Additional Broadridge resources:

View our Contact Us page for additional information.

One of our sales representatives will email you about your submission.

Welcome back, {firstName lastName}.

Not {firstName}? Clear the form.

Want to speak with a sales representative?

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Nos représentants et nos spécialistes sont prêts à vous apporter les solutions dont vous avez besoin pour faire progresser votre entreprise.

Vous voulez parler à un représentant commercial?

| Table Heading | |

|---|---|

| +1 800 353 0103 | Amérique du Nord |

| +1 905 470 2000 | Canada Markham |

| +1 416 350 0999 | Canada Toronto |

Votre soumission a été reçue. Nous communiquerons avec vous sous peu.

Vous souhaitez parler à un commercial ?

| Table Heading | |

|---|---|

| +1 800 353 0103 | Amérique du Nord |

| +1 905 470 2000 | Canada Markham |

| +1 416 350 0999 | Canada Toronto |

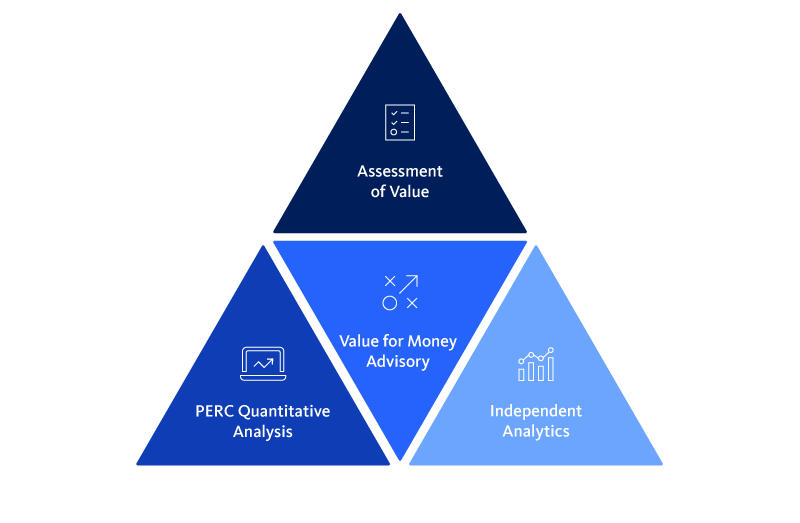

We equip AFMs with comprehensive tools and consistent support to foster a robust process. Deliver actionable insights to your board by meticulously assessing all seven fund criteria, while meeting UK Consumer Duty, Assessment of Value, and ESMA's undue costs and charges disclosure requirements.

The FCA’s COLL rules require AFMs to carry out an AoV at least annually, report publicly on their conclusions and appoint independent directors to AFM Boards. ESMA Article 12 amendments, requires Mancos and AIFMs to prevent Opens in a new window : 4KBundue costs being charged to a fund and its investors. AIFMs are required to review periodically its pricing process.

Under the new Consumer Duty Regulations, the FCA requires all firms to prioritize their customers’ needs and deliver a good outcome for retail investors, emphasizing fair value, suitable products, adequate support, and clear communications while avoiding foreseeable harm. For authorised funds the AoV rules and guidance act in place of the price and value outcome rules of the Duty.

Holistic reporting that provides detailed analytics of all value criteria required by regulations; equipping your board with critical insights into why a fund ranks how it does.

Overview of complex by asset class and macro-level data on costs, charges, and performance that enables your board to identify funds requiring deeper analysis.

We highlight quantitative data as outlined in the AoV criteria, specifically focusing on cost components, performance, risk measures, and PERC scoring.

Meaningful independent peer groups for benchmarking to address economics of scale and comparability of performance and charges.

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |