Access the latest news, analysis and trends impacting your business.

Explore our insights by topic:

Additional Broadridge resource:

View our Contact Us page for additional information.

One of our sales representatives will contact you about your submission.

Welcome back, {firstName lastName}.

Not {firstName}? Clear the form.

Want to speak with a sales representative?

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Nos représentants et nos spécialistes sont prêts à vous apporter les solutions dont vous avez besoin pour faire progresser votre entreprise.

Vous voulez parler à un représentant commercial?

| Table Heading | |

|---|---|

| +1 800 353 0103 | Amérique du Nord |

| +1 905 470 2000 | Canada Markham |

| +1 416 350 0999 | Canada Toronto |

Votre soumission a été reçue. Nous communiquerons avec vous sous peu.

Vous souhaitez parler à un commercial ?

| Table Heading | |

|---|---|

| +1 800 353 0103 | Amérique du Nord |

| +1 905 470 2000 | Canada Markham |

| +1 416 350 0999 | Canada Toronto |

Paving a path forward that benefits your organization.

What does the next generation of wealth look like?

In September of 2022, the MFDA and the IIROC passed a resolution approving the amalgamation of the two-self regulatory organizations (SROs), carrying on the regulatory functions of both groups. The new SRO, known as the Canadian Investment Regulatory Organization (CIRO), will oversee all investment dealers, mutual fund dealers, and trading activity on Canada’s debt and equity marketplaces. As the changes go into effect, there are interim consolidated rules to reduce disruption, with fully consolidated rules being implemented in phases.

CIRO will create an opportunity for expanded services and products across multiple segments. Specifically in a single branded stream by allowing for the consolidation of legal entities and systems for retail banks as well as full-service brokers, direct investing, and ICPM dealers. The question is whether this is something all legal entities should be on a journey towards. Do firms go about merging separate entities into one, or do they create a new stream of services for their clients? What are the benefits, trade offs, and implications to be considered? Now is the time to think about how to best merge siloed offerings, reduce systems and regulatory complexity by creating a single branded stream for your clients.

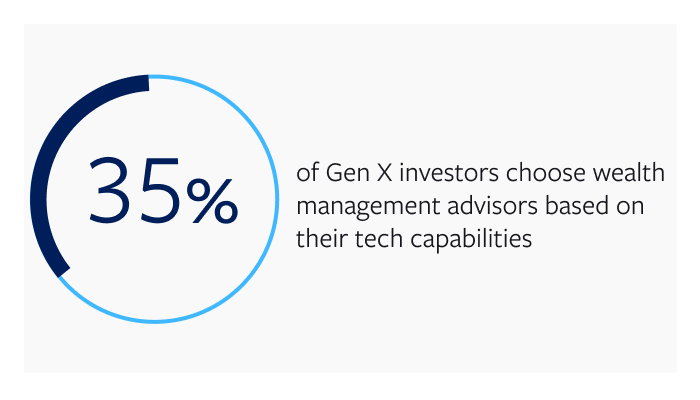

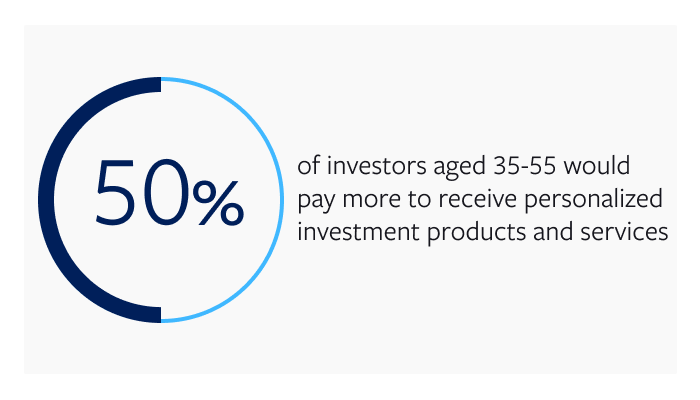

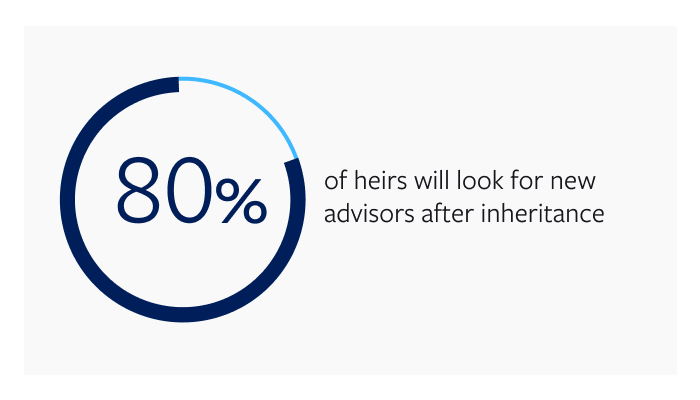

Competition for retail investor AUM is increasingly driven by wealth transfers, advisor consolidation, and emerging tools — both institutional and those focused on democratization of investment capabilities. As demographics shift, where roughly $72 trillion CDN will have new owners, competition is becoming fierce. Firms should shift their focus to target this new generation of wealth.

Key industry trends:

By embarking on the CIRO journey now, firms can enhance value for investors and sustain AUM, positioning themselves for future success.

With CIRO, members have the opportunity to restructure their entity, including: operating multiple advisor licensing models under one CIRO dealer, consolidating dealer entities and operations of front and back-office systems, entering into carry/broker agreements, becoming dual-registered, or maintaining the status quo of current operations. The amalgamation of the two regulatory bodies is intended to:

Navigating your organization’s path can be challenging without guidance. Here are the implications and benefits of CIRO that your organization should consider.

