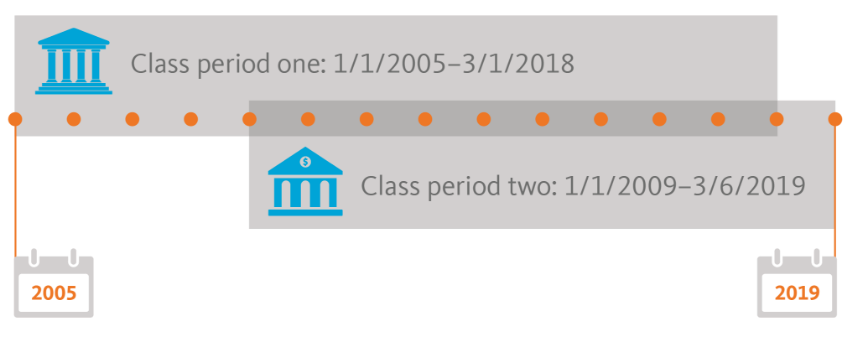

Class period spans 14 years

Typically, most financial institutions and individuals keep copies of statements, broker confirmations and house data relating to their accounts for 7 years. Given the length and the start of these class periods, it may be difficult for a class member to (i) provide transaction information for more than 7-10 years and (ii) provide required supporting documentation. As a result, class members may miss eligible transactions, negatively impacting their potential recognized loss.

Unusually complicated loss formula or “plan of allocation”

The proposed Plan divides the net settlement fund into two separate settlement pools based on the currency denomination of the SSA Bond transaction and within each pool different types of transactions are assigned relative weights based on: (1) the notional amount of each SSA Bond Transaction (the “Transaction Notional Amount”); and (2) the time period during which the SSA Bond Transaction occurred (the “Litigation Multiplier”). Transactions executed during the defined core conspiracy period i.e., January 1, 2009 to December 31, 2015 are applied a different Litigation Multiplier than those occurring outside of the core conspiracy period. Additionally, alternative minimum payments are authorized. Splitting the settlement fund into separate pools vastly increases the difficulty of projecting potential distributions, as each pool will be subject to a separate pro rata calculation. This complicates the work needed to audit the Administrator’s distribution amounts.

Complicated security type

There are many eligible transactions that are covered by the Plan, including all supranational, sovereign, sub-sovereign, governmental, quasi-governmental, and agency bonds or debt instruments regardless of the structure, currency, or credit quality. Moreover, transactions are defined broadly, to include any purchase, sale, trade, assignment, novation, unwind, termination, or other exercise of rights or options with respect to any SSA Bond. Bonds issued by sovereign nations in the sovereign’s domestic currency, including, but not limited to, U.S. Treasury bonds or U.K. gilts are specifically excluded. This challenge impacts a variety of areas of the case. First, portfolio monitoring is made more complicated by the size of the searches and resulting data exports. Second, the time required to prepare, and file claims can be increased exponentially. Finally, significant quality assurance measures are needed to ensure accuracy and completeness of the files before they can even be filed.