Access the latest news, analysis and trends impacting your business.

Explore our insights by topic:

Additional Broadridge resource:

View our Contact Us page for additional information.

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

With increasing regulatory and market pressures in the capital markets industry, executives need access to accurate, enterprise-wide data for insightful decision-making. However, most firms find they spend too much time and too many resources collecting and reconciling data, and not enough time analyzing data to improve operations and mitigate risk. Explore how the current industry landscape is driving changes in reconciliation, and learn how a data-centric reconciliation model can serve as a catalyst for new ways of exploring data. Discover how establishing your firms reconciliation maturity level can help you transform your business.

The continued confluence of regulatory changes, market pressures and an increased demand for data make this an especially challenging time for the capital markets industry. To navigate the changes impacting their firms, executives need access to accurate, enterprise-wide data that gives insights for better decision-making. However, most firms find they spend too much time and too many resources collecting and reconciling data, and not enough time analyzing data to improve operations and mitigate risk.

The root cause is that data is frequently scattered throughout the organization and siloed in myriad systems, making it difficult to validate its accuracy, mine it and derive business intelligence. Although firms have a growing volume of data, they lack a holistic enterprise view that allows them to make better business decisions and create a more flexible and dynamic organization that better adapts to new demands.

Perhaps nowhere is siloed data a more prevalent problem than in a firm’s reconciliation functions. Reconciliation touches internal and external data throughout every area of the firm, from core operations to credit, compliance, treasury and finance. Given its pervasive touch points, reconciliation can serve as a catalyst to help firms proactively leverage data for better business intelligence and actionable insight across organizations.

Traditionally known as a back-office function, reconciliation is often viewed as a necessary cost of doing business. However, that viewpoint is shifting as executives begin to consider reconciliation as a strategic asset. According to recent Aite Group research, these six trends are creating an increased focus on reconciliation:

![]()

REGULATORY PRESSURES

Central clearing measures outlined in Dodd Frank/EMIR are expanding firms’ reconciliation needs. This increased regulatory burden means firms must reconcile a higher number of internal and external data feeds, causing 40 percent of firms to say that compliance requirements are the biggest pressure on reconciliation.

![]()

INTRADAY REQUIREMENTS

Real-time processing to support intraday processing is becoming a business imperative; 68 percent of firms think real-time processing is important today.

![]()

LEGACY SYSTEMS

Many of the systems that support reconciliation require a technological refresh to handle today’s volumes and usability requirements. More than half of firms have a main reconciliation platform that is five or more years old, and 27 percent have a platform that is more than nine years old.

![]()

COMPLEXITY

Internal/external stakeholders are becoming more diverse, and organizations will need a more flexible platform to meet a broader, more diverse set of requirements.

![]()

Operational control processes are embedded within every area of an organization, from trading and core operations to financial and regulatory reporting. Seemingly minor data integrity issues can cause significant operational and financial risk. However, this is just the tip of the iceberg when it comes to the value that reconciliation can provide. Organizations need to take a holistic data-centric approach to their reconciliation model to reach the next frontier of business value.

Each internal reconciliation process creates a new and original dataset. An organization focused on data-centric reconciliation recognizes and cultivates this value.

As a result, data-centric reconciliation can serve as the catalyst for a new way of approaching how data is stored, accessed and analyzed enterprise-wide. This new proactive approach to applying data analytics to reconciliation data has the power to shift the fundamental value proposition from cost cutting to new financial value creation. In addition to providing a holistic view of data, a centralized reconciliation platform can reduce costs, minimize or even prevent breaks, and allow organizations to meet evolving regulatory requirements.

This new proactive approach to applying data analytics to reconciliation data has the power to shift the fundamental value proposition from cost cutting to new financial value creation.

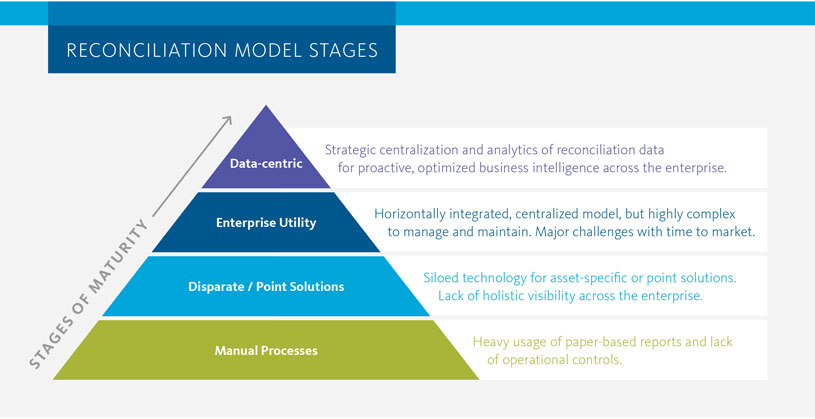

To gain business value from the data-centric reconciliation model, firms must first take a realistic look at their current reconciliation approach to assess its current value and the maturity level.

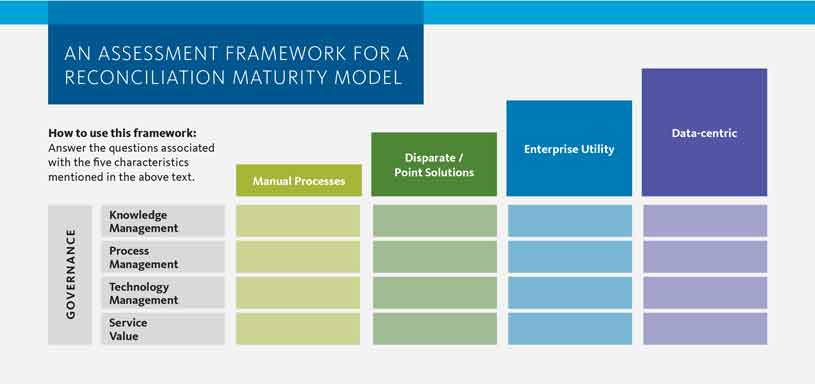

First, review the five characteristics below that define an organization’s reconciliation maturity model. Ask yourself the questions associated with each characteristic. Then fill out the assessment framework (below). This will help you chart a course to a more mature model:

This framework enables an unbiased assessment of an organization’s current maturity level, and can serve as a catalyst toward the establishment of a strategic and integrated vision. An often-overlooked attribute of a successful operational control function is the interoperability of various components. Once firms understand their current reconciliation operations and compare them to the characteristics of a mature reconciliation model, they can define an executable vision that uses technology as an enabler for organization-wide goal achievement. Proper alignment between a firm’s current and future state can facilitate a path to the next frontier of value generation.

When moving to an advanced, high-performing datacentric reconciliation model, organizations need a stepwise jump in maturity. This may include leveraging key enabling technologies.

A variety of factors, such as more demanding regulatory requirements, competitive market pressures and increased use of data analytics for decision-making, raises the stakes for all firms. Today’s organizations must harvest new technologies that can help them achieve their goals and can provide insights from across their enterprises to increase agility and the ability to react quickly to market changes.

When it comes to reimagining your reconciliation model, is your current in-house or vendor-provided technology an enabler or a constraint?

The road to a value-added reconciliation model starts with an assessment of an organization’s reconciliation maturity. Today’s leaders must know the answer so they can push the envelope to identify, cultivate and define implementable strategic plans that leverage reconciliation as a strategic value-added opportunity.

CHALLENGES: Client was challenged to meet increasing regulatory pressure and evolve its operations model.

SOLUTION: Partnering with Broadridge helped the organization introduce a new platform that allowed it to evolve its operating model.