Regulatory

Streamlined regulatory framework: Consolidation can lead to a more streamlined regulatory framework, reducing duplication and complexity. This can make it easier for financial institutions to navigate and comply with regulations.

Simplified regulatory adherence: Concentrating resources and expertise through consolidation can lead to more straightforward regulatory oversight. This can help maintain stability and integrity within the financial industry, protecting both institutions and consumers.

Increased efficiency: Consolidation may lead to more efficient regulatory processes, such as faster decision-making and streamlined reporting requirements. This can reduce the administrative burden on financial institutions, allowing them to focus more on their core operations.

Cost savings: The merging of resources can lead to cost savings for both regulators and financial institutions. Eliminating redundancies and achieving economies of scale can reduce regulatory costs, which may eventually benefit institutions.

Improved coordination and consistency: The integration of efforts can improve coordination and consistency in regulatory policies and practices. This can provide a more unified approach to regulation, making it easier for financial institutions to understand and comply with the rules.

Regulatory challenges: Consolidation may also bring some challenges, such as potential delays during the transition period and adjustments to new regulatory requirements. Financial institutions should closely monitor and adapt to any changes to ensure compliance.

Opportunity for feedback and collaboration: Financial institutions can actively engage with regulators during the amalgamation process, providing feedback and contributing to the development of new regulations. This collaboration can help shape the regulatory landscape in a way that better meets the needs of the industry.

Customer experience

Product expansion: CIRO creates new opportunities to meet investors’ needs by offering access to enhanced products and services. Mutual fund dealers can now offer expanded product and service experiences for investors by becoming dual-registered. This may ultimately reduce operating costs and help maintain a competitive edge. Alternatively, CIRO offers mutual fund dealers the opportunity to enter into broker/carrying broker arrangements with investment dealers, and add to their product offerings.

Simplification for the end user:

Clients seek front-end operational efficiencies, which will mean consolidation of front-office applications and associated operational activities. Clients will be able to view products and offerings on a single dashboard for different accounts (i.e., brokerage and mutual fund), which would include client facing tool integration capabilities and SSO protocols, reducing complexity and improving efficiencies.

Customer lifecycle value: Firms must meet client needs throughout various segments in services within a single place. This also helps them grow their business and create lifetime value for customers. CIRO makes it easier for clients to move from clients of specific advisors to long-term clients of the firm.

Salesforce considerations: With CIRO, the Salesforce administration process will allow firms to bring their advisors into the retail business and expand their services without having to be restructured as they grow. Additionally, use of a consolidation solution will allow for better data driven insights and decision making to steer the organizations.

Cost

Fee implications: An integration cost recovery fee will be applied to dual-registered firms and firms with affiliated mutual fund and investment fund dealers. Single platform firms, operating as either an investment dealer or a mutual fund dealer, that do not have an affiliated member, will not be charged for the costs of integration.

Economies of scale: By becoming dual registered, organizations can yield the benefits of an enhanced and consolidated technology stacks and team restructuring. For mutual fund dealers, there is an initial investment that will be required to become dual-registered, however, the long-term benefits should be evaluated to determine the value of this undertaking.

Technology: There are different current state functions of IIROC and MFDA organizations, including automation vs manual processes, and siloed systems. However, there are best-practice opportunities for the consolidation of the two. While there will be inherent immediate costs associated with the consolidation of technologies across the organization as they adapt to the new customer expectations, dual-platform firms could achieve high-cost savings from their systems and technologies in the long term.

Back office: There are also additional costs for back-office consolidations; the long-term benefits, however, will include reduced complexity, Streamlined Reporting and Oversight and long-term cost benefits.

Gaurang Sardana, Managing Director, Practice Lead, Canada, says “This is a time of new opportunity for dealer members to begin the CIRO journey, whether it be a complete consolidation of the mutual fund and securities advisor platform or a segmented implementation across designated areas.”

Regardless of your choice, remaining competitive and compliant in the face of CIRO changes, means:

Why Broadridge?

Our solutions are compatible with CIRO.

Broadridge’s Canadian Wealth Platform is scalable and modular, with integrated digital enablement to improve productivity.

Sardana says, “The Broadridge Wealth Platform is also Canada’s first operational client-centric wealth distribution solution designed to support a client-for-life relationships across OSFI, MFDA and IIROC regulatory models.”

The Platform will allow for seamless integration of best in-class solutions across all Canadian Plan types, with dealer flexibility to choose best-of-breed solutions.

Our Platform also offers seamless growth with an integrated view at the advisor, dealer, and transfer agent levels.

The Broadridge Consulting Services team can provide advisory and technology solutions for CIRO optimization and operations transformation.

1. CIRO BUSINESS IMPACT ASSESSMENT AND IMPLEMENTATION

Broadridge can assess the impact of CIRO directly on your business and identify the degree of transformation needed to balance with an appropriate return on investment.

2. TECHNICAL SUPPORT

Broadridge offers various fintech solutions to drive business growth while enabling cost mitigating workflow enhancements that support dealer consolidation, including tools that:

If you're not sure where to start, are unsure what the future could look like, or want to ensure that you get it right the first time, you can work with a data transformation expert like Broadridge.

Broadridge has more than 12,000 experts serving more than 600 of the world's leading financial institutions through complex changes for more than 50 years. We bring deep domain expertise of next-gen Broadridge technology solutions. We understand your firms challenges and complexity, and we are here to help you accelerate your CIRO journey and transform on your terms.

Written by Gaurang Sardana, Marc Biro, and Chaya Frost

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |